tupungato/iStock Editorial via Getty Images

It is not the first time that we provide updates on PostNL N.V.’s (OTCPK:TNTFF) performances. Last time, we concluded that the company was not our cup of tea, providing six negative key takeaways and a follow-up note on PostNL’s half-year results comment. In detail, our neutral rating was based on 1) higher competition (with just an important local presence in PostNL’s home market), 2) higher CAPEX requirements going forward (even compared to its closest competitors), 3) negative development on volumes in Post & Parcel division and 4) higher cost with an emphasis on transportation and salaries. Since our initiation of coverage, the company’s results were pretty in line with our analysis and at the stock price level, PostNL declined more than 50%.

Source: Mare Evidence Lab’s previous publication

Q3 results

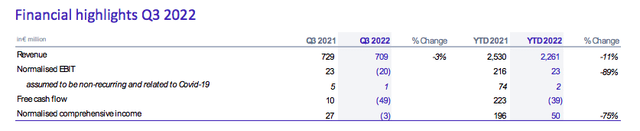

Our negative sentiment was also reported by the company’s CEO in Q3 results, who confirms that “the macroeconomic environment has deteriorated and is causing headwinds. The unprecedentedly high level of inflation puts further pressure on labor costs. In combination with low consumer confidence, it has clearly impacted consumer spending“. Here at the Lab, we forecast these headwinds to endure in the short-medium term horizon, providing prolonged uncertainty on PostNL’s P&L. Speaking of numbers, Q3 performances were not positive. With the lower e-commerce trends and the secular decline in the parcel division, PostNL’s top-line sales declined by 3% in the quarter. Going down to the company’s income statement, despite a positive price/mix effect, higher costs impacted the operating profit. Adjusted EBIT reached a minus €20 million compared to the positive number achieved last year (€23 million). Also at the nine-month aggregate, PostNL delivered a normalized EBIT of 23 million versus €216 million achieved last year. In detail, the negative performances were the results of 1) lower mail volumes which declined by almost 10% in the quarter, 2) €23 million of higher organic cost, especially in an increase of labor and fuel costs, and 3) lower results in the international market. In line with our previous analysis, FCF was negatively impacted by working capital requirements and also reflected a step-down in the company’s operating profit. Free cash flow was minus €49 million in the quarter and YTD performances are also negative. As a reminder, in August, PostNL paid an interim dividend of approximately €50 million.

Source: PostNL Q3 press release

Conclusion and Valuation

With a profit warming already announced in Q2, the company is unlikely that will reach its guidance range forecasted in an EBIT between €145 and €175 million. We assume no more buyback plan and also a likely dividend cut for 2023. With a P/E of 10x, we believe that PostNL is currently fairly priced, confirming our neutral rating. In light of our recent analysis of Deutsche Post, with a lower P/E ratio (8x), higher visibility on earnings growth, better guidance, and more M&A power, we are confident that the company is raising the bar and then is our top pick within the sector.

Be the first to comment