Croc80/iStock via Getty Images

Investment thesis

Powell Industries (NASDAQ:POWL) is facing some headwinds coming from the current complex macroeconomic landscape, all of which are having a direct impact on profit margins. Inflationary pressures, labor shortages, and supply chain issues are reducing the company’s ability to convert sales into cash from operations.

Still, the company’s cash reserves are enormous and the balance sheet is debt-free, which suggests it is prepared to overcome the obstacles that the global economy is putting in its way. Revenues are expected to rise in fiscal 2022 and 2023, but the rising risks of a potential recession that could derail the recovery keep investors pessimistic. We must not forget that the company manufactures products for companies that operate in industries with a high degree of cyclicality. For this reason, and despite the fact that I believe that the share price is currently offering us a good buying opportunity, I also believe that it is highly advisable to save an extra bullet in case recessionary fears come true.

A brief overview of the company

Powell Industries is a manufacturer of custom-engineered equipment and systems for the distribution, control, and monitoring of electrical energy, including integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, and bus duct systems, as well as traditional and arc-resistant distribution switchgears and control gears. Its products are mainly (but not only) used in the oil and gas, petrochemical, electric utility, and traction power markets.

The company was founded in 1947 and its market cap currently stands at ~$310 million, employing around 1,900 workers in the United States, Canada, and the United Kingdom. Insiders own 23.40% of the shares outstanding, which means they are the main beneficiaries of the good performance of the stock price.

Powell Industries (Powellind.com)

The nature of the industries for which the company operates makes Powell Industries a company with a high degree of cyclicality, and there are two ways to benefit as a shareholder: through capital gains by taking advantage of economic downturns by buying shares at low prices and selling when headwinds disappear, or by taking advantage of market downturns to acquire shares at low prices and enjoy a high dividend yield on cost in the long term. In this article, I will explain why it is worth holding shares of Powell Industries in the long term with the current high dividend yield on cost, but it is also valid for those investors interested in selling the shares once the current headwinds fade away, at least partially.

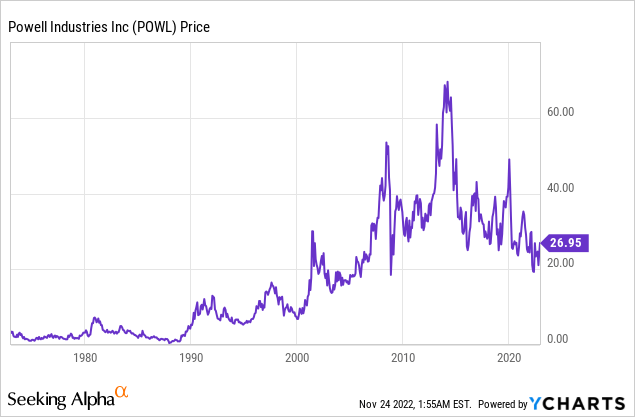

Currently, shares are trading at $26.95, which represents a 61.91% decline from all-time highs of $70.75 on March 4, 2014. Since then, both revenues and profit margins have been deteriorating until 2019 when they began to show significant improvements. Now, the coronavirus pandemic crisis has once again caused a blow to operations.

Revenues are returning to the path of growth

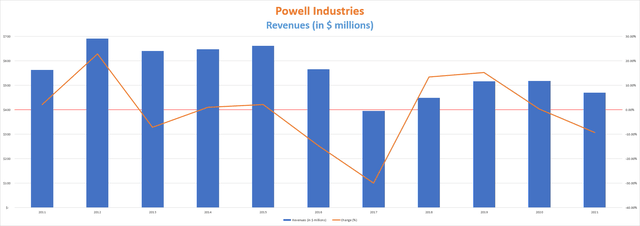

Certainly, the past decade has not been positive in terms of revenues. After a few years of declines and a slight improvement in 2018, 2019, and 2020, sales fell again by 9.25% in 2021.

Powell Industries revenues (10-K filings)

Even so, it seems that the positive trend is returning to take its course in recent quarters. In this sense, net sales increased by 16.98% year over year during the third quarter of 2022 to $135 million, and by 6% sequentially. Both domestic and international revenues increased by 16% and 19% year over year, respectively. This pushes the current trailing twelve months’ revenues to $499.4 million, or 6.12% higher compared to fiscal 2021. During the quarter, the company received $202 million in new orders, with which it currently accumulates a backlog of $503 million, which is 14% higher than in the prior quarter and 21% higher year to date. This is a sign that the positive trend should continue in the coming quarters. Using 2021 as a reference, 75% of the company’s revenues are generated within the United States, whereas 15% are generated in Canada, 8% in EMEA, 2% in the Asia/Pacific region, and 0.5% in Mexico, Central, and South America.

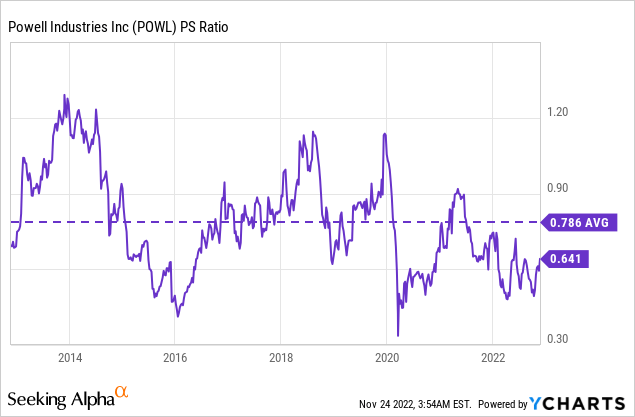

The recent price decline, which has been more pronounced than the drop in revenues as a result of deteriorated margins, has left a price-to-sales ratio of 0.641, which is 18.45% below the average of the past decade.

This means that the company generates revenues of $1.56 for each dollar held in shares by investors, each year. But this does not end here. The important fact is that the PS ratio is below the average despite revenue estimates of $510.90 million for fiscal 2022, which is 2.3% higher than the current trailing twelve months, and $555.37 million for fiscal 2023, which is 11.2% higher.

The problem is that despite the apparent current and expected improvement in the company’s sales, its current issues revolve around significantly deteriorating profit margins, and this is the main reason why the share price has suffered such a steep decline. After all, investors are not as willing to pay for the company’s sales as before because it is not able to convert them into cash in the same way that it did before the current headwinds.

Margins are declining due to current headwinds

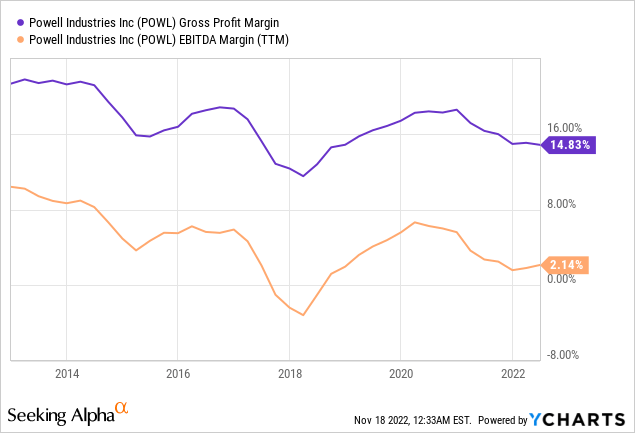

The company’s operations are currently impacted by inflationary pressures, labor shortages, and supply chain issues. This is causing increasing prices of raw materials and components, higher logistics costs, and higher labor and overhead costs, which are ultimately hurting profit margins. Currently, the trailing twelve months’ gross profit margin of 14.83% is significantly lower than the over 17% the company enjoyed prior to current headwinds, but the EBITDA margin took the worst hit, falling to 2.14% from over 6%.

The management is currently performing pricing and productivity initiatives in order to offset higher production costs, but so far these initiatives have only partially mitigated the damage caused by the current macroeconomic landscape. The gross profit margin slightly declined to 14.07% during the third quarter of 2022, but the EBITDA margin increased to 2.38% as SG&A costs declined by 2% year over year, boosted by higher revenues and management cost management initiatives.

During 2021, the price of copper, iron ore, and aluminum rose to abnormally high levels, but it seems that they are finally beginning to show signs of stability as copper prices have declined by ~13% since the beginning of fiscal 2022 while iron ore prices fell by ~33% and aluminum prices by ~19%. The company makes extensive use of these materials, so the recent drop in their prices should cushion some of the recent deterioration in profit margins.

In the following chart, we can see the recent drop in the price of copper.

Copper commodity price (Tradingeconomics.com/commodity/copper)

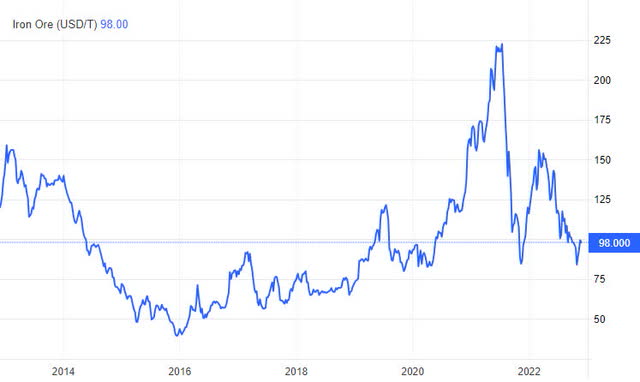

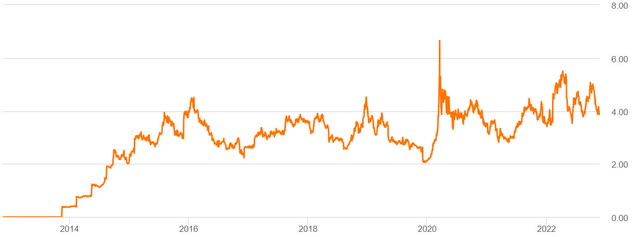

And in the graph below, we can see that the drop in the price of Iron Ore has been much steeper since it has fallen by more than half from the highest peak experienced in July 2021.

Iron Ore commodity price (Tradingeconomics.com/commodity/iron-ore)

And finally, below is the chart where you can see the recent drop in the price of aluminum.

Aluminum commodity price (Tradingeconomics.com/commodity/aluminum)

It should be said that the prices of copper and aluminum continue to be at very high levels compared to the past decade, not so much for aluminum, although it is still high anyway.

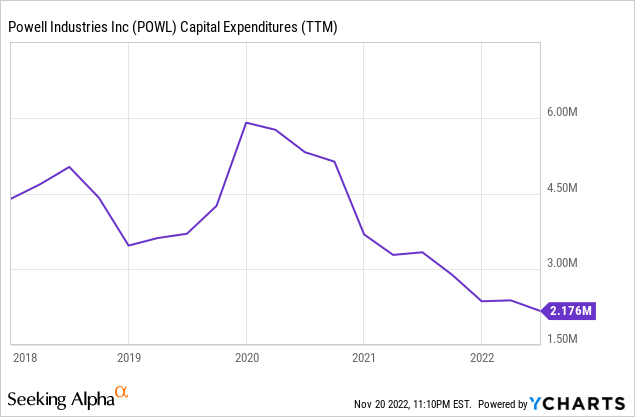

Trailing twelve months’ capital expenditures are significantly lower compared to the beginning of the fiscal year as they declined to $2.18 million during the last quarter vs. over $3 million at the end of 2021.

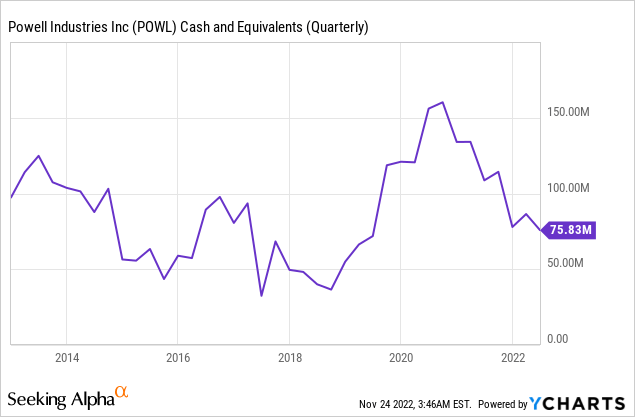

This is helping the company to survive the current headwinds with enough resilience while maintaining a very healthy balance sheet. In this sense, the company enjoys a debt-free balance sheet, which places it in a very advantageous position as it does not have to face any interest payments at the end of each period. Furthermore, the company has enough cash and equivalents to survive for many years in today’s complex global environment.

In this sense, the current cash and equivalents of $75.83 million are enough to cover the current dividend payout for 6 years assuming that the company is not capable of generating cash on its own beyond covering capital expenditures (which is not the case), and this gives a lot of security to the dividend.

The dividend is safe and the yield on cost is relatively high

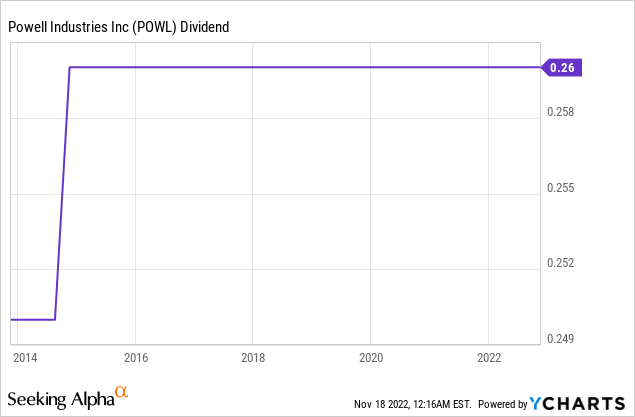

In November 2013, the management decided to initiate a dividend payment of $0.25 per quarter and raised it by 4% to $0.26 in November 2014. Since then, the dividend payout has remained flat.

This is so because by then the management decided to prioritize a new share buyback program to reduce the total number of shares and thus improve per-share metrics by progressively making each share an increasingly larger portion of the company, but a period of declining margins that lasted until 2019 cut short those plans.

Therefore, investors should not wait for a new share buyback program until profit margins stabilize, and for this to happen it will be necessary for the current headwinds to cease. Nor should they expect dividend raises as the management has no commitment to increase it, and the current situation is too delicate for them to decide that now is the time to do so. Not being in the hands of management, the only thing investors can hold on to right now is the current dividend yield, which stands at 3.91%.

Powell Industries dividend yield (Seeking Alpha)

To calculate the dividend safety, I decided to determine the cash payout ratio by calculating what percentage of the cash from operations is allocated each year to the payment of the dividend. In this way, I will be able to determine the company’s ability to cover the dividend with cash coming from actual operations.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $91.43 | $9.13 | $12.92 | $74.91 | $36.82 | -$28.54 | $68.76 | $72.39 | -$30.46 |

| Dividends paid (in millions) | $0 | $12.00 | $12.36 | $11.845 | $11.88 | $11.92 | $12.00 | $12.07 | $12.14 |

| Cash payout ratio | 0% | 131.44% | 95.66% | 15.81% | 32.26% | – | 17.45% | 16.67% | – |

As can be seen in the table, the unstable cash from operations due to the cyclical nature of the company can make one think that the dividend is not very sustainable, but during good years (2016, 2017, 2019, and 2020) the cash payout ratio remains at very low levels. This is so because low (or negative) cash from operations for a given year is usually associated with an increase in inventories or accounts receivable, which suggests that the current dividend yield is very sustainable in the long term.

Using the present as an example, cash from operations was -$14.8 during the third quarter as inventory increased by $5 million and accounts receivable by $22 million while accounts payable declined by $2.5 million, with which the company is generating enough cash to cover the current dividend quite easily despite current headwinds.

Risks worth mentioning

The company enjoys a debt-free balance sheet, which greatly reduces overall risks and allows it to take full advantage of the cash generated through operations. Still, there are some risks that are very important to consider.

- The company’s customers operate in highly cyclical industries, which makes it very sensitive to economic downturns. This means that the share price will always be subject to periods of high volatility.

- Also, technological advances can represent a serious headwind for the company if it fails to update its products on time or in the way that the market requires.

- And lastly, profit margins have fallen considerably in recent quarters. If the company is forced to increase the price of its products more than its competitors, it could lose market share, which would have a very significant impact on operations.

Conclusion

Powell Industries shares have fallen by 61.91% since 2014 as a result of declining profit margins and revenues. This has left a dividend yield of 3.91% despite the fact that the company can easily cover it in the current complex macroeconomic context. The headwinds the company is facing are likely temporary as they are closely related to the global economic situation, while sales are expected to increase in fiscal 2022 and 2023.

For this reason, I believe that this is a good opportunity to acquire shares of the company since the current dividend yield is very safe and has a large room for growth in the long term due to the relatively low cash payout ratio. Even so, it is highly advisable to keep an extra bullet in the chamber in case the current recessionary fears come true since the company operates in industries with a high cyclical component.

Be the first to comment