vitranc

Editor’s note: Seeking Alpha is proud to welcome Lincoln C. Wood as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

I am always open to examining firms in the construction industry as potential investments. While they can be challenging to run profitably, they can also be the source of powerful gains. There are several reasons why I believe PulteGroup (NYSE:PHM) is a good investment selection from the homebuilders sector. They have a strong set of internal factors and a focus on quality that will help them continue their successful projects. Second, they are conservatively managed and are focused on the careful use of share buybacks and dividends. Third, PulteGroup is undervalued as measured using several metrics, such as a comparison with their historic performance using PE multiples, a two-stage model, and peers, suggesting price appreciation is likely, and making PHM a secure buy on the merits of its strength and standing.

PulteGroup has over 70 years of history and has delivered over 700,000 homes in over 40 major metro markets. They have separate brands and segments with operations that deliberately target first-home buyers through to luxury home buyers. During the long period of activity, the group has traversed difficult and challenging economic climates and constantly strived to continue to offer quality, affordable homes. They have an increasing and strong focus on sustainability in their practices and the homes that they create.

The company remains in a strong position in its market, operationally, and with its finances. For the second year in a row, PHM has been named one of the best companies to work for. While this is never a strong signal to me as an investor, I am mindful of the impact that a powerfully motivated workforce can have on a firm in both good and bad times. In addition, a range of research shows the importance of a strong culture and enthusiasm for work, such as the Service Profit Chain, which connects these factors through to financial viability and success for the company. By itself, this is one factor, but a good sign that the firm will continue to be able to drive success operationally.

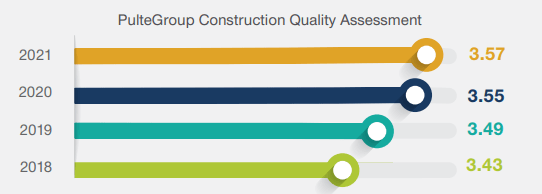

They have made ongoing efforts in Environmental, Social, and Governance (ESG) norms, as reflected in their 2021 report. There are ongoing efforts to enhance customer care, focusing on the overall experience and build quality. We can see this by the tracking and improvements from 2018 to 2021 in the overall construction quality assessment they undertake, including using on-site unannounced safety audits (Figure 1).

Figure 1. Continued strides in quality enhancement at PHM (PHM 2021 Environmental, Social, & Governance Report, p. 16)

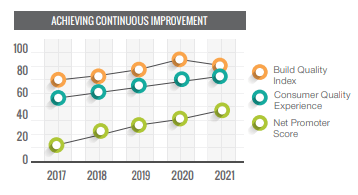

There is a strong focus on measuring and evaluating PHM’s ongoing operational aspects with a focus on continuous improvement. As part of the measurements, PHM also focuses on consumer quality experience as a core driver of overall evaluations of quality. From my own scholarly research, I understand how crucial it is to understand and respond to customer perceptions of quality in construction. We can see that the overall levels of quality and experience have been increasing over the last five years (Figure 2). Overall, this is a firm focused on growing, satisfying the consumer, and reaching improvements in quality. These are attributes we should look for in the firms we invest in.

Figure 2. PHM – a focus on continuous improvement (PHM 2021 Environmental, Social, & Governance Report, p. 17)

PHM has also begun to track its greenhouse gas (GHG) footprint, as shown in the PHM 2021 ESG Report. The results reflect the strong overall expansion of growth in the business, showing a high level of Scope 3 emissions driving their overall carbon footprint. This is not unexpected. Turning to the more focused elements, their Scope 1 emissions were larger, particularly driven by vehicular fuel (diesel) use – again, driven by an expansion of work undertaken. Favorably, the Scope 2 emissions were more muted, with both electricity and natural gas levels declining. Working backward suggests that efforts to maintain operational control and reduce costs have been successfully implemented. This will have a knock-on impact on costs and will feed into the strong corporate culture of continuous improvement.

Despite the challenges facing the company and the industry, PHM has increased its gross margins from 25.5 to 29% (Q1 2021 to Q1 2022, p. 5), representing a strong increase in the present market conditions.

Together, these internal factors, the strong focus on quality and continuous improvement, and a commitment to sustainable operations, all position PHM for ongoing success if it is trading at the right price.

Sector conditions

We still see strong demand for more homes. However, there is a widely recognized shortage of homes, with Freddie Mac finding that “In the past two years, the supply of available homes has declined to a level not seen since at least 2000. This lack of supply has influenced home prices.” This is a long-term trend that seems to be worsening. Last year, Freddie Mac suggested we may be short approximately 3.8 million units, a sizeable increase on the estimated shortage of 2.5 million units they made in 2018.

This is a rising tide that will promise to lift all boats. PHM should begin to capitalize on the wider lift in demand. However, they are still going to remain capacity constrained and unable to meet all demand, much as other builders will experience. Given the strong need for housing and the current shortage, there are powerful forces that should lead to success for firms in this sector.

What does their position and the sector mean for PHM?

As a company, they have experienced strong EPS expansions over the last several years as their business has grown. Given the overall housing shortage, we may expect to see a long-term tailwind for the company (and the industry) for many years as they work to close the gap between the supply and demand for housing. There is no way these firms can increase housing supply rapidly – they cannot simply turn on a tap and suddenly build 50% more homes next year. For instance, they have seen home closings consistent with prior years.

The firm has also struggled to control costs and operations due to supply chain disruptions. The disruptions have caused significant pricing and availability issues in materials like lumber. There are also challenges in hiring sufficiently skilled staff, even while PHM has experienced a rising wage cost.

Long-term, this remains a fairly challenging sector to make estimates in. If there is a severe recession or a prolonged period of financial turmoil more similar to the Global Financial Crisis (GFC) than the pandemic, then a firm like PHM will probably do poorly, which will be difficult to anticipate ahead of time.

Given the strong internal factors, emphasis on quality and improvement, and the strong sector-wide need for home building, there are strong forces in favor of PHM being a buy.

PulteGroup’s conservative management

PHM has been fiscally responsible and has maintained a reasonable debt level. Their last report listed $5,751 million of long-term and $2,479 million of short-term liabilities. Against this, they have $13,164 million in long-term and $12,081 million in short-term assets. This is not a company where I am concerned about their ability to pay the bills or I believe is at risk in an environment of rising interest rates, as they have elected not to be burdened by the issues of taking on significant debt levels.

The conservative nature of the company management is reassuring to me. My academic/scholarly research into investments leads me to believe that there are significant and substantial risks to firms in the construction industry in making high-stake investments into innovative and radical technologies in the search for sustainable outcomes. The risks of a firm doing this seem to be increasing with the emphasis put on ESG investing. And, as we saw earlier, with the increasing ESG reporting and wider systemic issues relating to expanding Scope 3 GHG emissions, it may be tempting for PHM to go down the path of riskier investments. However, based on my research, I remain more comfortable with firms that exhibit a more cautious attitude toward their investments and management of debt.

Dividends

This is not a company that continues to pay dividends no matter its circumstances. They saw a 2008-2013 gap in the dividends paid. Unsurprisingly, this period correlates to the global financial crisis focused on housing. Since the resumption of a quarterly dividend of $0.05/share in 2013, this has risen to levels of $0.15/share in 2022, representing a reasonable three-year CAGR of 12% that happily exceeds the sector median. They tend to hike the dividend in the final quarter, so investors may watch for the news in the coming months.

For income-focused investors, this is unlikely to be an attractive buy given the forward yield of 1.36% and the short period of dividend increases following the global financial crisis. However, investors may be reassured that they did not suspend the dividend during the 2020 pandemic-related market turmoil.

PHM has a good history of dividend payments and share repurchases. From 2018 through 2021, they have made between $301 million and $1045 million returns to shareholders. In Q1, they repurchased $500 million of common shares and ended the quarter with $1.2 billion in cash. This level of cash is down from the end of Q4 2021 cash, representing a minor risk to the company, and it seems to be a reasonably rapid depletion of cash reserves. However, the amount they have available is still a good buffer. In addition, they have a good history of long-term share repurchases, with 386.6 million in Q4 2012 against 248.7 million in Q4 2021, representing a 36% reduction in the outstanding shares and a strong return of value to shareholders.

The conservative management of the finances and careful use of dividends and share buybacks suggest that this is a firm that investors can be confident in.

PulteGroup’s Q1 – A strong quarter

PHM has come into 2022 in good shape, with improved financials over Q1 2021 and a strong balance sheet.

Financials

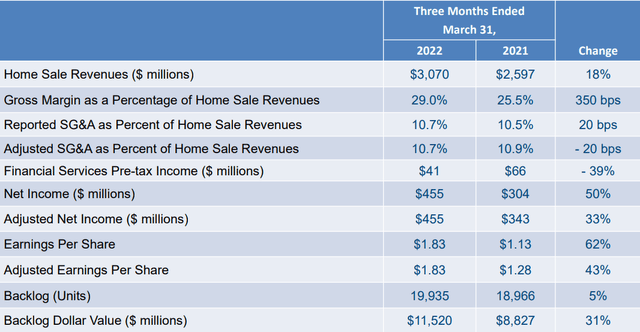

The financials for PHM change each quarter and so a 2022 Q1 comparison is best made against the 2021 Q1 (Figure 3). From the data, we can see that the revenue has increased by 18% while they have also slightly reduced the adjusted SG&A costs as a percent of the home sale revenues, reflecting their ongoing commitment to continuous improvement.

Figure 3. PHM Q1 2022 – selected financial results (PHM Q1 2022 Operating and Financial Results)

The net income has jumped 50% over the twelve months to $455 million, with an adjusted EPS of $1.83 for the quarter. Given the materials shortages and wage costs, these are some impressive gains in the climate.

Balance sheet strength in Q1 2022

There has been a slight weakening of cash and short-term investments, over the last several quarters, including in Q1 2022 ($1,162.4 million) against Q1 2021 quarter ($1,597.0 million). The current assets are $12,081.3 million against current liabilities of $2,479.1 million.

Assets and liabilities have been balanced over the Q3 2019 to Q1 2022 period. They have not changed significantly. This is solid and removes many risks for the company, as they are in a healthy position.

As a result, other than the slight deterioration in the near-term cushion provided by cash and short-term investments, this balance sheet has remained strong. This has reflected in a slight decrease in the cash per share value over the last several years, a figure to monitor in the coming years, as liquidity is crucial for ongoing construction activities.

Both financial gains and the strong balance sheet provide assurances to the investor that PHM will be sticking around and continuing to grow.

PHM stock valuation

PHM has a current PE of 5.4x and a forward PE of 4.17x. This is cheap in my opinion. My near-term preferred valuation method is based on the relationship between company prices and earnings. I work on the assumption that the PE ratio will snap back to a more normal range, either from the downside (where the firm is trading below the reasonable PE and prices increase to appropriate points) or from the upside (highly valued companies experience a tumble in prices to bring the PE back into alignment). Very often, I will use a 15x PE as a target with a higher multiple for high-growth stocks and a lower multiple for those facing challenges or, in particular, industries facing challenges or uncertainty.

Historically, from 2014 (normalizing following the global financial crisis) to 2021, the average PE that PHM traded at was just over 11x. So, by a blunt expectation, we might expect prices to double to ‘catch up’ to this average PE. This is lower than the 15x PE, representing a somewhat conservative target.

In contrast, since the pandemic-driven decline in the prices, the normal PE has been about 8x and has traded with a single full-year normal PE of bang-on 8x. Even at this PE, we might expect a strong price increase to reflect a normalization of the PE ratio.

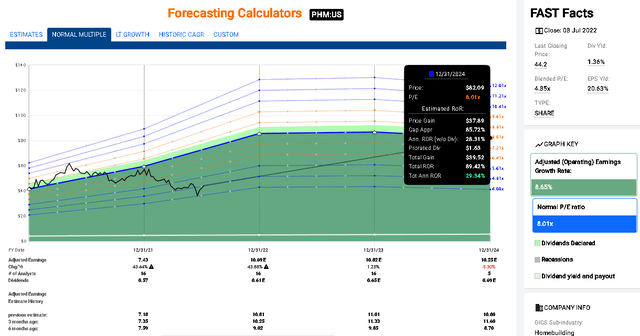

As a conservative investor, this recent PE ratio represents a reasonable valuation target for me moving forward in the coming years until 2024. Consequently, I derive a valuation based on the expected analyst earnings, as shown in Figure 4. The five analysts’ EPS estimate in 2024 is $10.25 and applying the conservative PE of 8.01x gives us a target of $82.09 by the end of 2024.

Figure 4. PE ratios and price forecasts to 2024 for PHM (Historical graph and analyst estimates – Copyright © 2022, F.A.S.T. Graphs)

From Figure 4, we can see that if we use the PE of 8x, we might expect a total rate of return of nearly 90% from here until the end of 2024, giving us an annual rate of return of 29%. This is good. During this time, we should expect to see several more dividend hikes, which is always a delightful bonus, but the normalization of prices is really driving the rate of return here.

These estimates (Figure 4) are based on FactSet analyst estimates of earnings (reported through FAST Graphs). Another important point to make is that the expectations are increasing over the last six months; we can see from Figure 4 that there are substantial increases in the EPS estimates over the last six months from analysts, of around 17% increases for 2024, despite the heightened recession risks during this period. This is encouraging but should be taken with some degree of caution as it reflects the difficulty in making longer-term estimates in this industry and it is also a reflection of the adequate analyst scorecard for this company with a 77% beat or hit on one- and two-year forecasts (this is for the period from 2009 and part of this poor analyst performance is driven by strong misses in the post-GFC period, which we may logically expect).

Checking with a two-stage model for a longer-term perspective

As a quick check on the valuations, I used a two-stage model to evaluate the buy now price from a long-term holding perspective. For the near-term EPS growth (0-5 years) I have used a 10% value (based on the more conservative analyst estimates on Yahoo Finance than the 15% FactSet analyst estimates) with a 5% expected EPS growth for 5-10 years. For the dividend growth, I have used 12% for 0-5 years and then 10% thereafter, representing reasonable dividend growth rates based on PHM’s achievements. Using a 12% rate of return and an expected PE of 11x at the time of sale (I noted a PE of 11x earlier as a reasonable PE based on their historic performance following PHM’s recovery after the GFC from 2014 onwards), all conservative measures, I assess PHM as a buy so long as the stock price stays below $59.64.

Peer comparisons

To ensure the analysis is helping identify a strong performer in this industry, I made a comparison to five comparable homebuilder firms and put in bold the lowest two firms in each category. In the overall Quant Factor grade for valuation, PHM receives a “B” which is respectable. It also has the second-lowest Price/Sales ratio and EV/EBITDA ratios. In terms of the price-to-cash flow ratio, it is not one of the best valuations, but it is in the middle of the pack and represents reasonable value.

| Company | Price/Sales | EV/EBITDA | Price/Cash flow | Quant factor grade – Valuation |

| PulteGroup, Inc. | 0.78 | 4.27 | 10.15 | B |

| Persimmon Plc (OTCPK:PSMMY) | 1.40 | 4.05 | 6.43 | A |

| NVR, Inc. (NVR) | 1.65 | 7.23 | 11.75 | C |

| TopBuild Corp. (BLD) | 1.5 |

11.29 |

14.46 | C- |

| Toll Brothers, Inc. (TOL) | 0.62 | 6.56 | 5.16 | B- |

| Skyline Champion Corporation (SKY) | 1.42 | 7.78 | 13.9 | C |

Risks that must be considered

I see three key risks: materials, staffing, and recessions. First, while there is a strong need for more home building, there are well-recognized supply chain issues that have dramatically increased in 2020, 2021, and 2022. Many materials have surged in price and become more difficult to acquire. The inability to secure sufficient supplies at appropriate prices will either squeeze margins (which, as noted, PHM has successfully been maintaining and growing) or cause delays if they are not available, adding a squeeze on margins and reducing client satisfaction with the firm.

Second, staffing remains an issue that the firm has been grappling with. Securing appropriately skilled staff requires higher wages, reducing their margins. In addition, if they cannot secure the right staff with the right skill sets, they cannot deliver their contracted builds on time. The impact will be delays and costs to the company, reducing future earnings.

Third, and perhaps one of the most concerning, is the potential for a more widespread slowdown and recession. Clients will have access to less personal savings and funding and are likely to become more risk-averse in these conditions, leading to a slowdown in contracts over all the segments that PHM operates in. Financial lending decreases and the availability of lending to first home buyers, in particular, often slows down, dealing a blow to PHM that their range of brands and homebuilding niches partially offset.

Thesis for buying this undervalued firm and building wealth for your family

This is a well-managed company that is reliable and with a long-term focus. I have confidence that their senior management team has a handle on the risks and debt they take on and have shown themselves as astute managers, cutting dividends when reasonable (e.g., following the GFC) while also engaging in long-term shareholder-friendly buybacks and dividend increases where possible.

The company pays a dividend, but the yield remains low, and the long-term security from the dividend likely will not attract an income-oriented investor.

I would rate this company as a Buy to reach 30% annual returns until 2024. I would remain positive about the buy, up to around $55, with the anticipation of prices moving upwards to normalize the PE ratio. The current PE ratio seems abnormally low and reflects a company that has current or few future growth prospects, is shrinking, or is being horribly mismanaged. The firm is clearly not shrinking and is not being mismanaged. As a long-term investment, I am happy with prices up to $59. Beyond that point, PHM prices exceed my current buy price and I would expect too much potential for a pullback and, therefore, a loss of my margin of safety.

Yes, there are risks, such as a looming recession. Despite these risks, there are sufficient overall macro trends (e.g., a need to increase the housing supply) that this company will ride the wave and will continue to be successful in growing its business and overall earnings per share. In addition, buying today will secure this company at a favorable valuation, enabling the long-term investor to participate in the company’s growth and see the chance to build returns for the future.

Be the first to comment