Kobus Louw

I covered Pliant Therapeutics (NASDAQ:PLRX) twice in the last 3 years. In 2020-2021, PLRX used to trade around $40 at peak. Even the trough, in those days, was higher than today’s peak. Then, starting from mid-2021 till around July 2022, the stock was in a downward spiral. In July, after its 90-patient Phase 2a trial for PLN-74809 (Bexotegrast) in idiopathic pulmonary fibrosis (IPF) met primary and secondary endpoints, the stock doubled overnight. Even a huge $200mn secondary offering right after that could not dampen the market enthusiasm.

At that time, I opined that while PLRX looks like a great company, investors should wait for a price drop following next year’s 320mg data drop to buy in. I hinted that even if there’s no price drop following that data readout, a positive readout will make PLRX more derisked, so even current prices will look attractive, given that nobody actually has a glass bowl where they can see the future. Interestingly, the stock has stayed stable in the last four months, down 0.21%.

In brief, Pliant ran a phase 2a study where a middle dose cohort saw the best response in the exploratory efficacy endpoint of forced vital capacity or FVC. Both the lower and the higher dose cohorts produced poorer responses than the middle dose one, raising questions of dose dependent response. Analysts are hoping that a highest dose readout next year will resolve the confusion one way or another. However, I doubt that the readout will clarify dose response issues. If it produces unlikely stronger response than any of the lower doses, the dose response will look like a zigzag curve. If it does not produce a higher response, then the question will be: why did the 80mg cohort do better? Ultimately, the decision will be to do a larger, longer duration phase 3 trial to resolve this question.

There were two phase 2 studies, so this can be a little confusing. One of these was a PET imaging study, and the other, called INTEGRIS-IPF, was a safety, pk and FVC evaluation study. In the INTEGRIS-IPF study, there were four different dose levels tested – 40mg, 80mg, 160mg and 320mg. 320 mg was the highest dose in the study.

PLN-74809 is an oral, once-daily, dual-selective inhibitor of αvβ6 and αvβ1 integrins. Dual inhibition of αvβ6 and αvβ1 integrins reduces “fibrotic gene expression in lung tissue explanted from patients with IPF.” Dose-dependent target engagement of ααvβ6 integrin by PLN-74809 was observed in the lungs of participants with IPF. In certain patients, a lower dose produced a higher response than a higher dose in other patients. However, available data does not show any reverse dose response, i.e., patients did not fare better at lower doses.

Key results from the INTEGRIS-IPF study:

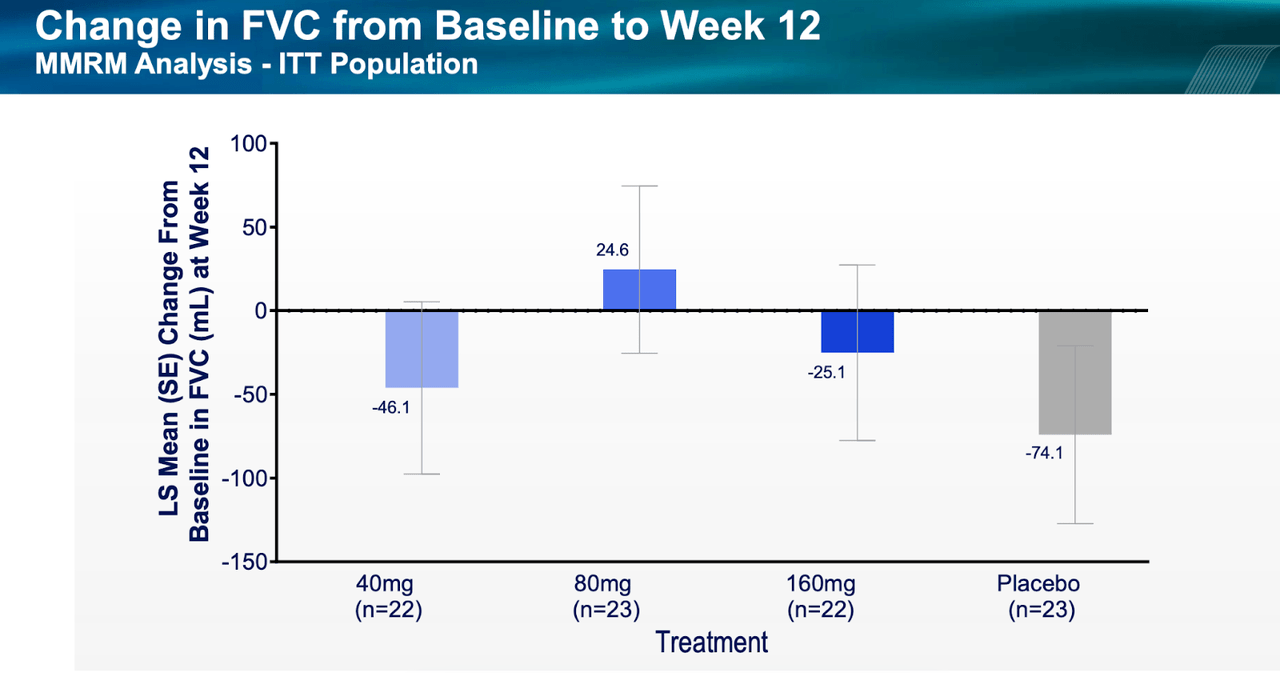

• Bexotegrast (PLN-74809)-Treated Patients Experienced an 80% Reduction in FVC Decline Over 12 Weeks (-15.1 mL, Pooled Active Groups) Compared to Placebo (-74.1 mL)

• PLN-74809 treatment effect was evident with and without use of standard-of-care agents

• An improvement in FVC (+24.6 mL) was observed in Bexotegrast (PLN-74809) 80 mg dose cohort

• Dose-dependent reduction in proportion of patients with percent predicted FVC (FVCpp) decline of ≥10%, a well-established predictor of death and disease progression in IPF

The one point of concern is the following chart:

PLRX data FVC (PLRX website)

As we can see, the 80mg dose cohort in 23 patients showed a much better FVC response than what was seen in the next higher dose, 160mg, or the lower 40mg dose. Confounding matters even further, some other metrics saw dose-dependent response. For example, a dose-dependent reduction in the proportion of patients with FVCpp decline of ≥10% was observed across treatment groups: 18.2%, 8.7% and 4.5% of patients experienced a ≥10% decline in FVCpp in the 40 mg, 80 mg and 160 mg treatment groups, respectively, versus 17.4% in the placebo group. Again, there was a dose-dependent response in QLF score. The mean percentage change in QLF at 12 weeks was 3.15%, 0.70% and 0.00% in the 40 mg, 80 mg and 160 mg treatment groups, respectively, versus 1.15% in the placebo group. However, as we can see, the placebo group fared better than the lowest dose cohort. Data was, really, all over the place.

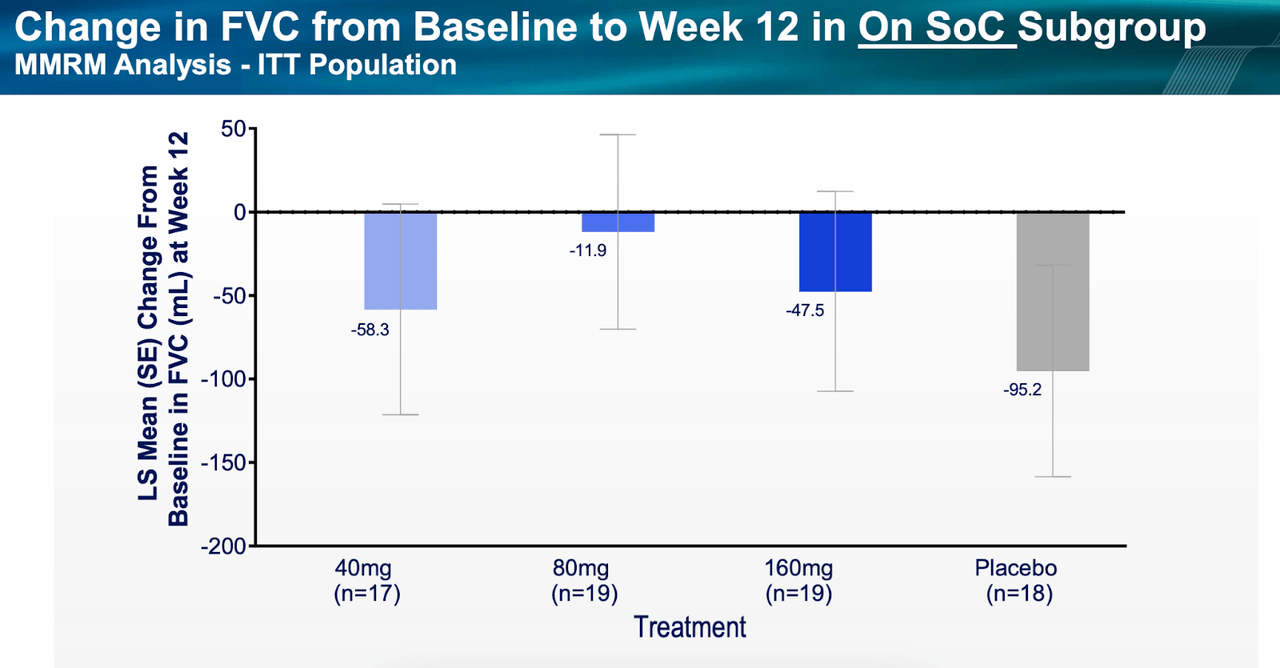

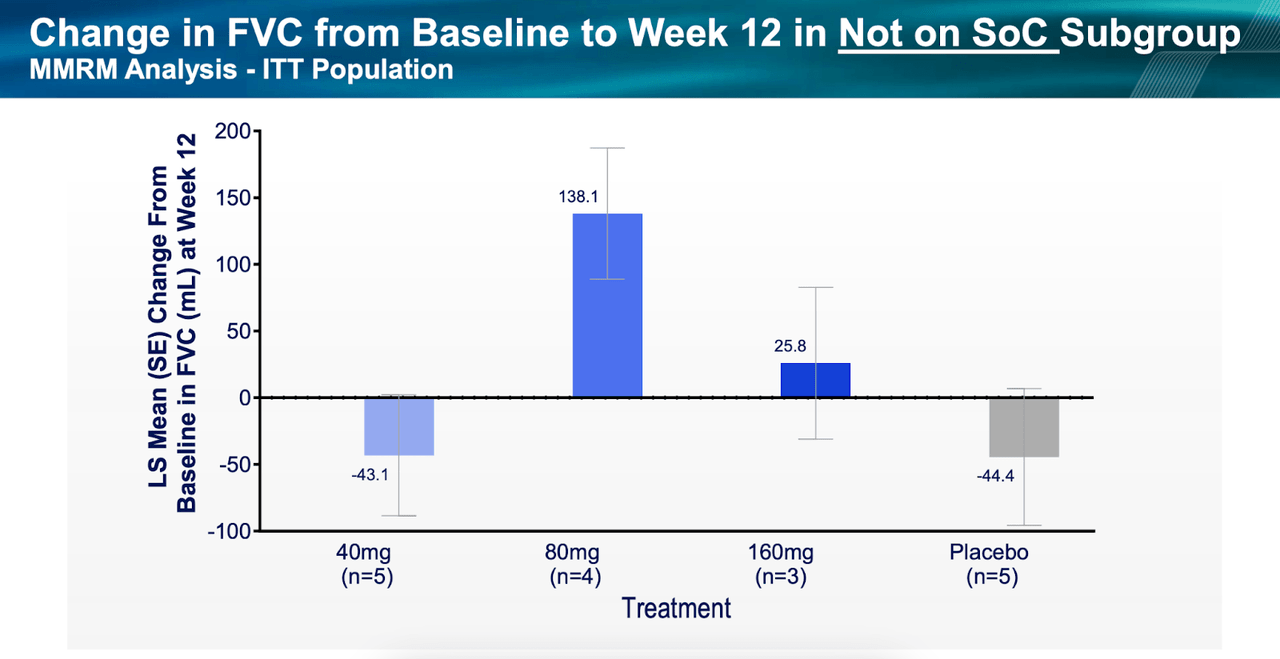

All that puts the upcoming 320mg data in jeopardy, even though all cohorts fared better than placebo. Secondly, this was a too small study with too low duration to effectively measure a progressive disease like IPF. Thirdly, some patients were allowed to use standard of care nintedanib, which may have produced some data confusion. The following two diagrams with data from patients on SOC versus those not on SOC will make the difference clear:

PLRX data (PLRX website) PLRX data (PLRX website)

The 80mg cohort, again, fared best, and it is surprising to see patients not on SOC doing better than those on SOC.

The independent Data Safety Monitoring Board (DSMB) has approved the trial for progression without any modification. The 320 mg cohort is fully enrolled and will produce interim data early next year from 28 enrolled patients.

Despite the confusion, the data was able to rapidly move the stock. I worry that the 320mg readout may not be as benign.

I noted in my previous coverage:

IPF has 140,000 US patients, with 30-40,000 new patients every year. Boehringer Ingelheim’s Ofev or Roche’s (OTCQX:RHHBY, OTCQX:RHHBF) Esbriet are two approved therapies which together made $3bn in 2021. However, two things; one, Esbriet has gone off patent and Ofev will go off patent in 2025; and two, neither drug is very effective nor safe. In my opinion, while the second point creates an opportunity for PLRX, the first point actually hurts its prospects.

Financials

PLRX has a market cap of $935mn and a cash reserve of $360mn plus a $100mn loan facility from Oxford Finance. Research and development expenses were $24.6 million, while general and administrative expenses were $8.8 million. At that rate, they have cash for more than 10 quarters.

Bottomline

PLRX has produced some interesting results in an area where a number of other companies have failed trials, and even the two approved products haven’t been very effective, despite pulling in large revenues. The data needs to be cleared up of all confusion, which only a larger and longer duration phase 3 trial can do. I expect a price drop with the 320mg cohort unless it produces clear signs of FVC improvement over all previous doses. Such a price drop may be an opportunity for a somewhat risky investment.

Be the first to comment