asbe/iStock via Getty Images

Logo from the company website

Prime Medicine, Inc. (NASDAQ:PRME) launched its IPO last week, raising $175M at an initial offering price of $17 and reaching a market cap of $1.48B. The company was founded by Dr. David Liu, Vice-Chair at the Broad Institute of Harvard and MIT, who also is a co-inventor of the gene editing technology owned by the company (also termed CRISPR 3;0).

In this initiation report, I will discuss the competitive advantage of the company’s gene editing technology and the revenue potential for the focus pipeline indications.

Novel Prime Editing Technology: Higher Precision and Better Safety

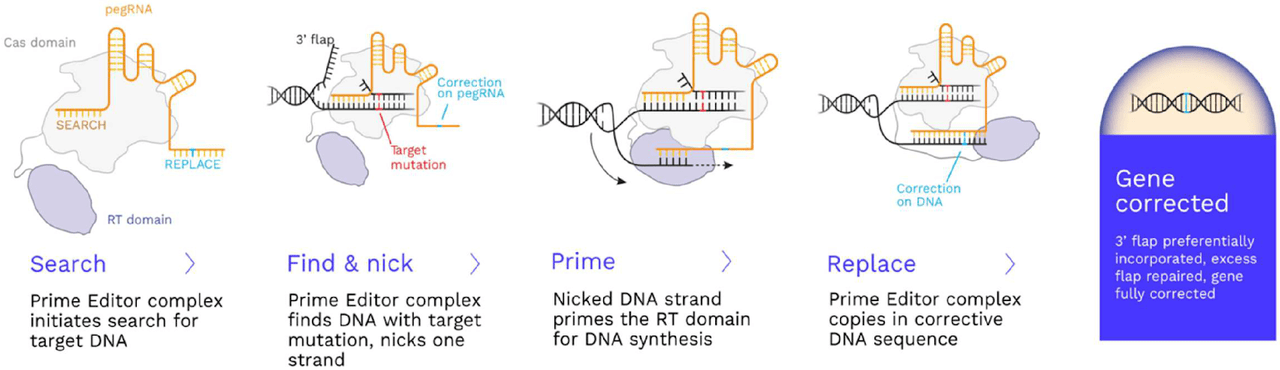

The company’s gene editing technology is known as Prime Editing. The figure below summarizes how this technology works.

Source: S1

The gene editing technology has two components: (1) Prime Editor Protein: Cas + reverse transcriptase, (2) pegRNA: targets prime editor to a specific genomic location.

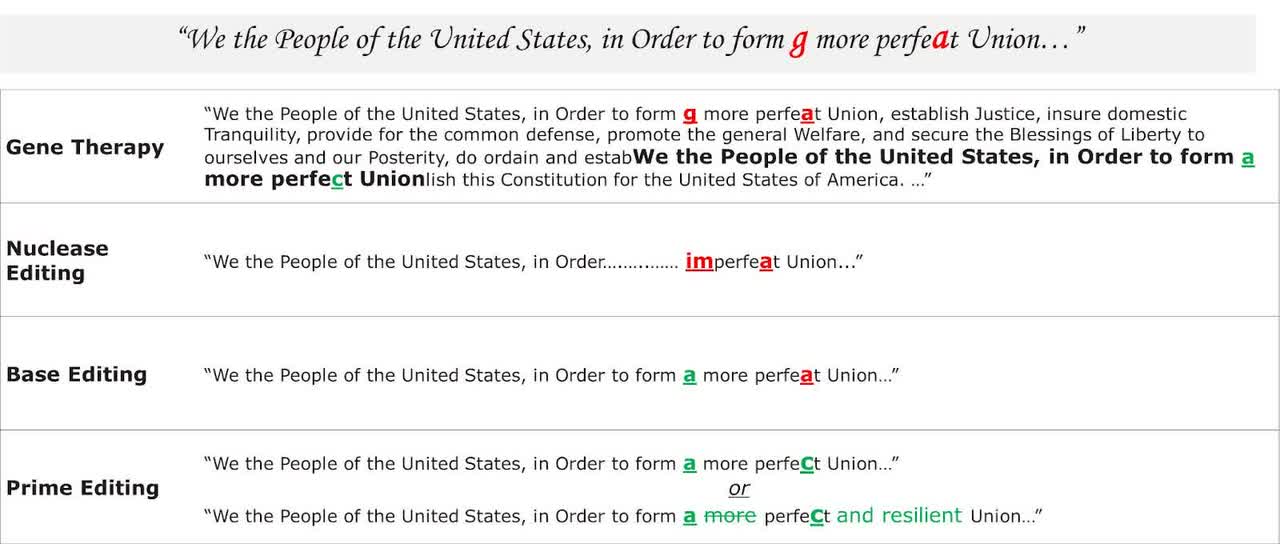

The following figure from the S1 illustrates in a very clear way how Prime Editing differs from the currently existing gene editing technologies (CRISPR 1.0 by CRISPR Therapeutics AG (CRSP) and Intellia Therapeutics, Inc. (NTLA); and CRISPR 2.0 by Beam Therapeutics Inc. (BEAM) and Verve Therapeutics, Inc. (VERV)).

Source: S1

Prime Editing avoids double-stranded DNA breaks, thus having the potential for increased precision and better safety (less off-target edits) compared to the competition. The company has licensed Prime Editing technology from the Broad Institute and the patents extend till 2035.

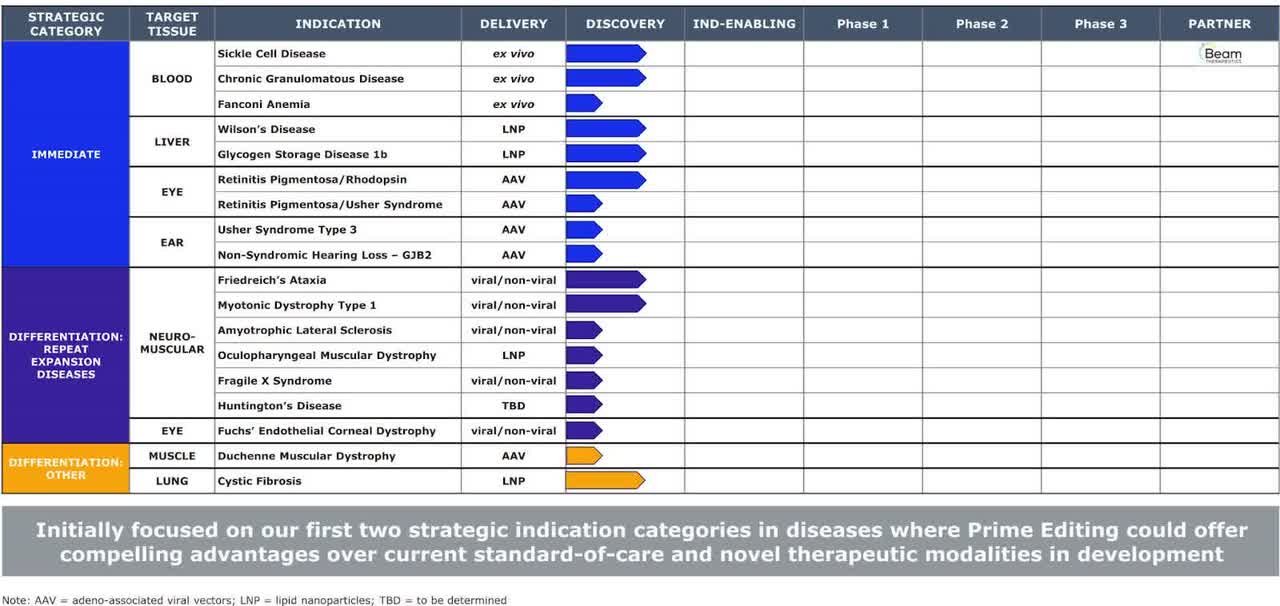

Broad Pipeline With Beam Partnership And Over 18 Therapeutic Programs:

Prime Editing can cover ~ 90% of >75,000 diseases. The pipeline figure given below summarizes the programs of the company. The sickle cell program is partnered with Beam Therapeutics.

Company pipeline, from S1

Sickle cell disease: The U.S. prevalence is approx. 100K cases in the U.S. Base editing company, Beam Therapeutics has licensed Prime editors for use in this indication and will provide royalties (mid-single to early-double-digit percentage) on the revenue. Preclinical data showed long-term engraftment of ex-vivo CD3+ cells in mice.

Chronic granulomatous disease: It is a form of immunodeficiency disease. The company is targeting the NGF1 gene. The annual incidence estimate is approx. 18 new cases/year in the U.S. The annual mortality rate is 10%. The vector delivery method is electroporation.

Wilson’s disease: It is a disease leading to copper accumulation in different organs of the body which may lead to seizures. The company is targeting the H1069Q gene, which is seen in 40% of cases (estimated target market of 10K existing cases in the U.S.). The vector delivery method is lipid nanoparticle, LNP.

Retinitis Pigmentosa due to P23H mutation: This is an inherited disorder that can cause blindness. The target market is 2000-2500 cases in the U.S.

Friedreich’s Ataxia: This is a genetic neurodegenerative disease. The estimated prevalence is 4000 cases in the U.S. and 15K-94K cases worldwide.

Myotonic Dystrophy type 1: It is a disorder causing muscle weakness. The company is targeting the DM1 mutations in this disease. The estimated prevalence is 140K cases in the U.S. and 100K cases in the U.S., E.U., and Japan.

Fanconi’s anemia: It is the most common inherited cause of aplastic anemia (decreased blood cells in the bone marrow). The target market is 5500 existing cases in the U.S. and 15 new cases/year.

The company also has a partnership with Myeloid Therapeutics for LINE-1 retrotransposon technology, which may expand the Prime Editing pipeline to more broadly address human diseases (beyond rare genetic diseases). Myeloid will receive tiered low to mid-single percentage royalties on net sales of products originating from this technology.

The company has generated encouraging preclinical data in several of the above indications and expects to report more preclinical data over the next 12-18 months and is targeting IND-enabling studies in several indications in 2024.

Experienced Management Adds to the Confidence In The Pipeline Execution:

CEO Gottesdiener served as the CEO at Rhythm Pharmaceuticals (RYTM). He also has senior leadership experience at Merck (MRK) for 16 years and was on the faculty at Columbia University. Chief Scientific Officer Duffield served as the Global Head of Human Biology at Vertex Pharmaceuticals (VRTX) and a Vice President and Senior Research Fellow at Biogen (BIIB).

Head of Prime Editing Platform and co-founder Anzalone has MD and Ph.D. from Columbia University and was a postdoctoral fellow in the lab of Founder Dr. David Liu at Broad/MIT where the company’s technology was discovered. The founder Dr. David Liu is also the founder of several other biotech companies like Beam Therapeutics, and Editas Medicine (EDIT). He is a Harvard Professor and the Vice-Chair at the Broad Institute of Harvard/MIT.

Financials, Valuation, And Other Data:

Cash reserves are estimated at $216M after the IPO (estimated by the company as enough till 2025). Long-term liabilities are $46M. The accumulated deficit is $224.6M at the Q2 end. The company’s operating expenses were $34M in 2021.

The public float after the IPO is 8.9M shares (~9% of the outstanding shares of 85.4M).

U.S. revenue potential for fully owned programs:

Estimated cost per patient = $2 million (Bluebird Bio’s gene therapy was priced at $2.8 million).

- Wilson’s disease: 10K U.S, cases or $20 billion of cumulative revenue opportunity.

- Myotonic Dystrophy 1: at 5% of 140K cases qualifying for the therapy = 7000 cases or $14 billion of cumulative revenue opportunity.

- Fanconi’s anemia: 5500 U.S. cases or $11 billion cumulative revenue opportunity.

- Friedreich’s ataxia: 4000 U.S. cases or $8 billion cumulative revenue opportunity.

- Retinitis Pigmentosa (P23H mutation): 2000-2500 U.S. cases or $4 billion cumulative revenue opportunity.

- Chronic granulomatous disease: Estimated 80 existing U.S. cases and 18 new cases/year.

Valuation comparison with competition:

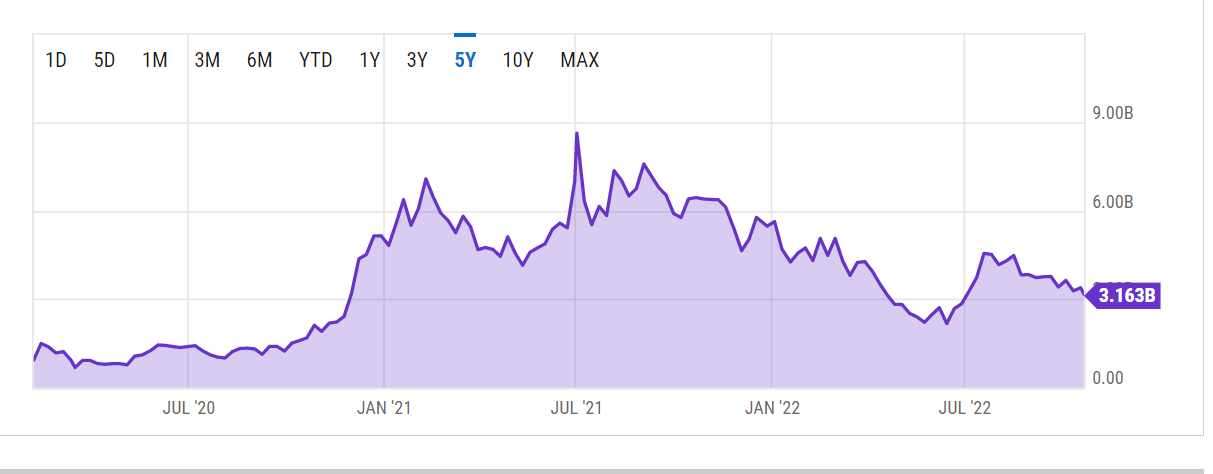

The closest competition is Beam Therapeutics which went public with a market cap of $843M. The company’s stock subsequently reached a peak market cap of approx. $9 billion before pulling back and currently trades at a market cap of $3.16 billion.

Ycharts

The current market cap of Prime Medicine is $1.48 billion. The premium for the company’s market cap at its IPO compared to Beam can be explained by the competitive advantage of Prime Editing over rival gene editing technologies (as shown in the technology section of this report), which may enable it to not only gain significant market share in one-time curative therapeutics of the above clinical indications but also expand beyond the above mentioned rare genetic diseases into other genetic disorders and more common human diseases like diabetes, hereditary hypercholesterolemia, beta-thalassemia, etc.

A discounted enterprise value/peak revenue approach (popular for M&A transactions): Biotechs are usually valued at an EV/peak sales of 7 in an M&A scenario. Considering peak revenue of $13B in 2032 (link to spreadsheet) (which includes only the U.S. revenue, though if we include the E.U. revenue potential, this figure could be 50% higher), ad a more conservative EV/peak sales ratio of 4, a discount rate of 15%, and peak revenue in 2032, an estimate of the pipeline’s value is $12 billion. Even if we subtract an estimated $8 billion in operating expenses until this peak revenue is reached, the pipeline could be of $4 billion value.

A spreadsheet showing an attempt at modeling for the company’s pipeline can be found here (including U.S. and E.U. markets). Please feel free to use this spreadsheet for your own financial modeling purpose. While this is not a pure-play discounted cash flow (“DCF”) approach, I have focused on modeling the target markets and the revenue potential in the U.S. and the E.U. markets. I have used a probability of just 1% at this stage. However, as the pipeline advances, the probability will increase (the average probability is 10% in Phase 1, 30% in Phase 2, and 65% for Phase 3 for biotech/pharma companies), and the discounted cash flow value will increase. It will not be, however, until at least 2028 that any product is FDA approved and enters the market.

The company will also incur significant operating expenses and capital raise until then (Bluebird Bio financials report a total of $4 billion in accumulated deficit while they had two gene therapy products entering the market this year. Any investor in the company should therefore take a long-term view with at least a 5-year timeframe.

Conclusion

In conclusion, I consider Prime Medicine as one of the disruptive companies in the gene editing space. Due to the ongoing bear market, the stock saw some pressure on the IPO date, however, it showed signs of stability on Friday. Investors have the opportunity to invest in the company’s stock at a price below the IPO pricing. I believe in the potential for the company’s technology across rare genetic diseases.

In addition, more value could be unlocked if we see more licensing deals with other companies for the Prime Editors. The company deserves to trade at a premium valuation considering its competitive advantage and potential across large target markets. I also expect Prime Medicine stock to get some buying interest once the Wall Street analysts initiate coverage in a few weeks. I picked up a long position with a 2% portfolio allocation.

Price target = $50 (minimum 2-3 years timeframe).

__________

This is a preclinical-stage biotech company that has not yet shown results in clinical studies and therefore is risky. There is no guarantee that the preclinical results will be replicated in human studies. The results in clinical studies may be underwhelming and side effects may be seen. FDA may put any ongoing studies on hold in case of any side effects. The company will also need to raise a significant amount of capital before it reaches the revenue stage, resulting in significant dilution for the stockholders. This is not a short-term trade opportunity and any investor should be willing to be patient and wait for a minimum of 2-3 years timeframe. This report is my own opinion and is not professional investment advice. Please do your own due diligence before making any investment decisions.

Be the first to comment