the.epic.man/iStock via Getty Images

Note: All amounts discussed are in Canadian dollars and references are to the TSX price change.

When we last covered Pizza Pizza (OTCPK:PZRIF), we were just drowning in the euphoria of a well timed performance. The stock had delivered just over 31% outperformance and proved to be an inflation hedge, just as we envisioned. We still went ahead and poured cold water on the story and used our discipline to point out why we were stepping to the sidelines.

PZRIF should do well overall in 2022 but the multiple here is getting uncomfortable for us. At this point we think a shift in stance is warranted and we are downgrading this to a “hold/neutral” rating. We are saying that this would be a risky point to initiate fresh positions, but we are not ready to put a sell rating, yet. We continue to hold shares as well and are enjoying the monthly dividends.

Source: Pizza Pizza Delivers As A Superlative Inflation Hedge

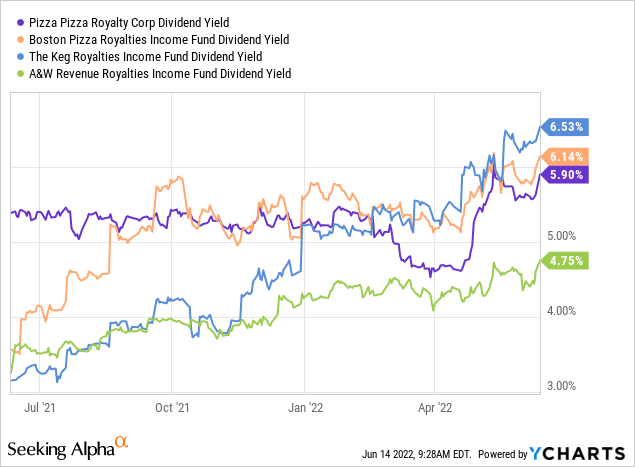

That call has obviously paid off. The stock has retreated and kept pace with the broader S&P 500 (SPY) index since then.

Seeking Alpha

We look at the recently released Q1-2022 numbers and macro environment to update our thesis on this.

Q1-2022

PZRIF reported scintillating numbers for Q1-2022 with same store sales growth of 13.6%. If readers remember, Q1-2021 was almost exactly in the opposite direction with negative 13.3% same store sales growth. The growth in 2022 was driven by mass reopening and addition of non-traditional locations. We will note here that its brand called “Pizza Pizza” delivered 16.0% same store sales growth, while the other brand “Pizza 73” came in at just 2.1%. So there continues to be a critical difference in brand strength and we have observed this over longer time frames as well. Earnings came in at 19 cents a share EPS was in line with our estimate of $0.19 and we would model 82 -83 cents/share for the whole year. The back half the year is generally stronger and PZRIF plans on adding more non-traditional store openings around September. This gets us to about 15-15.5X earnings per share.

Dividend

At 6.5 cents a month, the company is on track to pay out 78 cents. The payout ratio seems high with the expected 82-83 cents of earnings, but that is deliberate. The company needs zero capex to grow restaurant counts as it just licenses out the brand. It aims to pay out all its earnings over time and makes no apologies for it. So we would feel very comfortable with this 6.5 cent number and look for a bump to 6.75 cents in the back half of the year.

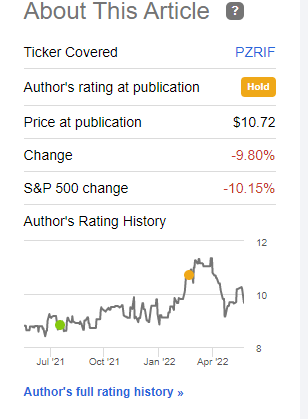

The dividend yield is quite appealing here, though not the highest among the “royalty restaurants” pack.

Outlook

Inflation is great for royalty plays that play on the top line. But there can be too much of a good thing, and in this case we believe there is reason to be concerned. It is great to talk about how PZRIF benefits from the revenue structure moving up, and it does, but the underlying restaurants are definitely getting challenged. The conference call touched on many areas of this, one of which is shown below.

Derek Lessard

Okay, and I guess you touched on sort of my follow up to that in terms of the mechanism. So has it been price increases sort of across the board? Are you doing it through bundling? Maybe some color on sort of the mechanisms.

A – Paul Goddard

Yeah, I think it’s been a combination of things. You know I don’t want to go too much into detail just for proprietary reasons, but to give some transparency, I mean definitely some key specials. You can see there are three key price points for us. So we’ve also taken a close look at competition and what people are doing and you know we’ve definitely tried to be judicious about it, but you know we look at the mix of our different specials, and create your own side items, things like that and just look for certain opportunities there as well.

And also on that fuel side we’re conscious of drivers also you know having that additional pressure they face economically would vastly increase fuel costs just as another example. So we’re trying to sort of take all that into account with our pricing, our delivery, etc. and just our overall supply chain.

Source: PZRIF Q1-2022 Transcript

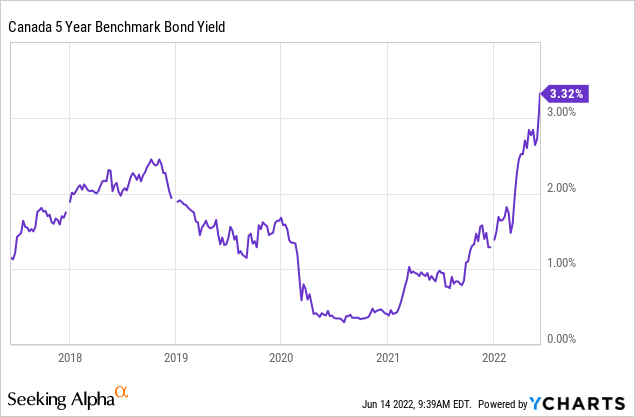

There is more color in that transcript and it did not even touch on the headwinds from mortgage refinancings. A lot of mortgages in Canada are on a 5 year fixed term versus the 30 year we see in US. Those refinancings will be quite bitter. This is the history of the 5 Year Government of Canada bond yield, over the last 5 years.

While that itself is not the mortgage rate, it is easy to see that anyone refinancing today, is not a happy camper. Pizza Pizza of course is an alternative to the more expensive restaurants so there is some benefit from “moving down” in tough times. Overall, we think that the company likely benefits from inflation but suffers some more valuation compression in this environment.

Verdict

PZRIF’s dividend is very well supported. It appears one of the few firms in its market cap range that we think will hike. The stock has retraced and has removed some of the froth we saw at the highs. But we still don’t see it as attractive enough for a buy. It would have been wonderful if this had options, so we could sell cash secured puts at the right strike. But since it lacks those, we will have to go with the “buy-under” method. Here that would be about 14X earnings for 2023 (which we estimate at about 86 cents). That works out to about $12.00. We continue to rate this as a hold and we will only add if we see prices below that mark.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment