All_About_Najmi/iStock via Getty Images

By Robert Hughes

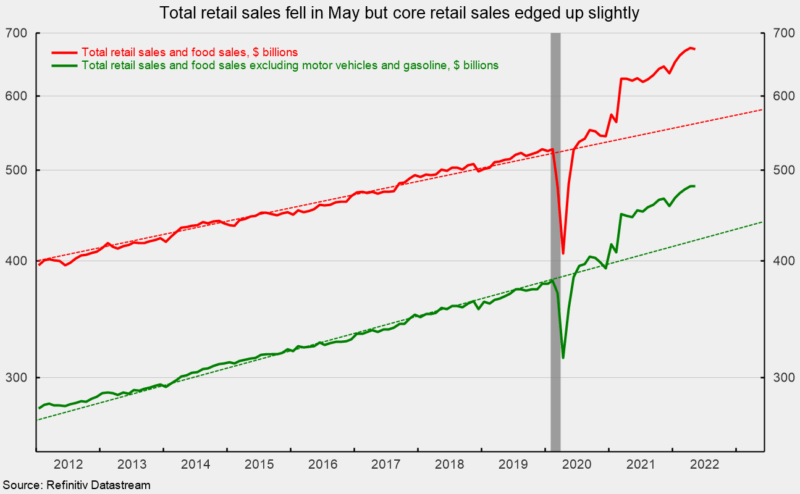

Retail sales and food-services spending fell 0.3 percent in May following a 0.7 percent gain in April. From a year ago, retail sales are up 8.1 percent. Total nominal retail sales remain well above the pre-pandemic trend (see first chart).

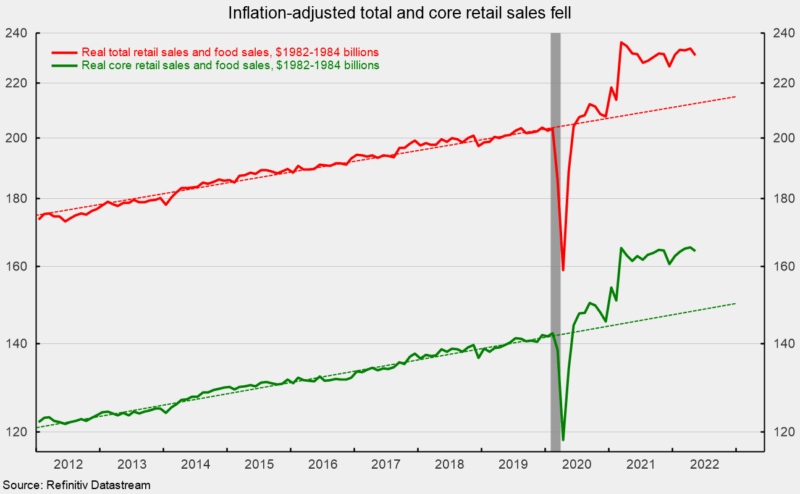

However, these data are not adjusted for price changes. In real terms, total retail sales were down 1.2 percent (adjusted using the CPI) in May following a 0.4 percent increase in April. From a year ago, real total retail sales are down 0.4 percent. As with nominal retail sales, real retail sales remain well above trend (see second chart).

Core retail sales, which exclude motor vehicle dealers and gasoline retailers, rose 0.1 percent for the month following an 0.8 percent gain in April (see first chart). The gains leave that measure with a 7.9 percent increase from a year ago.

After adjusting for price changes, real core retail sales fell 0.6 percent in May but are up 1.8 percent from a year ago. Real total and real core retail sales are both well above prior trends (see second chart).

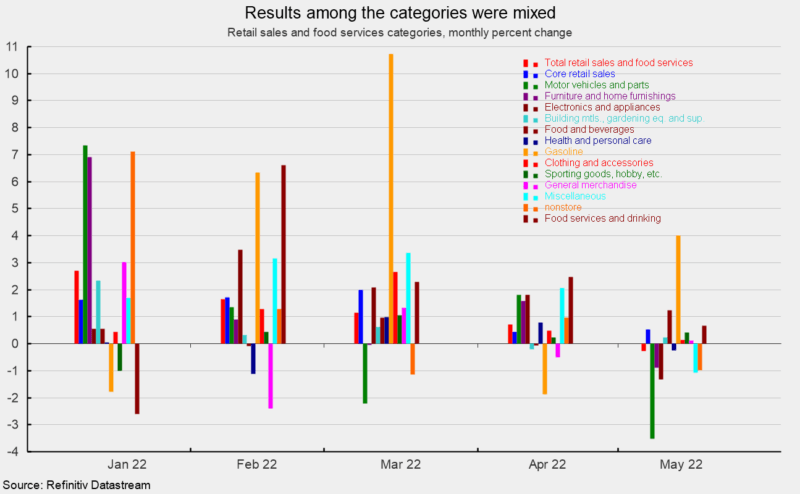

Categories were mixed for the month with seven up and six down in May, on a nominal basis. The gains were led by gasoline spending, up 4.0 percent for the month. However, the average price for a gallon of gasoline was $4.70, up 7.5 percent from $4.37 in April, suggesting price changes more than accounted for the rise. Food and beverage store sales were up 1.2 percent in May while restaurants posted a 0.7 percent gain, and sporting goods, hobby, musical instrument, and bookstores sales were up 0.4 percent (see third chart).

Among the decliners, automotive retailers had a 3.5 percent decrease in sales followed by electronics and appliance store sales (off 1.3 percent), miscellaneous store retailers (down 1.1 percent) and nonstore retailers (down 1.0 percent; see third chart).

Overall, retail sales fell for the month and were dragged down by slower auto sales but remain well above trend. Excluding autos and gas, nominal core retail sales managed a small gain. However, rising prices are still providing a significant boost to the numbers. In real terms, total and core retail sales were down for the month. Furthermore, persistent elevated rates of price increase are starting to have a negative effect on consumer attitudes and may lead to a retrenchment in spending.

While continuing labor shortages, along with materials shortages and logistical issues, are likely to continue to slow the recovery in production across the economy, sustaining upward pressure on prices, the effects of inflation on consumer attitudes combined with a new Fed tightening cycle may lead to significant demand destruction and raises the risk of recession. In addition, the Russian invasion of Ukraine and waves of lockdowns in China remain threats to economic expansion. The outlook has become highly uncertain.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment