DNY59

By Lee Clements, Head of Sustainable Investment Solutions, SI Research

In recent years, we’ve lived in a world of rising temperatures and falling interest rates, but one side of this has abruptly changed this year. Interest rate risk has become one of the key worries of the global investors, as central banks struggle to keep inflation in check.

However, rising rates pose a particular risk to sustainable investors, both in achieving sustainable goals and in the return on their sustainable investments, particularly in fixed income. The direction and extent of interest rate rises will play a critical part in funding the climate transition.

Commentators have already raised the issue that rising rates will impact the funding of climate plans and central banks should consider climate risk in differentiating their interest rate policies[1]. One of the key drivers of sustainable investment is increasing the flow of climate finance and in particular to reduce the cost of capital for climate solutions. Renewable energy and energy efficiency solutions can be particularly sensitive to financing costs[2][3], given that the majority of the lifetime cost is in the upfront investment. As the market has matured, these rising financing costs can no longer be compensated by generous subsidies (although the US climate bill will help) or the continuous fall in renewable energy equipment prices[4]. All of this means the focus on increasing capital flows to climate finance is more important than ever, particularly as they are increasingly having to deal with not only climate mitigation but also the costs associated with adapting to the physical impacts we are already seeing as well as the increasing costs to meet broader social development goals[5].

However, sustainable fixed-income investors have seen a particular additional aspect of interest rate risk. Many of the areas of sustainable fixed income have heightened exposure to interest rate risk, with lower yields and longer maturities, leading to higher duration risk.

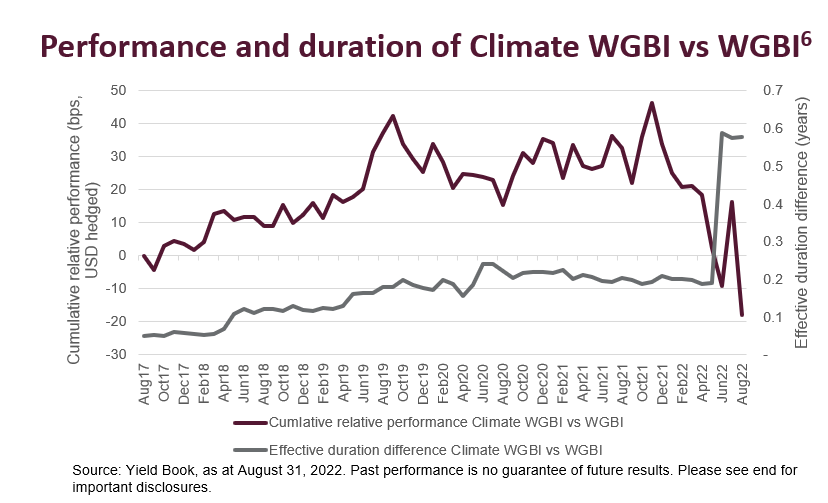

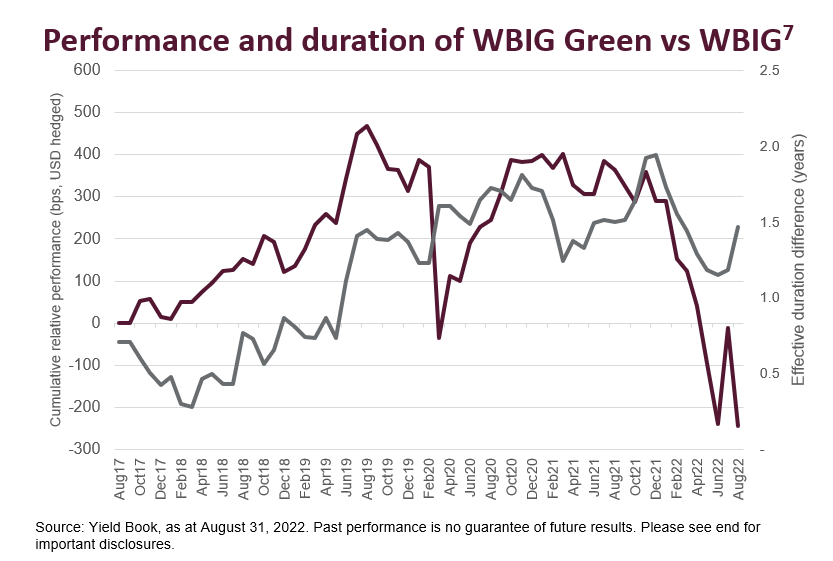

The FTSE Climate Risk Adjusted World Government Bond Index (‘Climate WGBI’) has a higher weight in European sovereign bonds and a lower weight in US sovereign bonds relative to the World Government Bond Index (‘WGBI’) as European countries typically score much better on climate risk metrics. However, they also have lower interest rates, particularly this year, and longer maturity debt relative to the US. This has given rise to a 0.6-year longer effective duration (end August) of the Climate WGBI relative to the WGBI and hence higher interest rate risk. Or the risk can come from a longer maturity of the debt, as we see in the green bond market, where the recent growth in domestic sovereign green bond issuance has primarily been at the longer end of the curve. This has led to a 6.7-year longer effective duration for domestic sovereign portion of the FTSE World BIG Green Impact Index7 (‘WorldBIG Green’) and a 1.5-year longer effective duration for the overall WBIG Green (vs the FTSE WorldBIG Index), leading to a 4.3% underperformance YTD (to end August, USD hedged)

However, what we see in global, developed markets sovereign bonds is different from that in investment grade corporate bonds and when looking at Europe. The corporate issuers in the WorldBIG Green have a shorter effective duration than conventional investment grade corporate bonds (due to a shorter average maturity), or the Climate Risk Adjusted EMU Government Bond Index (‘Climate EGBI’)[8] (covering European sovereign issuers) has a similar duration profile to the EMU Government Bond Index (‘EGBI’) and has not seen the same underperformance year-to-date.

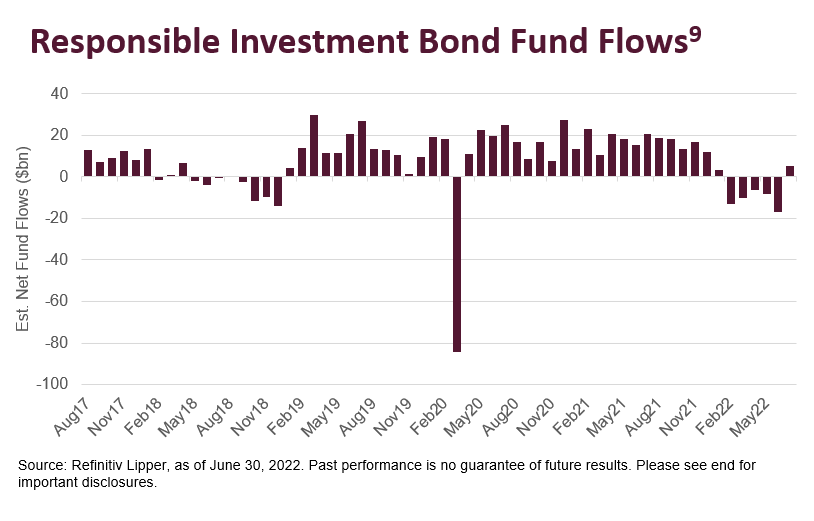

While we will have to wait and see the long-term impact of rates on climate financing, green bond issuance was down on Q1 2022, much like the rest of the bond issuance market, but saw growth return in Q2. Flows into global responsible investment bond funds were abruptly down at the beginning of the year, turning negative for the first six months, but saw its first positive flows YTD in July.

This creates a dilemma for investors and central bankers: in a world of rising rates how to balance climate risk on one side, with exposure to interest rate risk on the other. However, they may well be two sides of the same coin, Christine Largarde, Head of ECB recently said “climate change has an clear impact on inflation”[10] and lower interest rate risk across both portfolio and economies today may lead to great climate risk tomorrow.

[2] Adverse effects of rising interest rates on sustainable energy transitions, Schmidt et al, Nature Sustainability Sep 2019

[3] Susceptibility of renewables to interest rates, Brandon Sutherland, Joule, Nov 2019

[4] Solar Panel Costs Rise in Climate Change Threat as Longi Boosts Prices – Bloomberg

[6] Climate Risk Adjusted World Government Bond Index (‘Climate WGBI’, the index series measures the performance of fixed-rate, local currency, investment-grade sovereign bonds in WGBI incorporating a tilting methodology that adjusts index weights according to each countries’ relative climate risk performance. FTSE Climate Risk-Adjusted Government Bond Index Series | FTSE Russell

FTSE World Government Bond Index (‘WGBI’, A broad index providing exposure to the global sovereign fixed income market, the index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. It comprises sovereign debt from over 20 countries, denominated in a variety of currencies)

[7] FTSE World Broad Investment-Grade Green Impact Bond Index (‘WorldBIG Green’, constituents are selected from the WorldBIG, screened in accordance with the transparent and defined green bond criteria) FTSE Green Impact Bond Index Series | FTSE Russell

FTSE World Broad Investment-Grade Bond Index (‘WorldBIG’, A multi-asset, multi-currency index that provides a broad-based measure of the global fixed income markets. The index includes investment-grade government, government-sponsored/supranational, collateralized, and corporate debt)

[8] Climate Risk Adjusted EMU Government Bond Index (‘Climate EGBI’, the index series measures the performance of fixed-rate, local currency, investment-grade sovereign bonds in EGBI incorporating a tilting methodology that adjusts index weights according to each countries’ relative climate risk performance. FTSE Climate Risk-Adjusted Government Bond Index Series | FTSE Russell

FTSE EMU Government Bond Index (‘EGBI’ the index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. It consists of the European Monetary Union (EMU) participating countries that meet specific criteria for market size, credit quality, and barriers-to-entry)

[9] Refinitiv Lipper Global Responsible Investments Snapshot July 2022.

[10] ECB’s Lagarde: climate change has clear impact on inflation | Reuters

© 2022 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) The Yield Book Inc (“YB”) and (7) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (A) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (B) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment