DOERS/iStock via Getty Images

Pizza Pizza Royalty Corp. (TSX:PZA:CA) collects top-line royalties from system sales of its namesake restaurant chains.

I believe PZA is an attractive way to benefit from rising menu prices due to inflation without the profitability risks from rising wages and input costs.

(note, all figures in this article are in Canadian dollars)

Brief Company Overview

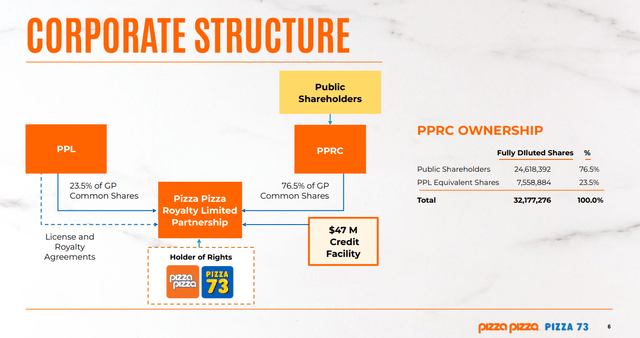

Pizza Pizza Royalty Corp. owns 76.5% of Pizza Pizza Royalty Limited Partnership (“PPRLP”), which owns the Pizza Pizza and Pizza 73 brands and earnings royalty income from restaurants bearing those brands (Figure 1).

Figure 1 – PZA corporate structure (PZA investor presentation)

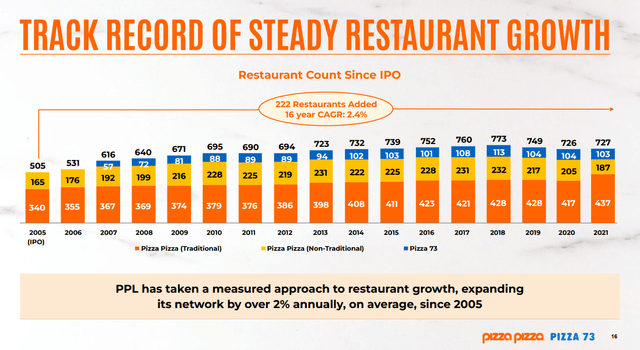

Pizza Pizza is an iconic Canadian brand and has over 50 years of operating history. Pizza Pizza has the #1 market share in many Canadian markets and the number of restaurants in its Royalty Pool has grown at a 2.4% CAGR since PZA went IPO in 2005 (Figure 2). As of September 30, 2022, there are 727 restaurants in the Royalty Pool, with 624 Pizza Pizza restaurants and 103 Pizza 73 restaurants across Canada.

Figure 2 – PZA has track record of store growth (PZA investor presentation)

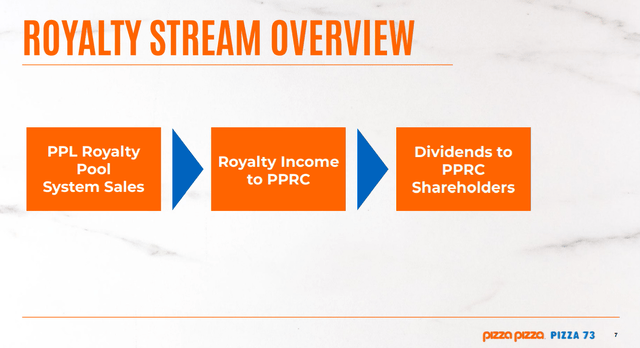

PZA’s value comes from the distribution of royalty income from PPRLC to PZA, which are then distributed as dividends to public shareholders (Figure 3). PZA earns 6% of system sales from Pizza Pizza restaurants and 9% of system sales from Pizza 73 restaurants.

Figure 3 – PZA royalty stream overview (PZA investor presentation)

COVID Was A Big Blow But QSR Recovered Quickly

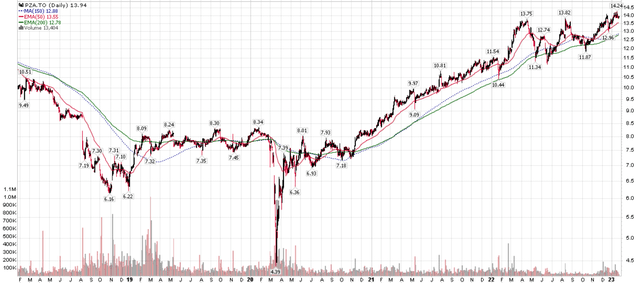

As can be imagined, the early days of the COVID-19 pandemic was a huge blow to the restaurant industry, as many restaurants were closed and consumers were ‘locked down’ at home. PZA’s shares plunged from ~$8 to ~$4.50 in the immediate aftermath of the pandemic (Figure 3).

Figure 4 – PZA stock plunged during COVID (stockcharts.com)

However, while many full-service restaurants continued to suffer during the year-long lock down until vaccines were developed in late 2020, Pizza Pizza’s QSR business model was well suited for the change in food consumption patterns, allowing PZA’s stock price to bounce back relatively quickly. PZA’s stock recovered most of its losses by the summer of 2020 and by late 2020, had surpassed its pre-pandemic price level.

Latest Financials Show Further Recovery

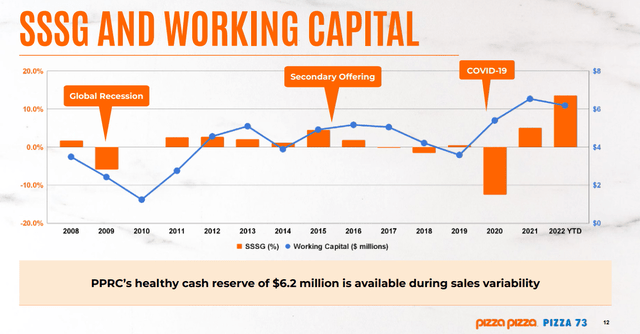

After a tough 2020, PZA’s same store sales growth (“SSSG”) began to recover in 2021, and recently accelerated in 2022 on the back of consumption patterns recovering to pre-pandemic norms and inflation helping to driver further sales growth (Figure 5).

Figure 5 – PZA SSSG accelerating (PZA investor presentation)

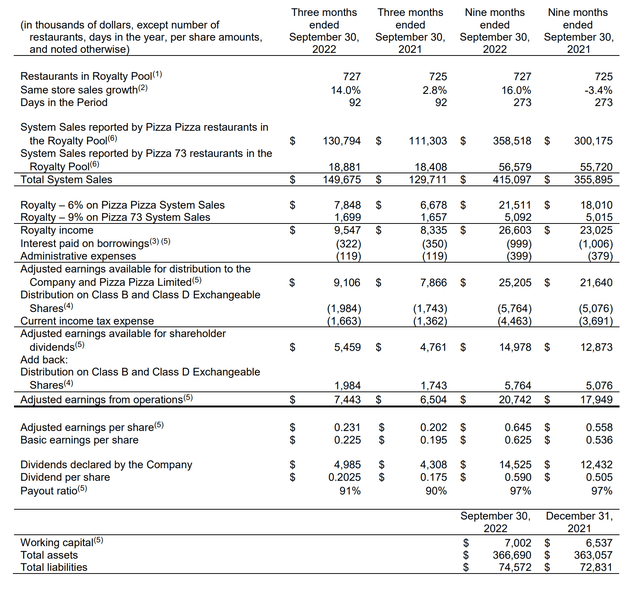

In the first 9 months of 2022, system-wide sales for PZA increased 16.6% YoY to $415 million, leading to adjusted EPS of $0.645 / share (Figure 6)

Figure 6 – PZA financials (PZA Q3/2022 MD&A)

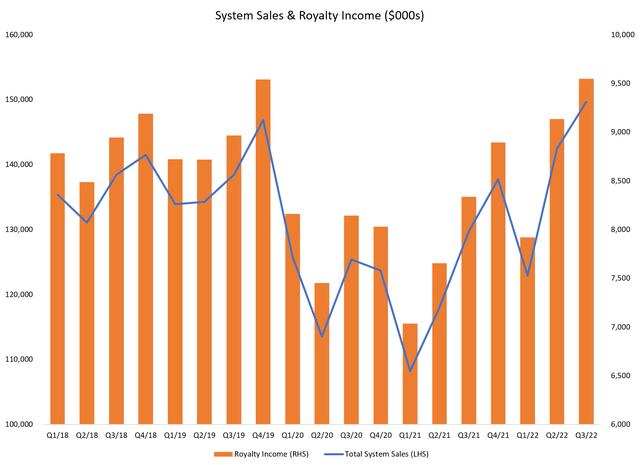

In fact, system sales and royalty income recently surpassed the peak level in Q4/2019, despite there being 45 less restaurants in the Royalty Pool now versus in 2019 (Figure 7).

Figure 7 – System sales and royalty income have surpassed Q4/2019 peak (Author created with data from company reports)

Pizza Is A Cheap Dining In/Out Option

Undoubtedly, inflation has been hitting consumers hard in the wallet in the past few years. Everything from gasoline to eggs have been soaring in price, with few places to hide. However, relative to other forms of Food Away From Home (“FAFH”), pizza has probably gained in relative price attractiveness as menu prices have soared everywhere.

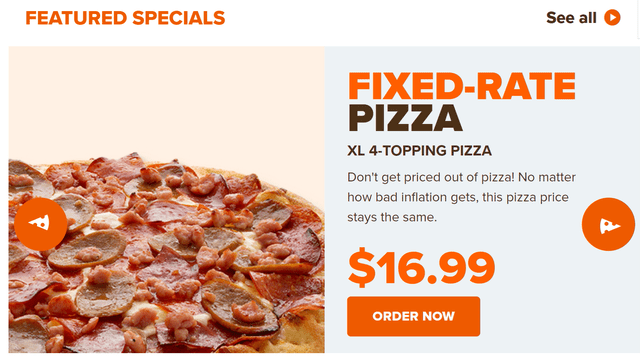

For example, Pizza Pizza recently launched a fixed-rate pizza promotion, allowing consumers to purchase an extra large 4-topping pizza for $16.99 (Figure 8). Given an extra large pizza can feed ~5-6 adults, this works out to approximately ~$3 per person.

Figure 8 – Pizza Pizza fixed rate pizza promotion (pizzapizza.ca)

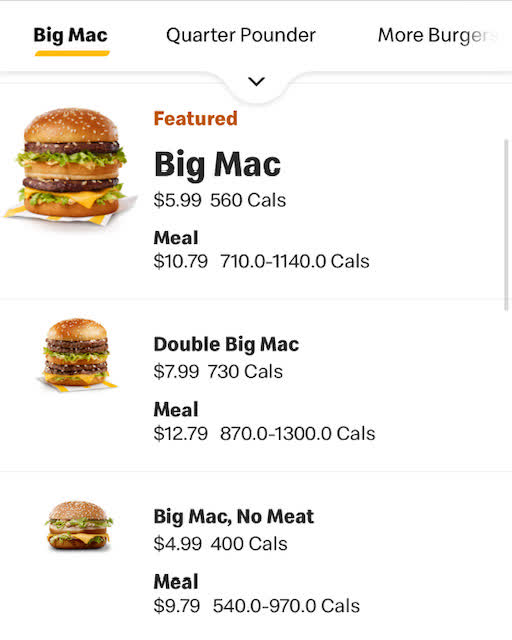

This compares favorably with other dining out options. For example, a regular ‘Big Mac’ sandwich from McDonald’s now cost $5.99 in Canada. So an equivalent amount of food to feed 5-6 adults would cost upwards of $30 dollars (Figure 9).

Figure 9 – Mcdonald’s menu prices in Canada (Mcdonalds.ca)

For large gatherings or budget constrained consumers, pizza has become a much more ‘affordable’ dining option.

PZA Benefits From Higher Menu Prices

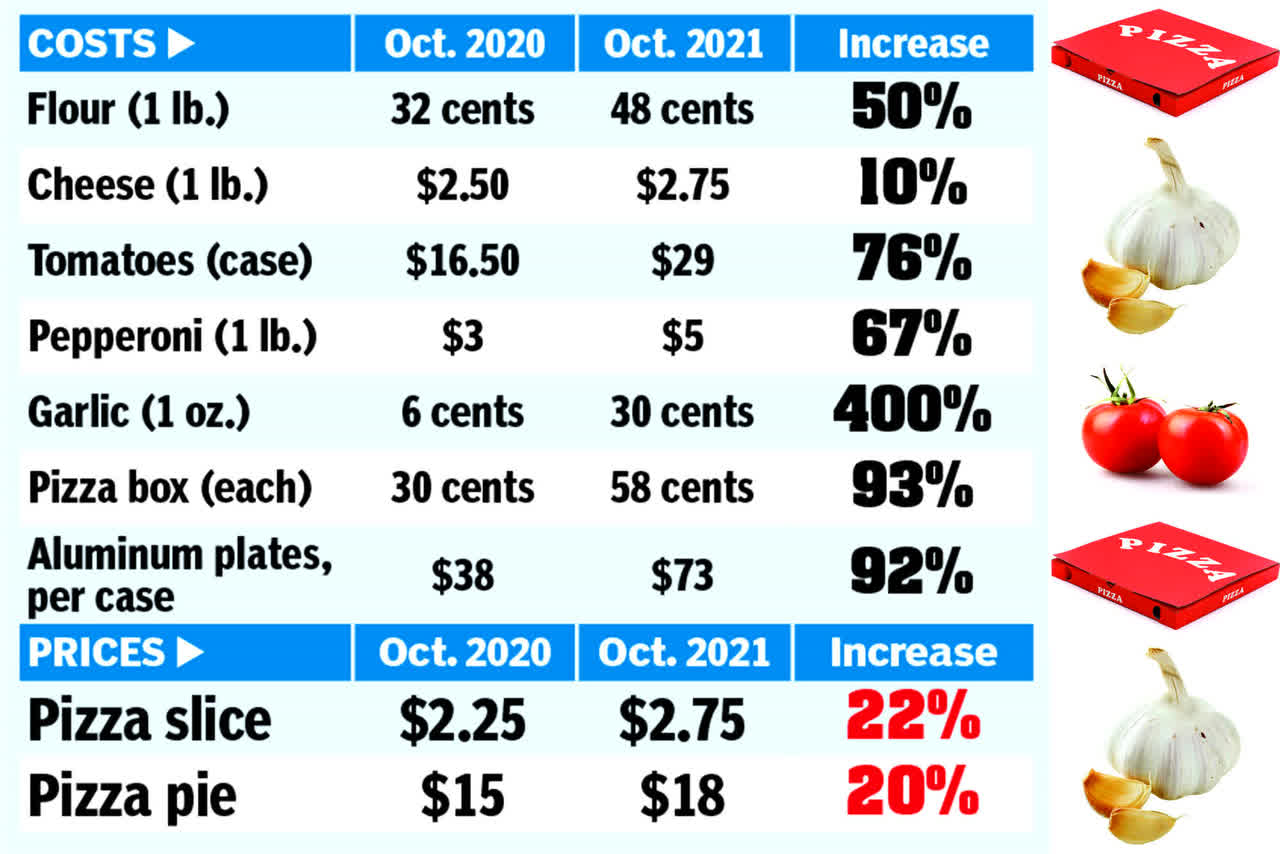

In a 2021 article, the New York Post found that the costs of ingredients for a typical pizza slice had gone up 10-400% in the year to October 2021, leading to menu price increases of ~20% (Figure 10).

Figure 10 – Soaring ingredient costs in Pizza (nypost.com)

By April of 2022, the same slice was selling for an average of $3.14, a 14% increase from the October survey as ingredient prices continued to soar, with food inflation running at a greater than 10% annual rate.

While profitability for many restaurants are still constrained due to rising costs, royalty companies like PZA can benefit from inflation’s impact on rising menu prices without the associated profit risks from higher wages and input costs as the royalty is calculated as a percentage of system sales.

Dividend Continues To Recover; Trading At 6% Yield

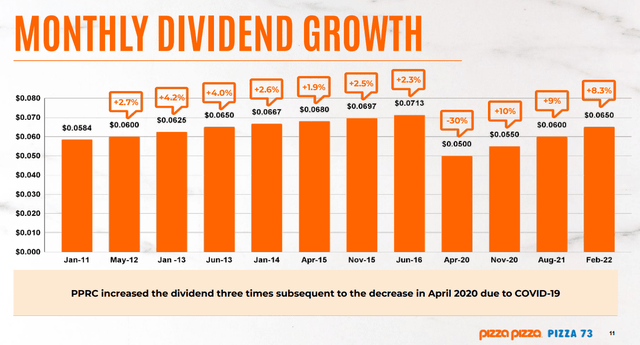

When COVID initially hit, PZA made the painful decision to cut its distribution to $0.05 / month in order to conserve capital. The cut to PZA’s distribution was probably a main driver in the plunge in share prices as shown in figure 4 above.

However, PZA has been increasing its monthly dividend as its business fundamentals have recovered (Figure 11). Most recently, concurrent with the Q3/2022 earnings report, PZA increased its monthly dividend by 3.7% to $0.07, with the shares now trading at an attractive 6.0% forward yield.

Figure 11 – PZA monthly dividend history (PZA investor presentation)

Risks To PZA

The biggest risk to PZA is if the Canadian economy slips into a recession, then consumers may further reduce their dining out budgets. In figure 5 above, we can see that Pizza Pizza’s SSSG went negative during the 2008 recession. However, this risk is mitigated somewhat by the relative price attractiveness of quick serve pizza versus other food offerings that I highlighted above.

Next, if inflation severely hurts the profitability of its franchisees, then we may see a reduction in the number of restaurants in PZA’s Royalty Pools. This would have a negative impact on PZA’s revenues and dividends.

Finally, there is a risk to PZA from competition, especially as foreign competitors like Dominos expand in Canada. For example, within the Canadian food industry, we have seen the gradual decline of the ‘Second Cup’ brand, as Starbucks expanded its presence over the past few decades and captured the ‘premium coffee’ segment. A decline in Pizza Pizza’s market positioning is possible as there is little differentiation between different brands of pizza.

Conclusion

Pizza Pizza Royalty Corp. collects top-line royalties from system sales of its namesake restaurant chains. Royalty companies like PZA enjoy the benefits of inflation on menu prices without the associated risks to profits from higher wages and input costs. PZA currently trades at an attractive 6% dividend yield that could continue to grow if restaurant menu prices increase with inflation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment