Spencer Platt/Getty Images News

This article was prepared by Shahmi Anas in collaboration with Dilantha De Silva.

Robinhood Markets, Inc. (NASDAQ:HOOD) stock is down almost 80% from its IPO price of $38 per share. The company’s market value has been on a downward spiral ever since the initial boom that took HOOD stock to $85 following the highly anticipated IPO in July 2021. At the time of the IPO, we published an article reasoning out why we would remain on the sidelines because of our fear that Robinhood stock will be a proxy for the performance of meme stocks. In this analysis, we will evaluate the recent financial performance of the company to determine whether the recent pullback in stock price offers a good opportunity for long-term-oriented investors.

Q1 2022 Succeeds Dour Results from Q3 and Q4 2021

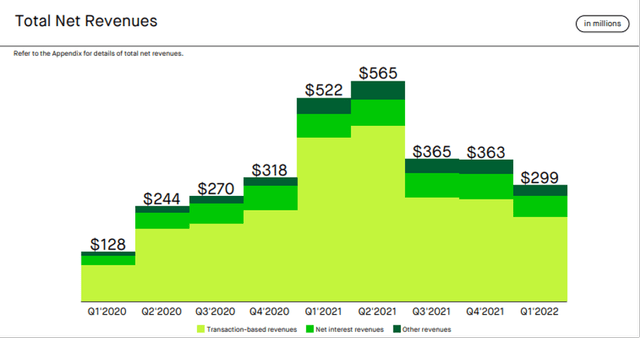

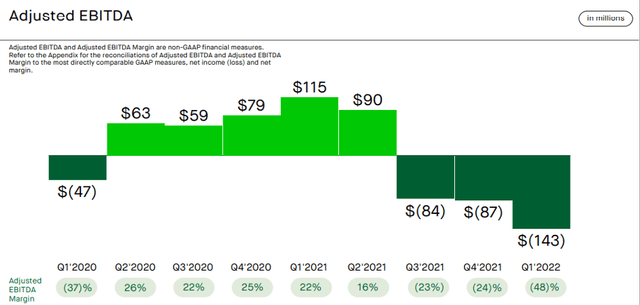

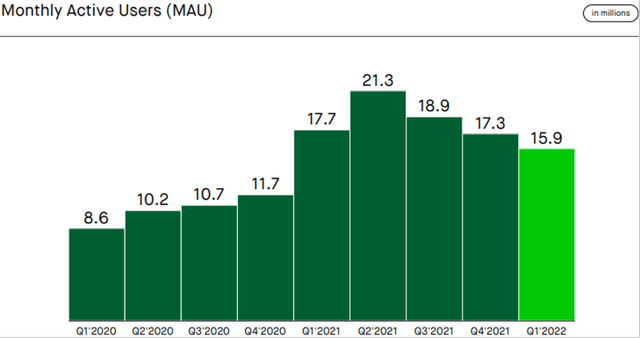

There is no shying away from the fact that Robinhood has seen a wane in its fundamentals in the most recent quarters (Q3, Q4 of 2021, and Q1 2022) after showing promising growth since going public, with revenue, adjusted EBITDA, and monthly average users (MAUs) all declining.

Exhibit 1: Total net revenues

Q1 2022 presentation

As shown in the chart above, Robinhood’s Q1 2022 revenue was down 43% to $299 million against $522 million in Q1 2021. Of this, transaction-based revenue, which is the largest revenue contributor to the company, was down 48% owing to a decline in both active users as well as crypto-trading volumes amid asset prices taking a nosedive. Challenging macroeconomic conditions and pandemic trading highs fizzling out (small-dollar trading boom) played their part in this disappointing financial performance of the company in the first quarter.

Exhibit 2: Adjusted EBITDA

Q1 2022 presentation

As we can see from the above chart, Robinhood’s adjusted EBITDA margins continued their slide in Q1, doubling quarter-on-quarter from -24% in Q4 2021 to -48% in Q1 2022. Robinhood has seen its operating costs bloat due to growth initiatives taken on by the company which include variable marketing costs and web-hosting expenses. It should be noted that the adjusted EBITDA shown above is exclusive of stock-based compensation, meaning that the company is truly burning cash from all fronts at the moment.

Exhibit 3: Monthly active users

Q1 2022 presentation

Although Net Cumulative Funded Accounts registered marginal quarter-over-quarter growth in Q1, we believe this cannot be considered a very relevant performance metric due to the company’s revenue largely being dependent on transactions (i.e. active users). As seen in the chart above, MAUs for Q1 2022 fell 10% compared to Q1 2021, and 8% compared to Q4 2021.

Robinhood attributed this lackluster financial performance to lower account balances engaging at a lower level in the current market climate. Rising inflation is likely to result in many small-time investors utilizing their savings for consumption on top of being burdened with rising credit card debt, which could prompt these investors to take money out of their investments. Robinhood CEO Vlad Tenev said on a conference call with analysts:

Our larger customers are still remaining active, but we are seeing more pronounced declines from those that have lower balances. With the uncertainty in the market, our customers became more cautious with their portfolios.

Concerns

Robinhood primarily caters to young investors, in particular Gen-Z and late Millennials, who in the age of social media have shown a collective ability to shake up markets – at least in the short term. The company emerged as one of the key players in last year’s meme stock saga, in which the trading platform drew heavy criticism for its handling of the GameStop Corp. (GME) stock trading spike when it decided to restrict trading amid substantial volatility. Regulators were drawn into the meme stock mania as concerns grew regarding manipulative activities by some market participants, and we believe Robinhood will continue to be the subject of this regulatory scrutiny. In addition, Robinhood’s focus on young investors at a time when the U.S. economy is expected to enter a recession (or at least a difficult period) will make life difficult for the company due to low trading activities in this cohort of investors.

As mentioned earlier, declining users and challenging market conditions are concerning, given the fact that the pandemic trading bubble has now burst. Robinhood will need to come up with strategies to engage existing larger users as well as attract new users post-bubble. Moreover, if Robinhood continues to lose MAUs and make losses, burning through its cash pile will be inevitable, which is very likely to deteriorate the investment sentiment toward HOOD stock further.

Around 80% of Robinhood’s revenue comes from selling orders to market makers. The company as well as its competitors like Charles Schwab (SCHW) are facing the possibility of regulatory challenges surrounding payment for order flow (PFOF), as Securities and Exchange Commission (SEC) Chairman Gary Gensler could air some proposals that shake up current arrangements in which brokers route retail orders to computerized market makers like Virtu Financial (VIRT) and Citadel Securities (a key market maker for HOOD), who pay brokers for their order flow. The SEC could require retail brokers to route market orders to a new kind of auction mechanism that would allow many companies to compete to fill the orders.

Positives

Robinhood is gearing up for the long term and the company confirmed in the Q1 earnings call that it would be implementing cost control measures to improve its bottom line (EBITDA, to be more precise). The company went on to announce a reduction of the workforce by 9% as part of this objective in April 2022. Robinhood is well-funded for the time being with cash surpassing $6 billion, which gives the company some buffer against future losses in the near term.

Robinhood has stuck to its 2022 roadmap, where it looks to constantly innovate and improve the products offered to its customers. In Q1 2022, the company expanded its trading hours, while also rolling out a crypto wallet, the Robinhood Cash Card, and added new coins to its crypto selection. International expansion is also an avenue Robinhood is exploring, with the company entering into an agreement to acquire Ziglu, a UK-based electronic money institution and crypto-asset firm. The Robinhood Cash Card serves as a debit card for those interested in investing and also allows customers to utilize their accounts like a bank but with a lower cost and better user experience.

Takeaway

Robinhood still holds a sentimental value to its users as its platform is considered to be one of the most user-friendly and fun apps to trade on. The company remains to be one of the most preferred trading applications among young investors who are largely looking for convenience and less complexity when it comes to trading. This is one of the biggest strengths of Robinhood, but for the time being, we believe this will be one of the biggest weaknesses of Robinhood as the U.S. economy navigates a tough period.

We believe Robinhood offers indirect exposure to the strength of the spending power of the average American, and with inflation already eating into the savings of the younger generation, we are wary of any exposure to Robinhood today although we believe there could be upside from the current depressed stock price. A quick and explosive turnaround in the stock price is very unlikely, considering the company is no longer in a stage of hyper-growth. If Robinhood can return to growth and cut losses, the company would then be able to channel net cash into growth initiatives. This is for the long run, however, and we believe there is a lack of clarity regarding Robinhood’s long-term prospects today.

Be the first to comment