FG Trade

A few quarters previous, we wrote an article predicting Antero Midstream Corporation (NYSE:AM) (“Midstream”) financials through 2026. We revisit that prediction now that the company’s business just turned the corner, becoming cash flow positive after dividends. Antero’s plans included an aggressive drilling agenda intended to increase transportation revenue for natural gas (NG). In time, the support capital needed for the future significantly trails off. Visiting those healing financially can be a chore or a joy. Let’s go inside, make a visit and check on the patient.

The Prediction

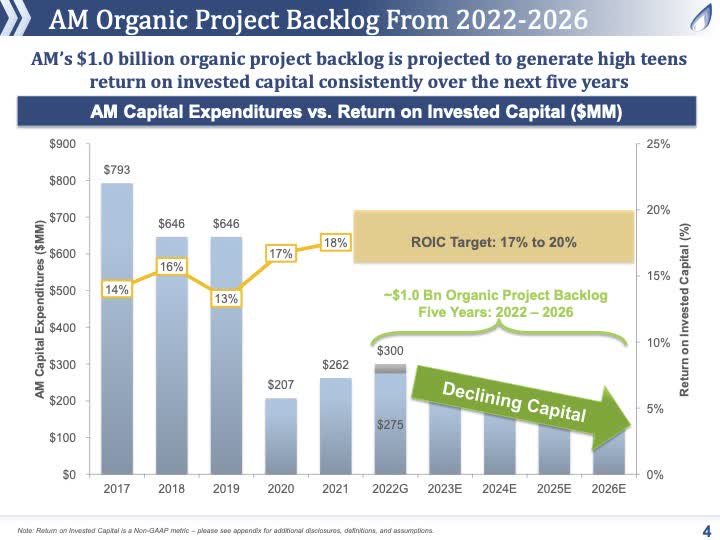

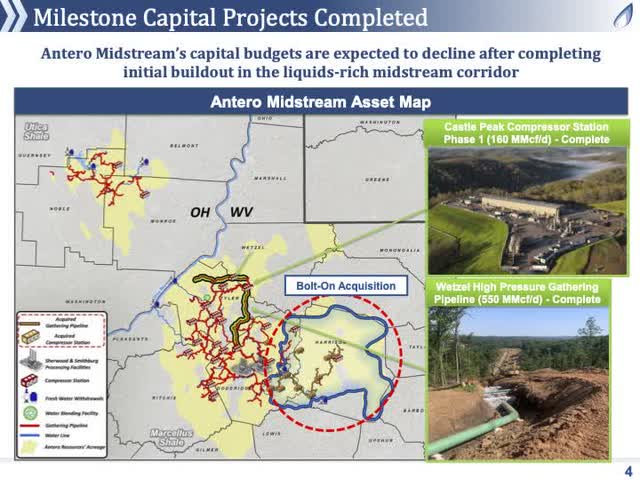

At the beginning of 2021, Antero slashed its dividend from $0.31 per quarter to $0.225 per quarter. In the press release, management stated that the difference would be used to support a capital drilling program targeted for production growth with Antero Resources (AR). The discussions with analysts made clear that increased revenue with Midstream wouldn’t begin until late in 2021. The drilling activity was scheduled to last five year being heavily front-end loaded. The next slide presents the estimated capital through 2026.

Antero Midstream

We include our EBITDA/capital estimates from our article, “Antero Midstream Corporation’s Corner,. . .”

Since the company didn’t include details by year for cash flows, we developed a table below for an estimate.

| Cash Flows (Millions) | EBITDA* (+5%) | Capital ($800M) | Distribution | Net Cash |

| 2023 | $920 | $250 | $430 | $240 |

| 2024 | $960 | $200 | $430 | $330 |

| 2025 | $1000 | $175 | $430+** | $400 |

| 2026 | 1060 | $175 | $430+** | $450 |

*$875 (2021) times 1.05 (Low-single-digit Growth) equals $920 million. Also, investors might consider asking, is 5% low single digits?

**Cash left-over for distribution increases to be determined.

The Results Thus Far

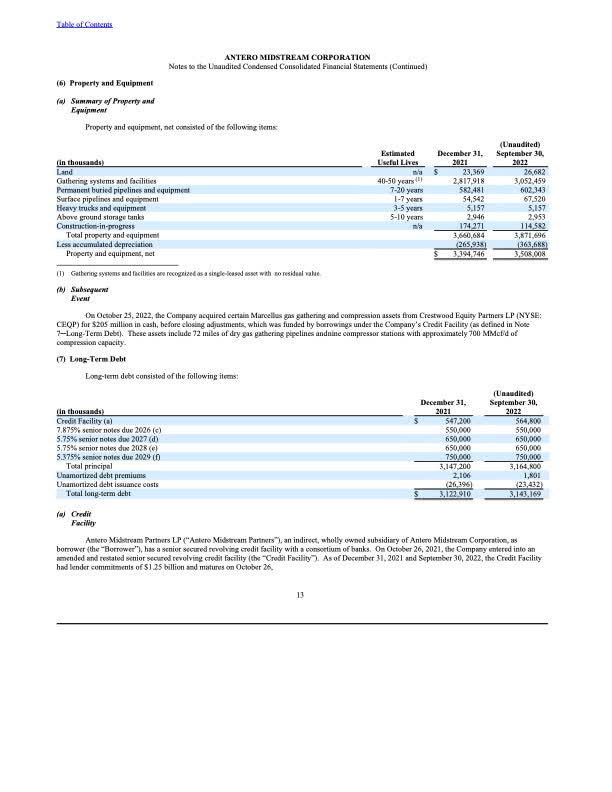

With the company’s expectation for increased EBITDA beginning in 2022, the result thus far for the first nine months was negative. Midstream reported EBIDTA of $663,000,000 in 2021 with a loss of $10,000,000 to $653,000,000 in 2022. Interestingly, the company announced a purchase of a bolt-on expansion, purchasing Crestwood Equity Partners LP (CEQP) for $205 million in cash using its revolver. We suspect that at least part of the motivation for the purchase resides with lagging EBITDA growth.

The following slides and commentary summarize the benefits.

The purchase adds 20% compression capacity, increases pipeline milage by 15% while reducing capital expense through synergy of $50 million plus. It also adds over 400 undeveloped drilling locations now held by Resources and adds 10% cash flow after dividends. Using one estimation method, additional EBITDA of $45 million a year is expected ($205 million divided by 4.5).

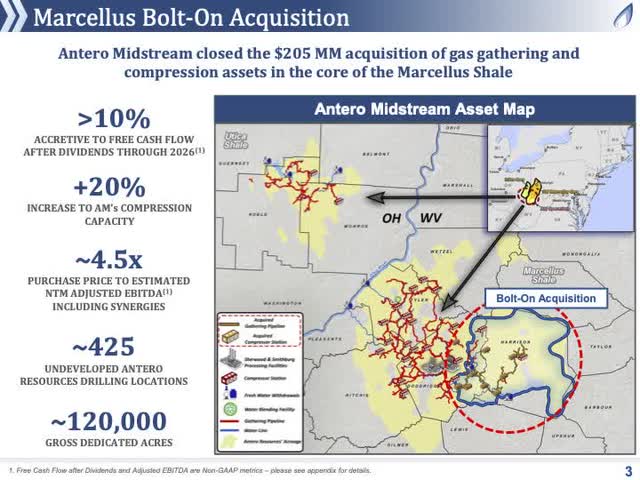

Management also included an update on its capital spending forecast with a summary of completed projects shown again in the next slide.

Phase 1 of the Castle Peak compressor station was completed. A 20-mile high pressure line in Tyler and Wetzel counties was also completed. This added 160 million cubic feet a day of compression capacity in the liquids rich midstream corridor located in Tyler and Wetzel counties.

Finally, during the 3rd quarter, the company claimed that it achieved the key inflection point, being $30 million cash positive driven primarily from the reduction in capital costs. “Once we achieve this target, we will be in a position to evaluate or the return of capital strategies.”

Meeting the 2024 Leverage Target

Again, Midstream set a goal in 2021 for lowering its leverage to 3x or lower by the end of 2024. We aren’t sure exactly what that means. Does it include the whole or just a projection based on the last quarter or two? Our understanding suggests that it’s the last quarter or two projection. At the bottom of the next slide is shown Midstream’s debt structure.

Antero 10-Q

Leverage equals debt divided by the last four quarters of EBITDA. Debt now equals $3.3 billion with the Crestwood purchase.

Management stated it “expect[s] mid single digit sequential throughput growth in the fourth quarter compared to the third quarter driven by two months of contribution from the acquired assets.” Going forward, they expect the same growth on a year over year basis. We interpret this to mean approximately +5%. Without further information, our estimate assumes a growth in EBITDA of the same, 5%. We included a table showing estimated levels of excess cash.

| Leverage Balance (Millions) | EBIDTA | Capital Quarter | Capital Year or Year-to-Date | Debt Reduction | Debt |

| 3rd Quarter * | $223 | $40 | $200 | $30 | $3300 |

| 4th Quarter ** | $235 *** | $50 | $250 **** | $30 | $3270 |

| 2023 ** | $935 # | NA | $200 | $220 + | $3100 |

| 2024 ** | $980 ## | NA | $150 | $310 + | $2800 |

* Base line EBIDTA.

** Estimates.

*** Crestwood adds $12 million per quarter.

**** Budget was $300 million, but with the purchase of Crestwood, a capital reduction of $50 million is estimated.

# $890 (2022 EBITDA) times 1.05.

## $935 (2023 EBITDA estimate) times 1.05.

+ At 2022 EBITDA levels, a rough estimate of $30 million per quarter of extra cash was generated. The savings calculation becomes $120 million plus the change in capital vs. 2022 plus the difference between yearly EBITDA minus the base year EBITDA being 2022.

Next, a table helps understand the likelihood for management meeting the leverage target of 3 by 2024 year-end.

| Leverage | Debt (Billions) | EBITDA | Leverage |

| 2022 End | $3.3 | $890 * | 3.7 |

| 2023 End | $3.10 | $935 | 3.4 |

| Case 1 2024 End | $2.8 | $980 ** | 2.9 |

| Case 2 2024 End (Smaller growth) | $2.85 | $950 | 3 |

* Estimated by adding $10 million from the Crestwood operation plus $10 million enhanced operation year over year plus $213 million, 2021 4th quarter’s result.

** Mid-single digit growth.

The table shown above helps investors understand that Midstream needs to pay down approximately $400 million in debt to reach its goal leverage target, a likely feat with the inclusion of Crestwood. Without the purchase, the target seemed unlikely leaving us with the clear impression that this drove the purchase. It also appears that with Crestwood, at least through 2024, our table estimating revenue seems plausible.

A Dividend View

Once the leverage goal is achieved, Antero Midstream Corporation management expects to revisit the dividend. With the uncertainty abounding, a higher look is probably possible, but certainly nothing more than a look. At the end of 2024, approximately $300 million in extra cash appears to be probable. With 480 million shares outstanding, $300 million cash equals $0.60 per year or $0.15 a quarter. In early 2021, management cut the dividend by $0.0825 per quarter. We suspect that at least that amount will be added back toward the end of 2024 or beginning of 2025. At approximately $1.20 a year in dividends, the value of Antero Midstream Corporation stock might increase into the $14-$15 range, a 30% increase from recent closing prices. Investors will likely be paid nicely while gaining a valuable capital return.

Risk

With natural gas players such as Antero Midstream Corporation, risks include recessions, governments targeting fossil fuels and unseasonal weather. The European and American winters thus far has been mild to write the least cutting the need for winter heating. Colder than normal summers or warmer winters can negatively change producer volumes. Increased production by producers can lower prices which in turn lower volumes. For example: from Oilprice,

“Continued increases in U.S. dry natural gas production are expected to outpace domestic demand and exports this year and in 2024 according to the EIA.”

This is why we added a lower growth line in the table above (Case 2). All the risks only alter timing, not the objective. In our view, the patient is recovering; the doctor came pronouncing that a discharge date is coming. On any weakness, Antero Midstream Corporation is a buy.

Be the first to comment