RHJ/iStock via Getty Images Source: Own Processing

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

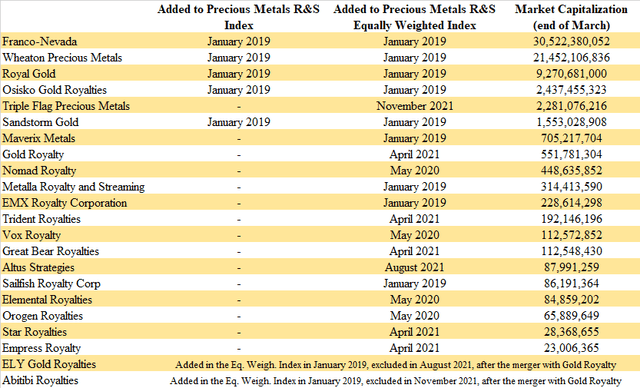

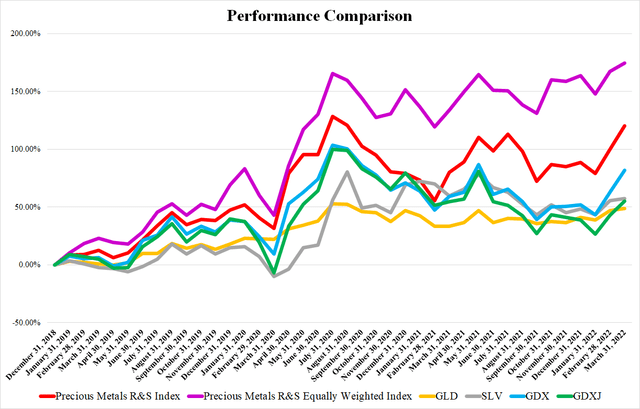

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021, October 2021, November 2021, December 2021, January 2022 (extended edition), February 2022.

As of March 31, the total market capitalization of the 20 precious metals royalty & streaming companies amounted to $65.2 billion. The big three (Franco-Nevada, Wheaton Precious Metals, Royal Gold) accounted for 94% of this amount. The biggest company, Franco-Nevada, had a market capitalization of more than $30.5 billion. On the other hand, the smallest one, Empress Royalty (OTCQB:EMPYF), had a market capitalization of only $23 million.

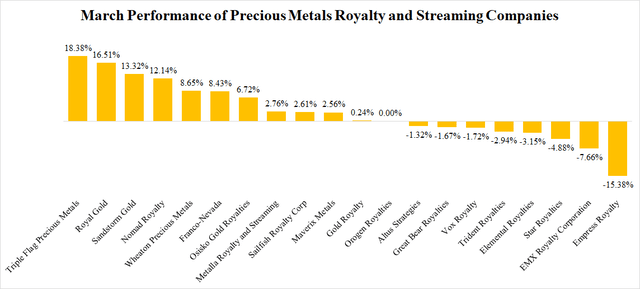

The March performance of the precious metals royalty & streaming industry was pretty mixed. Out of the 20 companies, 10 recorded positive returns, 8 recorded negative returns, and 2 remained flat or nearly flat. The highest gains were recorded by Triple Flag Precious Metals (OTCPK:TRFPF). Its share price grew by more than 18%. The growth lasted for the whole month without any major company-related news. Triple Flag’s 2022 guidance was released in the middle of the month when the bull trend was long underway. Also Royal Gold recorded nice gains of approximately 16.5% and without any major news. But for several months, both companies belonged to the most attractively valued out of the whole industry. The recent performances could be just a sign of the market finally realizing the value. The worst performance was recorded by Empress Royalty. The decline began in early March, and once again, without any major company-related news.

In March, the precious metals prices recorded mild growth. The gold price represented by the SPDR Gold Trust ETF (GLD) grew by 1.27%, and the share price of the iShares Silver Trust ETF (SLV) grew by 1.15%. On the other hand, the precious metals mining industry showed much better returns which is documented also by the 11.55% growth of the VanEck Vectors Gold Miners ETF (GDX), and by the 8.67% growth of the VanEck Vectors Junior Gold Miners ETF (GDXJ). The Precious Metals R&S Index showed similar returns, as it grew by 10.13%. It was supported especially by good performances of Royal Gold and Sandstorm Gold. On the other hand, the Precious Metals R&S Equally Weighted Index grew only by 2.68%, negatively impacted by the poor performances of the smaller companies.

The March News

The news flow was poor in March. The news was usually related to financial results and to several smaller deals.

Franco-Nevada reported Q4 sales of 182,543 toz of gold equivalent (including energy), which is 12% more than in Q4 2020. The revenues grew by 8% to $327.7 million, and net income by 25% to $220.9 million ($163.7 million adjusted). The operating cash flow grew by 13% to $279 million. The company ended Q4 debt-free, with cash of $539.3 million. The overall 2021 sales amounted to 728,237 toz of gold equivalent (including energy) which is 27% above the 2020 levels. The operating cash flow grew by 19% to $955.4 million and net income even by 125% to $733.7 million. In 2022, Franco-Nevada expects attributable production of 680,000-740,000 toz of gold equivalent which should be in line with 2021. Approximately 75% of this volume should be attributable to precious metals. The attributable production should increase to 765,000-825,000 toz of gold equivalent by 2026. This is not so bad given the fact that Franco-Nevada has been very passive lately, without adding any assets to its portfolio.

Wheaton Precious Metals recorded attributable production of 88,321 toz gold, 6.356 million toz silver, 4,733 toz palladium, and 381,000 lb cobalt in Q4. The revenues amounted to $278.197 million and operating cash flow to $195.29 million, which is slightly worse compared to Q4 2020. The net income grew by more than 85%, to $291.8 million, however, the adjusted net income declined by 11.5%, to $132.2 million. The net income was inflated by a $157 million impairment reversal related to the Voisey’s Bay cobalt stream. Despite not so impressive Q4, the overall 2021 results were good, as the revenues grew by 9.6%, operating cash flow by 10.4%, and net income by 48.7% compared to 2020. Wheaton ended the year 2021 with cash of $226 million and an undrawn revolving term loan of $2 billion at its disposal. Although Wheaton was very active over the recent months, adding several new assets, it has still a lot of gunpowder left. In 2022, the company expects attributable production of 350,000-380,000 toz gold, 23-25 million toz silver, and 44,000-48,000 toz of gold equivalent of other metals. It means 700,000-760,000 toz of gd equivalent in total. Also the recent acquisitions should help to grow the attributable production volumes to an average of 850,000 toz of gold equivalent over the next 5 years.

Wheaton also declared a quarterly dividend of $0.15 per share payable on April 7 to shareholders of record as of March 24. Right now, the dividend yield stands at 1.22%. The annual and special meeting of shareholders will take place on May 13.

Royal Gold declared a Q2 dividend of $0.35. It will be paid on April 14, to shareholders of record as of April 1.

Triple Flag Precious Metals released its 2022 guidance. The company expects gold equivalent sales of 90,000-95,000 toz. It means a 7.7%-13.6% growth when compared to 83,602 toz sold in 2021. The sales should consist of 50%-55% gold, 40%-45% silver, and 5%-10% should be attributable to other sources.

Osisko Gold Royalties announced the acquisition of a 100% silver stream from the CSA mine that is being acquired by Metals Acquisition Corp. (MTAL). Osisko will pay $90 million to acquire the stream, and the ongoing payments will equal 4% of the spot silver price. Over the last 3 years, the average silver production amounted to 431,000 toz per year. Metals Acquisition Corp. believes that the remaining mine life will be more than 15 years. Osisko will also purchase shares of Metals Acquisition Corp. worth $15 million and it will provide the company an option to draw further $100 million in upfront proceeds through the sale of a copper stream from the CSA mine. An article focused on this deal can be found here.

Following the announcement of the CSA silver stream acquisition, Osisko Gold Royalties announced a $250.17 million bought deal financing. The company will issue 18.6 million new shares at a price of $13.45. The financing was closed on March 31.

Sandstorm Gold (SAND) provided an update on several of its assets. Probably the most important one is Lundin Mining’s (OTCPK:LUNMF) new copper-gold discovery on the Chapada property (Sandstorm holds a 4.2% copper stream), the Lobo Marte project feasibility study (Sandstorm holds a 1.05% NSR royalty), and 95 meters grading 1.4 g/t gold drilled by Tower Resources (OTCPK:TWRFF) at the Rabbit North project (Sandstorm holds a 2% NSR royalty).

The company also declared the Q2 dividend of C$0.02 per share. It will be paid on April 29, to shareholders of record as of April 19.

Maverix Metals (MMX) released the Q4 financial results. The gold equivalent sales amounted to 9,173 toz, which compares favorably to 8,836 toz in Q4 2020. The revenues amounted to $16.5 million, which is in line with Q4 2020. Although the operating cash flow improved by 50%, to $11.6 million, the net income declined from $5.35 million to $2.77 million. The total 2021 sales grew by 10.6%, to 32,026 toz of gold equivalent. The 2021 revenues grew by 11.3% to $57.3 million and operating cash flow by 30.3% to $43.2 million. The net income remained in line with 2020. In 2022, Maverix expects attributable production of 32,000-35,000 toz of gold equivalent.

The 2022 production guidance of the company projects 32,000-35,000 toz of gold equivalent. Moreover, Maverix Metals announced the acquisition of three Nevada royalties for $5 million. The three projects are located in Nevada. Dixie Creek (4% NSR royalty) and Railroad (4% NSR royalty) cover part of the South Railroad project and nearby areas. Lewis (3.5-4% NSR royalty) is situated near Nevada Gold Mines’ Phoenix gold mine.

Gold Royalty (GROY) announced that it will provide an additional C$4.5 million in financing to Monarch Mining (OTCQX:GBARF). As a result, the per tonne royalty on material from the Beaufor mine will be increased from C$2.5/t to C$3.75/t, and the McKenzie Break, Croinor Gold, and Swanson NSR royalties will grow from 2.5% to 2.75%. Moreover, the buyback rights related to these assets will be terminated. The company also completed the formerly announced acquisition of the Cote gold royalty.

The company also announced that it negotiated an increase to its credit facility from $10 million to $40 million, with an intention to repay Elemental’s expensive debt. This indicates that Gold Royalty’s management believes that the deal will be accepted by the majority of Elemental’s shareholders.

Probably to support the declining share price, Gold Royalty reminded its shareholders that it is about to pay an inaugural dividend of $0.01 per share.

Metalla Royalty & Streaming (MTA) reported that it recorded revenues of $3 million in 2021. The company generated a net loss of $10.4 million. It held cash of $2.3 million as of the end of December.

Trident Royalties (OTCPK:TDTRF) announced the acquisition of a gold offtake agreement over Silver Lake Resources’ (OTCPK:SVLKF) Sugar Zone Mine. Trident pays Orion Resource Partners $3.75 million for this offtake agreement that covers 50% of the Sugar Zone Mine gold production up to 375,000 toz delivered (335,000 toz are remaining). Last year, the mine produced 51.453 toz gold, however, starting in 2023, the production should increase to approximately 100,000 toz per year. Trident didn’t release any more specific details, but the offtake agreement portfolio acquired in December historically provided an equivalent of a 1.33% NSR royalty equivalent return. Should the returns from this agreement be similar, it would mean around $600,000 for Trident this year and $1.2 million after the mine expansion. The remaining 335,000 toz gold under this agreement should be exhausted in 6-7 years.

What’s important is two assets started production in March. On March 7, Trident Royalties announced the commencement of production at the Lincoln Gold Mine. It should be producing 20,000 toz gold per year on average, however, an operation with a capacity of 80,000 toz gold per year has been already permitted. Trident holds a 1.5% NSR royalty that should generate around 300 toz gold per year (1,200 toz, after the mine is expanded). And on March 22, Trident Royalties announced that i-80 Gold Corp (OTCPK:IAUCF) produced the first gold at its Ruby Hill mine which means also first deliveries under the offtake agreement held by Trident.

Vox Royalty (OTCQX:VOXCF) released a portfolio update. The most important news is the South Railroad feasibility study. Gold Standard Ventures (GSV) plans to produce approximately 100,000 toz gold per year on average, over 10.5-year mine life. Over the first four years, production should amount to approximately 152,000 toz per year. Vox holds a 0.633% NSR royalty on South Railroad. The mine should get into production in 2024. Besides the positive South Railroad FS, some positive drill results came from the Sulphur Springs, Bulgera, and Kookynie projects.

In Q4, Vox recorded revenues of $574,200. The overall 2021 revenues amounted to $3.652 million. Vox also submitted an application for a NASDAQ listing.

Altus Strategies (OTCQX:ALTUF) announced the sale of its Toura nickel-cobalt license application to Firering Strategic Minerals for €15,000 and a 1% Gross Revenue Royalty on nickel and cobalt.

The company also reported positive drill results from its 100%-owned Diba & Lakanfla gold project. The results include 4.37 g/t gold over 6 meters (starting at a depth of 32 meters), or 0.9 g/t gold over 66 meters (starting at a depth of 41 meters).

Sailfish Royalty (OTCQX:SROYF) declared a quarterly dividend of $0.0125 per share. It will be payable on April 15, to shareholders of record as of March 31. At the current share price, the dividend yield equals 4.35%. Sailfish also announced that it has purchased 1,948,700 shares under its normal course issuer bid since July 13.

Another positive news is that Mako Mining (OTCQX:MAKOF) prepares a $17.2 million drill campaign at its San Albino and Las Conchitas properties. It will include more than 110,000 meters of drilling. This drill campaign is important for Sailfish as the company owns a gold stream on Makoko equivalent to a 3% NSR royalty, as well as a 2% NSR royalty on Las Conchitas.

Elemental Royalties (OTCQX:ELEMF) paid $11 million for a 50% gold stream on the Ming copper-gold mine. After 10,000 toz gold is delivered, the stream will be reduced to 35%. After another 5,000 toz gold is delivered, it will be reduced to 25% for the rest of the mine life. The ongoing payments equal 20% of the prevailing gold price. Elemental financed the deal by issuing 9.275 million new shares at a price of C$1.51 per share. The 2022 guidance was updated to 5,700-6,700 toz of gold equivalent. In 2023, the attributable production should amount to approximately 8,100 toz of gold equivalent.

Star Royalties (OTCQX:STRFF) announced that Agnico Eagle Mines (AEM) will make a C$14.13 million ($11.4 million) equity investment in Green Star Royalties. Agnico will acquire 14,134,620 shares at a price of C$1 per share. Green Star’s management will acquire 1,250,000 shares at the same price. After the transaction is closed, Green Star will have 40.4 million shares outstanding and it will be 61.9%-owned by Star Royalties, 35%-owned by Agnico Eagle Mines, and 3.1%-owned by the management.

The April Outlook

As the earnings season is over (except for several smaller companies), the broader stock market performance and the gold and silver price development should be the main driving forces in April.

Be the first to comment