Solovyova/iStock via Getty Images

Thesis

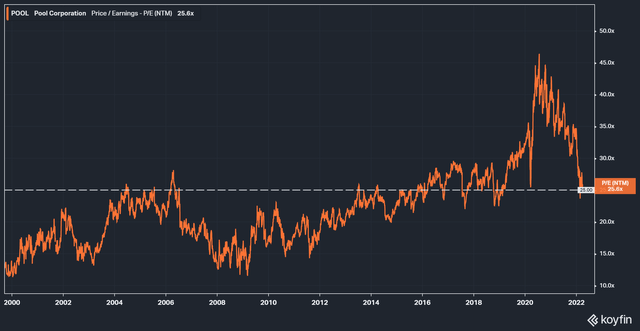

Pool Corp (NASDAQ:POOL) is ~30% off all-time highs while their price to earnings [P/E] multiple has contracted ~50% since mid-2020.

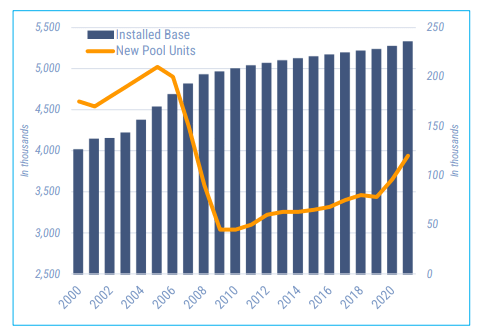

While COVID & cheap debt-related new construction may slow moving forward, the recent expansion in the total pool installed base may drive maintenance/repair & upgrade/remodel revenues in the future, in my opinion.

PK Data

The potential support from stable maintenance earnings may allow management to continue focusing on delivering growth via acquisitions and continuing to drive profitability through M&A. I also believe if management continues to generate revenues from a current install base while growing with new acquisitions, they may be able to stay on the path of returning capital to shareholders, potentially driving returns in the long run.

Background

I’ve covered Pool in the past so I will link my previous article where you can review the company’s background more in-depth, below is a quick synopsis:

Pool Corp. is currently the #1 wholesale distributor of pool-related & outdoor living products. The company operates three primary distribution networks with over 410 locations worldwide:

- SCP Distributions LLC

- Superior Pool Products LLC

- Horizon Distributors Inc.

Pool serves four principal markets:

Thesis Support

Maintenance / Upgrade Growth

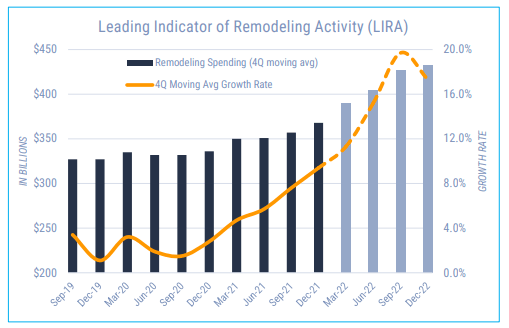

I believe Pool was a major beneficiary during COVID as people began upgrading their current homes during lockdowns while cost of debt declined.

Harvard University

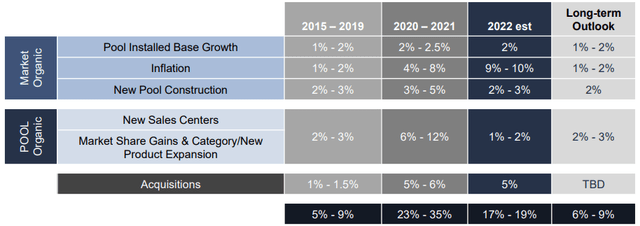

The sharp growth in remodeling activity was a clear tailwind for Pool in my opinion as their pool installed base grew ~50,000 in the past two years relative to ~50,000 from 2010 to 2020.

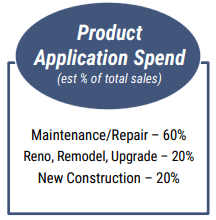

While new construction accounts for only 20% of total revenues, I believe growing their installed base rapidly allows for growth in maintenance/repair & remodel/upgrade in the future.

Pool Corp.

Acquisition Growth

The ability for potentially stable growth in maintenance/repair & remodel/upgrade segments may allow for management to continue focusing on acquisitions.

The most recent acquisition Pool completed was finalized late last year for Porpoise Pool & Patio. Porpoise Pool & Patio immediately adds an additional 210,000 sq. ft. distribution center to Pool’s arsenal as well as a 105,000 sq. ft. chemical operations facility. While Pool’s main focus is wholesale distribution, Porpoise distributes directly to their 265 franchised specialty retail stores granting Pool access to a ~$3 billion DIY customer market.

With Porpoise now able to leverage Pool’s national distribution network, potentially deliver gross margin accretion through chemical sourcing, and leverage transportation and logistics support, this acquisition may increase Pool’s overall operating leverage.

Capital Return to Shareholders

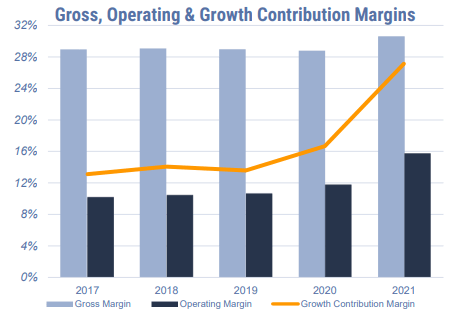

Even in the wake of risks & potential headwinds (which I will touch on later in the article), Pool is expecting to grow revenue in the high teens and expand operating margins by 20-40 basis points.

Pool Corp.

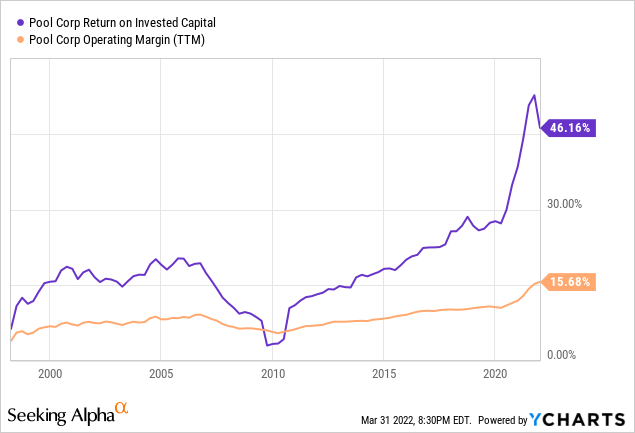

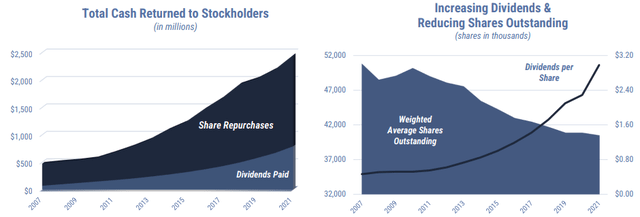

Increasing operating leverage may also equate to continuous free cash flow growth, potentially giving management the ability to continue funding their shareholder capital return initiatives.

Historically, Pool has rewarded shareholders handsomely in my opinion:

Financials

Forecast Highlights

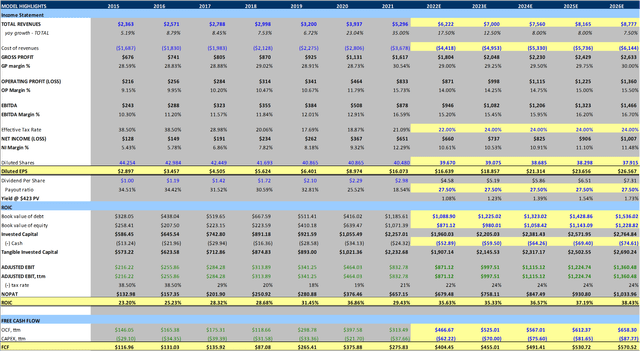

Below are my earnings, profitability, free cash flow projections for Pool through FY 5:

Created By Author Using Data From POOL IR

Valuation

Currently, Pool trades at ~25x forward earnings:

While an argument could be made that Pool’s long-term P/E consolidates around 15-20x earnings; growth in profitability and heightened competitive advantages (through organic and acquisition growth) may support an elevated valuation:

That being said, I believe possible retractions in profitability and margins may weigh heavily on Pool’s multiple.

Price Targets

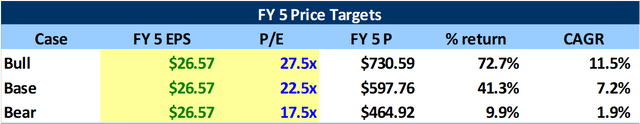

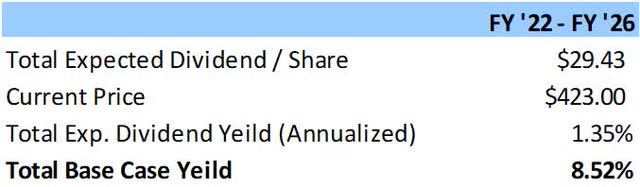

Using my bear, base, and bull case P/E multiples alongside my FY 5 earnings forecasts, I have created price targets for Pool: (CAGR uses the current price of $423 per share with n=5)

After accounting for my forecasted dividend payouts over the next five years, the base total return CAGR is 9.5%.

Risks

Inflation

If inflation stays elevated moving forward I believe there may be volatility in Pool’s business operations. Alongside potential operating cost pressures, demand for new pool construction and refurbishing may fall if consumers feel priced out. Also, if the Federal Reserve feels inclined to hike rates rapidly to fight inflation, increased debt costs may disincentivise consumers.

The mitigant to this risk is that Pool is the #1 distributor and they have successfully demonstrated their pricing power as management explained they have been able to pass all costs along to customers and even improve margins due to ‘buy ahead’ orders.

Supply Chain Disruptions

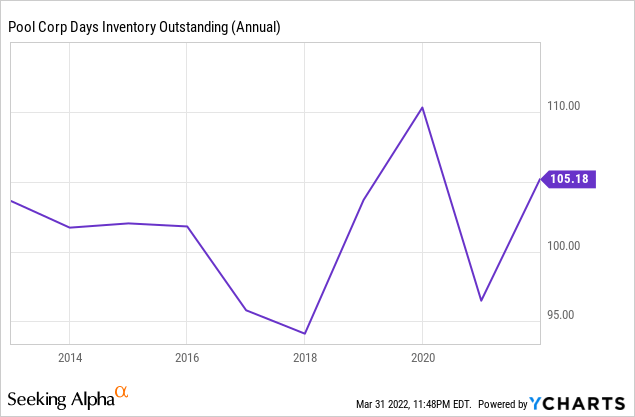

Disruptions in global supply chains have constrained some products for Pool increasing average days held in inventory.

While supply chain issues for Pool haven’t reached levels seen during COVID (2020), it is definitely a risk I will be watching closely.

Recessionary Risks

I believe if we do enter a recession domestically Pool financials will suffer. While the business performed great the last decade, in my opinion, earnings did suffer during 2008 and peak to trough the stock price declined ~75%. At 25x earnings currently, if there was a recession bad enough I believe it would be feasible to see Pool’s multiple contract back to the lows seen in 2008 (~11x forward earnings).

Summary

If inflation stays heightened and debt costs increase, I believe Pool could see consumer demand fall off significantly. If this proceeds a recession where potentially declining discretionary spending also inhibits demand, there could be an even bigger problem.

With that being said, I believe Pool’s management has navigated the current inflationary environment excellently shown through continued top-line growth and margin expansion. In my opinion Pool’s growth runway is intact driven by maintenance revenues and M&A. Couple a positive earnings runway with management’s focus on capital return to shareholders and I believe at current valuation levels Pool could be an excellent investment.

Threats are still evident for Pool and monitoring the consumer spending environment is key in risk management for this position, in my opinion.

Be the first to comment