Stephen Brashear

Q2 was an ugly quarter for Redfin (NASDAQ:RDFN). They missed revenue expectations that management guided for, losses mounted (this was expected), the acquisition of Bay Equity could not have come at a worst time as the mortgage industry suffered through a significant slowdown, and they expect to sell homes purchased in April and May as a part of their iBuying program at a loss. Most of the downside surprise in these metrics can be attributed to the historic rise in mortgage rates in early June which slammed the brakes on the housing market.

Despite this, I came away with some reasons for optimism. It doesn’t look like the slowdown in housing demand will get much worse than what we saw in early June. Management also acknowledged a willingness to pull any and all levers to ensure the business has ample liquidity if housing demand once again take a turn for the worse. This calms any short term fears of existential business risk. And from a business operations perspective, it looks like all of the pieces are finally starting to come together as they’re increasing attach rates of their offerings of ancillary services.

But does Redfin employ a viable business model for long term success? And will housing demand continue to decelerate at its current pace? My optimism doesn’t stem from definitively knowing the answers to these question, but more from the fact that I think that Q2 was rock bottom for both Redfin and the housing market. Things should improve from here even if the improvements are marginal.

No More Existential Business Risk

It’s no secret that Redfin is unprofitable and burns through cash. They ended the quarter with a little under $400 million in cash on its balance sheet, down from about $600 million in Q2 2021. Two more quarters like that and the business will be out of cash.

This is a risk for investors but Glenn Kelman squashed those fears in what was, in my opinion, the most interesting news that came from the earnings call. Regarding commission refunds for buyers, Kelman said:

On July 26, we eliminated the commission refund we offered homebuyers in 22 markets with few objections from customers or agents. If this pilot continues to be successful, will eliminate the refund entirely as early as January 2023, improving full year gross margins in our core business by more than 500 basis points. In the nine small markets that already eliminated the refund in 2019, we kept taking share.

This is a big shakeup in Redfin’s core principle of returning commission to the consumer.

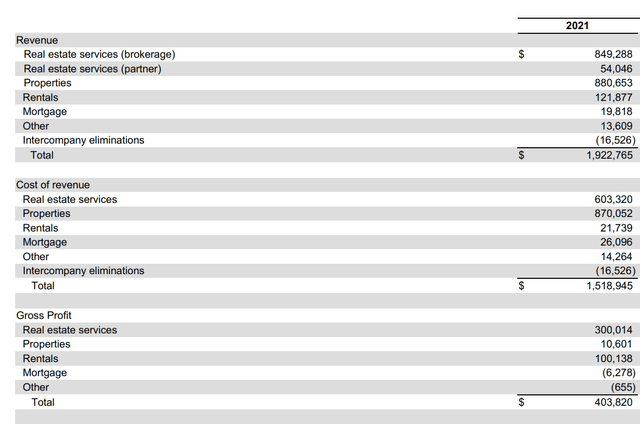

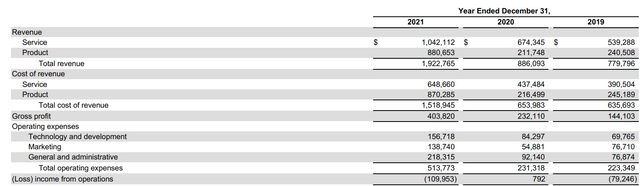

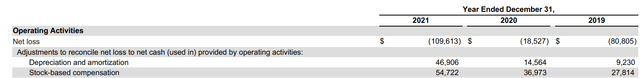

To me, this is huge news. Applied to 2021, adding 500 basis points to real estate gross margin would make it 38.2% and this would have added $45 million to the bottom line. This would not have caused the business to swing to a GAAP profit but any sort of adjusted EBITDA with stock based comp added back in would have been positive (in 2021, D&A plus stock based comp was a bit over $100 million while EBIT was negative $109 million so adding $45 million would make this comfortably positive). Positive adjusted EBITDA is a low financial bar to clear but it relieves urgent liquidity pressure and comforts investors especially with fears of potential housing market turmoil on the horizon.

Redfin 2021 Financials by Segment (Redfin 2021 10-K) Redfin 2021 Income Statement (Redfin 2021 10-K) Redfin 2021 D&A and Stock Based Comp (Redfin 2021 10-K)

While this change essentially squashes bankruptcy fears, I’m not sure how to think about it from a long term perspective. Commission refunds to buyers and sellers was always one of the core principles of the business. Does removing it show that management doesn’t stick to their guns or is it a savvy business move? If this change truly doesn’t lead to a loss of market share, I suppose it would be a savvy business move. But if this were the case, I think that it pokes a major hole in the Redfin thesis that consumers will bypass traditional brokerages to save money on commission with Redfin.

I’m sure investors will cheer the cancelled buyer commission refund, but it may be a short sighted cheer as it could prove that the long term business model isn’t so differentiated after all.

The Pieces are Coming Together

Redfin’s bet is that by employing agents, they are better able to push the entire real estate service package during home transactions. Some signs started to show in Q2 that this plan may be bearing fruit. The percentage of Redfin buyers that used Redfin Mortgage increased to 11% in June and 15% in July which is nearly double the 5 year monthly high of 8% prior to acquiring Bay Equity. Redfin’s title segment attach rate also improved as it more than doubled from 2021 to 2022.

At a basic level, almost every real estate tech company is trying to the same thing: increase the attach rates of ancillary services to drive profits. The main transaction is only one part of the larger picture and the brokerage that can successfully drive profits with ancillary services will create the most value for shareholders. I find it remarkable that brokerages with the most market share like RE/MAX (RMAX), Redfin, Anywhere Real Estate (HOUS), Keller Williams, are generally valued in the $1 billion to $5 billion dollar range. Those are big numbers but considering the size of the residential real estate market and the total volume of homes bought and sold every year, these are small businesses. This discrepancy exists because brokerages make money by splitting commission money with agents that provide real estate services. They’re essentially left with the scraps. The brokerage that develops the business model that allows them to collect the most scraps via ancillary services will be the big winner.

Redfin’s model of employing agents, as opposed to only paying agents with commission splits, in order to increase attach rates is unproven but showed positive signs last quarter.

Valuation

My buy rating mainly stems from the fact that urgent liquidity concern have been squashed by the potential end of the buyer commission refund and because I don’t think upcoming housing data will be worse than it was in June. Longer term, Redfin’s success will come down to profitably increasing market share.

In terms of profitability, Glenn Kelman reiterated the near term targets of positive adjusted EBITDA in 2023 and positive net income by 2024. They are very likely to hit these targets if they go through with canceling the buyer commission refund. Once they are GAAP profitable, I could see the stock trading closer to an upper single digits gross profit multiple, which is what it has traded at historically (not including the bubble territory multiples of 2020 and 2021). Right now the gross profit multiple is about 3 which seems to be pricing in extreme liquidity fears due to a slow housing market. Those fears will dissipate if Redfin follows through on canceling buyer commission refunds and if housing market data doesn’t get any worse than it was in June.

Even though this is a tech company, Redfin operates in the housing industry. This is a cyclical industry and multiples for housing related stocks will rise and fall with those cycles. If housing data gets better, June multiples could have been trough multiples.

In the short term, the stock should move with upcoming economic data points (inflation numbers, employment, housing data, oil prices etc.) which will make it volatile. Again, I think Q2 was rock bottom for Redfin and the housing market so I see things getting better. But the stock is already up 60%+ from its lows so that could be priced in already. I have no position but I would be most comfortable holding it in anticipation of the stock re-rating to a higher gross profit multiple through 2023 and into 2024 when it’s clear Redfin’s profitability targets will be met. After that it comes down to your confidence in the long term business model and strategy.

Final Thoughts

I think Q2 was rock bottom for both Redfin and the housing market. My buy rating could be seen as something of a macro call but I see reasons to be optimistic specifically with Redfin. Management eased any urgent fears of excessive cash burn by mentioning they are willing to cancel the buyers commission refund in all markets. This could add upwards of 500 basis points to gross margin for the real estate services segment. This makes their goal of positive adjusted EBITDA in 2023 and positive net income in 2024 highly likely.

The commentary about increased attach rates for ancillary services in the earnings call is also something for investors to be excited about. Driving profitability with ancillary services is a common goal for most real estate tech companies and these early signs of success with the Bay Equity acquisition is a reason to be bullish. It doesn’t guarantee long-term success but it’s a start. These improvements in Redfin’s financials and business operations, and potential improvements in housing market data could bring the stock up closer to a mid to upper single-digit gross profit multiple compared to its current gross profit multiple of about 3.

Be the first to comment