IvelinRadkov

Introduction

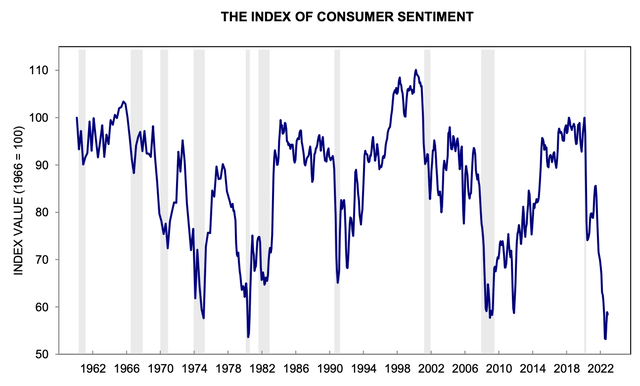

The market environment couldn’t be more challenging. Inflation is extremely high and slow to come down, consumer sentiment is in a horrible state, general economic conditions are slowing down, geopolitical and supply chain headwinds are persistent, and the Fed is unlikely to end hiking rates anytime soon.

In this article, I will present you two dividend growth stocks that suffer in this environment. The two stocks have underperformed the market by a wide margin. Yet, both stocks are high-quality dividend growth stocks that investors love outside of recessions.

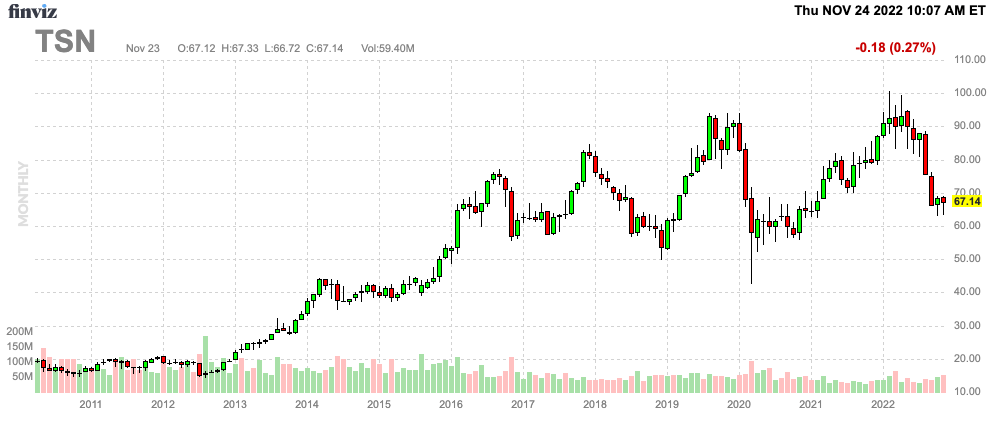

Tyson Foods (TSN) is currently working on the fourth major drawdown since 2016, allowing investors to buy its dividend at a better yield and a very low payout ratio, making continuing aggressive dividend growth likely.

The other defense consumer stock is Target Corp. (TGT). A stock I hated going into this year has fallen so much that I’m getting interested in buying a stock that will, without a doubt, continue what it started many decades ago: providing investors with great long-term returns.

So, let’s get to it!

Recession Opportunities & Why I’m Buying Dividend Growth

I sometimes joke with friends that our dividend growth strategy is a win-win strategy. When stocks rise, we win. After all, it means our net worth goes up. When stocks fall, we get to reinvest dividends and add to our favorite investments at better prices. Hence, also a win.

That’s a very blunt way to put it, and it only works with stocks that do generate value. It doesn’t work with useless investments like dying crypto coins most haven’t heard of. You’ll just buy weakness until you’re out of cash while your asset keeps dropping.

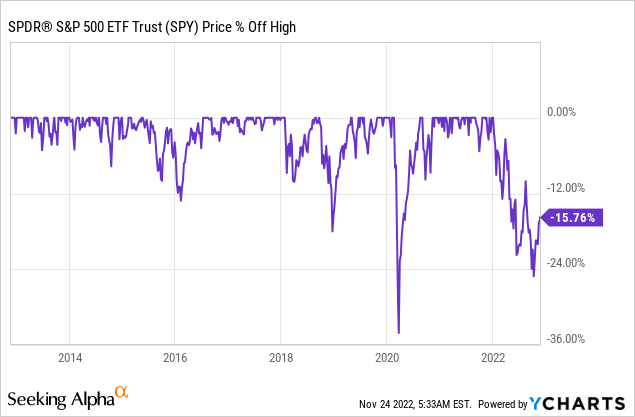

Right now, the S&P 500 is 15.8% below its all-time high. That’s without dividends. It makes the current correction the second-worst since the Great Financial Crisis.

This year, I have added to several stocks. I added to defense stocks in light of the war in Ukraine and improved long-term fundamentals in the industry. I have bought energy stocks to benefit from yields tied to supply shortages and lasting demand growth. However, I have also bought cyclical stocks during the summer. This includes companies like Home Depot (HD) and railroads.

While I’m not necessarily bullish on a mid-term basis due to economic challenges, I do buy quality stocks whenever I like the valuation. That has worked out quite well this year (so far), and I keep finding new opportunities, especially among stocks that I wouldn’t necessarily buy during bull markets.

When I look for dividend growth stocks during recessions, I want a decent yield and a company that will maintain its dividend, even if headwinds get nasty.

After all, my base case has become a prolonged sideways trend for the stock market comparable to the 1980s. Back then, the S&P 500 remained in a prolonged sideways trend. Investors buying stocks with a decent yield or companies with secular growth tailwinds were better off than the market back then.

Back then, the US saw several inflation upswings that pressured the Fed into hiking rates quite aggressively. Back then, it was truly toxic for stocks.

Federal Reserve Bank of St. Louis

The only reason why I make this comparison is the similarities. Inflation is high. It’s once again at levels not seen since the 1980s. Moreover, inflation is largely supply driven. For example, supply chains are still weak, energy and materials are seeing production shortages, and labor issues are far from resolved.

If the Fed were to suddenly pivot, a further weakening dollar and higher expected economic growth would cause a steep rebound in inflation. That would force the Fed to hike again.

I’m not saying this to scare anyone, but I believe it is very plausible that markets do not resume the QE-fueled uptrend we witnessed before 2021.

It’s a low-risk view. Even if I’m wrong, I still own great stocks. The biggest risk to my strategy is that I’m not buying as aggressively at these levels. *If* the market were to bottom and take off, that would be a loss of potential profits.

Hence, I’m focusing on buying high-quality dividend growth stocks. That includes beaten-down stocks like the one we’re going to discuss now.

1. Target Corporation (TGT) – 2.6% Yield

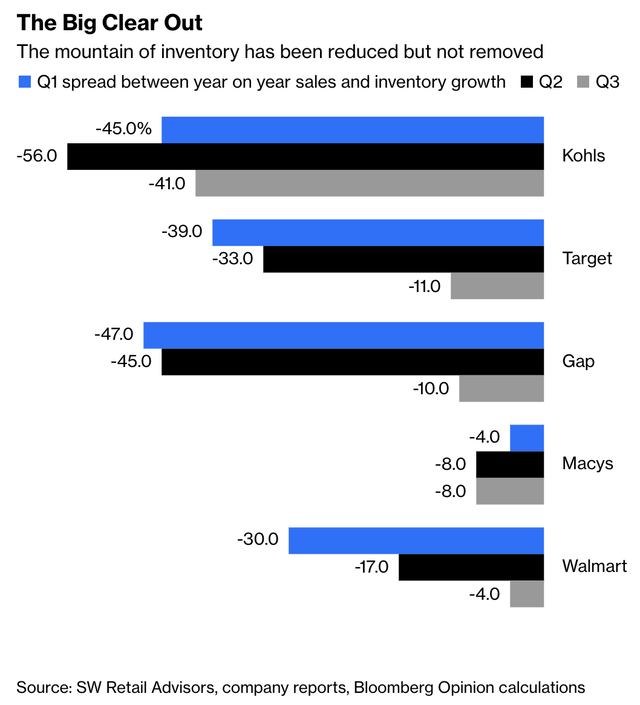

In the past, I didn’t care for this Minnesota-based retailer. That was mainly because I liked stocks with higher dividend growth and better yields. When economic growth fell off a cliff, I continued to ignore the company as it was in a really bad spot due to the post-pandemic bullwhip effect. Retailers had too much inventory when consumer sentiment started to fall.

In the first quarter, major American retailers were sitting on too much inventory when sales started to weaken. In the case of Target, the spread between sales growth and inventory growth was -39%. That number has now gradually improved to -11%.

After the first lockdowns, retailers started to accelerate procurement. Most had decreased buying activity during the lockdowns as nobody was able to predict future demand. The reopening and the related spending spree caused retailers to buy too much inventory. Hence, when high inflation caused consumer sentiment to drop, most were sitting on too much inventory.

Now, retailers are working through high inventories, using discounts. In the third quarter, TGT made great progress reducing inventories, yet it hurt margins as discounts pressure profitability.

On the profit line, we saw an expected improvement in the third quarter as we move beyond the bulk of those costs from our second-quarter inventory actions. However, Q3 profitability came in well below our expectations, driven by several factors. First and foremost, we faced an unexpected gross margin rate headwind from a higher-than-expected mix of promotional sales as guests moved away from full-price purchases.

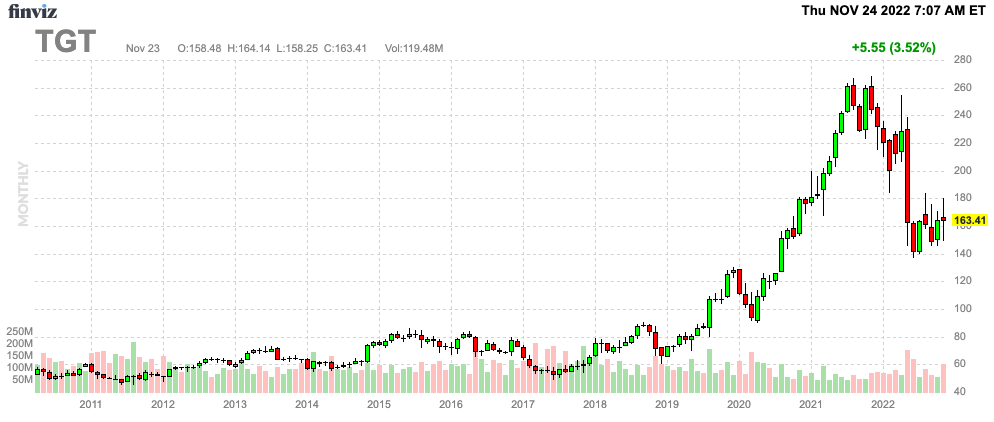

The company’s stock price is currently 36% below its all-time, which makes this the worst sell-off since the Great Financial Crisis. Most of the damage was done between the summer of 2021 and the second quarter of 2022.

FINVIZ

That makes sense as smart investors knew what retail companies were facing. Since then, the stock is hovering somewhere between $140 and $180.

The reason I’m interested now is that “everyone” is avoiding Target. That’s when I start to like an investment. At least when it comes with great value. In the case of TGT, that’s the case.

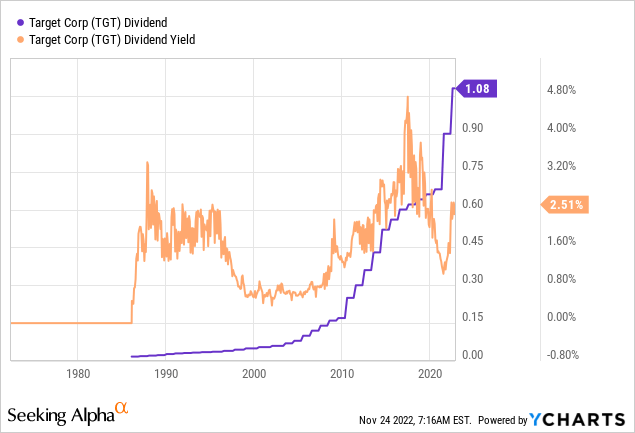

The company is now yielding 2.6%, based on a $1.08 per quarter dividend.

The yield is now back at pre-pandemic levels and backed by great fundamentals.

This dividend aristocrat has hiked its dividend for more than 50 consecutive years. Target’s main cash priority is investing in its business. That makes sense. The second priority is its dividend. In the third quarter, TGT paid $500 million in dividends. That’s 20% higher compared to the prior-year quarter.

Over the past ten years, the average annual dividend growth rate was 11.6%. These are the most recent hikes:

- June 2022: +20.0%

- June 2021: +32.4%

- June 2020: +3.0%

- June 2019: +3.1%

- June 2018: +3.2%

- June 2017: +3.3%

In this case, I went a bit further back than usual, as Target isn’t known for aggressive dividend growth.

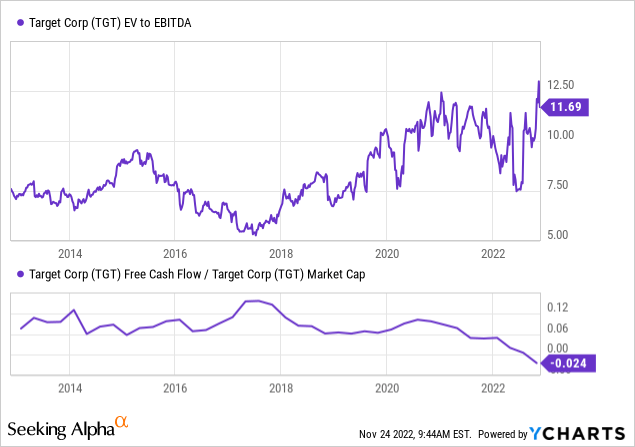

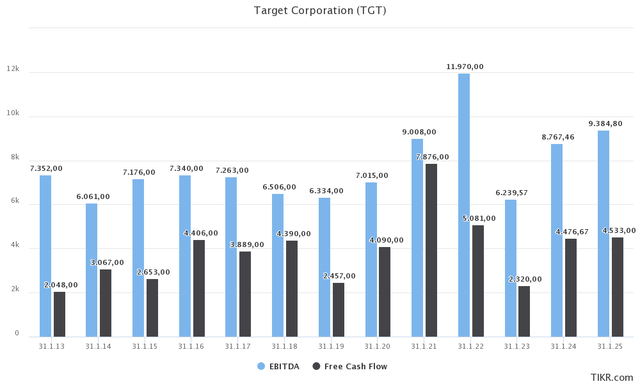

After all, this company is NOT fast-growing. Like most mature dividend stocks, TGT’s EBITDA and free cash flow have been in a very long sideways trend. Hence, timing an investment is so important.

Hence, it helps that TGT has approached an attractive valuation.

The company is trading at 10.3x FY24 EBITDA of $8.8 billion. That is based on its $90.2 billion enterprise value, consisting of its $75.2 billion market cap and $15.0 billion in estimated FY24 net debt. Net debt is expected to remain below 2.0x EBITDA. Its credit is A-rated.

Using a mid-cycle free cash flow of $4.5 billion, TGT has an implied FCF yield of 6%. That’s a fair valuation. It also supports future dividend growth.

I put TGT on my watchlist. If the market falls again, I might buy some at $140. I think it’s good value, and I own just one consumer stock (Home Depot) so far,

Number two is also a defensive consumer stock.

2. Tyson Foods (TSN) – 2.9% Yield

Tyson Foods is also a consumer defensive stock. However, it operates in a completely different industry. The company is one of the nation’s largest meat processor companies. Or to put it more bluntly, it operates slaughterhouses.

Essentially, Tyson’s business model is extremely anti-cyclical. After all, people need to eat.

However, the stock is still dependent on people’s willingness to spend money on higher-priced food items, meat inflation, its ability to use pricing as a tool to grow operating income, and labor-related issues.

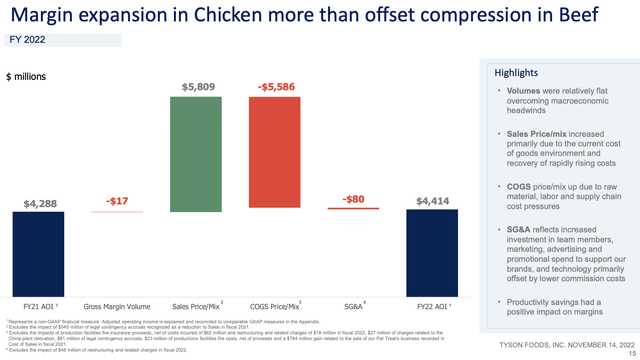

Right now, the company is trying to balance high inflation and pricing. In its fourth fiscal quarter, the company saw flat volumes and higher prices that barely offset high operating costs.

Hence, despite its anti-cyclical business model, the stock has a history of allowing investors to buy at better prices and higher yields.

FINVIZ

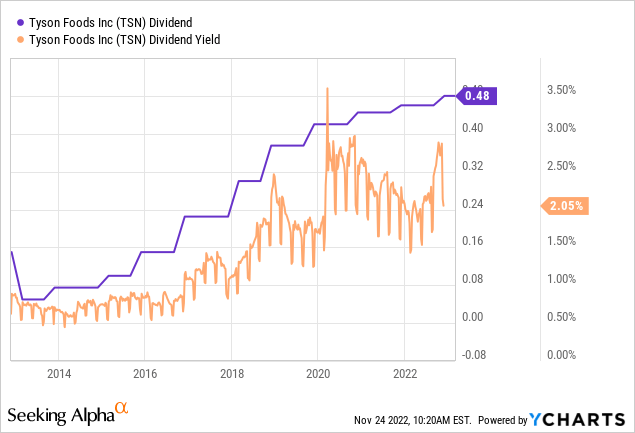

The dividend yield is now inches away from 3.0%. Please be aware that this is based on a $0.48 quarterly dividend (per share). The YCharts chart below is not entirely correct. The dividend number is correct, but the yield is not.

That’s OK as the chart still shows that a 2.9% yield is one of the highest of the past 10 years.

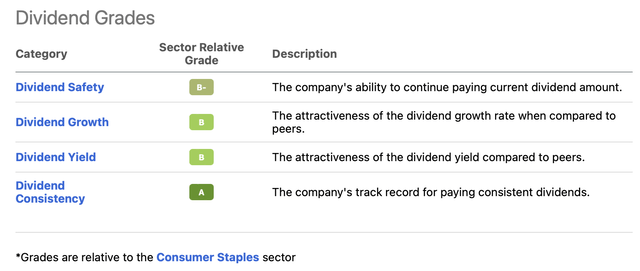

Moreover, the company has a terrific dividend scorecard.

The company scores high on safety, growth, yield, and consistency. The cash flow payout ratio is a mere 21%. The industry median is 37%.

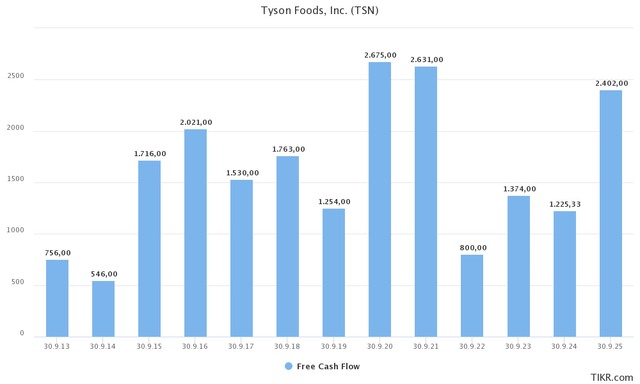

However, it needs to be said that the company’s free cash flow is highly volatile and dependent on large business investments. Using a mid-cycle free cash flow of $1.4 billion, the company has an implied FCF yield of 5.8%. This implies a payout ratio of roughly 50%. However, once costs decline, the company’s payout ratio falls back to the 20% range.

With that said, the 10-year average dividend growth rate is 27.7%. Over the past five years, that number has declined to 15.4%. That’s still impressive.

These are the most recent hikes:

- November 2022: +4.3%

- November 2021: +3.4%

- February 2021: +6.0%

I expect Tyson to win as soon as inflation in agriculture comes down. I don’t expect inflation in that space to come down a lot as I wrote in articles like this one, but the risk/reward has become attractive.

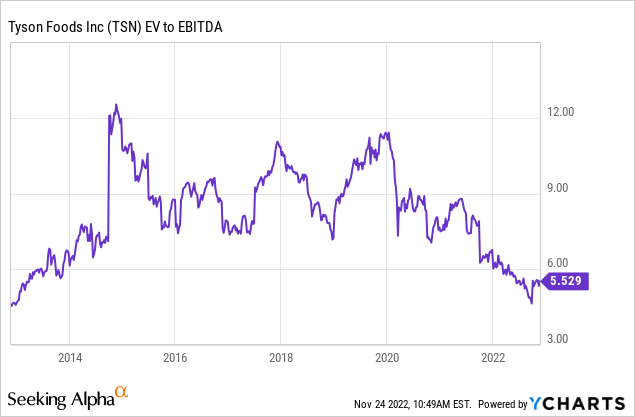

The company is now trading at 6.5x next fiscal year’s expected EBITDA. Net debt is expected to fall to just 1.5x EBITDA.

Takeaway

In this article, we discussed two consumer defensives that are both performing quite poorly. Target suffers from high inventories, poor consumer health, and a high chance of inflation remaining high. Tyson Foods is different. Tyson mainly suffers from high input costs and related supply issues.

Both stock price yields have risen recently. Both yields are now attractive. Both yields are backed by high free cash flow and solid balance sheets.

I believe that both stocks will generate great returns for investors on a long-term basis, even if the market remains somewhat flat-ish on a prolonged basis.

TSN looks good to buy right now. The valuation has become extremely attractive. TGT is also far from expensive, but I like to buy it a bit lower. I hope that the market offers us a new opportunity to buy closer to $140 per share.

I believe we could get that opportunity as the market is a bit too eager when it comes to betting on a quick Fed pivot.

(Dis)agree? Let me know in the comments!

Be the first to comment