Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 21.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of November.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

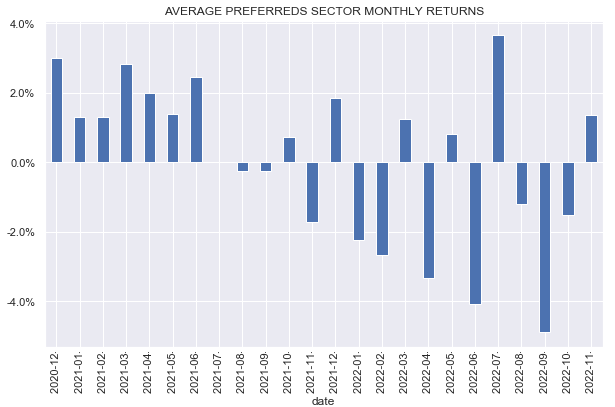

Preferreds were down slightly this week as medium-term Treasury yields rose. Over November, preferreds are still up around 1.5% in aggregate, nearly offsetting the drop over October. Mortgage REIT preferreds continue to outperform over the month.

Systematic Income

Market Themes

High yields and low dollar prices on preferred stocks are bringing issuers back to the market, except instead of issuing securities many are buying them back. Recently we witnessed two issuers: the mortgage REIT Two Harbors (TWO) and the household name Bank of America (BAC) coming to the market to buy their shares.

TWO repurchased 2.9m of its preferred shares or a chunky 10% of the outstanding. The idea behind the buyback was that the shares offered a very attractive risk/reward opportunity for the company – a ~10% risk-free yield on the preferreds versus 10-15% leveraged yields across other types of investments it normally allocates to.

BAC recently announced a tender offer for up to $1.5bn of a number of their preferreds across both institutional and exchange-traded shares. Most of the dollar prices of the exchange-traded shares are in the $17-20 range. Having issued these at $25, it can make a lot of sense to buy these back at a 25% discount. Many issuers do something similar with their debt when it starts trading at a significant discount. The one key difference is that companies whose debt trades significantly below par typically don’t have a lot of cash on hand to buy it back. BAC is clearly not struggling in this regard and so can easily afford a buyback at such attractive levels. It does also suggest that the company likely views lower rates as the more likely scenario, perhaps in the scenario that the economy enters a recession in the medium term.

Market Commentary

Mortgage REIT TWO reported results. Book value saw a drop of around 20% which is on the high side in the mREIT sector though not a million miles away from where NLY, DX and AGNC reported. TWO is one of a few mREITs that have an Agency / MSR portfolio – the ratio for TWO is around 80/20.

As mentioned above, what’s perhaps more interesting is that TWO repurchased around 10% of its preferreds and also issued a small number of additional common shares. The net result of these two actions was that equity / preferred coverage fell only modestly to 3.2x from 3.4x.

Every time coverage approached a level of around 3 the company either retired preferreds (Q4-20) or did a large common issuance (Q3/Q4-21). They are probably not looking at it from an equity/preferreds coverage perspective but rather from a yield on capital and cost of equity perspective as suggested above.

Another way to look at it is that TWO appear not to want preferreds to rise above a third of total equity. This makes sense since, at some point, preferreds would be siphoning off a big chunk of the company’s earnings, leaving less for common shareholders. TWO also cannot just cut preferreds dividends to reflect its lower earnings stream since these dividends are contractual. They can of course be suspended but that has an obvious impact of also suspending common dividends and would make TWO an uninvestable basket case for investors.

Stance and Takeaways

This week we made three preferreds rotations in our Income Portfolios.

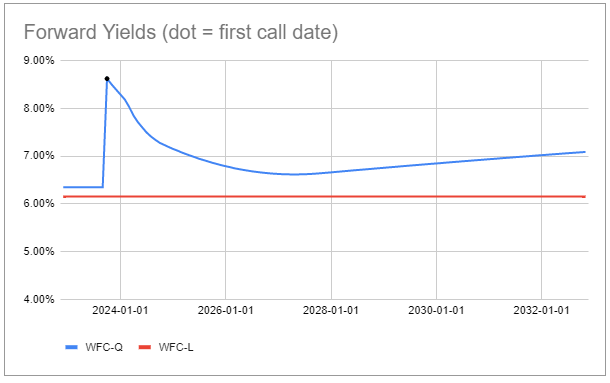

A rotation in the Defensive and Core Income from WFC.PL to WFC.PQ. Q is a Fix/Float preferred with a significantly higher forward yield than all other fixed-rate WFC preferreds. It also looks better than the other Fix/Float WFC preferred WFC.PR. It may underperform in case of a sharp drop in interest rates however, as far as yield is concerned, short-term rates would have to be cut in half from the expected peak before its yield moves below its fixed-rate counterparts. Q trades at a 6.35% yield and a 8.7% reset yield (i.e. the expected stripped yield on the first call date in Sep-23).

Systematic Income Preferreds Tool

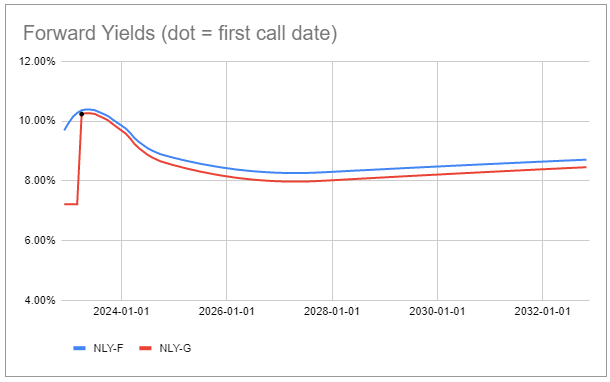

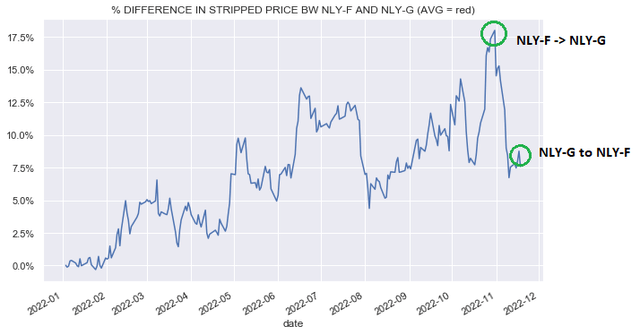

There was also a rotation back to NLY.PF from NLY.PG. G has outperformed F by around 7.5% since our original switch from F to G at the start of the month. At this point F trades at a consistently higher forward yield than G as the following chart shows. F has a huge yield pickup over G until Q2 next year when G floats and then a 0.2% yield pickup over G after G floats.

Systematic Income Preferreds Tool

As the following chart shows NLY.PG has outperformed NLY.PF by around 10% since the original rotation, pushing NLY.PF into a more attractive position.

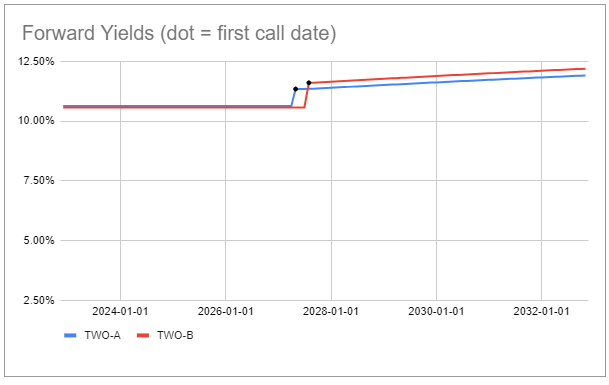

Finally, we rotated from TWO.PA to TWO.PB. TWO.PA has outperformed recently, pushing its yield to a level where TWO.PB looked much more attractive. The two stocks have a similar yield until the TWO.PA first call date at which point TWO.PA yield moves higher. However, only a few months after that the TWO.PB yield will shift to a higher level after its own first call date. As it happens, the TWO.PB yield-to-call is also higher.

Systematic Income Preferreds Tool

Be the first to comment