SeventyFour

Investor Thesis

As a long-time holder of RioCan Real Estate Investment Trust (OTCPK:RIOCF) (TSX:REI.UN:CA) I have owned this REIT through some challenging periods, including the global financial crisis in 2008 and the Covid-19 Pandemic shutdowns of 2020. Instead of selling in these dismal periods, I took advantage of battered unit prices to add to my position. Over this period, I have continued to hold RioCan because of its great assets and simple, steady business model.

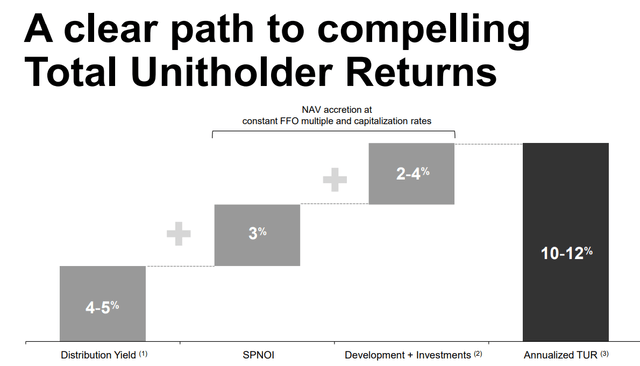

REITs provide attractive monthly income derived from tangible assets. RioCan offers investors exposure to some of the best real estate properties in Canada. The REIT targets 10-12% annualized unitholder returns through: a 4-5% distribution yield; 3% growth in same property NOI growth; and 2-4% development and investments.

RioCan Total Return (RioCan Shareholder Presentation)

Company Profile

With 204 properties and 36M square feet of leasable space, RioCan is one of Canada’s largest REITs. While among the largest in Canada, the REIT’s current portfolio compares to 284 properties comprising 45 million square feet of leasable space in 2018. RioCan has streamlined it portfolio to reflect its strategy of focusing on large urban centers. This portfolio reduction follows the REIT’s exit from the U.S. market in 2016, its continued disposition of its secondary market properties, and its concentration into the greater Toronto area, one of North America’s largest metropolitan areas.

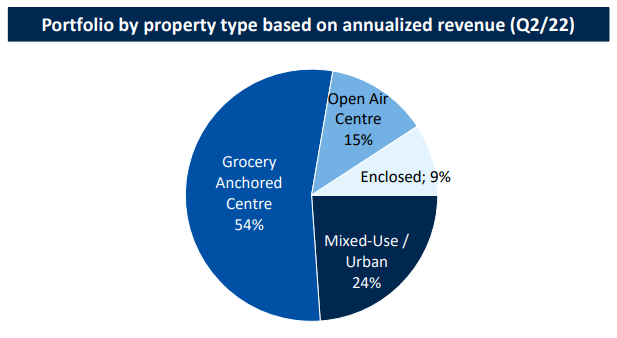

RioCan Tenant Mix (RioCan Shareholder Presentation)

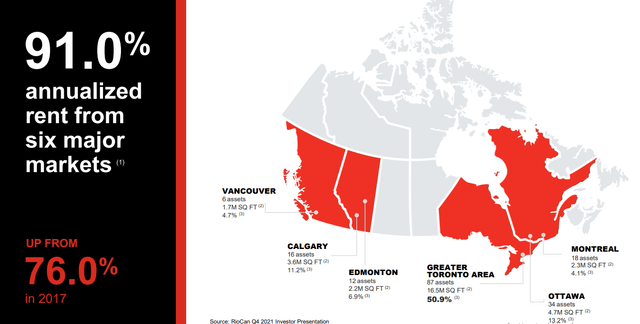

RioCan owns, operates, and develops retail, office and mixed-use residential properties. These properties are located in Canada’s largest metropolitan areas focused on population density and economic activity. More than half of RioCan’s assets are located in the Greater Toronto Area, home to over seven million inhabitants and the sixth-largest metro area in North America. The remainder of RioCan’s properties is concentrated in Canada’s next five largest metropolitan areas. In these strong markets, RioCan enjoys in-place occupancy of over 96%, with strong demand to release. Strong occupancy and a diverse and well-curated tenant mix have led to same-property NOI growth of approximately 3% YoY.

RioCan Geographic Mix (RioCan Shareholder Presentation)

Business Strategy

The REIT’s strategy is largely centered on urban densification in its six key VECTOM markets, the major metropolitan areas of Vancouver, Edmonton, Calgary, Toronto, Ottawa, and Montreal. This “major-market” strategy has been employed over the past few years to centralize RioCan’s assets in Canada’s most productive and dense urban areas. The company has been recycling capital from assets in secondary markets with higher cap rates and reinvesting them into urban densification projects.

Dennis Blasutti, Chief Financial Officer at RioCan, elaborated on the REIT’s capital recycling strategy on the recent Q2 2022 earnings call:

Our asset sales program has progressed well with $123 million of completed disposition during the first half of 2022 and a total of $376 million when adding firm or conditional deals. These were at an average cap rate of 6.7%, as we have been selling lower quality assets, further improving our overall asset quality and recycling that capital into more productive uses.

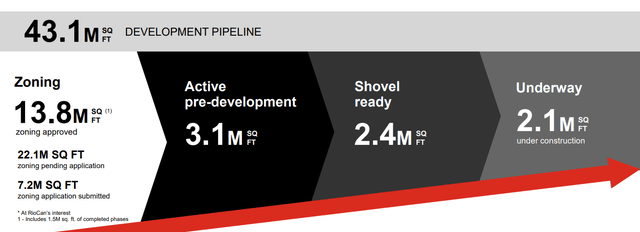

Funds from the dispositions of secondary market assets have been deployed to RioCan’s development program in recent years. The REIT’s current development plan is comprised of 13.8M square feet of zoned projects and 43.1M square feet of identified projects. The segment of projects in active or predevelopment is equivalent to 21% of the REIT’s current portfolio by square feet. RioCan is executing on a truly ambitious vision of focused growth.

RioCan Development Program (RioCan Shareholder Presentation)

With a strategy focused on densifying existing sites around transit lines and economic hubs in major cities, RioCan is building assets that will be desirable and central to commuters and customers for the long term. As RioCan owns the land on many of these sites, these developments are accretive as they come into service. Projects coming online in 2022 and 2023 will add $28.3M and $28.0M, respectively, in annual NOI.

The company’s foray into residential development is a promising direction. However, in order to truly diversify the portfolio away from retail will take years or decades. Even massive projects like The Well, coming into service next year, will only incrementally change RioCan’s business mix. RioCan targets earning $55-60M in NOI attributable to residential assets by 2026. With 2021 total NOI of $659M, the REIT could see residential revenue account for 7-8% by 2026. While this is a significant change from the current residential portfolio that represents 1.7% of properties, it is clear that RioCan will continue to be a predominantly retail REIT well into the next decade.

The Well Under Construction (RioCan Shareholder Presentation)

Distribution

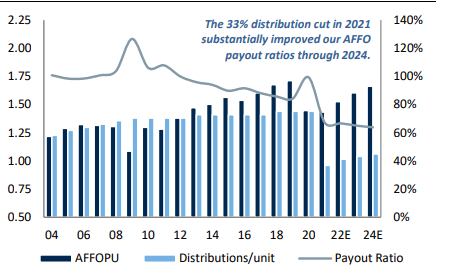

RioCan has a current AFFO payout ratio of 67%, the REIT’s healthiest payout profile in decades. RioCan has been working to correct its worryingly high payout for some time. This payout ratio compares favorably to industry peers, including Choice Properties REIT (OTC:PPRQF) and SmartCentres REIT (SRU.UN:CA) which have AFFO payout ratios of 89% and 100%, respectively.

RioCan Payout Ratio (RBC Capital Markets)

Since I last wrote about RioCan in 2020 (incorrectly advocating the safety of its distribution), the REIT has cut its distribution by 33%, from $0.12 monthly to $0.08 monthly. Despite the distribution cut, RioCan has achieved a total return of over 26% since summer 2020, compared to the S&P 500, which has returned less than 6% in the same period.

In July 2022, the REIT increased this by 6.25% to $0.085 monthly on positive occupancy recovery from the pandemic. RioCan currently pays $1.02 per unit annualized. At current unit prices, this represents a distribution yield of 5.49%. Even after accounting for the 2021 distribution cut of 33%, this yield is just slightly less than the 5-year average distribution of 6.1%. Over the next few years, as current developments come in service and start adding incremental NOI, I expect modest distribution growth in the low-to-mid single digits.

Valuation and Buybacks

In October 2021, RioCan was approved to repurchase up to 31,616,150 of its units, or approximately 10% of the public float through a normal course issuer bid over the next 12 months. According to Dennis Blasutti, RioCan’s Chief Financial Officer, buying back units at current prices is a good use of capital:

During Q2, we allocated capital from disposition proceeds and retained earnings to our development program, as well as unit buybacks to our NCIB, which totaled $129 million or 6 million units. This is an addition to the 8 million units that we repurchased in Q4 of 2021. We see these buybacks as an attractive use of capital as recent news unit prices, these repurchases this quarter reflect an implied cap rate of over 6%. This implies the unit price of these purchases was at a discount for income producing properties and ascribe effectively no value to our development pipeline.

To date, the REIT has repurchased a little over half of that amount at approximately 14,000,000 units. This opportunistic repurchasing of units with the proceeds of dispositions while unit prices are trading below historical levels, has resulted in a buyback yield of 5.52% for the trailing 12 months.

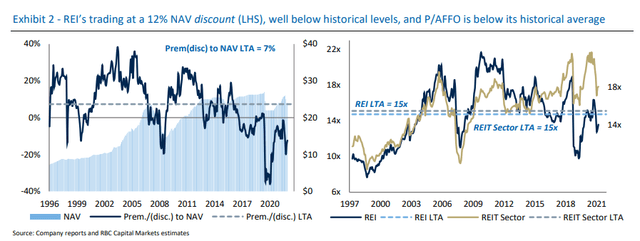

Currently, RioCan is trading at 14X AFFO, below its 2019 level of 16.5X. At present levels, RioCan units are trading at a 12% discount to NAV, well below historical levels and below the peer average discount of 6%. These fundamentals make for an attractive entry point.

RioCan P/AFFO (RBC Capital Markets)

Risk Analysis

With available liquidity of $1.38B, RioCan has a liquidity ratio (liquidity as a percentage of total debt) of around 20%, higher than the industry average of 16%. The REIT has total debt of $6.895B with a weighted average term to maturity of 3.7 years. This is a shorter duration than peers such as Choice Properties, with a weighted average term to maturity of 5.7 years, or SmartCentres REIT with 4.4 years. Both DBRS and S&P maintain BBB credit rating for RioCan.

RioCan’s cap rate is middle of the pack at 6.1%, up slightly from 5.8% in the previous quarter. The REIT’s higher cap rate is a result of it ownership in malls and its remaining presence in secondary markets. In terms of leverage, RioCan looks very similar to its peer group with debt/EBITDA of 10X in line with group averages and LTV profile of 48% compared to a peer average of 47%.

Beyond debt and rising interest rates, RioCan’s most significant risk factor is its client mix. As a retail REIT, its individual tenants compete and navigate in competitive retail environments. While RioCan has moved its client mix to “Amazon-proof” retail locations such as grocery-anchored and more experiential retail, changing trends in consumer behaviour could still have an impact on individual tenants. An example of this is movie theaters, which before the pandemic were thought to be resilient experiential tenants.

Investor Takeaway

RioCan offers a steady monthly distribution that is a good fit for investors seeking current income. With a low AFFO payout ratio, its distribution will have room to grow as projects in RioCan’s development pipeline begin contributing incremental NOI. The REIT is executing on its strategy of urban densification and has a substantial development program. With a current P/AFFO and discount to NAV below historical levels, RioCan’s current unit price offers a reasonable entry point.

Be the first to comment