vgajic/E+ via Getty Images

Investment thesis

In the past two years, Progyny (NASDAQ:PGNY) has seen its multiple contract from 90 times earnings in 2020 to 75 in 2022 and its shares have declined by 53%. Despite Mr. Market reaction, Progyny is continuing to report strong revenue growth and record profitability. The current valuation of 75 times earnings corresponds to a 1.3% earning yield, which still appears to be too stretched. In addition, despite investing for future growth, Progyny is cash flow positive and has an excellent balance sheet compared to many competitors.

Three main pillars sustain my investment thesis: the value propositions that Progyny was able to articulate into effective benefits to its patients, employers and fertility specialists; then, there is the management team’s data-driven mentality, which allows the company to deliver superior clinical results compared to the competition and finally Progyny’s moat that will continue to expand as the company keep gathering and implementing data into its services. Below, I will break down the previously mentioned factors that raised my attention regarding this compelling business.

Overview

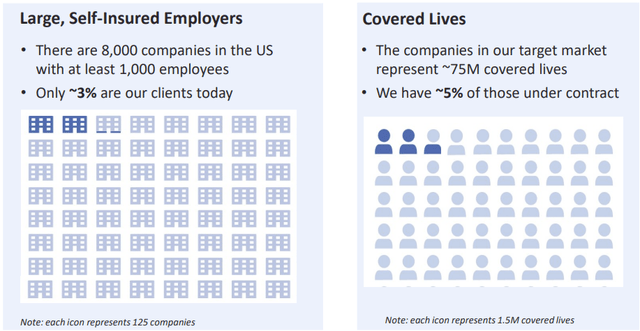

Progyny is a benefits management company in the US offering fertility and pharmacy benefit solutions. The company strives to reduce healthcare costs for employers and employees seeking family-building services. In 3Q 2022, Progyny serves 280 companies with 4.6 million lives covered. I expect their growth rate to remain high due to increasing awareness of infertility issues.

The fertility company enjoys industry-leading NPS of +81 and +79 respectively for its fertility benefit solutions and pharmacy services. Progyny’s high NPSs are what I regard to be the manifestations of customers’ satisfaction and loyalty with the company’s services as it is further demonstrated by the “near 100%” client retention rate that Progyny is enjoying from 2016. I believe Progyny to be a superior business compared to its competitors because of the following reasons:

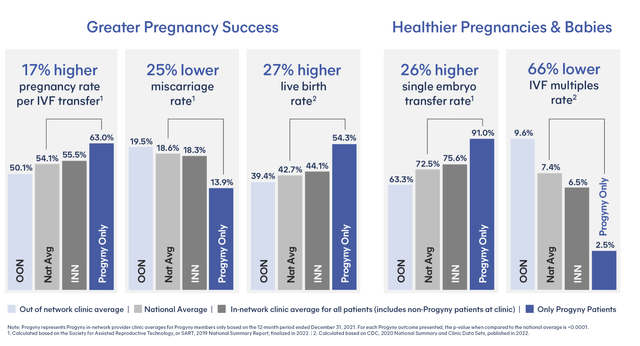

According to the CEO David Schlanger, Progyny was able to achieve far better clinical results compared to other fertility companies because it is the only company in the whole industry to collect and publicly provide data from fertility providers. As opposed to other growth companies, Progyny is already conducting its operations profitably as it is demonstrated by its multi-year margin expansion.

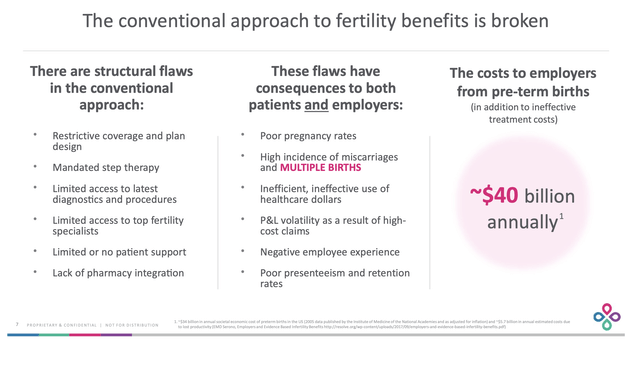

The 2021 annual report outlines a potential addressable market of at least $18 billion for Progyny. I strongly believe this untapped market could be dominated by the company’s data-driven and cost-saving approach through its services. Employers spend an estimated $34 billion on pre-term births plus $5.7 billion in lost productivity annually, suggesting an even larger opportunity.

Progyny

Business segments

Progyny’s business model consists of two main services: fertility and pharmacy benefits solutions, plus adoption and surrogacy reimbursement programs. Its 19 “Smart cycles” bundles significantly increase chances of a successful and safe pregnancy as it is demonstrated by Progyny’s 27% higher live birth rate and 25% lower miscarriage rate than the national average.

These results enable Progyny’s clients to fund fewer treatment rounds, resulting in a significant cost advantage. In contrast to most fertility solutions available, Progyny allows its patients to choose between different “Smart cycles” and combine them so they can adopt the most suitable option.

The company also offers integrated pharmacy benefits solutions through Progyny Rx, which allows patients to have access to prescriptions fulfillment and the medications they need through their fertility rounds. This solution enables patients to save up both on time and expenses.

As stated in the company’s 2021 annual report, legacy companies require patients to wait one to two weeks for authorisation and medication delivery. This increases the risk of not receiving medications on time and postponing fertility treatment by at least a month. Progyny Rx offers prescriptions and medications within two days, allowing patients to avoid this delay.

Value proposition

Benefits to employers

According to SART and Progyny, the latter reported an average pregnancy rate per IVF transfer of 61.4%, compared to the national average of 53%. This suggests Progyny members require on average 1.58 rounds, while the national average stands at 1.85. The American Society for Reproductive Medicine reports that the US’s average cost for one IVF cycle is $12,400.

These data lead to average savings equal to $3,000 for Progyny patients. Moreover, since Progyny patients undergo fewer rounds, they also need fewer quantities of medication, which result in 20%-unit cost savings and 8% from “waste management protocols” An additional saving is achieved through lower multiple birth rates.

Benefits to patients

Before diving into Progyny’s competitive solutions, I believe it should be noted that since the company is able to integrate with all large national carriers, Progyny can provide its services on a pre-tax basis instead of post-tax granting patients average savings of $17,040 per treatment cycle. This is based on a full fertility treatment costing on average about $60000 (per the National Library of Medicine) and a 28.4% income tax rate (2021 OECD estimate).

As of today, Progyny offers a total of 19 different smart cycles which can be mixed depending on patients specific needs and times. Progyny, unlike many other fertility companies, appears to be far more focused on reducing the cost burden that patients have to bear when adopting fertility solutions. As a matter of fact, Progyny’s plans have no “limited lifetime dollar maximums”, which means that they are fully covered from a cost perspective.

I’m comfortable with saying that Progyny’s ability to enable its patients to avoid the risk of remaining without coverage in the middle of the treatment. (p. 7 Progyny 2021 annual report). All these factors that have been previously outlined enable Progyny’s patients to receive the best in the industry services. This is demonstrated by Progyny’s results as it is shown in the table below:

Benefits to fertility specialists

Progyny’s patients have access to the company’s network, which include about 900 fertility specialists who conduct their operations at 650 clinics. When analysing the company’s value proposition toward fertility specialists I asked myself the following question: what does Progyny do differently for its network of clinics compared to its competition? The first element to consider is that the company provides a large volume (4 million lives covered over a total of 75 million) to its network of clinics, which can count on patients that are fully covered as opposed to those of other fertility solution providers. Therefore, Progyny enables its partners to fully concentrate on their tasks since patients are able to choose the best treatment solution, while always having a clear idea of how much costs the plans they choose.

Progyny provides clinics with direct payments in advance, resulting in lower debts and interest expenses. In return, they must share data collected on treatments and outcomes. Progyny then generates quarterly clinic scorecards to its specialists that promote the sharing of best practices and outcomes.

I think this reinforcing mechanism creates a sense of competition among Progyny’s clinic partners, allowing Progyny to exclude those that don’t meet its standards. Additionally, it would take considerable resources and time for new entrants or existing competitors to catch up with where Progyny stands today; however, in the same period, Progyny will continue to improve.

Competition and moat

Progyny has two main competitors: national health insurance carriers and small emerging companies. Despite having more resources, national care providers cannot replicate Progyny’s fertility solutions because it would require them to switch from a “one size fits all” process to one which meets patients’ needs. Due to the low US expenditure on fertility healthcare (less than 1% of total) national carriers are less incentivised to change their approach since this would require them to spend an higher amount of resources.

I believe smaller emerging companies like Carrot Fertility and Maven Clinic to be a more direct form of competition that Progyny is facing. As it was previously mentioned, Progyny differentiates itself from these competitors for two main competitive advantages. The first is that it is able to integrate its solutions with its clients’ health insurance coverage plans on a pre-tax basis. This enables them to enjoy significant savings as Progyny’s clients don’t have to pay income tax on the amount of the reimbursement.

The second competitive advantage consists of Progyny being the only organisation in the industry that is “collecting and tracking comprehensive treatment data and clinical outcomes in real time”. This means that Progyny enjoys a strong time advantage over its competitors considering that it would take many years of data collection to cover the lost ground, while in the meantime Progyny will continue to strengthen its offerings.

Valuation

Over the past 4 years, Progyny increased its revenue at an impressive 79% CAGR. Considering Progyny’s superior operating efficiency and that it has only captured about 5% of the total market, I take into consideration two different revenue compound growth rates: 25% and 30%, which I apply from 2022 to 2027. For the full year 2022, I consider the average of the company’s guidance ($755 million) that estimates revenue to be between $735 million and $775 million. Then I apply a 10% EBIT margin at the 2027 revenue amount. I believe that a 10% EBIT margin is a conservative assumption over the next 5 years if we consider Progyny’s major competitive advantages and superior operational efficiencies.

|

Projected revenue (25% CAGR) * |

$755 |

$943,75 |

$1179,7 |

$1474,6 |

$1843,2 |

$2305 |

|

Projected revenue (30% CAGR) ** |

$755 |

$981,5 |

$1276 |

$1658,7 |

$2156,3 |

$2803,2 |

Figures are in million

| Assumptions | Estimates |

| EBIT (10%)* | $230,5 |

| EBIT (10%)** | $280,3 |

| Tax rate | 21% |

| NOPAT (25% CAGR assumption) | $182 |

| NOPAT (30% CAGR assumption) | $221,4 |

| Multiple | 30 |

| Intrinsic value | $5460 |

| Intrinsic value | $6640 |

| Shares outstanding | 93 |

| Intrinsic value per share | $58,7/share |

| Intrinsic value per share | $71,4/share |

| Margin of safety | 47-56% |

Figures are in million excluding percentages, multiple and per share values

If we apply the current US tax rate of 21% to the EBIT figures, we obtain two NOPAT of $182 million and $221,4 million. Moreover, if we apply a multiple of 30 to the earnings, we will have two fair values: $5,46 billion and $6,64 billion. Dividing the previous values by the number of shares outstanding, we have the following intrinsic value per share: $58,7/share and $71,4/share. Considering that Progyny’s market capitalization is equal to $3,22 billion, we would end up having the following returns: 11,1% CAGR in the first scenario and 15.5% CAGR in the second one.

From a financial standpoint, Progyny has a pristine balance sheet since it has no outstanding debt. This means the company’s EBIT is not eroded by interest expenses. Moreover, Progyny’s operating expense decreased from 19,1% in Q1 to 16,9% in Q3 (2,2% points difference) resulting in a favourable operating leverage.

Risks

I believe the main risk is the potential regulation of the fertility segment of health care industry, which many refer to as a “wild west” due to its largely unregulated nature. We can’t know if or when legislators will step in, so investors should be wary when considering an investment in Progyny. Additionally, customer concentration represents another important risk; two clients accounted for 34% of Progyny’s revenue in 2021 compared to 35% in 2020. If one were to terminate their contract, it could hurt the company’s growth and economic performance significantly. Nevertheless, this is unlikely since Progyny has a strong client retention rate and network effect with clinic partners.

Conclusion

I believe that Progyny is a company characterized by what every value investor is looking for: a sustainable moat. As I outlined in the previous paragraphs, it would take years for competitors to match Progyny’s current data advantage, but in the meantime Progyny will continue to collect more and more data further improving its solutions over the competition. Despite the intrinsic values provided above, I think that investors should be cautious as the company still trades at more than 70 times earnings, which reflects a 1% earnings yield.

Be the first to comment