Delbars/iStock via Getty Images

This is my first look at Provention Bio (NASDAQ:PRVB), another biotech that is in near term PDUFA limbo with its lead therapy teplizumab (PRV-031). In this article I review its prospects for FDA approval, Provention’s recent Sanofi deal, and its investment merits.

After long development, teplizumab’s pending BLA is a white knuckle affair

Teplizumab has been the subject of 15 different clinical trials reported on clinicaltrials.gov since 2005, the vast majority of which trials evaluated it in treatment of Type 1 diabetes (T1D). Provention first entered the teplizumab scene with its 05/2018 MacroGenics (MGNX) Asset Purchase Agreement.

Provention shareholders who are excited about their prospects should its BLA be accepted, need to be aware of the deal terms. As described in Provention’s Q2, 2022 10-Q, in addition to ~2.1 million $2.50 warrants, they provide inter alia:

…contingent milestone payments totaling $170.0 million upon the achievement of certain regulatory approval milestones, including $60.0 million payable within 90 days of an approval of a BLA for a first indication in the United States. In addition, the Company is obligated to make contingent milestone payments to MacroGenics totaling $225.0 million upon the achievement of certain sales milestones. The Company has also agreed to pay MacroGenics a single-digit royalty on net sales of the product.

MacroGenics also cleverly negotiated additional payments of:

…a low double-digit percentage of certain consideration to the extent it is received in connection with a future grant of rights to teplizumab by the Company to a third party. The Company is obligated to use reasonable commercial efforts to develop and seek regulatory approval for teplizumab.

Of course these are contingent and satisfaction of the contingencies should benefit Provention so that it will be well able to make these payments. Nonetheless they dampen the impact of such an approval.

Still the most important issue now is whether or not the FDA will approve teplizumab. This effort has been going on for a while. Initially the FDA seemed to recognize teplizumab’s importance when it granted it breakthrough therapy designation for the prevention or delay of clinical T1D in individuals at-risk of developing the disease.

Provenance’s initial BLA filing for teplizumab for the delay or prevention of T1D in at-risk individuals got mixed FDA reception. In 12/2020 the FDA accepted and filed it for review accepting it for priority review with a PDUFA date of 07/02/2021. When 07/2021 arrived it slapped it with a CRL.

Provenance responded on 02/2022 when the company resubmitted the BLA, announcing at the time:

We look forward to the FDA’s review and determination on whether the BLA resubmission sufficiently addresses the Agency’s PK comparability and other CRL considerations to advance teplizumab towards its first potential approval as a disease modifying therapeutic option for the T1D patient community…

In 03/2022 the FDA accepted the resubmittal filing assigning an 08/17/2022 PDUFA date. That was good news, then on 06/30/2022 came some decidedly less sanguine news:

…the FDA extended its review period by three months for the BLA for teplizumab. The extended user fee goal date is now November 17, 2022. The FDA informed us that our timely responses to an information request, related to updating the PK model to include additional anti-drug antibody data and re-10 the proposed modeled regimens made earlier in June 2022, to be a Major Amendment to the BLA resubmission, requiring additional time for the FDA’s review.

This may sound benign but it clearly signals that the FDA has no urgency to approve this application and it may well end up with a second CRL.

The market has overreacted on the upside to Provention’s recent Sanofi deal

Seeking Alpha’s 10/06/2022 Provention news feed included the following headline:

Provention stock soars 17% on pact with Sanofi for potential diabetes drug teplizumab

Wow, that sounds pretty good, the right deal with big pharma could save Provention’s bacon as it spars with the FDA. Was this the right deal? As always the devil is in the details. In this case such details as are available come to us through Provention’s 10/06/2022 8-K.

The pact referenced in the headline takes the form of a co-promotion agreement coupled with a securities purchase agreement. The arrangements are somewhat complicated and important pieces of the agreements are not revealed. The 8-K provides a summary only, with the agreements (likely with key terms redacted) to be exhibits to Provention’s 2022 10-K that should be filed after the close of fiscal year 2022.

I will unpack the key substantive parts that are included in pieces. Sanofi’s (SNY) wholly owned subsidiary Genzyme Corporation is the actual party, but I will refer only to Sanofi.

A. Co-Promotion agreement/commercialization

The initial agreement in the pact addresses commercialization if teplizumab is approved in the United States. Sanofi agrees to commit 100 FTE (full time equivalent) field resources for commercialization activities. Provention will reimburse it up to $33 million for these and related expenses and other allowable expenses.

B. Co-Promotion agreement/right of first negotiation

The pact also included an exclusive right of first negotiation for Sanofi:

…to research, develop and commercialize teplizumab with respect to the treatment or delay of Type 1 diabetes, or any of its root causes throughout the world, and to manufacture teplizumab in support of such research, development and commercialization (the “ROFN”) in exchange for a one-time upfront payment of $20 million, and subject to certain retained rights of the Company to engage in discussions with third parties with respect to certain transactions (“Third Party Transactions”).

The ROFN initially runs from October 4, 2022 until June 30, 2023. It includes a diverse suite of extension rights tied to Provention’s delivery of top line data from a specified (unidentified) clinical trial sponsored by the Company. As long as the ROFN remains in force it provides:

…the Company may not enter into a Third Party Transaction on terms that are materially less favorable in the aggregate to the Company than the most recent terms Sanofi offered, if any, without first permitting Sanofi to execute an agreement with the Company on either such terms previously offered by Sanofi or the terms offered by such third party.

The potential for defined Third Party Transactions relates to retained rights of the Company to engage in discussions with third parties with respect to certain transactions. The agreement calls for oversight by a joint steering committee. The agreement terms expire on 12/31/2023.

C. Securities purchase agreement

In addition to the co-promotion agreement, the pact included a securities purchase agreement. It provides that if the BLA is accepted by the FDA, Sanofi will purchase $35 million in stock of the Company at 140% of its daily average price for the five days before closing. The Company can select the closing date but it must be occur no later than 02/16/2023.

Provention’s meager pipeline outside of teplizumab is concerning.

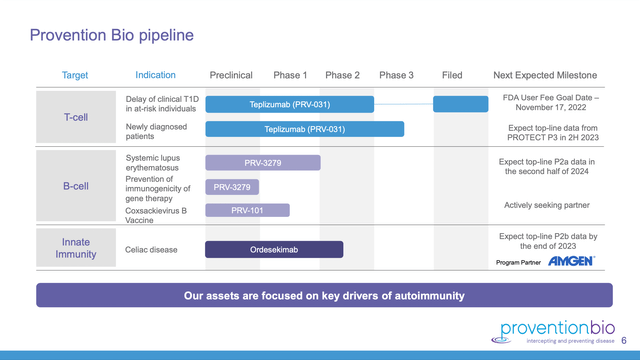

Provention’s website (accessed 10/25/2022) includes a helpful 33 slide presentation dated 10/2022. Slide 6 of this presentation lists its pipeline as follows:

Teplizumab in two indications is pretty much Provention’s sole late stage opportunity. If teplizumab disappoints this coming November it will come up to bat again in treatment of newly diagnosed patients with phase 3 top-line data expected in 2H 2023. Other than that there are a smattering of early trials and a phase 2b trial in Celiac disease expected to report at the end of 2023.

On 08/04/2022, Provention reported its Q2 2022 earnings and business update. It provided guidance for its Q3 2022 with aggregate cash based expenses in the range of $27-$31 million. It closed Q2 with cash, cash equivalents and marketable securities of ~$96 million.

Subsequently on 07/07/2022, it netted an additional ~$57.2 million from security sales of 13,318,535 shares of common stock at ~$4.50 and 13,318,535 5 year warrants exercisable at $6.00. Still later, on 09/01/2022, recognizing its potential milestones and general launch expenses on approval of teplizumab, Provention secured a $125 million credit facility.

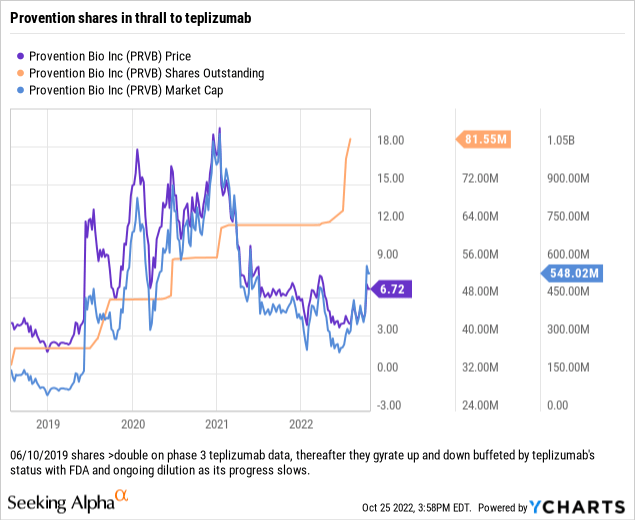

This facility calls for funding in 5 tranches, with $25 million loaned at closing. The other 4 tranches are payable upon approval of teplizumab and satisfaction of other conditions. The price and share count chart below shows a current picture for Provention:

Conclusion

Provention is a stock for gamblers. It will rise or fall based on its success or failure in front of the FDA with teplizumab. I might have liked its chances as a long shot bet following its resubmission after its CRL. However the FDA’s 06/30/2022 extension of its review period changes my assessment.

The FDA considered information provided subsequent to Provention’s original resubmission of the BLA to be a major amendment to the BLA. This is exactly the situation which Omeros (OMER) encountered before it received its first CRL from the FDA. I am too scarred by that disappointment to view Provention’s current prospects as anything other than nil.

I wish the best of luck to all those who are willing to follow Provention as it pursues its fortune in the FDA’s lions’ den… jamais moi.

Be the first to comment