Just_Super/E+ via Getty Images

Hut 8 (NASDAQ:HUT) is not looking to capture or even aggressively defend its share of Bitcoin’s (BTC-USD) total network hash rate this year. While the company’s goal is to more than double the current installed operating capacity by year end, the greater focus is on cautious capital expenditures, monitoring mining economics and further diversifying from sole reliance on Bitcoin network mining.

With the above in mind, during the Q4’21 earnings call last month, CEO Jaime Leverton highlighted the company’s January acquisition of TeraGo’s cloud and colocation data center business. While listing all the diversification and differentiating efforts, she gave the most significance to the TeraGo purchase and said:

…most importantly, seize upon a crucial acquisition opportunity that will bring Hut 8 to the forefront of infrastructure innovation at the intersection between blockchain and Web 3.0.

And a moment later, Leverton opined:

But as we’ve said, we’re not just miners. We are business building technologists.

During both the comments and Q&A portions, Leverton elaborated on, and to some degree was obliged to defend, the new direction for the long-time miner and hodler of bitcoins. The article below expands and comments on some of her remarks in the following areas.

- Where Hut 8’s Bitcoin mining business is headed this year relative to competition and the total network hash rate.

- The coming challenge to their GPU mining business with The Merge on the Ethereum (ETH-USD) platform.

- The TeraGo data center business acquisition in perspective with the larger company.

Digital Asset Mining

On the recent call, when asked about power costs, the new North Bay mining location, and expected change to the cost per coin mined this year, Leverton made an important distinction. What is driving thinking around costs are not marginal changes in the power supply structure, but rather the ever-present increase in mining difficulty. She answered the power costs question as follows:

…everybody kind of needs to run their own models on where they think hashrate and difficulty are going in the short and medium-term.

It is worth noting here that Bitcoin mining difficulty was up 15% in the first quarter and 40% over the last two quarters. Looking forward from the current 200 EH/s total network hash rate, industry participants are forecasting a year end total of between 300 and 350 EH/s.

Accordingly, Hut 8’s stance on mining growth has a little nuance. On the one hand, they are bringing 35 megawatts online at North Bay which will enable 1 EH/s of incremental capacity in the coming months. But looking to the rate of return on new equipment expense, they are currently being cautious and not contracting for the full quantity of equipment needed to reach their 6 EH/s goal for the year. With an optimistic perspective, Leverton explained as follows.

..the pricing that we had been seeing the last few months was, we thought out of sync with where the economics were, from an IRR perspective, we expected the price per terra hash to come down, particularly as we see new entrance[sic] moving into the ASIC manufacturing space. And we are starting to see some of that softening now and actually better delivery lead times as well.

As a final consideration on the mining topic, a good comparison to make is between Hut 8 and Bitfarms (BITF), another Canadian miner. Among numerous other factors, they both have remarkably similar current market caps, hash rates, primary equipment vendor, cooling systems and hodl policy. But there is a growing dichotomy of strategy regarding growth that is worth recognizing.

Bitfarms has similar power expansion plans in Canada but is also making an even larger investment in Argentina. Their current contracted MicroBT equipment orders are stronger and their plans for making 8 EH/s by year end are more solidified than those for Hut 8’s smaller 6 EH/s goal.

Commenting this week on achieving 3 EH/s, Bitfarms CEO Emiliano Grodzki stressed the company’s “laser focus” on increasing hashrate, completing the buildout of new power supplies, and their “robust miner deliveries scheduled”.

The Problem of The Merge on Ethereum

Hut 8 settles their Ethereum mining in bitcoins, making for easy comparison of the economics. In March, Ethereum mining represented 13% of total production and had an average BTC equivalent cost of about CA$2600. Ethereum mining power requirements are comparatively low and average equivalent costs are only about an eighth of the cost of Bitcoin network mining. So Hut 8’s purchase of Nvidia GPUs last year and diversification to Ethereum mining has proved to be a sound tactic to drive earnings.

However… apparently in the next three to six months, Ethereum is going to switch from a proof-of-work consensus mechanism that requires mining to a proof-of-stake mechanism that does not. When questioned, Leverton remarked the following:

We really don’t have a timeline for that move to — for Ethereum to go proof-of-stake, it’s obviously been talked about for many years. If and when that happens, we would move our compute to the next most profitable blockchain to mine using our GPUs and I think currently that is a Ethereum classic, but I haven’t checked it in a while.

So the company can use the equipment to mine Ethereum Classic (ETC-USD), which split with Ethereum in 2016, or some other smaller cap coin like Dogecoin (DOGE-USD). The GPUs may also be repurposed for the new data center business. But in any case, at 13%, a substantial piece of production with high gross margins will be meaningfully impacted and profitability on the equipment could be cut in half.

Mine for Gold and Sell Pickaxes

Hut 8’s new data center business is highly adjacent to their existing mining operations. But one key difference between mining and the data center business is the customer experience component. And note that in February they added Joshua Rayner as VP of Sales. Rayner is experienced in sales, management and data center operations and from the outside looks to be a fit for Hut 8’s new hybrid model.

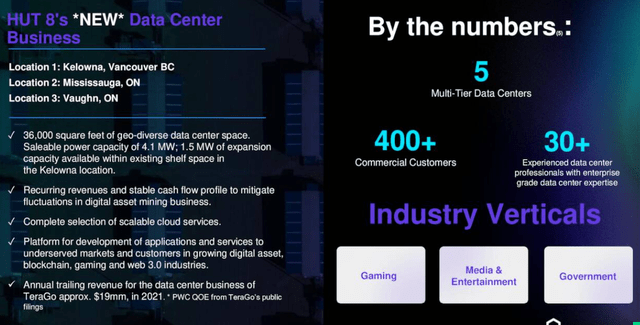

Looking back to compare the revenue buckets, Hut 8’s mining-based annual revenue last year was CA$174.0 million and the applicable TeraGo revenues acquired through the acquisition were about CA$19.0 million. For perspective on the new power supply, prior to the current North Bay, Ontario expansion, Hut 8 was operating at 107 MW total at two Alberta locations. The data center acquisition represents about 4.1 MW that is expandable another 1.5 MW and located in Ontario and British Columbia.

Leverton gave the following color:

With our acquisition of TeraGo’s Data Centers and Cloud Business, we welcomed more than 400 enterprise customers to the Hut 8 family. We also gained 36,000 square feet of geo diverse data center space and cloud capacity powered by emission-free energy sources.

Hut 8 DC Business (Seeking Alpha)

Final Thought

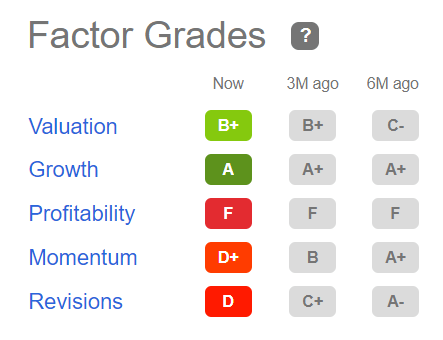

Looking at Hut 8 using Seeking Alpha’s Quant Rankings and Factor Grades, one sees the company ranks well in valuation with strong, though slowing growth. The company appears reasonably priced with forward P/E at about 10 and forward EV/EBITDA near 7. Note that the “F” Profitability Grade is skewed due to a number of quirks such as how bitcoins mined and held in custody are not being factored into measures like free cash flow and cash from operations. And while Momentum has been volatile and dependent on the underlying price of Bitcoin, the January lows may mark another reversal. And notably, prices are holding a 20% gain off that low.

Factor Grades (Seeking Alpha)

Look for continued strong earnings with the price of Bitcoin below but near the average seen in 2021. And expect some more moderation in growth as Hut 8 shifts its focus to the data center business and employs caution in making capital expenditures for new mining equipment.

As a summary point, consider the following from Leverton:

Look, we’ve been transparent that will continue to drive growth through organic and inorganic means. We have proven ourselves to be patient with our balance sheet and opportunistic when it comes to deploying capital and that’s something that you’ll continue to see from us.

Be the first to comment