AerialPerspective Works

A Quick Take On Powerbridge Technologies

Powerbridge Technologies (NASDAQ:PBTS) reported its 2H 2021 financial results on May 12, 2022.

The company provides a range of software for trading, Internet of Things, smart city and cryptocurrency mining and digital asset applications.

PBTS has previously reached earnings breakeven and we await financial results for the first half of 2022. Until then, I’m on Hold for PBTS.

Powerbridge Technologies Overview

Guangdong, China-based PBTS was founded in 1997 to make global trade easier and more cost-effective by providing more collaborative and efficient trade processes to customers in China.

Management is headed by Chairman, CEO and President Stewart Lor, who is likely related to previous CEO Bon Lor.

Powerbridge Technologies has developed Powerbridge System Solutions [PSS] and Powerbridge SaaS Services [PSSS], which represent “more than 15 solutions and services deployable on-premise and in the cloud.”

The company’s Trade Enterprise Solutions enable import and export businesses and manufacturers to “manage business operations, simplify trade processes, reduce document handling, minimize operational cost and increase overall efficiency and productivity.”

PBTS’s Trade Compliance Solutions empower government agencies and regulatory authorities with greater “control and security, better use of resources, higher duty collection, less processing time and higher compliance efficiency in servicing global trade businesses and logistics service providers.”

The company’s Import & Export Loan and Insurance Processing facilitates global trade-related loan and insurance processes, allowing businesses, financial and insurance service providers involved in global trade to “reduce workflow complexity, processing time and operational cost while increas[ing] processing efficiency.”

Powerbridge’s Market & Competition

Among the company’s corporate customers are manufacturers engaged in international trade, import and export companies as well as logistics and other service providers.

PBTS’s government customers include “customs and other government agencies that oversee goods transport through the border, as well as government organizations that manage and operate free trade and bonded trade zones, ports and terminals, as well as other international trade facilities.”

The firm obtains new clients from its in-house sales and marketing teams. PBTS has experienced a major drop in government customers, resulting in a sharp drop in top-line revenues.

Management intends to refocus its efforts away from the government sector toward the enterprise market, SaaS market, and blockchain development.

According to a 2018 market research report by Grand View Research, the global trade management software market is projected to reach $1.43 billion by 2025, growing at a CAGR of 8.9% between 2018 and 2025.

The main factors driving market growth are growing complexities of international trade and commerce and changes in international trade regulations.

The Asia-Pacific region is projected to grow with the fastest CAGR, at 11.6% during the forecast period.

Powerbridge’s Recent Financial Performance

-

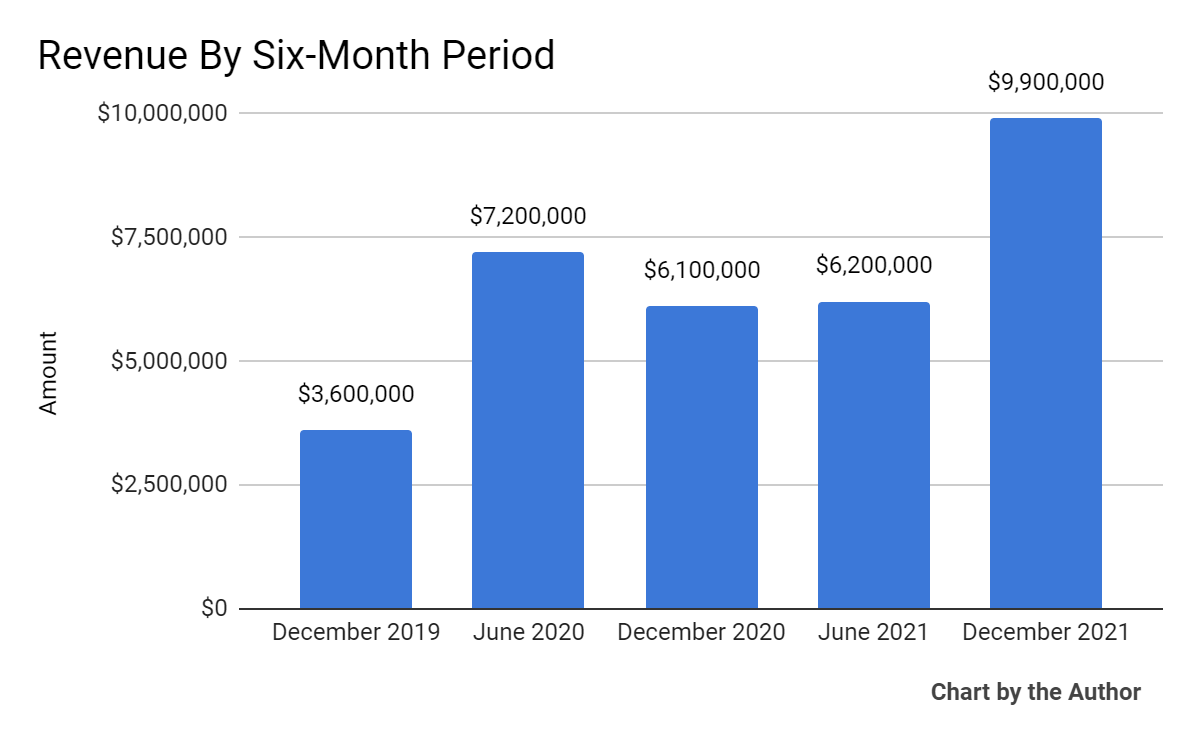

Total revenue by six-month period has been uneven but has trended higher, as the chart shows here:

5 Quarter Total Revenue (Seeking Alpha)

-

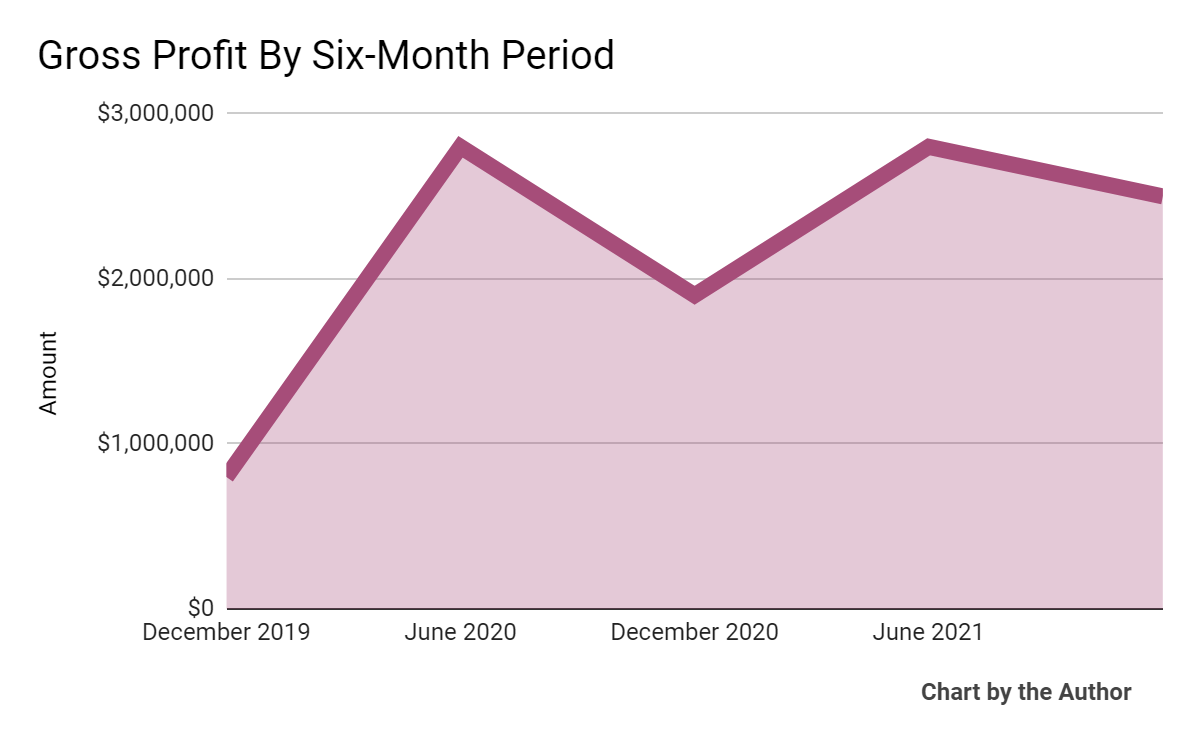

Gross profit by six-month period has been variable as well:

5 Quarter Gross Profit (Seeking Alpha)

-

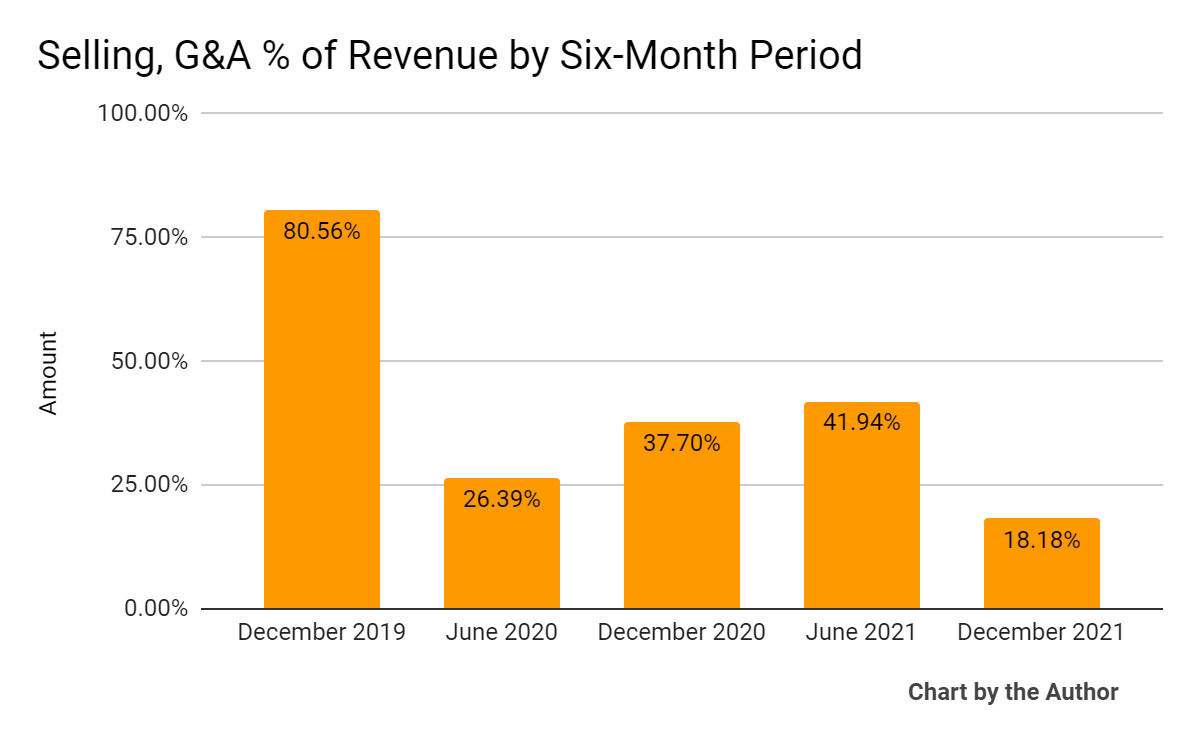

Selling, G&A expenses as a percentage of total revenue by six-month period have trended lower as revenue has increased, a positive signal:

5 Quarter Selling, G&A Of Revenue (Seeking Alpha)

-

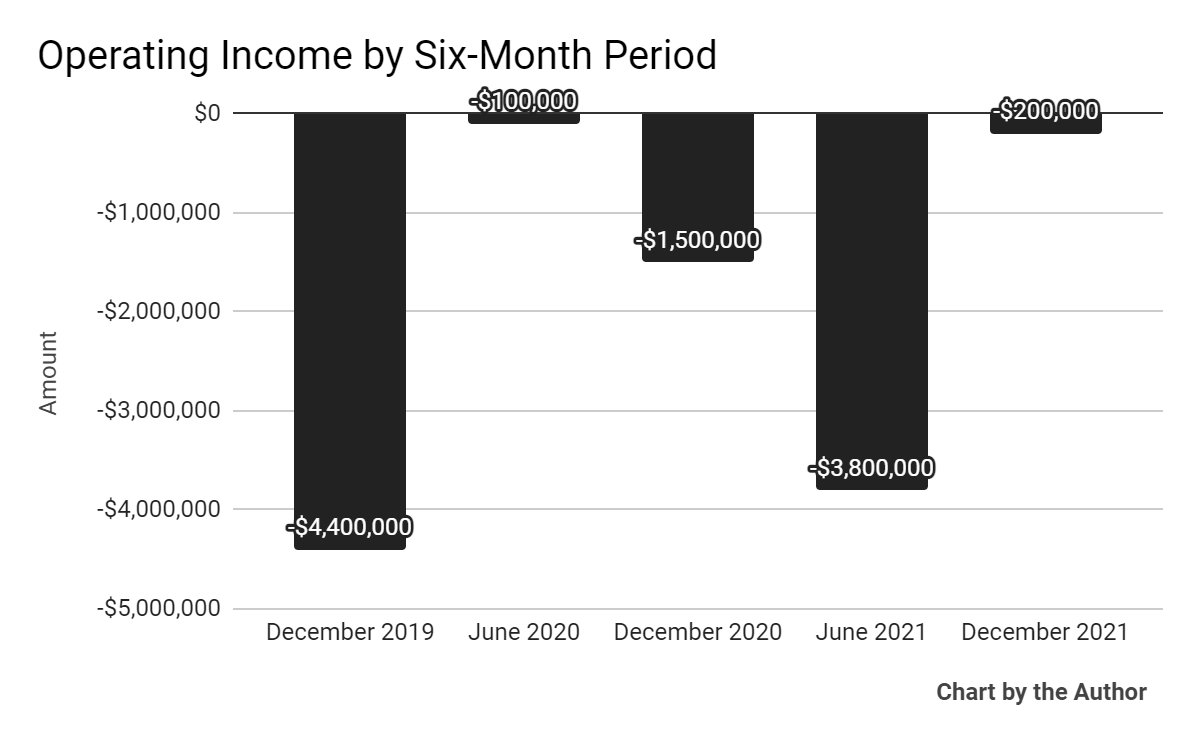

Operating income by six-month period has remained negative and highly variable in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

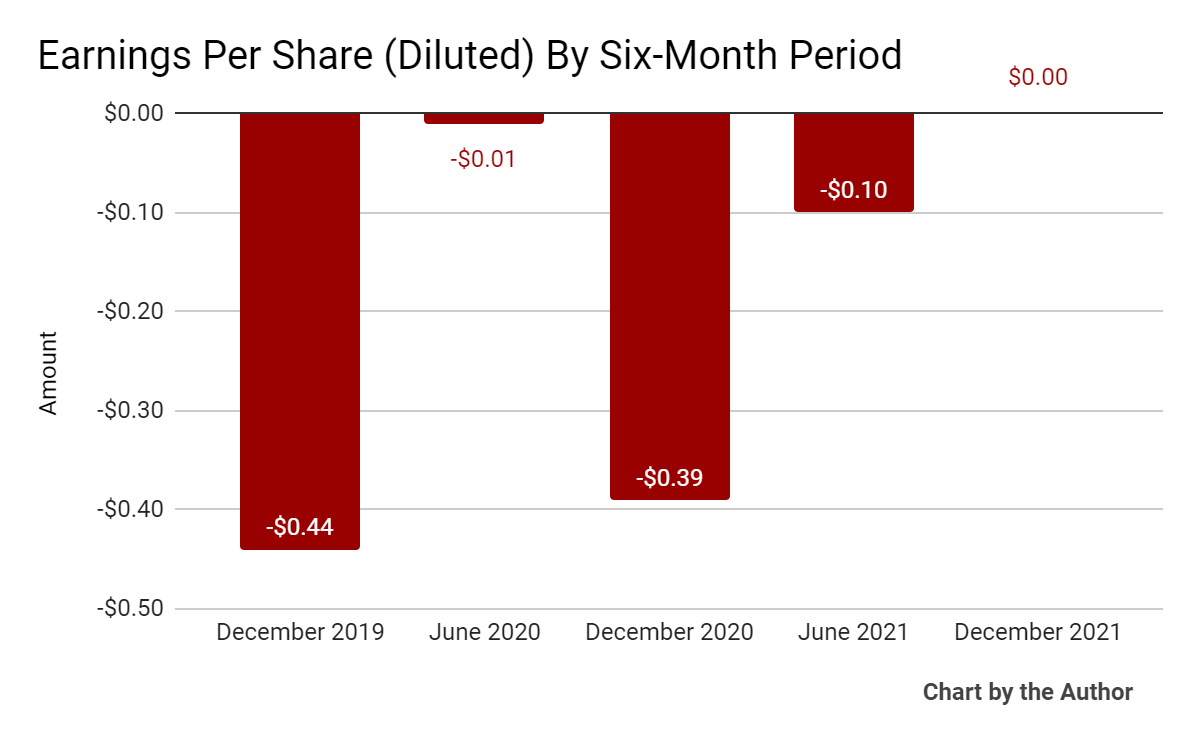

Earnings per share (Diluted) have reached breakeven in the most recent six-month reporting period:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

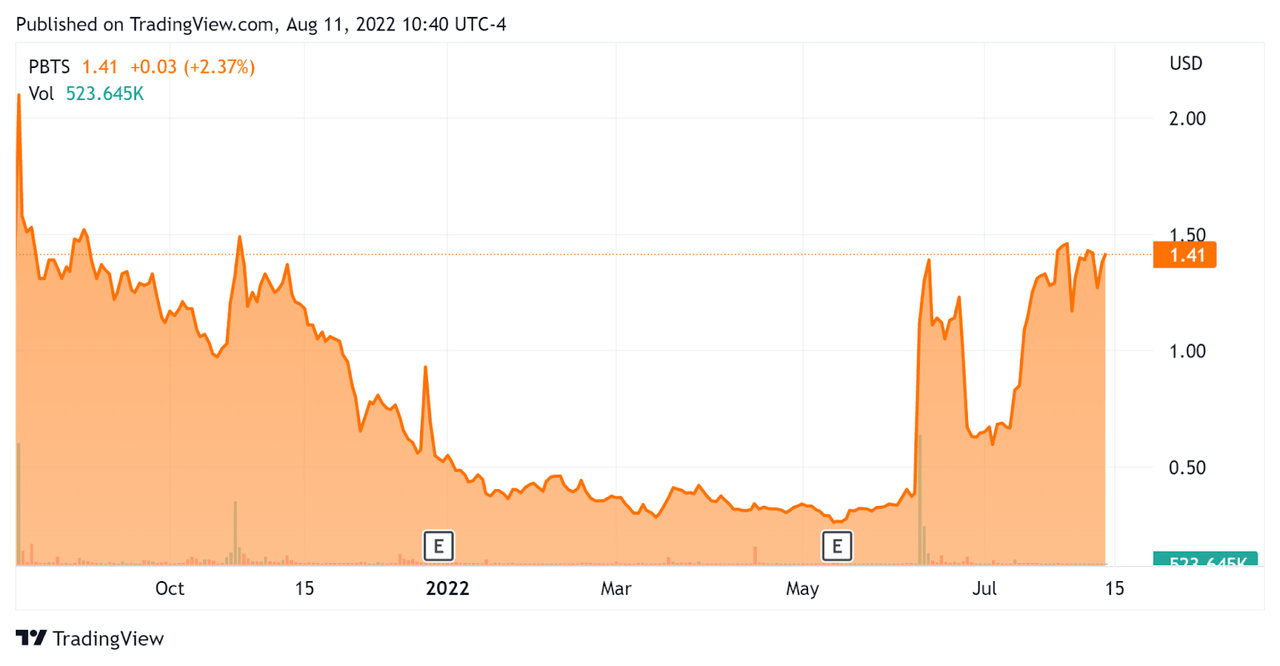

In the past 12 months, PBTS’s stock price has risen 11.8% vs. the U.S. S&P 500 index’ drop of around 4.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Powerbridge

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$108,870,000 |

|

Market Capitalization |

$108,980,000 |

|

Enterprise Value / Sales |

3.39 |

|

Revenue Growth Rate |

20.4% |

|

Operating Cash Flow |

-$9,760,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.50 |

|

Net Income Margin |

-29.1% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PBTS’ most recent GAAP Rule of 40 calculation was negative (4%) as of the end of 2021, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

20% |

|

GAAP EBITDA % |

-24% |

|

Total |

-4% |

(Source – Seeking Alpha)

Commentary On Powerbridge

In its last report (Source – Seeking Alpha), covering the second half of 2021’s results, the firm produced growing revenue, reduced gross profit, lowered Selling, G&A as a percentage of total revenue and reached earnings breakeven.

Since then, the firm’s co-founder and co-CEO Bon Lor has resigned, although not because of any dispute with the company, according to an SEC filing.

The company has been making a number of minority stake acquisitions in various technology companies using its stock.

These deals are presumably to advance or expand its operations, although management has not provided any information to shareholders about the firm’s plans for these business relationships.

PBTS was previously notified by the Nasdaq of being non-compliant with its minimum bid price rule.

On August 1, 2022, the company announced that it had regained compliance with the requirement. Interestingly, only a few days prior, co-CEO Bon Lor had resigned per the firm’s SEC filing.

For the balance sheet, the firm finished calendar year 2021 with $7.0 million in cash and equivalents and $31.9 million in total liabilities, all of which were current liabilities with no long-term debt.

For the full calendar year of 2021, the firm used $14.7 million in free cash flow, so may be in some difficulty with respect to its cash burn and potential runway.

Looking ahead, I’m expecting financial reporting for the first half of 2022 any day now, though we shouldn’t expect to hear any commentary or guidance from management.

Like other firms with Chinese operations, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on companies across a wide range of industries combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese stock performance on U.S. exchanges.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

While the firm has reached earnings breakeven, with management communication, it is difficult to get too excited about the company.

Until we learn 1H 2022’s results from management, investors will be in the dark as we await the latest update.

Be the first to comment