Vanit Janthra/iStock via Getty Images

Thesis

Plug Power Inc. (NASDAQ:PLUG) has continued to underperform the broad market since our previous Hold rating, urging investors to be cautious. Despite the slew of Wall Street analysts’ upgrades following its Q2 earnings release, PLUG has collapsed nearly 35% from its August highs.

Consequently, the market has digested all its gains in August, as it drew investors in rapidly following the passage of the Inflation Reduction Act (IRA). Therefore, we would like to remind investors to be wary about joining such momentum spikes, which we highlighted in our previous article. We emphasized that the market had already anticipated the successful passage of the IRA, given its price action in July. Therefore, by the time the Act was passed, the near-term upside had already been reflected.

Our analysis suggests that PLUG’s valuation is more well-balanced now. However, we have yet to glean a sustainable basing price structure akin to the lows in June (when we upgraded PLUG to a Buy). Furthermore, there’s significant resistance at the $32 level, which should continue to impede PLUG’s buying momentum.

We postulate that PLUG is likely at a near-term bottom. Therefore, we expect a consolidation phase/short-term rally at the current levels to help stanch further downside pressure. Notwithstanding, we urge investors to avoid pulling the buy trigger at this point until the market presents us with more clarity that it intends to hold the current levels.

As a result, we reiterate our Hold rating for now.

PLUG’s Valuation Is More Well-Balanced But Not Undervalued

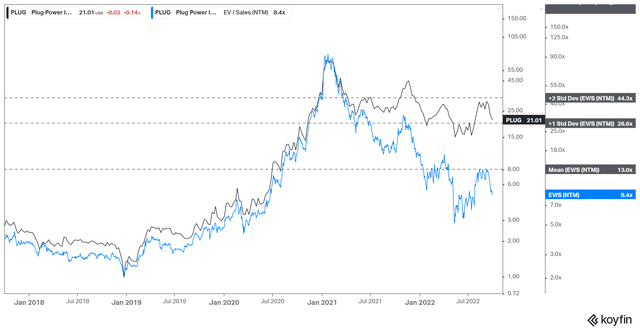

PLUG NTM Revenue multiples valuation trend (koyfin)

As seen above, we assessed that the market has continued to de-rate PLUG from its unsustainably overvalued highs in 2021 through its lows in June 2022.

However, the rejection at its 5Y NTM Revenue multiples mean (13x) in August 2022 suggests that the market does not expect to re-rate PLUG anytime soon, despite the passage of the IRA. Hence, we urge investors to apply a generous margin of safety from its 5Y mean in their assessment of PLUG’s valuation.

Our analysis suggests that June’s lows of 5.5x to 6x NTM Revenue have a reasonable margin of safety to add more positions. As such, we deduce that the current valuation of 8x NTM Revenue is not attractive enough to add exposure to an unprofitable and highly speculative stock.

Don’t Be Carried Away With The Inflation Reduction Act

Plug Power highlighted in its Q2 release that it sees the potential to accelerate its profitability through FY24, given the benefits afforded by the passage of the IRA.

As such, it expects to benefit tremendously from the $3 per kilogram Production Tax Credit, benefiting its bottom line.

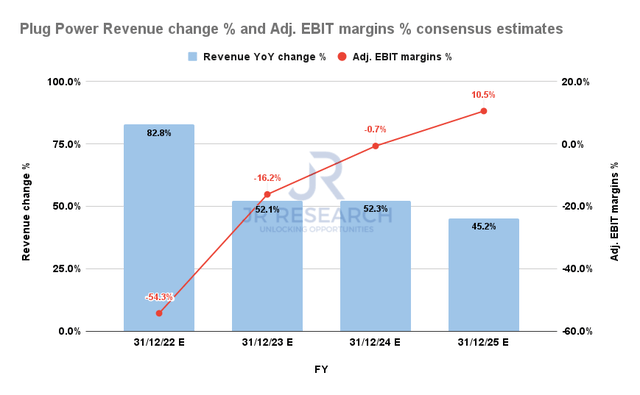

Plug Revenue change % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Notwithstanding, Plug did not revise its revenue target of $3B by FY25, which is also modeled by the Street consensus estimates (bullish). As such, Wall Street expects Plug Power to continue growing its topline rapidly through FY25, in line with its guidance.

However, the Street consensus lowered its adjusted EBIT margins projections to -0.7% for FY24 (down from 0.6% in early August, pre-IRA passage) while keeping FY25’s margins relatively unchanged. Therefore, even the Street has not significantly raised Plug Power’s margins profile, despite increasing their price target (PT).

Hence, we believe the Street’s decision to raise PLUG’s target multiples, given investors’ exuberance with the passage of the IRA, has been astutely “exploited” by the market once more to digest that optimism in the recent selloff.

Is PLUG Stock A Buy, Sell, Or Hold?

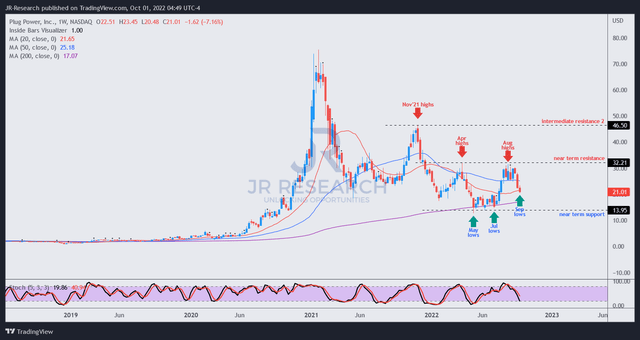

PLUG price chart (weekly) (TradingView)

In our June update, we upgraded PLUG from Sell to Buy, as we saw highly constructive basing action (despite a lack of news catalysts). We would like to remind investors that the market is a forward discounting mechanism.

By waiting for the catalysts (such as the IRA) to be announced, the near-term upside would already have been reflected, as seen in PLUG’s selloff through September.

Therefore, investors are encouraged to consult PLUG’s price action for meaningful clues to the market’s forward intentions.

Our analysis suggests that PLUG is already near- and medium-term oversold. Therefore a consolidation phase or even a short-term relief rally could follow from here. The extent of the selloff has likely forced out weak hands rapidly, given PLUG’s price action over the past three weeks. Hence, its downside volatility could subside moving forward.

If PLUG could base constructively, similar to its price action seen in June, then we are confident that its medium-term bottom in June could be sustained moving forward.

Hence, we urge investors to be patient for now and wait for the market to unveil its intention given PLUG’s more well-balanced valuation.

We reiterate our Hold rating on PLUG.

Be the first to comment