Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

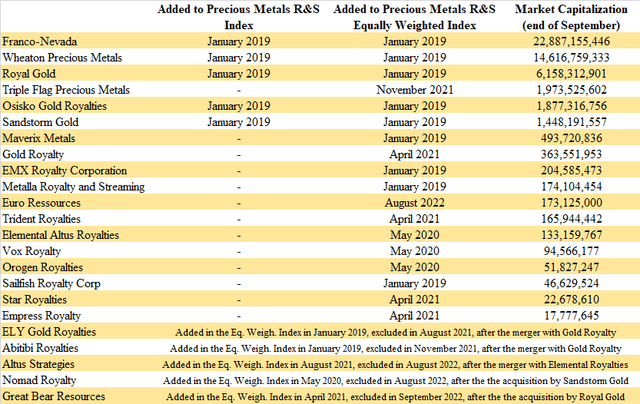

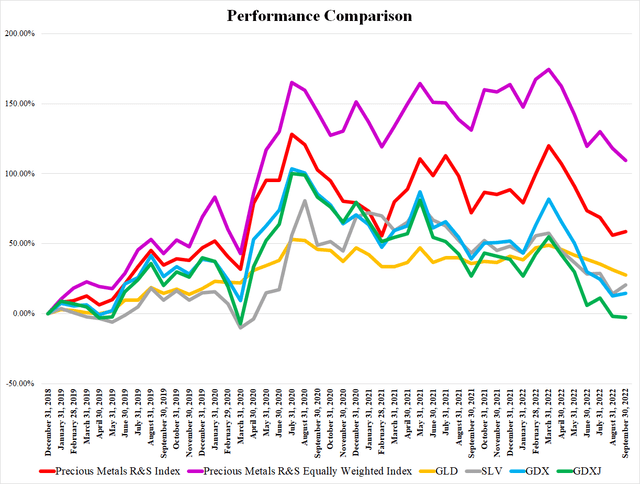

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022, July 2022 (extended), August 2022, August 2022 (extended), September 2022 (extended).

In September, Royal Gold completed the acquisition of Great Bear Royalties. As a result, the number of followed companies declined to 18. The biggest one is Franco-Nevada with a market capitalization of $22.89 billion, and the smallest one is Empress Royalty (OTCQB:EMPYF) with a market capitalization of $17.78 million. As of the end of September, Franco-Nevada’s market capitalization was 1,287 times bigger than Empress Royalty’s market capitalization.

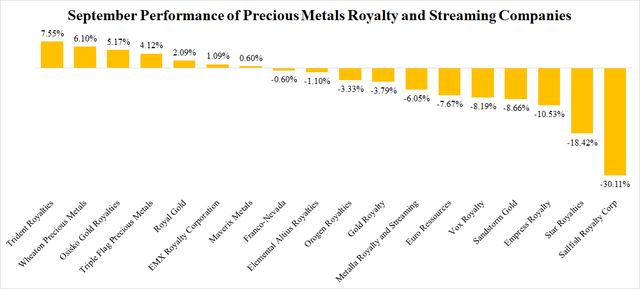

In September, 8 out of the 18 companies recorded some share price growth. The chart above would look much worse, hadn’t the markets bounced up over the last trading days of the month. The best performance was recorded by Trident Royalties (OTCPK:TDTRF) whose share price increased by 7.55%. The majority of gains were recorded following the announcement of positive interim financial results. On the other hand, the worst decline was recorded by Sailfish Royalty (OTCQX:SROYF). The majority of losses were recorded after the announcement of management changes and the appointment of a new CEO.

In September, gold didn’t do well. The share price of the SPDR Gold Trust ETF (GLD) declined by 2.89%. However, silver did much better and the share price of the iShares Silver Trust ETF (SLV) grew by 5.55%. The improved performance in late September saved the month for the miners. The VanEck Vectors Gold Miners ETF (GDX) grew by 1.34%, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined only by 0.51%. Also the R&S companies were able to erase the majority of losses at the very end of September. As a result, the Precious Metals R&S Index grew by 1.7%, and the Precious Metals R&S Equally Weighted Index declined by 3.99%. The equally-weighted index was dragged down mainly by the poor performance of Star Royalties and Sailfish Royalty.

The September News

There was not much news in September. The share prices were driven mainly by the general market sentiment. The announced deals were only small, except for Maverix Metals’ $50 million acquisition of a royalty portfolio from Barrick Gold (GOLD).

Royal Gold completed the acquisition of Great Bear Royalties.

Osisko Gold Royalties acquired a 1% NSR royalty on the Marimaca copper project for $15.5 million. According to the PEA, Marimaca should be able to produce around 80,000 lb copper per year; however, given the exploration results, the project will most probably grow bigger. My detailed article about this deal that looks really good for Osisko can be found here.

Sandstorm Gold Royalties announced an $80 million bought deal financing. The company will issue 15.7 million shares at a price of $5.1 per share. The proceeds should be used for further acquisitions and debt repayments. The timing of the financing was not good, as Sandstorm’s share price was at multi-year lows (and subsequently created new ones). Only two days later, the company declared a quarterly dividend of C$0.02 ($0.0146) per share. It will be paid on October 28, to shareholders of record as of October 18.

Maverix Metals (MMX) started the month of September by announcing an acquisition of a royalty portfolio from Barrick Gold. The portfolio includes 21 royalties, the most advanced of them is the 1% NSR royalty on Skeena Resources’ (OTCQX:SKREF) Eskay Creek project. Maverix agreed to pay $50 million plus contingent payments of up to $10 million for the portfolio. The completion of the acquisition was announced on September 29.

Gold Royalty (GROY) announced that it managed to extend the maturity of its existing $25 million secured revolving credit facility with the Bank of Montreal by 2 years, until March 31, 2025.

The company also completed the $27.5 million acquisition of the royalty portfolio from Nevada Gold Mines, announced back on September 1.

EMX Royalty (EMX) announced the acquisition of a royalty portfolio on Nevada Exploration’s (OTCQB:NVDEF) Nevada gold projects. The 2% NSR royalty applies to projects covering approximately 62.5 square miles. EMX will pay $500,000 for the royalties.

The company also announced that it received the first payments from its 10% NSR royalty on the Gediktepe mine oxide production. For the months of June and July, EMX received $1,842,452 in total. The amount includes $281,052 in Value Added Tax for which EMX has credits to recover.

Only a week after the first payment from the Gediktepe royalty, EMX Royalty announced the receipt of the initial payment from the Balya North 4% NSR royalty. For H1 2022, EMX received $98,787, inclusive of $15,069 in Value Added Tax. However, the mine was only ramping up. The payments should improve soon.

Trident Royalties reported that the operator of the Lincoln Gold Project will focus on resource expansion and Stage 2 development. Stage 1 production will be suspended. In an exchange for the deferred royalties from the Stage 1 production, Trident will be receiving a fixed sum of $173,500 per quarter, until $3 million is delivered. After $3 million is delivered, the regular payments will be stopped and the 1.5% NSR royalty will be reduced to 0.75%.

The company also reported its interim financial results. During H1 2022, Trident recorded royalty and offtake receipts amounting to $7.84 million, net revenues equaled $3.13 million, and operating cash flow equaled $762,000, Trident ended H1 with cash of 20.15 million.

On September 21, Trident announced that Ramelius Resources (OTCPK:RMLRF) successfully continues its drill campaign at the Rebecca Gold Project. The recent drill results include 59.3 g/t gold over 10 meters, 9.76 g/t gold over 13 meters, or 1.53 g/t gold over 20 meters. The August resource estimate outlined resources of 1.2 million toz gold. The aim of the current drill campaign is to convert the resources into reserves, Trident holds a 1.5% NSR royalty on Rebecca.

Elemental Royalties (OTCQX:ELEMF) announced the name change to Elemental Altus Royalties.

Vox Royalty (OTCQX:VOXCF) declared its historically first dividend. On November 4, shareholders of record as of October 21, will receive $0.01 per share. After annualizing, it means a dividend yield of 1.73%.

Sailfish Royalty declared a Q3 dividend of $0.0125 per share. It will be paid on October 14, to shareholders of record as of September 30. Moreover, Sailfish appointed Paolo Lostritto as its new CEO and Director. He will replace Cesar Gonzalez who will focus on his duties at Bonterra Resources.

Orogen Royalties (OTCQX:OGNRF) and Altius Minerals (OTCPK:ATUSF) formed a Nevada Generative Alliance focused on generating gold and silver targets considered geologically similar to the recent major gold deposit discovery at Silicon in the Walker Lane trend in Nevada. Altius will contribute $300,000 and Orogen its technical databases and expertise. Further costs and proceeds will be split evenly between both partners.

On September 20, Orogen optioned the Astro Gold Project to Rackla Metals (OTCPK:RMETF). Rackla will give Orogen 120,000 shares, and it will have 12 months to expend $250,000 on exploration and pay a further payment of $382,000 (a combination of cash and shares). Orogen will retain a 2.5% NSR royalty.

On September 26, Orogen sold the Kalium Canyon gold project to Green Light Metals for $30,000, 1 million shares valued at $400,000, a 3% NSR royalty, and a $5 million payment if the property gets into production.

Empress Royalty announced a $1.5 million private placement consisting of 6.5 million common shares and 6.5 million warrants with a strike price of C$0.6 and 5-year maturity. The placement was later upsized to C$2.6 million ($2 million). The first tranche of the private placement, when 4.35 million units were sold to Rick Rule, was completed on September 29.

The October Outlook

The month of October started relatively positively; however, the optimism may be premature. The problems weighing on the global financial markets are still intact, and further sell-offs cannot be excluded. The broader market sentiment should be the main driving force also in October.

Be the first to comment