anouchka

Yesterday, Ralph Lauren Corporation (NYSE:RL) released its first three-month numbers. The CEO emphasized how the company delivered a “strong first quarter performance underscores the power of the RL brand and momentum of our strategy around the globe, following our significant multi-year reset“. Indeed, the company recorded a positive quarter with only two negative facts to report: 1) a negative FX development with an impact on turnover and adjusted profitability and 2) a lower expectation for the US outlet channel.

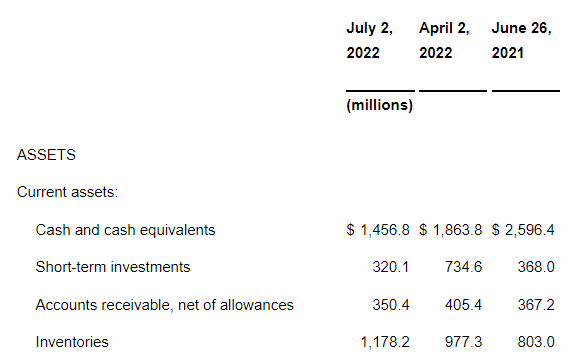

Compared to the pre-covid-19 level, we also note higher SG&A expenses. However, this might add more earning per share cushion if top-line sales will slow down. Important to highlight is the fact that inventory levels are rising faster than turnover (+20% versus +8%). This is not very appreciated by Wall Street analysts.

RL Inventories

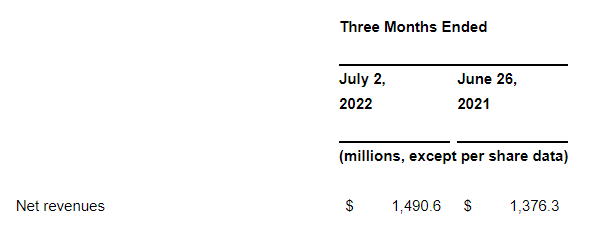

RL net revenues

Source: Ralph Lauren Q1 2023

Q1 results

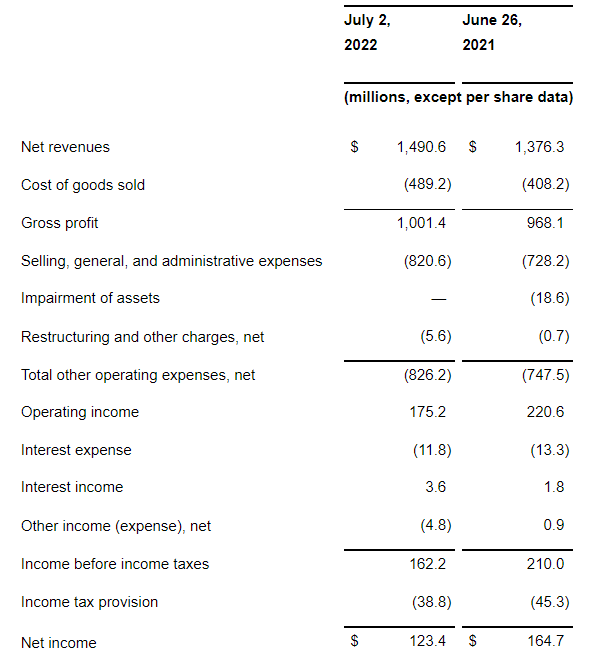

In the period between April and June 2022, the American company delivered net revenues of $1.49 billion, up at current rates and at comparable rates by 33% and 8%, respectively. All the regions positively contributed to RL’s performances. North America and Europe revenue growth increased by 6% and 28% at the current FX level, and more important to note is the Chinese sales evolution. Despite a prolonged lockdown with their unrealistic zero-COVID policy (50% of RL stores were closed in the period), top-line sales recorded a growth of 26%. An important contribution, as also registered in our Kering (OTCPK:PPRUY) follow-up note, was due thanks to e-commerce, signing an 80% growth compared to last year’s numbers. Going down to the P&L, gross margin decreased and was mainly due to higher logistic costs. Cross-checking Wall Street analyst estimates, we noticed that revenue was a beat while gross margin was a miss. Aside from the negative FX implication, marketing expenses were at the high end of the range and SG&A, as already mentioned, was 3% above RL’s internal estimates (this was due to ongoing and higher reinvestment). For the above reason, operating profit further declined and the margin stood at 11.8% compared to the previous year’s result at 12.7%. The reduction was more remarkable in North America while China partially offset the outcome.

Ralph Lauren Q1 2023

Source: Ralph Lauren Q1 2023

Conclusion and Valuation

As our internal team has expected, the company reaffirmed its FY 2023 turnover and operating profit margin guidance excluding currency development. However, including unfavorable FX, for Ralph Lauren now headwinds are looming for a minus 200 basis points and a minus 50 basis points on turnover and EBIT, respectively. Despite the fact that Europe was a strong contributor to RL results (thanks for the travel rebound), there are increasing concerns about consumers’ discretionary spending (especially if these energy prices will be sustained over the future). Due to FX and rising risks, Mare Evidence Lab is cutting EPS estimates to $7.9 per share. With a lower revenue projection, we are still maintaining our buy rating with a lower target price now set at $140 per share. The next catalyst is planned for the 19th of September.

Be the first to comment