bjdlzx

Ring Energy (NYSE:REI) has completed the Stronghold acquisition. The first order of business will be to maximize any cost advantages from the combined operations.

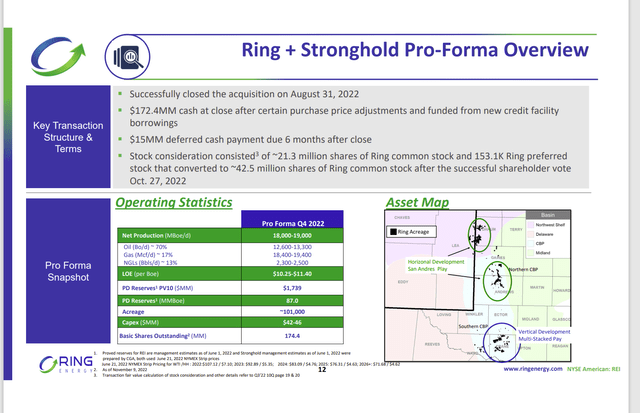

Ring Energy Newly Combined Operations With Stronghold (Ring Energy Third Quarter 2022, Earnings Conference Call Slides)

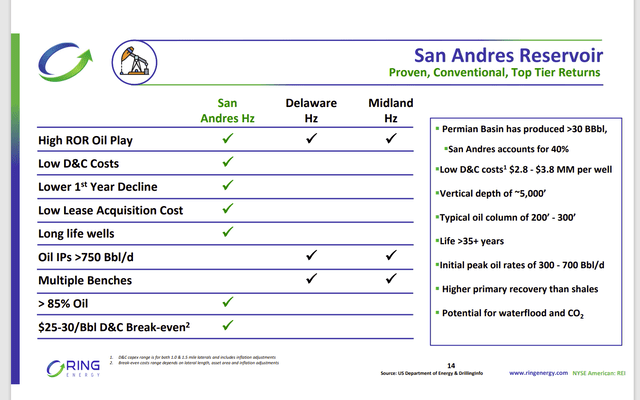

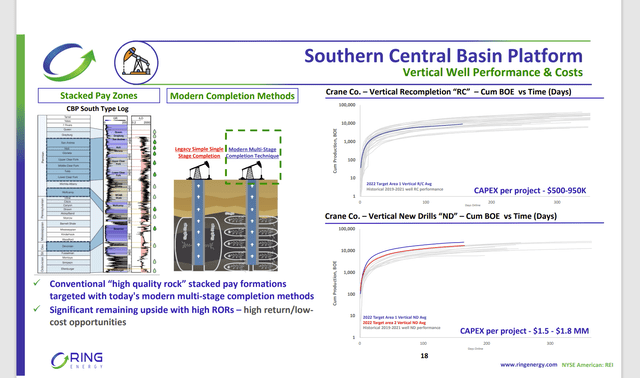

Ring Energy already has an important cost advantage in that the business is a conventional business. “Modern completion techniques” definitely play a part. But a conventional opportunity usually means the oil flows easier (or in greater quantities) than is the case with unconventional.

The other advantage is that the acquired properties still have the profitable opportunity to drill vertical wells. This is a big deal because it saves the “turn left” part along with “and go another mile or two” when drilling wells. It is another cost saving that is not so easy to find in this day and age.

Conventional opportunities often have higher recovery rates as well along with a better decline rate than unconventional. That means the conventional operator is likely to get more money back faster from that slower decline rate.

Ring Energy Description Of San Andres Development Advantages (Ring Energy Third Quarter 2022, Earnings Conference Call Slides)

The Stronghold acquisition continues the Ring Energy strategy of finding profitable intervals that the rest of the industry does not emphasize. Such a strategy enables cheap lease acquisition costs and the low breakeven point cited above. This is one of very few companies I follow that will show the acreage cost as part of the well breakeven calculation. Many companies do not include that usually sizable cost.

More importantly, the company is not getting into a bidding war with larger companies that have more financial resources. There are companies out there paying up to $66K per acre for prime Permian property. This company is not paying anything close to that price for wells that have comparable profitability.

This is exactly what shareholders pay management to do. Management found an interval that is not as popular as the usual Permian intervals so there is less competition for acreage. That results in an overall bargain for shareholders. Anyone can pay full price for prime land. High priced management is not needed for that. This management is clearly earning their pay with this business plan.

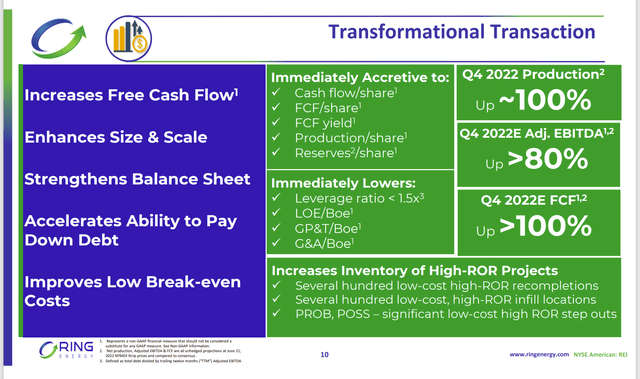

Ring Energy Summary Of Stronghold Acquisition Benefits (Ring Energy EnerCom Denver August 2022, Presentation)

The one thing that management needed to do was create some financial breathing room that disappeared with the coronavirus challenges. This opportunity appears to be just what was needed. Management is already cutting back the capital budget because there are a lot of low-cost opportunities to decrease costs (and probably) while increasing production.

The other consideration is the immediate production increase allows for efficiencies that were not available to the company as a smaller standalone operation. Most likely both entities will benefit from the combination.

The September 26, 2022, SEC Filing for the proxy statement to approve the issuance of common shares to convert the preferred issued in the transaction shows long-term debt of less than $100 million to get to an equal amount of production. Investors can bet management had a lot of questions about that because it points to considerably better free cash flow in the future than was the case in the past.

Management Improvements To Acquisition

Management is going to lower costs by taking care of deferred maintenance. But management will also be using the latest technology to recover more oil than has been the case in the past.

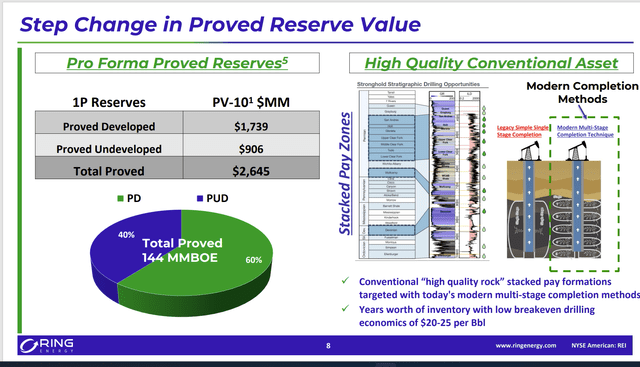

Ring Energy Proposed Future Well Design And Completion On Stronghold Acquisition Acreage (Ring Energy Presentation Of Stronghold Acquisition Advantages)

The proposed future drilling will likely reduce breakeven costs because the modern completion techniques keep advancing at rates that were not anticipated. These advances keep the costs declining for the whole industry.

The latest announcement that the capital budget will be cut now that the combination is complete should surprise no one. Management will likely spend much of the next six months or so optimizing operations. After that, then growth will be on the table. But management needs to know what it has first and then needs to take care of deferred maintenance (and any supporting midstream infrastructure issues).

Debt reduction for the company now that the acquisition has been completed will remain a high priority. But at least now there is a possible future where dividends can be contemplated. Before that was not possible as the financing was strict. The company had used much of its bank line because fiscal year 2020 was unanticipated. Without the challenges of fiscal year 2020, that bank line would likely have been materially repaid through the normal conversion process to an operating entity (from a beginning, lease acquisition company).

Key Takeaways

There is always the risk of another industry downturn as well as the risk that the acquisition would not work out as planned. Both risks seem small compared to the chances of successes. Management knows the operating area very well. That alone decreases the risk of failure. The last risk is the “small company risk” where the company loses a key officer and remains adrift through a lack of leadership. The last risk is the one from a lack of basin diversification that can sometimes lead to less than desirable profits.

But overall, this company made a material step in the stock price recovery direction. The market has demanded lower debt ratios and many companies I follow have done acquisitions to do just that.

Ring Energy Stronghold Acreage Well Operational Goals (Ring Energy Third Quarter 2022, Earnings Conference Call Slides)

The combined company will continue to have low location costs. Dividing that purchase price by the acres acquired is clearly under $20K an acre which is far below prime acreage costs. Yet the breakeven of these wells and the fast payback rivals the best acreage on the continent.

Additionally, management has a lot of cheap projects (as shown above) in the nearly acquired acreage. So, the lower capital cost is coming from capital devoted to these low-cost projects. It is probably a good bet that these projects have a fast payback as well.

Many companies fail to include acreage costs in their well breakeven calculation to shareholders. If they ever did, shareholders would be able to tell real fast why companies are not nearly as profitable as the wells they drill.

The use of stock and debt allows for an increase in earnings and cash flow per share despite a stance of little to no overall production growth. That is a common growth tactic when debt is an issue, and the market demands some form of return through dividends.

Management reported far better financial leverage than was the case in the past. The third quarter was a partial quarter with combination costs included as well as optimization costs. But the statements should “clean-up” relatively fast. The acquisition was a good move for management.

Dividends are very unlikely to be paid for a couple of years by this company (if then). Before the coronavirus challenges, management was building a company to be sold. Clearly the latest acquisition was made to get the company back on that track.

Now management has to make the combined company work. But “bolt-on” type acquisitions are usually considered fairly low risk with less challenging acquisition hurdles.

The company may be positioning itself as a consolidator of smaller operations that are less profitable as standalones. That would be good news for shareholders.

Be the first to comment