bjdlzx

(Note: This article appeared in the newsletter on May 28, 2022 and has been updated as needed.)

One of the concepts that is hard to get across for any cyclical stock like Ranger Oil (NASDAQ:ROCC) is that management will most likely exceed earlier highs in the latest cycle. So many times, investors look at market bottoms and only see years of decline. A 20% or 30% profit on the way back up is often greeted with loud cheers of success. But most cycles do not abort the way the last one did (though there is always the risk in any recovery).

In fact, the recent stock price pullback has largely ignited fears that “the party is over”. But the essential ingredient of over production is lacking. Similarly, a much-feared recession is unlikely to last long. Rather this is likely to prove to be a case of the market spotting “eleven of the last seven” recessions (yet again!). Worry and fear sells. It also makes contrarian investing very hard.

Economic Background

Now, there is some fears of a recession that is brought about by rising interest rates. That certainly could happen. But from an economic viewpoint, this is not 2008 where the whole situation was allowed to continue for two presidential terms before things literally got out of control. This time around, the Federal Reserve is taking action a few years sooner.

There are clearly some overpriced stocks that will get hit very hard by the decreasing liquidity (through the open market operations of the Federal Reserve) combined with the fact that many of those managements have now realized that competition arrived. Those stocks are very likely to make the headlines to the point that the correction now underway will seem much worse than it was.

But the oil and gas part of the investment world was housecleaned twice (once in 2016 and again rather recently). There really is not enough left to clean out. Furthermore, the start of this rally saw the typical consolidation of the stronger competitors shopping for bargains that financially weaker members of the industry were willing to unload. That also included some who thought they could make a killing in the industry only to endure fiscal year 2020. Therefore, whatever lies ahead for the stock market is very unlikely to do to oil and gas what has already happened yet again.

Oil and gas stocks are certainly volatile and a pullback at some point due to a recession is a possibility. The end of the current war would be another point that could cause a commodity price retreat. But the fact is that demand is in excess of supply. We have gone through these periods before with the result that the marketplace takes time to sort the situation out. So, no one should expect surpluses “tomorrow” or in the near future unless something unexpectedly significant is going to happen.

Ranger Oil Fits Right In

Ranger Oil is doing what many in the industry are doing. A lot of small producers have suffered tremendously over the last five years or so. They now want out and want out at very flexible prices. Ranger Oil management has got the company in a position to offer prices that get those sellers out while providing shareholders with a reasonably accretive deal.

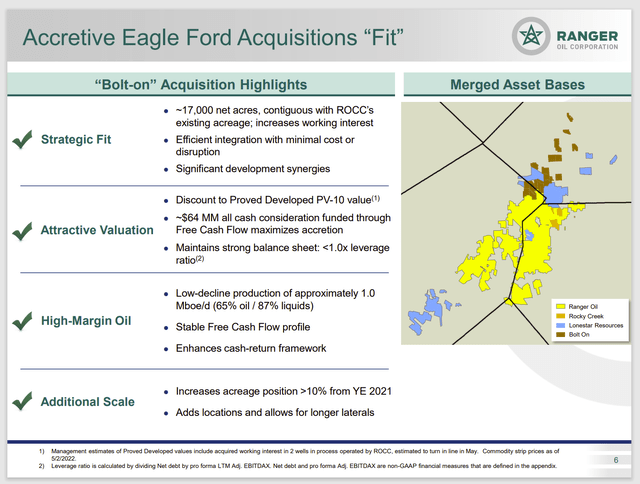

Ranger Oil Map Of Bolt-On Eagle Ford Acquisitions (Ranger Oil May 2022, Corporate Presentation)

The company just acquired more acreage in a prime Eagle Ford location. Keep in mind that the company production is largely oil. The recent acquisitions appear to maintain that focus. Management announced a few more small transactions at the end of June to complement the transactions shown above.

But the best part of the deal is that the acreage cost is well below the going rate for similar acreage in the Permian. Yet the wells often are every bit as profitable, and the Eagle Ford rarely suffers from insufficient takeaway capacity like the Permian did in the last upcycle. On an execution basis, the Eagle Ford often exceeds the Permian in profitability when the location costs of wells is included because the Permian takeaway issues lead to pricing discounts while the Eagle Ford often sells production at a premium to the related benchmark. There is no guarantees of course that it will again happen this time around.

But, as the saying goes, I like the chances of another takeaway shortage developing in the Permian. The Permian is still the “hot basin” in the industry and attracts far more interest. That alone, should be a warning sign of what may happen as activity steadily increases. Furthermore, the midstream industry is waiting for customers to demand more takeaway capacity. Once that happens, it is typically two years until that capacity is actually in service. Oftentimes, the midstream industry is increasing capacity well into a cyclical downturn as transportation needs catch up with the last cycle peak. This is and will be a serious issue for the “hot spots” of the industry. It frequently leads to unexpected outperformance of basins thought to have inferior profitability prospects. The result is that some top operators just avoid the basin completely to produce their above average results.

Ranger Oil picked up oil weighted inventory for less than $5K an acre at a time when some are paying $50K an acre and higher. Later announced acquisitions were similarly discounted even if not quite as good a price at times. This happens because the lease holdings purchased were small. Management is creating value by taking those “too-small” holdings and combining them into the larger contiguous holdings shown above. That creates value for shareholders before they even drill the first well.

The real payback comes when management drills on this acreage. Very few managements discuss the cost of acreage as part of the well breakeven. In this case, the acre cost of roughly 5K an acre on 100 acre spacing would add about $500,000 to the breakeven calculation. That is easy to cover in this environment. But the company paying $50K an acre on that same spacing adds $5 million to the breakeven calculation. That much money is much harder for management to justify (especially given the steep first year production declines of these wells) in any pricing environment. The result is that Ranger Oil will show shareholders a far greater return on capital with the lower priced acreage.

Conclusion

This management is “going the extra mile” for shareholders by piecing together small parcels that are likely to be uneconomic by themselves into contiguous acreage that is more marketable and more profitable to drill.

This is one of many signs that the company should outperform the next upcycle in the industry. Of course, investors have a lot more work to do than just one particular item to evaluate overall management.

But cyclical investing is all about catching the lion’s share of a recovery while adding some safety in the form of likely stock outperformance. The more outperformance that is likely, the larger the margin of safety available in case the investor misses a point to sell.

Management increased the share repurchase program and has now initiated a dividend. Management in effect is purchasing company shares through this program. It is part of the industry trend I follow that insiders are largely buying and not selling.

Furthermore, managements like this one are very likely to grow the company throughout the industry cycle. Therefore, investors that want to buy and hold can often hold a company with superior management because that management is likely to continue to add value to the stock in the future. Any principal losses in a downturn should be more than made-up for in the next cyclical recovery.

I have known people that do not sell cyclical companies. They have done very well over time by finding and owning companies with superior management. Buy and hold investors often do fine long term because well run companies often become takeover candidates. Acquiring companies want a good deal without a lot of trouble. Ranger Oil is working hard to check a lot of those boxes that result in an acquirer seeing a good deal.

Be the first to comment