Richard McCracken/iStock via Getty Images

Polaris Inc. (NYSE:PII) is a leader in the Powersports Vehicles industry that operates in three materially relevant business segments; Off-Road Vehicles (“ORV”); On-Road Vehicles; and Marine.

The company has a strong balance sheet that includes over +$300M in cash on hand and a manageable debt load. Given the nature of its business, inventory balances do run higher, but there has been no notable build-up over the last year attributable to demand drivers, such as those reported by more traditional retailers.

Balance sheet strength combined with strong cash generation enables the company to maintain its status as a dividend aristocrat, with over 25 years of continuous increases. While the current yield of 2.6% may not be enough to entice income investors, its reliability as a dividend payer is indicative of the staying power of the business.

Record quarterly sales during the quarter in the face of challenging macroeconomic conditions further validates their success as a business. And down just 8% YTD, shares have greatly outperformed the broader S&P, which is presently down just under 20% over the same period.

Though topline results have shined, the company still has a way to go before realizing its true potential.

Record Topline Quarterly Sales Growth

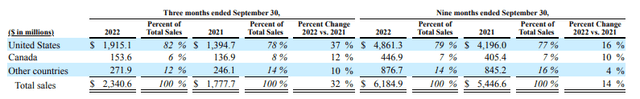

In the three months ended September 30, 2022, PII reported record topline sales of +$2.3B. This was 32% greater than the same period last year and +$140M better than expected. YTD, sales are now up 14% from last year.

Q3FY22 Form 10-Q – Quarterly Sales Disaggregation By Geographic Segment

While higher pricing and favorable product mix continued being primary drivers of current year sales growth, PII also benefitted from increased ORV shipments, with overall volume contributing 14% towards total quarterly sales growth. These gains were partially offset by unfavorable currency impacts, which drove a 2% decrease in sales for both the quarter and YTD.

Expenses Still Elevated But Margins Are Improving

Cost of sales continues to remain elevated, up 31% YOY and 17% YTD, driven by higher labor, material, and transportation costs. As a percentage of sales, however, there was a 26bps improvement in the quarter, which ultimately resulted in stronger quarterly gross margins.

Higher topline sales also more than offset the 16% increase in operating expenses during the quarter. This resulted in a 61% increase in YOY operating income and a 64% increase in adjusted earnings per share (“EPS”). This also fed into improved adjusted EBITDA margins, which came in at 13.7% during the quarter versus 12.1% last year.

Robust Overall Sales Growth But Notable Decline In Retail Sales

On a segment basis, all three materially relevant units reported robust sales growth, with ORV, their largest segment representing approximately 75% of total revenues, posting YOY sales growth of 33%, driven by increased shipments, higher pricing, and favorable product mix.

Growth in the On-Road segment was also comparable to ORV. But Marine topped both, with sales growth of 42%, driven primarily by a 16% increase in average unit sales prices.

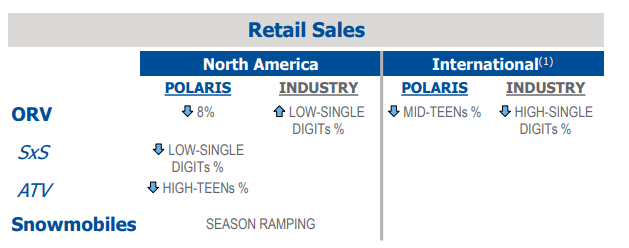

Though sales grew to a record during the quarter, retail sales were negatively impacted in both their ORV and Marine segments. In North America, for example, ATV unit retail sales were down nearly 20%, while unit sales of side-by-sides were down low-single digits. Overall, North America ORV unit retail sales were down in the high-single digits.

Q3FY22 Investor Presentation – Snapshot Of Retail Sales Compared To The Industry

This compares unfavorably to the broader industry, which was estimated to be up in the low-single digits. Similarly, unit retail sales were down in the low-double digits in the Marine segment, despite being up in the low-double digits in the overall industry.

Balance Sheet And Cash Flows Remain Supportive

At the end of the period, the balance sheet remained strong, with cash on hand of over +$300M and no notable deterioration in operating performance from the prior quarter, despite more challenging operating conditions in the general macroeconomic environment.

Collections on A/R also remain in-line with their five-year average. Inventory turnover, however, remains lower than historical averages, but improvements were noted in the current period due in part to alleviation in supply chain challenges.

Cash flow generation also remains positive, with over +$100M generated in the current year through the first nine months of the year. Though free cash flow is currently ($55M), which is worse than the ($20.1M) reported last year, management expects year end free cash flows to be up significantly over 2021, which ended the year at +$21.8M.

Guidance Maintained At Upper Boundaries

Looking ahead, management retained their full-year guidance, though they did narrow the range due to the fact that they are now nine months into the fiscal year. Still, the narrowing reflected a move higher to the upper boundaries of their range.

Q3FY22 Investor Presentation – Full-Year Guidance

Post-Earnings Insights

Despite the strain on household budgets due to inflationary pressures, consumers are still splurging on big ticket durable goods, as evidenced by PII’s record sales growth during the quarter, driven by pricing and product mix, in addition to volume growth, which contributed 14% of the total growth during the period.

Demand, however, was not evenly distributed across the income spectrum or across functional purposes. Though their premium products continued to see stable demand, softness was experienced in models that tend to be more price sensitive. This is indicative of the financial health of consumers on opposite ends of the income bracket.

While more affluent consumers, ones that tend to gravitate toward the premium lines, appear to be faring well, given current macro pressures, others appear less willing to take on a large purchase, such as an ATV or a boat.

For more price sensitive consumers, demand appears to be directed towards the most entry level models. In the Marine segment, for example, demand was reported to be steady in their entry and premium models but lower in the middle of the lineup.

In addition, their lineup of Indian motorcycles experienced demand trends that bucked those reported in Marine and ORV, with upper-single digit retail growth. This is perhaps due to some consumers trading in their existing vehicles for more fuel-efficient modes of transportation in the midst of record high gas prices.

Similarly, demand remained robust for utility purposes, such as on farms, ranches, and construction sites, but moderation was noted on the recreational side. Organic searches for industry terms, however, is still well ahead of levels noted in 2019.

While the nicheness of the current quarter’s demand drivers may be limiting, PII’s average consumer base has historically been categorized as affluent dual income homeowners. In addition, approximately 60% of their ORV business is in the utility space. It bodes well, then, for the company’s outlook if these two groupings are holding steady despite the inflationary environment.

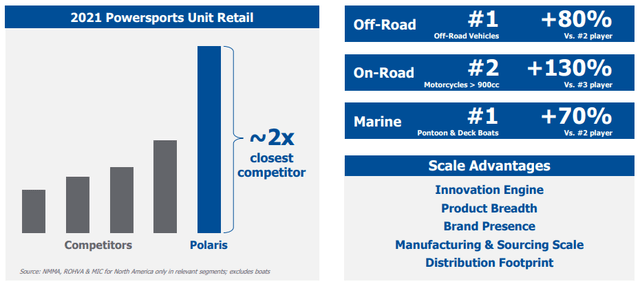

This is not to say PII is immune to setbacks. They did lose retail market share during the quarter. Still depressed dealer inventory levels that are 25% below 2019 levels was one culprit, as it prevented the company from meeting demand that would have otherwise been supplied in a normalized market. Moderating demand was another notable contributor.

Nevertheless, the company still maintains a dominant competitive moat in the industry. As such, even with the share loss, it would have hardly been enough to materially affect their standings as of the end of 2021.

2022 Investor Presentation – Snapshot Of Current Market Leadership Positions

A Great Long-Term Holding But The Terrain Is Still Rocky

PII is posting record sales figures, but moderation was noted in certain segments of the market. In addition, the company has exhibited cost discipline and has also benefitted from an improving supply outlook. But margins are still down from prior years and dealer inventory levels still have a way to go before reaching internal targets.

At present, shares are trading off their 52-week lows at a forward earnings multiple of about 10.0x. While a prior analysis supported a price point of $150, it’s appropriate to scale that back by about 10-15%, given current market conditions. Even at those lower levels, however, shares would still have implied upside of approximately 30%.

For existing shareholders, PII stock is a great long-term holding with significant share price upside potential, though the road to realize that potential is rocky in the near-medium term. In the periods ahead, shares may trade higher, but additional initiation may be best left on hold until dealer inventory levels improve to more optimized levels, which may take another quarter or two.

Be the first to comment