Richard Villalonundefined undefined/iStock via Getty Images

Thesis

As recession fears mount and the various stock indices tank, investors are rightfully assessing their options in shorting the market. With the VIX index above 30, it is fairly expensive to buy put options now, and it is very likely they will expire worthless or without providing adequate downside protection. We will examine a put example in our analysis below. Another way to hedge a portfolio, or simply take a view that short term the market will lose more value is via an inverse ETF. The ProShares Short Dow 30 (NYSEARCA:DOG) is an ETF that provides the inverse daily performance of the Dow Jones Industrial Average. Investors holding for longer than a day will not necessarily see the proportional, inverse performance versus the index on a one-to-one basis. To note that the vehicle also has a high expense ratio of 0.95%, hence it falls more in the shorter dated trading tools area, rather than a long term buy-and-hold instrument.

Are puts on the Dow Jones Index expensive?

As a direct competitor to an inverse ETF such as DOG, one can find the option chain for the index. In this section we are going to look at a six months put option on the Dow Jones, struck at-the-money (i.e. at the current spot levels) and assess whether it is expensive or not.

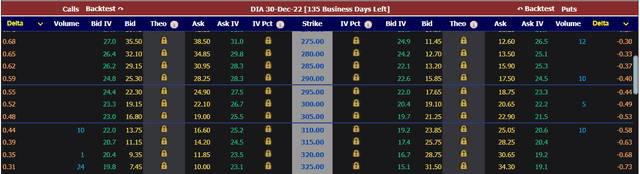

Courtesy of Market Chameleon we can find the six months option chain below for the Dow Jones ETF (DIA):

DIA Option Chain (Market Chameleon)

We can note that buying an at-the-money put with a December 30th maturity date costs $20.65 per contract. We are using here the $300 strike (spot is currently 298.72 as of the writing of this article). So an investor will pay $2,065 to get protection on $30,000 notional of DIA. Let us analyze potential payout scenarios:

Scenario 1: The market tanks another -10% from here

- DIA goes to 268.85

- the math is 300 – 268.85 – 20.65 (cost of put) = 10.5

- an investor ends up making $1,050 or 3.52%

- despite the fact that the market tanked -10%, due to the high cost of the put the investor only gets a 3.52% positive protection

Scenario 2: The market tanks another -5% from here

- DIA goes to 283.78

- upon expiry the put is exercised since it is in the money

- the math is 300 – 283.78 – 20.65 (cost of put) = -4.4

- an investor ends up losing $440

- despite the fact that the market tanked another -5% the investor did not get any protection due to the high cost of the put

Scenario 3: The market rises 3%

- the put expires worthless

- the investor loses the premium paid for the option which is $2,065

We have basically demonstrated how currently the cost of protecting the downside via put options is extremely high and uneconomical. An investor would ultimately get only 3.52% downside protection via put options if the market tanks another -10%.

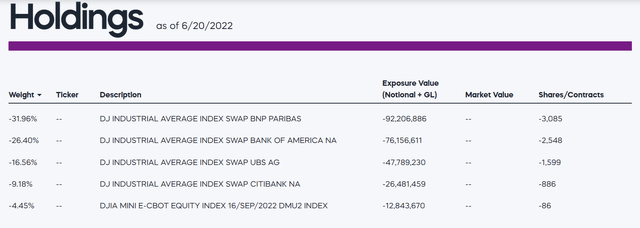

Holdings

DOG generates the daily inverse performance of the Dow Jones Industrial Average via swaps:

We can see that the fund faces some of the largest investment banks via swaps for their inverse daily total return. All swaps are done on a mark-to-market basis and probably cleared through a clearing house, hence the counterparty risk is completely mitigated (i.e. if BNP defaults the performance of the ETF would not be impacted).

As per the vehicle’s literature:

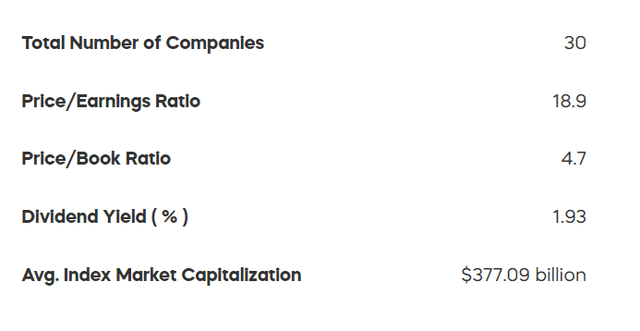

The Dow Jones Industrial Average is a price-weighted index that is calculated as a simple average. The Index includes 30 large-cap, blue-chip U.S. stocks, excluding utility and transportation companies. They represent the leading U.S. companies in the industries driving the U.S. stock market, are widely held by investors and have long records of sustained growth.

The current characteristics of the underlying companies are as follows:

Performance

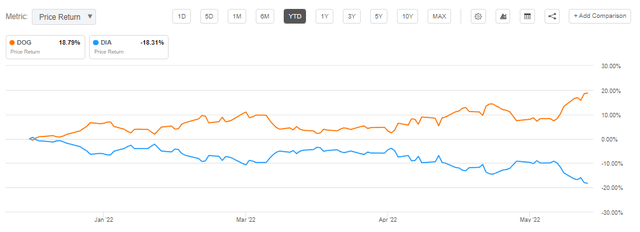

The fund is up more than +18% year to date, with a symmetrical performance to the Dow Jones index:

YTD Performance (Seeking Alpha)

On a longer term basis the fund loses its inverse correlation with the index due to the management fees as well as the fact that the swaps underlying the ETF track the daily performance solely:

5-Year Performance (Seeking Alpha)

On a 5-year basis, for example, the index is up approximately 39% while the inverse ETF DOG is down more than -46%. A buy and hold investor thus needs to keep in mind that DOG is essentially a trading tool that works best within 1 year time frames. Longer term there is a wider and wider basis that manifests itself versus the index performance.

If an investor holds an index, does not want to realize capital gains via an outright sale and finds put options expensive then DOG might be the right approach for certain periods of time. Portfolio immunization can be achieved by virtue of buying the same notional amount of DOG as what is present in the investor’s portfolio.

Conclusion

DOG is an inverse ETF that offers a retail investor the inverse daily performance of the Dow Jones Index. With a high management fee of 0.95%, DOG is not a long-term buy and hold investment but a portfolio trading tool best used within one year time-frames. The fund is up more than +18% year to date, perfectly hedging the Dow Jones negative performance. For an investor looking for alternatives to hedge against further market downside DOG is an appropriate tool to consider, given the current uneconomical risk/reward math behind purchasing put options.

Be the first to comment