Bet_Noire

By Matt Wagner, CFA, Associate Director, Research

Investors have refocused on fundamentals this year.

That has translated to outperformance for profitable stocks and dividend payers over the hyped story stocks that flourished for most of the last two years.

In a recent blog post, we discussed the composite risk screen (CRS) used to enforce a focus on fundamentals and weed out value traps from WisdomTree’s dividend Indexes.

Now let’s walk through how that screening process looks with a Russell 3000 universe and illustrate how these companies deemed “riskier” on our screens have performed amid recent volatility.

Avoiding “Risky” Stocks

WisdomTree’s U.S. dividend Indexes are rebalanced annually in December with data as of the end of November.

The WisdomTree CRS uses a model combining dividend yield, quality and momentum as factors to mitigate exposure to companies more likely to cut (and/or less likely to grow) dividend payouts.

All U.S. companies are ranked (dividend payers or not) on our model, with the riskiest companies (bottom decile) excluded.

In addition to screening out the riskiest decile of companies based on the CRS, the highest-yielding companies (the top 5%) that also have below-average (bottom five deciles) risk scores are excluded.

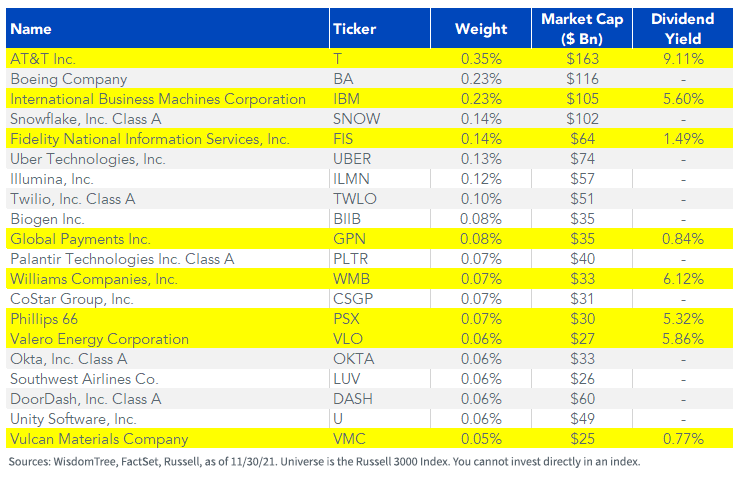

The below table shows the top 20 Russell 3000 weights that would have been removed. The companies highlighted in yellow are the dividend payers excluded from WisdomTree U.S. Dividend Index.

In total, 4% of the weight of the Russell 3000 would have been categorized as “risky.”

Top 20 Companies Removed on Composite Risk Screen

WisdomTree, FactSet, Russell

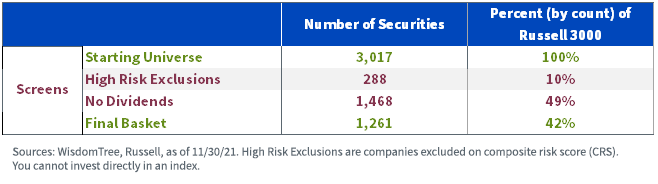

The below table summarizes the step-by-step screening process to arrive at a basket of high-quality dividend-paying companies.

First, 288 securities (or 10% of the Russell 3000) are screened out based on the CRS (both dividend payers and non-dividend payers).

Second, 1,468 companies are removed as non-dividend payers (or nearly half of the Russell 3000).

The final portfolio holds 1,261 securities, or 42% of companies in the Russell 3000.

Russell 3000 Index: Risk Screening

WisdomTree, Russell

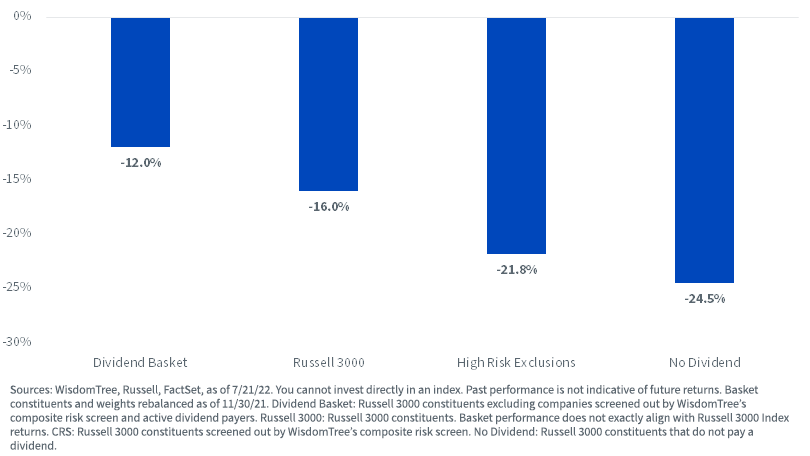

Amid heightened volatility in 2022, the 288 high-risk exclusions have lagged the performance of the Russell 3000 by over 500 basis points.

The no dividend basket (not including companies excluded by CRS) are down even more severely at −24%.

Year-to-Date Performance

WisdomTree, Russell, FactSet

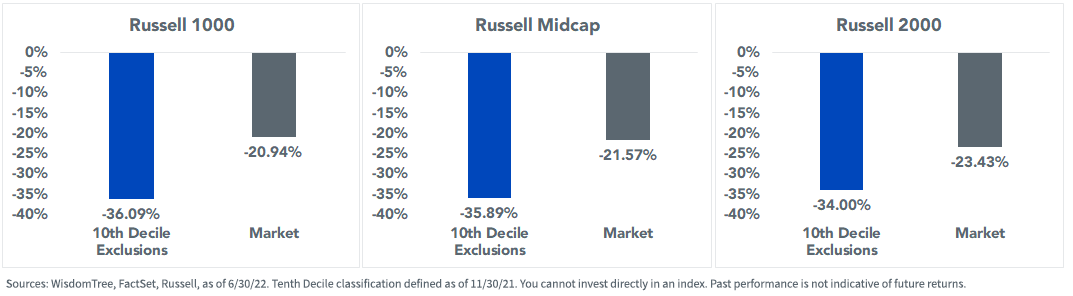

Looked at another way, across large-, mid-, and small-cap indexes, we see that the tenth decile on CRS—the riskiest stocks screened out of our dividend indexes—have heavily lagged across size cuts.

Year-to-Date Tenth Decile Stocks Lag across Markets

WisdomTree, FactSet & Russell

Bottom Line: Dividend Indexes Leading in 2022

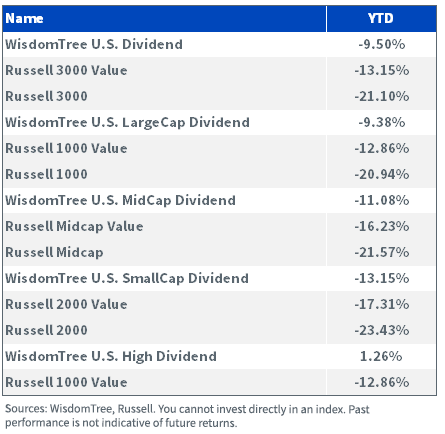

Now let’s turn from the hypothetical of the widely followed Russell 3000 universe to the performance of WisdomTree’s dividend Indexes this year.

Dividends have worked in a big way in 2022 reflected in outperformance across WisdomTree’s dividend Indexes relative to both the value and broad-market Russell benchmarks.

This year remains one of the most challenging macroeconomic environments investors have faced in some time. It is encouraging that WisdomTree’s original and pioneering dividend methodology has provided downside mitigation—and we further believe that our risk screening enhancements to exclude the highest composite risk securities are likely to pay even more dividends during any future recessions and steep bear markets.

Index Performance, as of 6/30/22

WisdomTree, Russell

Matt Wagner, CFA, Associate Director, Research

Matt Wagner joined WisdomTree in May 2017 as an Analyst on the Research team. In his current role as an Associate Director, he supports the creation, maintenance, and reconstitution of our indexes and actively managed ETFs. Matt started his career at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 where he focused on unsecured funding planning, execution and risk management. Matt graduated from Boston College in 2015 with a B.A. in International Studies with a concentration in Economics. In 2020, he earned a Certificate in Advanced Valuation from NYU Stern. Matt is a holder of the Chartered Financial Analyst designation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment