andreswd/E+ via Getty Images

I talked about ReneSola (SOL), a leading solar farm builder internationally, as a great turnaround idea last October here, priced in the $7 range. Well, the company keeps making money and growing the underlying business, despite witnessing less respect from investors, with a price under $5 yesterday.

ReneSola Built Minnesota Solar Farm – 2021

Investors have sold off all solar names with the technology bust since November. Continued and new solar project tax incentives inside the Build Back Better plan from Democrats went down in flames in the Senate during December. And, states like California are talking about ending many tax breaks for solar. None of this is good news for ReneSola shareholders.

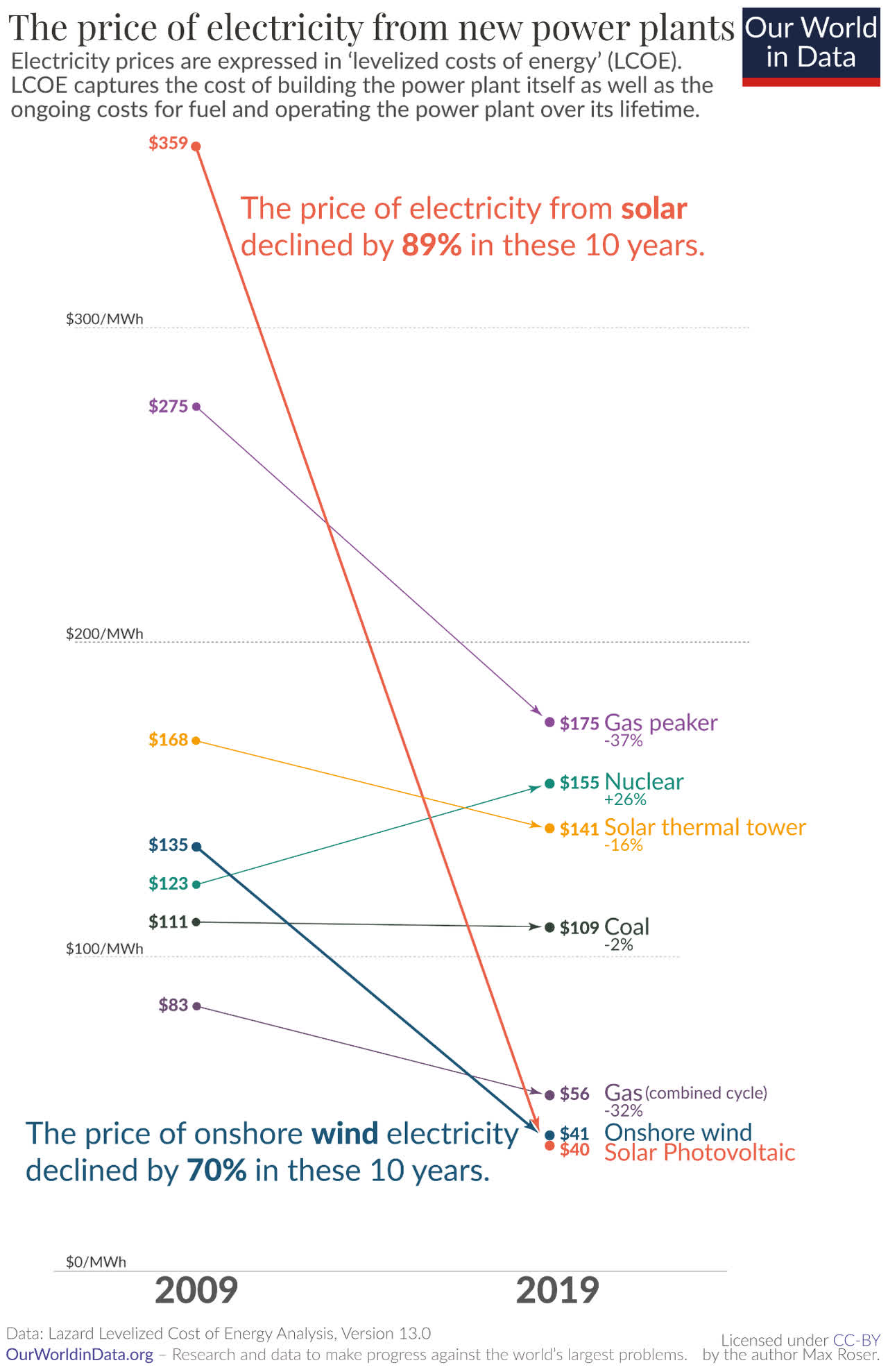

But here’s the brightening long-term story. With fossil fuels like crude oil selling at 7-year highs in January, the profit motive to construct large-scale solar plants is becoming more undeniable, without any funding help from governments. Today, most major solar farm projects can generate long-term electricity supply at costs BELOW that of natural gas, coal, and other less environmentally friendly sources. For the industry, it’s been a technology ramp of greater economies of size lowering costs, new inventions and designs capturing more sunlight efficiently, and manufacturing process advancements producing longer-lasting panels and modules. Looking forward, further spikes in oil, gas and coal will do all the work to encourage solar development at even faster rates, sooner rather than later. In essence, free market forces are about to take over, encouraging solar farm buildouts at far stronger growth rates than today. So, ReneSola’s assets, technical expertise, and experience could be swamped with projects in a year or two, especially if society is serious about slowing global warming pollution.

Our World in Data Graph

Absurd Valuation

You would think investors and Wall Street analysts understood the truly positive future for ReneSola, and are now putting a premium valuation on the business today. You would be wrong. Presently, you can buy SOL’s wonderful operating future for basically… NOTHING! You heard me right. Instead of paying outrageous overvaluations for Big Tech with growth rates beginning to fail (look at Meta-Facebook (FB) or PayPal (PYPL) as examples), why not add a high-growth business future into your portfolio for next to nothing upfront?

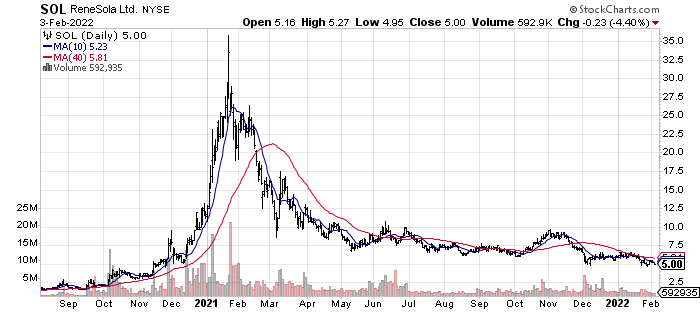

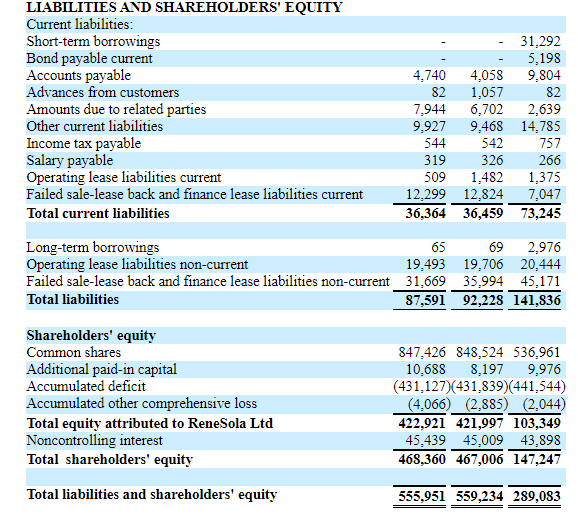

How can I say such a thing with the stock quote around $5 per share? When the stock exploded higher in early 2021, from excitement over the Democrats gaining control over both chambers of Congress and the Presidency, new solar incentives looked like a sound bet to fight climate change. Wall Street went wild for solar names. ReneSola rose from $2 a share in September 2020 to $35 in January 2021. Luckily, management was paying attention, smartly deciding to issue new shares in the open market for cash, as a low-risk, low-cost avenue to fund future business growth. Share offerings were sold at $16 and $25 about a year ago. This effort actually jumped the underlying asset value of shares dramatically for existing shareholders owning before 2021 (instead of diluting them like most issuance schemes) with cash holdings climbing from under $0.50 to $4 per share, and book value from $2.50 to $6.

StockCharts.com

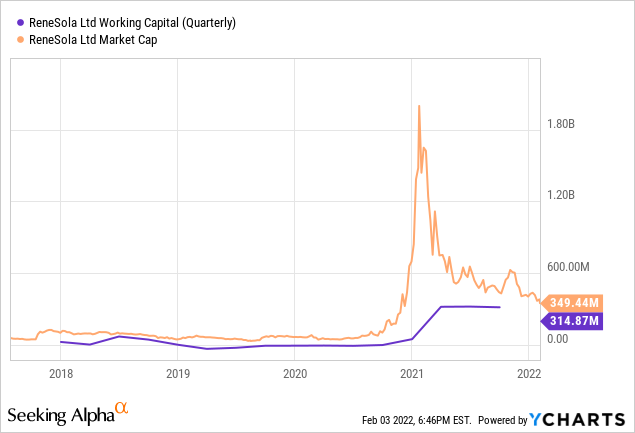

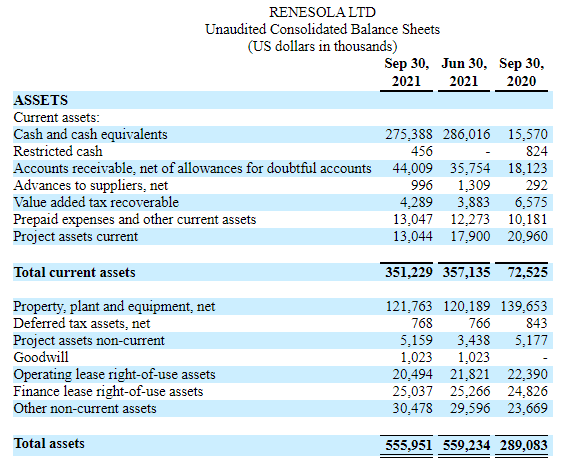

The new capital paid off debt, and the rest is mostly sitting on the balance sheet. As of the end of Q3 in September (the last reported period), ReneSola held $275 million in cash and short-term investments, and $351 million in current assets vs. just $36 million in current liabilities. The remaining $315 million in working capital is largely an unnecessary surplus if one owner bought out the company. Here’s the kicker: the company’s outstanding share total multiplied by $5 in price creates a theoretical take private equity capitalization of $349 million, roughly equal to working capital.

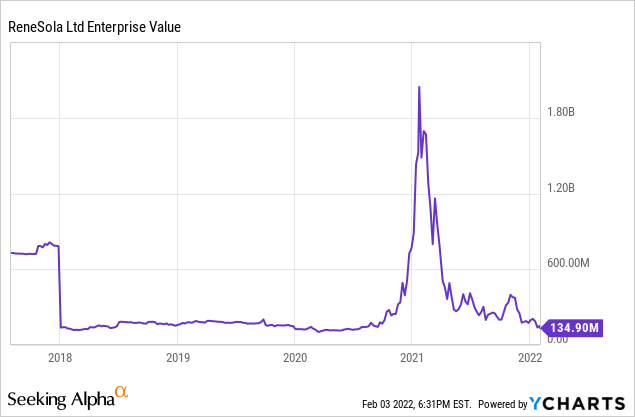

YCharts

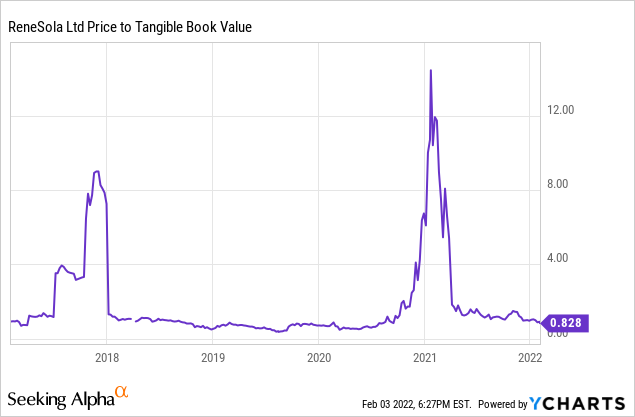

The company also owns $157 million in other hard assets like net depreciated plant & equipment vs. only $51 million in long-term liabilities, almost entirely real estate lease obligations. Again, today’s $349 million in total stock market ownership value is measured against a net tangible book value (mostly cash) of $421 million. The price to tangible book value multiple of 0.83 is drawn below, and is close to the same ratio as mid-2020, when the stock quote was hovering under $2. However, the current balance sheet is flush with cash, more so than any other time in recent memory. The way I look at it, Wall Street is giving no real value to future business growth, despite forecasting decent improvements in the underlying business during 2022-23.

YCharts

Amazingly, when you subtract cash from total equity and debt capitalization, the enterprise value of $135 million today is very near the same setup as the middle of 2020, when few investors wanted anything to do with solar right after COVID-19 pandemic shutdowns. Believe it or not, this minor sum compares to an enterprise value of better than $2 billion in January 2021.

YCharts ReneSola Q3 Report ReneSola Q3 Report

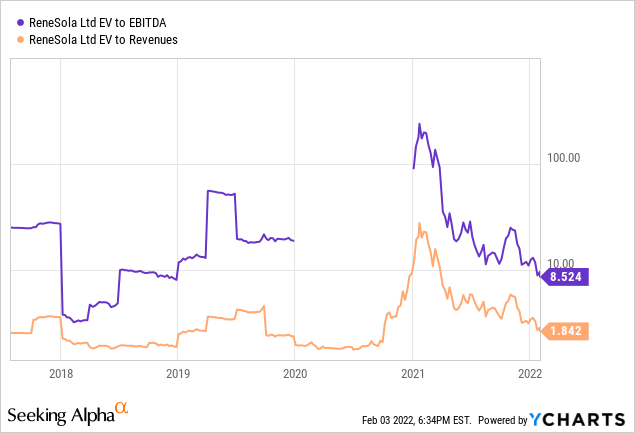

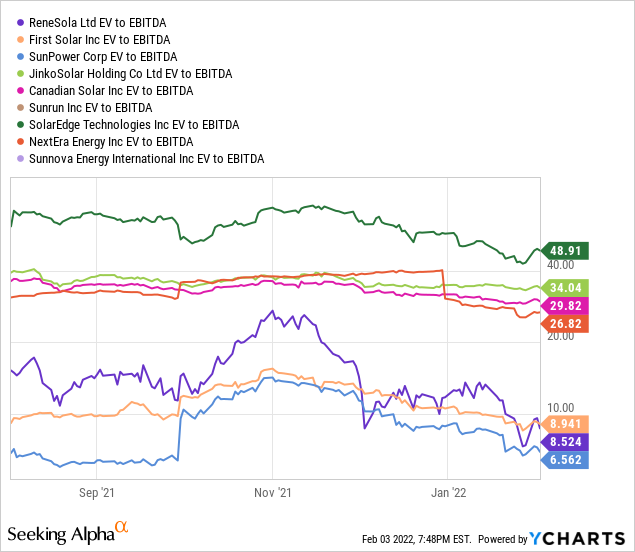

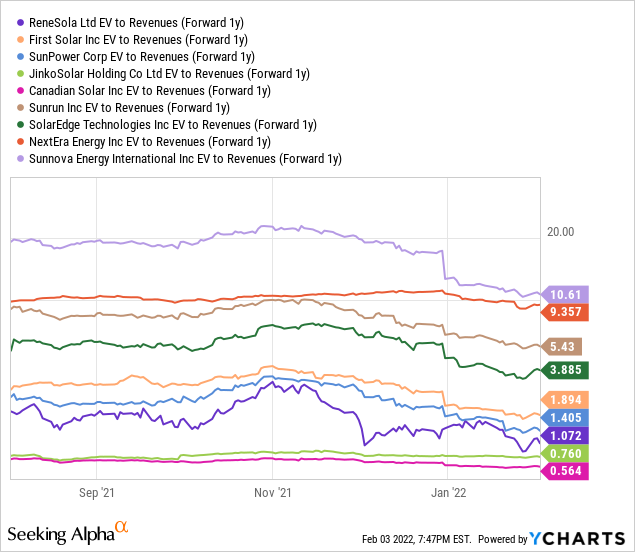

Another point to ponder, EV to EBITDA and Revenue ratios are back near 5-year lows for ReneSola, and a discount to other solar names.

YCharts YCharts YCharts

Final Thoughts

To illustrate how sharp managers at ReneSola have become, in December they decided buying back shares on the open market with their cash pile would be a great idea, and I concur. Selling stock for a dear price of $25 a year ago, and repurchasing it today for $5 is borderline brilliant for existing stakeholders. In fact, if they used the entire board approved $50 million repurchase amount to purchase stock at $5, tangible book value and liquidation readings would grow from $6.00 to $6.20 per share (on the reduced outstanding share count), all else being equal.

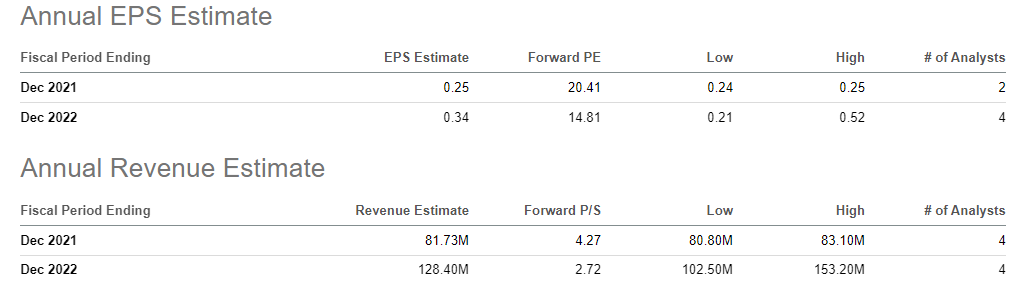

If business sales grow +30% annually between 2023-24, after the Wall Street analyst projected +55% increase in 2022 vs. last year, who wouldn’t want to own this solar farm builder for little upfront cost? Further, this year’s projected $0.34 EPS number compares quite favorably with a cash-adjusted enterprise value of $1.92 per share. Can you find another strongly-positioned solar company with a super-conservative balance sheet, selling for less than 6x EV to EPS? I cannot.

Seeking Alpha Consensus Estimates – February 3, 2022

What could go wrong? Management could expand too fast, hurting cash flow and earnings numbers. This is my biggest operating fear. However, ReneSola operating decisions have been ultra-conservative, and the advantageous change in share counts and cash during 2021 are just one example. Another risk is the whole solar industry stops growing, and nobody wants to build a large solar plant with cheap green energy electricity generation. Of course, that would mean everybody on planet earth gives up on pollution control and climate change goals.

Overall, I am not very concerned about the operating business as currently configured. A final risk, which has been playing out in January, is the stock markets of the world decline sharply, bringing extra selling to ReneSola and all stocks. The overvaluation bubble in Big Tech stocks has been deflating, and selling has spilled over into solar names as a side effect. This trend could continue for a while longer, but may only bring a better deal for new buyers in SOL shares.

Downside risk appears quite limited from $5. Assuming the whole $50 million share buyback is spent, and its plant & equipment is worth 50 cents on the dollar held on its books, ReneSola still holds an asset liquidation value of at least $4.00 per share.

I am modeling potential worst-case scenario downside to $4 vs. upside targets of $10+ in 12-18 months. Clearly, the risk/reward equation is asymmetrically tilted in favor of ownership. Today, it’s incredibly difficult to find a similar growth story selling for next to nothing, net of huge cash holdings. For those hunting for solar industry exposure or a potential multi-bag winner over several years with very limited risk in portfolio construction, ReneSola should be near the top of your research list.

Absolutely, a takeover play from the current bargain price is an outcome worth contemplating for ReneSola. A variety of potential suitors from management to private equity, other solar infrastructure build companies to any billionaire wanting exposure to the coming high growth rates in clean energy, might consider an acquisition deal with the nearly free valuation on the business, after subtracting out the unnecessary cash position.

I own a small stake and may add to my position if prices dip below $5 in the coming few weeks.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment