Justin Sullivan

Thesis

QUALCOMM Incorporated (NASDAQ:QCOM) is scheduled to report its FQ4 and FY22 earnings release on November 2. Semi investors will be looking toward CEO Cristiano Amon & team for guidance and leadership to help stabilize the industry’s prospects.

Industry analysts have continued to lower their earnings estimates for semi companies through 2023, expecting earnings growth of -4% in 2023 (according to Refinitiv data) after 2021’s unsustainable 40% earnings growth rate.

Notwithstanding, analysts’ projections for Qualcomm suggest they expect the company to outperform the revised industry estimates in 2023. Qualcomm also delivered an exciting Automotive Investor Day in September, highlighting a rapidly growing design portfolio. As such, Qualcomm seems well-positioned to leverage its one technology roadmap, scaling across connected domains and platforms to power the world’s devices (including smartphones on wheels).

We are pleased with the company updating its ex-smartphone guidance, which we have been asking for some time. In addition, we believe it demonstrated Qualcomm’s ability to deliver a comprehensive automotive strategy against its peers, such as Mobileye (MBLY) (INTC) and NVIDIA (NVDA).

QCOM’s recent price action is also constructive, forming a base predicated against June’s lows. Also, we assess that its battered valuation indicates substantial damage has already been reflected at the current levels.

Despite the uncertainties in the broad market and economy as we head into Qualcomm’s FY22 earnings call, we are confident of the company’s execution prowess through the cycle.

We reiterate our Buy rating on QCOM.

Growth Is Likely To Slow Markedly In FY23

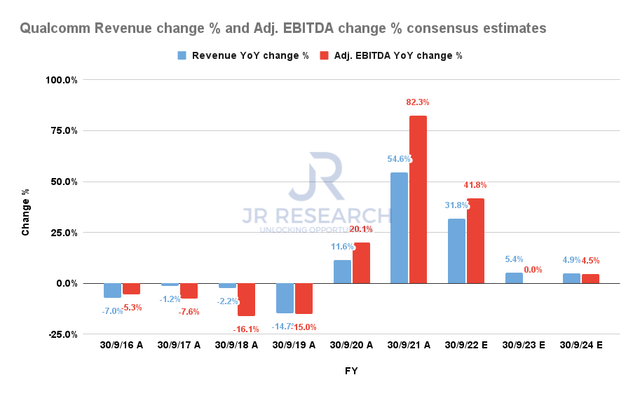

Qualcomm Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The revised consensus estimates (bullish) suggest Qualcomm could deliver revenue growth of 31.8% in FY22. However, it’s expected to fall to 5.4% in FY23, with adjusted EBITDA growth also normalizing to 0%.

Given the context of a significant semi downturn in consumer electronics, Qualcomm is certainly not immune, given its sizeable smartphone exposure (65.6% of FQ3’s QCT revenue). Furthermore, Chinese President Xi Jinping is committed to continuing its stringent zero-COVID policies that political watchers had expected to ease after China concluded its National Congress.

As such, economists have also revised their GDP growth rates for China through 2024, factoring in the continued impact of COVID restrictions hampering China’s economic recovery.

Notwithstanding, Qualcomm is still expected to outperform the industry in 2023 (revenue growth of -0.1%, according to Refinitiv data). Therefore, we anticipate management to boost investors’ confidence by delivering slower but still robust guidance for FY23.

Automotive Pipeline Is Robust But Takes Time

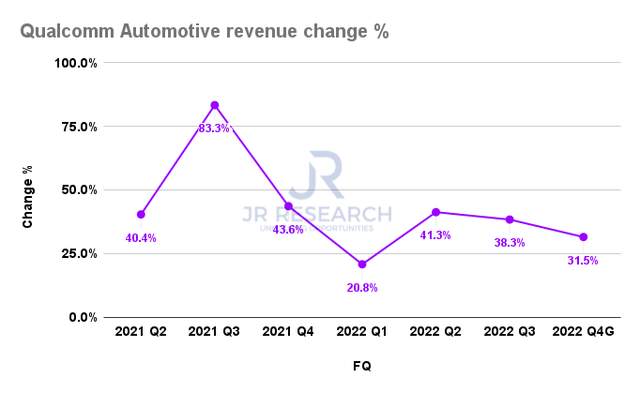

Qualcomm Automotive revenue change % (Company filings)

The company’s guidance for its auto segment revenue indicates a 31.5% YoY growth in FQ4, representing a deceleration from FQ3’s 38.3%. However, we believe it’s still highly respectable guidance, demonstrating the EV industry’s confidence in Qualcomm’s ability to execute.

Management also communicated its FY31 automotive model, projecting auto revenue of $9B (out of a blended TAM of $100B). That suggests management sees a revenue CAGR of 24% from FY22-31 for its auto segment. We believe it’s a significant driver. Furthermore, management sees potential upside from services and other recurring revenue streams that have not been added to the forecasts.

We asked for something substantial that could prove Qualcomm is ready to lead with its automotive digital platform. Management answered with aplomb.

Is QCOM Stock A Buy, Sell, Or Hold?

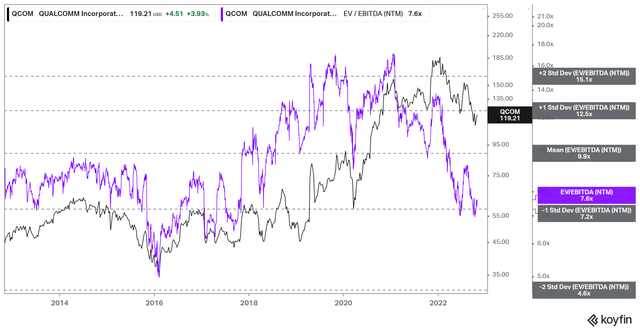

QCOM NTM EBITDA multiples valuation trend (Koyfin)

We believe it’s clear that QCOM’s NTM EBITDA multiples have been hammered as it continues to trade close to the lows seen in 2018. Of course, a worse-than-expected semi downturn could see further value compression. But, at these levels, coupled with a solid automotive pipeline through FY31, we are confident that the reward-to-risk profile is highly favorable.

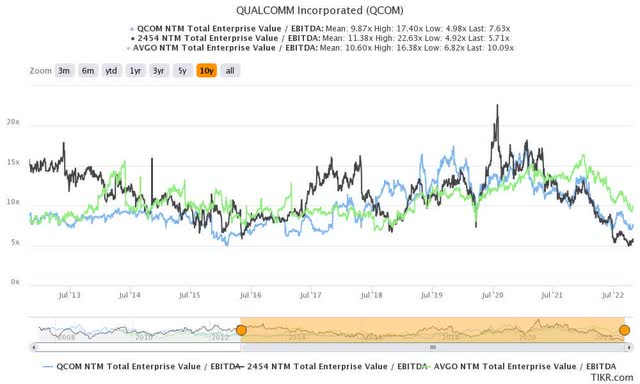

QCOM NTM EBITDA multiples Vs. peers (TIKR)

However, QCOM is still tagged with a lower “smartphone” valuation rating, which is expected to be a much slower growth vertical than the enterprise/hyperscale markets. As such, Broadcom’s (AVGO) enterprise/hyperscale prowess sees its stock trade at a much higher valuation than QCOM and MediaTek (OTCPK:MDTKF) stock.

We believe Qualcomm needs to continue executing its growth diversification from its core smartphone revenue to justify a material re-rating by the market.

For now, investors need to exercise patience and shouldn’t expect miracles to happen overnight.

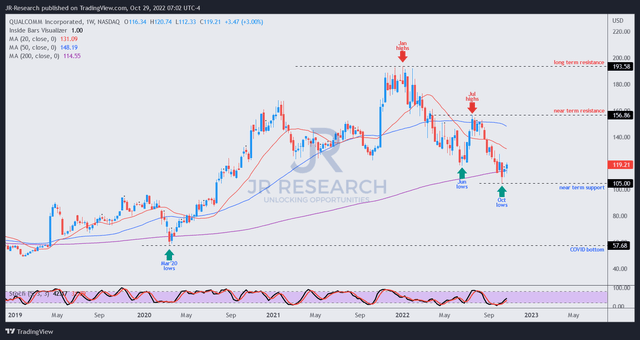

QCOM price chart (weekly) (TradingView)

However, we like QCOM’s price action as it’s constructive. Moreover, it has attempted to form a base, potentially bottoming out and supported by its critical 200-week moving average (purple line).

Its price action looks to be in a much healthier shape than AMD (AMD) and NVIDIA stock.

Hence, we are confident that investors can consider taking near-term downside risks to add exposure before its earnings release while keeping some ammunition to capitalize on unexpected downside volatility.

However, we observe that intense selling pressure could form in the near term at the $157 level. Therefore, investors should abstain from adding at those levels.

We reiterate our Buy rating on QCOM.

Be the first to comment