AEvenson/iStock via Getty Images

PNM Resources, Inc. (NYSE:PNM) is a regulated electric utility operating in New Mexico and Texas. This is one of the least populated regions of the United States and this certainly shows through the company’s relatively low $4.15 billion market capitalization. However, this has not prevented the company from sharing many of the traits that have made utilities a popular asset class among conservative investors for several generations. Chief among these is general financial stability, which certainly shows through in PNM Resources’ third-quarter results. We will discuss that more over the course of this article. The company certainly has more to offer than just financial stability though as it sports a respectable 2.87% yield and some significant growth potential. Unfortunately, the valuation appears to be a bit high at the current level so it might make sense to be cautious about taking a position now but the company still deserves to be watched until a good entry price presents itself.

About PNM Resources

As stated in the introduction, PNM Resources is a regulated electric utility that provides power to homes and businesses in New Mexico and Texas. These are among the least densely-populated states in the United States but PNM Resources still includes about 800,000 homes and businesses in its footprint. However, do not let the fact that the company does not blanket a heavily urban area dissuade you from considering it as PNM Resources still has many of the characteristics shared by its more urban peers. In particular, the company enjoys remarkably stable cash flows regardless of economic conditions. We can see this quite clearly by looking at the company’s operating cash flow. Here it is over the past several quarters:

As we can see, the only major changes here come from a spike in the third quarter. This is hardly unexpected considering the company’s service area. A good portion of the company’s service area is desert and deserts tend to get very hot during the summer, which causes a spike in electric consumption due to air conditioner usage. We see the same thing with natural gas utilities during the winter months. The biggest reason for this general stability over time is that electricity is generally considered to be a necessity. After all, many people in the modern world would have a very difficult time functioning without electric service in their homes. As such, they will typically prioritize paying their electric bills ahead of making discretionary expenses if money is tight. This allows electric utilities like PNM Resources to be fairly recession-resistant.

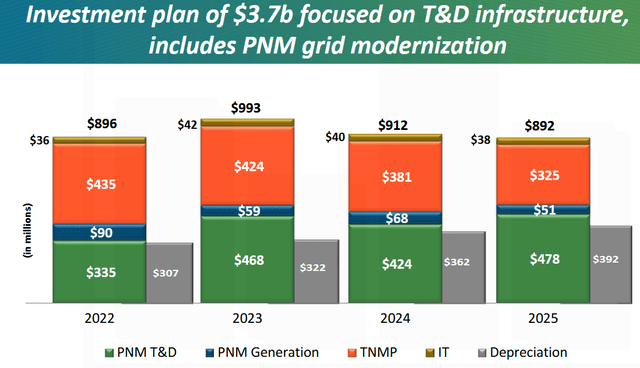

Naturally though, as investors, we are interested in growth as well as stability. We can see from looking at PNM Resources’ operating cash flows above that the company has generally grown over time. This growth was also reflected in the company’s third-quarter income as the company reported earnings per share of $1.42 compared to $1.32 in the prior-year quarter. This is something that is likely to continue going forward. This is because PNM Resources is actively working to grow its rate base. The rate base is the value of the company’s assets upon which regulators allow the company to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows the company to raise the prices that it charges its customers in order to earn that specified rate of return. The usual way that a company grows its rate base is by investing money into upgrading, modernizing, and possibly even expanding its rate base. PNM Resources is doing exactly this. The company plans to invest $3.7 billion over the 2022 to 2025 period into improving its infrastructure:

This is expected to grow its rate base at an 8% compound annual growth rate over the 2020 to 2025 period. However, the company only expects its earnings per share to grow at a 5% compound annual growth rate over that same period. There is a very good reason why the company’s earnings per share growth will trail its rate base growth by such a significant amount. That is that PNM Resources will need to finance the spending required to execute this plan, which will involve issuing both debt and common equity. The additional common equity will somewhat dilute the effect of the rate base growth. However, when combined with the current 2.87% dividend yield, PNM Resources should still be able to deliver investors an 8% total annual return. This is a reasonable rate of return from a conservative investment, albeit not as impressive as some other utilities are offering.

In my last article on PNM Resources, I mentioned that the company is in the process of retiring its old coal-fired power plants in pursuit of its goal of reducing carbon emissions by 60% by 2025. The company made some progress toward that goal during the third quarter. On September 29, 2022, the company retired the last remaining unit of the San Juan Generating Station. This plant had been operational since 1973 and possessed a nameplate capacity of 847 megawatts. The company did not specifically state what would replace that lost capacity but considering that solar facilities in the Southwest have been selling power for far less than the operational costs of San Juan, it seems reasonable that renewables will ultimately replace it.

PNM Resources does not really seem to have a plan to achieve its renewable energy goals, however. The company has been banking on an acquisition by Avangrid (AGR) but regulators in New Mexico have been rejecting this deal because Avangrid has been having problems with regulators in New England. PNM Resources did state during its third-quarter earnings report that it has until April 2023 to consummate that acquisition. The companies involved have been fighting the decision of regulators in a series of court hearings that concluded back in August, but no decision has been announced yet. Thus, it is quite possible that the deal will ultimately fall through.

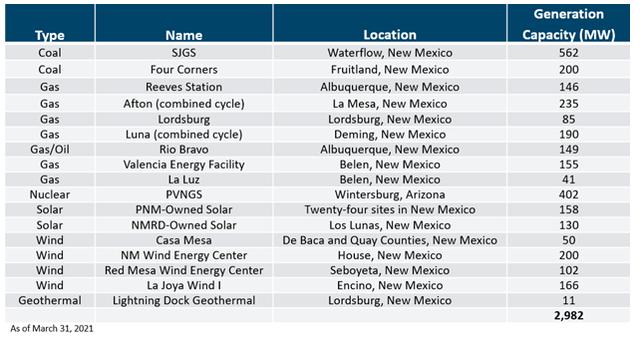

If this merger should fail, PNM Resources could be in something of a bind. The company still has two operational coal plants following the shutdown of San Juan:

The company has not yet announced what will replace these two plants, which generate a total of 762 megawatts of electricity. It has hinted at solar and wind, which would actually work pretty well considering the climate and geography of the company’s service area, but it has made no announcements to date. Avangrid is a leader in the deployment of renewable technologies and PNM Resources has been counting on that company’s expertise to deploy sufficient renewable capacity to replace the plants that will be retired. If the court appeal fails, it is uncertain what the company will do and it may have to delay its plans for a while.

Financial Considerations

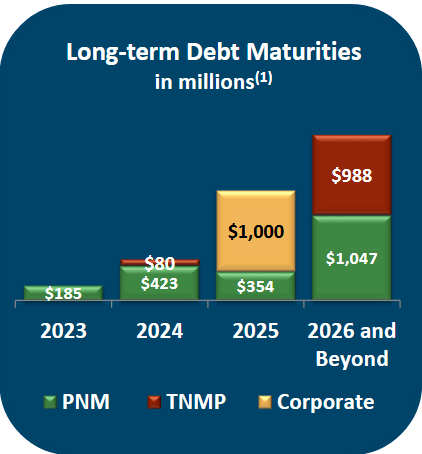

It is always important that we look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is typically accomplished by issuing new debt to repay the existing debt, which can cause a company’s interest expenses to increase following the rollover depending on the conditions in the market. This is something that could be important today considering that interest rates have been climbing over the past year and they are likely to continue to do so. This is because PNM Resources has a fairly sizable amount of debt maturing over the next few years:

PNM Resources

This will almost certainly cause the company’s interest expenses to increase over the next few years as PNM Resources rolls over this debt. This will have something of an adverse impact on its earnings growth but presumably, that was already factored into the company’s guidance of 5% earnings per share growth despite an 8% growth rate in the rate base.

Another way that we can evaluate the company’s debt is by looking at its net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to equity. It also tells us how well the company’s equity will cover its debt obligations in the event of a liquidation or bankruptcy, which is arguably more important. As of September 30, 2022, PNM Resources had a net debt of $4.2154 billion compared to $2.2673 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.86, which is substantially higher than the 1.61 ratio that the company had at the end of the third quarter of 2021. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

PNM Resources |

1.86 |

|

DTE Energy (DTE) |

2.22 |

|

Eversource Energy (ES) |

1.43 |

|

Exelon (EXC) |

1.55 |

|

NextEra Energy (NEE) |

1.33 |

|

CMS Energy (CMS) |

1.81 |

This certainly does not bode well for PNM Resources. As we can see, the company is generally more levered than its peers, with only one exception. This could be a sign that the company is relying too much on debt to fund its operations and is creating risks for its investors that are greater than those of peer companies.

Valuation

As is always the case, it is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a sub-optimal return on that asset. In the case of a utility like PNM Resources, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its earnings per share growth. However, there are very few companies that have such a low ratio in today’s market so the best way to use it is to compare PNM Resources with its peers to see which company offers the most attractive relative valuation.

According to Zacks Investment Research, PNM Resources will grow its earnings per share at a 4.22% rate over the next three to five years. This seems like a bit of a low estimate. As we have already seen, the company should grow its rate base at an 8% compound annual growth rate over the period, which should give it a higher earnings growth rate than 4.22%. However, using the Zacks estimate, we get a price-to-earnings growth ratio of 4.41. Here is how that compares to its peers:

|

Company |

PEG Ratio |

|

PNM Resources |

4.41 |

|

DTE Energy |

3.15 |

|

Eversource Energy |

3.18 |

|

Exelon |

2.44 |

|

NextEra Energy |

3.01 |

|

CMS Energy |

2.59 |

As we can clearly see, PNM Resources appears to be pretty expensive compared to its peers. This is somewhat surprising given the company’s current lack of direction. However, that is also calculated using the 4.22% compound annual growth rate. If we assume that the company will actually deliver the 5% growth rate that management assumes, the price-to-earnings growth ratio comes in at 4.16, which is still quite a bit higher than its peers but not by as much. Overall, it does appear that we should probably wait a bit for a dip in the share price before we buy in here.

Conclusion

In conclusion, PNM Resources continues to look unsure of where it is heading. The firm is providing very ambitious and nice-sounding goals but it appears to lack the direction that it needs to get there without a merger. As this merger is looking somewhat unlikely to happen, the company is in a bit of a bind. When we combine this with its high leverage and expensive valuation, there is little to recommend it at this price.

Be the first to comment