Dmitry_Chulov/iStock Editorial via Getty Images

Last week, we did a deep dive into Compagnie Financière Richemont (OTCPK:CFRHF) (OTCPK:CFRUY) providing a detailed analysis of the latest company disinvestment and its fair valuation. Since mid-July, the second largest luxury player is a target of a British activist fund called Bluebell Capital. Last time, we indicated how the next catalyst was the Annual General Meeting and after yesterday’s release, we now comment on the company’s outcome.

Annual General Meeting analysis

Richemont’s top management has obtained a broad consensus from the shareholders’ meeting. Bluebell’s proposals have been rejected but the British activist fund intends to continue with its initiatives in the future. Wendy Luhabe, already on the board since 2020, was appointed a member of the board of directors as the representative of A shares holders with 84% of the latter’s votes, whereas Francesco Trapani, supported by the activist fund, had 9.50% of the votes and was therefore not elected.

In line with the recommendations of the chairman of the board, Johann Rupert, Bluebell’s proposals to amend the statutes were also rejected. One proposal provided for equal representation on the board of directors for shareholders A and B, but was rejected with 83% of the votes. The same fate was also for Bluebell’s motion to increase the minimum number of members.

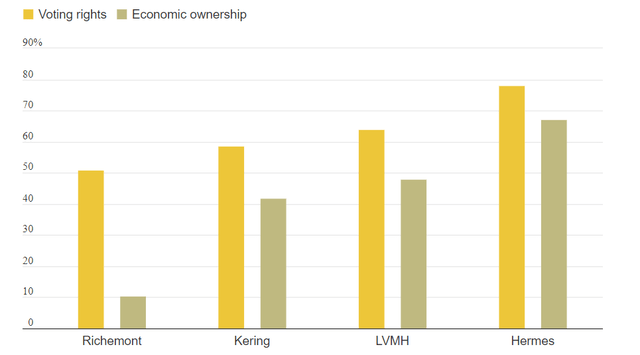

It is also necessary to recall that Richemont’s capital includes 522 million A shares with a nominal value of 1 franc each and as many B shares with a nominal value of 10 cents. A mechanism that leads the Rupert family to have 9-10% of the total capital but over 50% of the voting rights. This share-voting rights mechanism is precisely one of the objects of criticism by Bluebell.

Voting rights vs economic ownership

Following the AGM in the press release, Johann Rupert underlined the success achieved at the meeting held in Geneva: “I am deeply grateful to all our shareholders and wish to thank them for their vote of confidence in the leadership and governance of the company. The Board can now continue to work in a collegial manner, in the interest of all our shareholders“.

On the other hand, Giuseppe Bivona, co-founder of Bluebell, expressed satisfaction with the fact that the shareholders now have a representative on the board. He also reiterated that the fund will not stop. “It’s just the beginning, there is work to be done, we will have to be patient but we will continue” explained Bivona.

In recent months, Bluebell had also criticized the Geneva group on e-commerce investments. According to Bivona, the Swiss luxury house needs to refocus its activities on its core business of watches and jewelry. The Rupert family and Bluebell are aligned on this front given the recent Ynap sale.

Conclusion

Last week, we concluded that Richemont was fairly priced. Even if its stock price performance has lagged behind Hermes (OTCPK:HESAY) and LVMH’s (OTCPK:LVMUY) share development in the previous years, we remain neutral. Bluebell’s total investment is just 0.2% of the total capital but other activist funds are looking at the Swiss player. Corporate governance issues cannot be unnoticed. We will continue to monitor Richemont’s development. The next catalyst is on the 11 of November when the company will present its Q3 results.

Be the first to comment