Laser1987/iStock Editorial via Getty Images

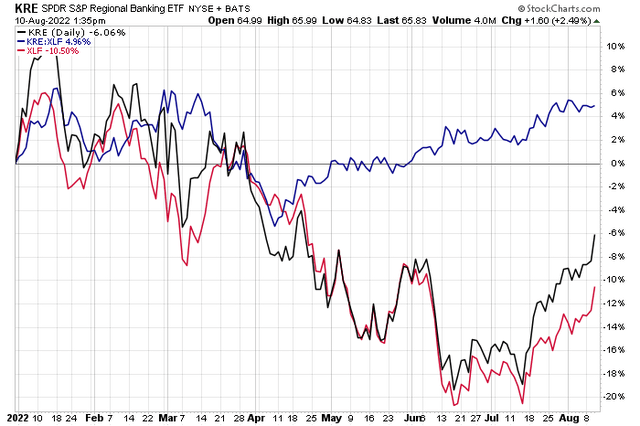

Regional banks are often seen as a bellwether for the Financials sector and the broader stock market. A popular ETF to play that industry is the SPDR S&P Regional Banking ETF (KRE). The industry had struggled mightily on an absolute basis through mid-July. In the last few weeks, however, small regional banks have taken flight.

Following a much better than expected U.S. employment report last Friday and (finally) a cooler-than-anticipated July CPI report on Wednesday morning, investors are piling into KRE. After outperforming the Select Financials Sector ETF (XLF) since early Q2, the bulls hope that this group of small banking firms can keep the momentum going into year-end.

Regional Banks Outpace The Financials Sector

One company shines within the niche with a solid 4% positive total return year-to-date. According to Bank of America Global Research, Regions (NYSE:RF) is a regional bank based in the Southeast with more than $160 billion in assets. Headquartered in Birmingham Alabama, the company has over 1,800 branches and a leading market share in Alabama, Tennessee, and Mississippi. The company’s lending portfolio focuses primarily on C&I, residential mortgages, home equity, and commercial mortgage.

The $20 billion market cap Financials sector banking company pays a handsome 3.6% dividend yield and trades at just 10.1 times last year’s earnings, according to The Wall Street Journal.

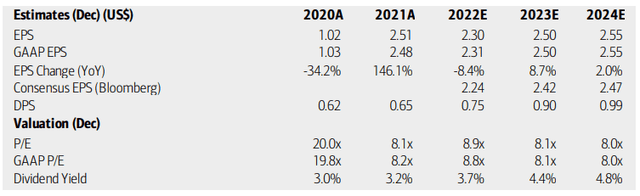

Analysts at BofA see a profit dip this year, but then a solid growth rate in 2023 before earnings per share stabilize in 2024. As such, RF’s P/E ratio is seen as remaining cheap if the stock does not continue to climb from here. Dividend investors will like BofA’s yield forecast on RF – rising to nearly 5% by year-end 2024.

RF: Earnings, Valuation, Dividend Forecasts

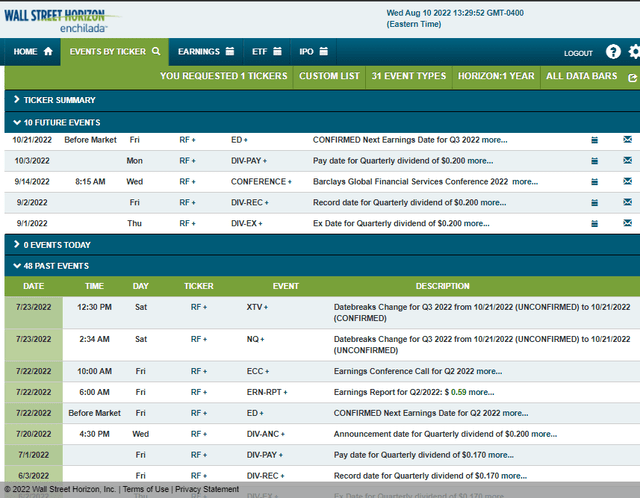

Regions beat its Q2 EPS forecast in July as the reporting season kicked off. Its next earnings date is confirmed by Wall Street Horizon for Friday, October 21, BMO. Between now and then, the company’s management team is expected to speak at the Barclays Global Financial Services Conference from September 12-14. Investors should be on guard for possible volatility around that date.

Regions’ Corporate Event Calendar: September Conference On Deck

The Technical Take

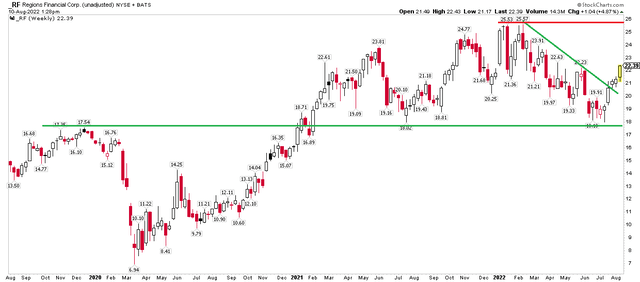

RF shares surged on Wednesday as the market, and the Financials sector, in particular, rallied on the better-than-forecast CPI report. Regions looks to post five consecutive weekly advances as the stock sports relative strength.

RF held its pre-pandemic highs nicely on a few tests since the middle of last year and just recently broke out above a downtrend resistance line off its early 2022 peak above $25. I think the stock is poised to revisit those highs in the coming weeks based on this momentum. If things don’t work out, a sell stop should be applied below $17.50.

RF: Breakout Above Resistance After Holding Its Late 2019 High

The Bottom Line

Regions Financial looks good to me as the stock looks to settle at its highest price since March. It has a cheap valuation with earnings growth expected over the next year. A solid dividend yield may inch higher if BofA is right. Meanwhile, the technical setup and impressive relative strength versus its industry and the broad market appear to make RF a leader in the second half.

Be the first to comment