Anna Richard

Introduction

Pipestone Energy (TSX:PIPE:CA) (OTCPK:BKBEF) is a Canadian natural gas and condensate producer. The company is able to sell a substantial portion of its natural gas production in the US which has been a tremendous help to boost the average realized price.

The third quarter was strong thanks to the high natural gas price

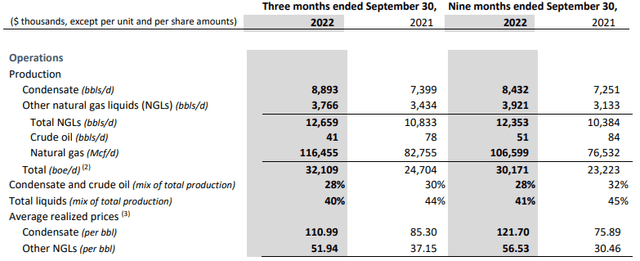

During the third quarter, Pipestone Energy produced just over 32,000 barrels of oil-equivalent which mainly consisted of natural gas which represented approximately 60% of the oil-equivalent output. Another important element in the production mix is Pipestone’s condensate production. Condensate is very useful in the region as the oil sands producers use it as a diluent to transport their heavy oil.

Pipestone Energy Investor Relations

The average natural gas price came in at C$6.09 per Mcf thanks to its ability to sell a portion of the natural gas it produces on the US markets thanks to its increased allocation of capacity on the Alliance pipeline. The impact of having two separate markets to sell the natgas into should not be underestimated as the average natural gas price was just over C$4.20 in Canada and C$9 in Chicago which means the average realized price of C$6.09 is almost 50% higher than the AECO natural gas price.

Pipestone Energy Investor Relations

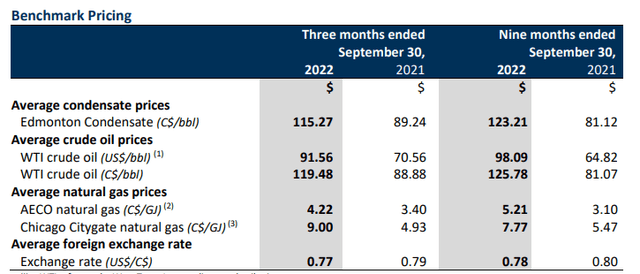

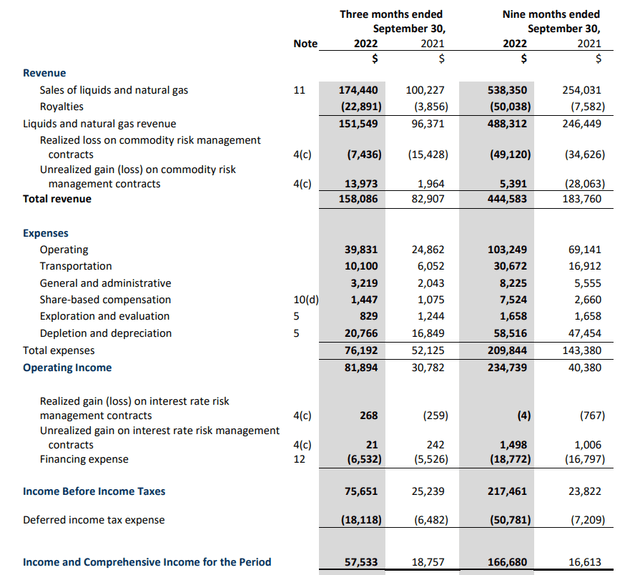

The total gross revenue came in at C$174M which is almost 75% higher than in the third quarter of last year, mainly thanks to the higher natural gas price. The total amount of royalties also increased and the net reported revenue was approximately C$158M, including a net benefit of C$6.5M from the hedge book (as the unrealized gains were substantially higher than the realized losses).

Pipestone Energy Investor Relations

The operating expenses remain relatively low and this resulted in a total operating income of just under C$82M and a net income of C$57.5M which represented C$0.31 per share.

Don’t read too much into the EPS as that was based on the share count as of the end of Q3. Subsequent to the end of the third quarter, Pipestone announced its preferred shares were converted into common shares and approximately 94 million new shares were issued. This pushed the share count higher to 278 million shares. This means that if you would calculate the EPS based on the current share count, the EPS would be just under C$0.21. That’s still fine considering the share price is still trading below C$3.50.

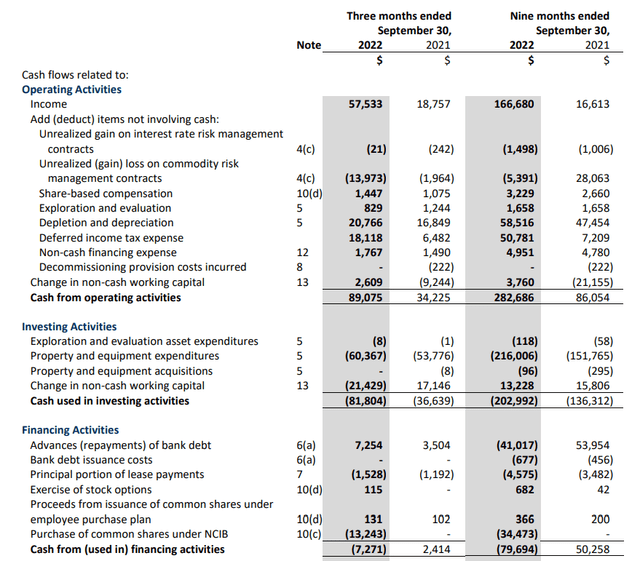

I also think the cash flow result is very important as Pipestone is still working towards reducing its gross debt and net debt. In the third quarter, Pipestone recorded an operating cash flow before changes in the working capital of approximately C$86M. After deducting the C$1.5M in lease payments, the adjusted operating cash flow was C$84.5M. Keep in mind this includes about C$18M in deferred taxes, but also includes the C$7.4M in realized losses on the hedge book during the quarter.

Pipestone Energy Investor Relations

The total capex during the quarter was pretty high at C$60M and this means the underlying free cash flow was pretty disappointing at C$24.5M as this represents less than C$0.10 per share based on the current share count.

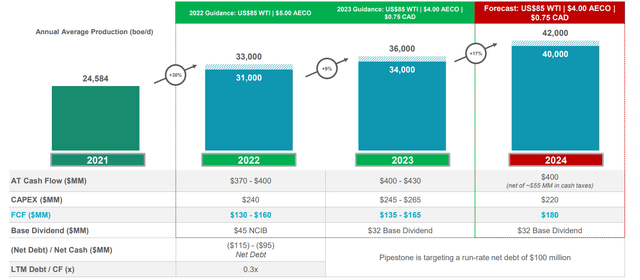

But as you can imagine, there’s more than meets the eye here. The capex obviously includes the growth investments as well, and from next year on the growth rate will be slower. This year, the production will increase by approximately 30% on an oil-equivalent basis, but the C$245-C$265M capex budget for next year will include a 9% production growth rate.

The longer-term outlook still looks promising

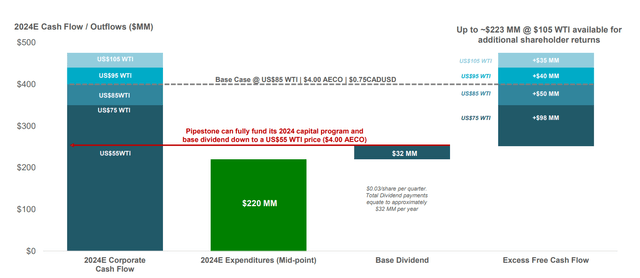

This means we shouldn’t really look at how much free cash flow Pipestone will generate this year, but we should have a look at the longer-term outlook. Next year, for instance, the production rate will indeed increase by almost 10% and this should generate just over C$400M in operating cash flow and this should result in a C$135-C$165M in free cash flow. That’s approximately C$0.50-C$0.55 per share, and it’s worth emphasizing this includes the growth capex and is based on an AECO natural gas price of C$4 (while the current spot price on the AECO markets exceeds C$6).

This also paves the way for Pipestone to pay a base dividend of C$32M (which would result in a dividend yield in excess of 3%) and pave the way for additional shareholder rewards. After all, the internal threshold of C$100M in net debt should be reached by the end of this year or by the end of Q1 2023 at the latest which means that in the company’s 2024 scenario with a C$180M free cash flow result for C$0.65 per share (despite having to pay cash taxes) there will be C$148M per year available after paying the C$32M base dividend.

Pipestone Energy Investor Relations

While this still looks fine, keep in mind the growth is a bit slower than what Pipestone had been promising at the beginning of this year. Back then, the company anticipated to pursue a more aggressive production growth plan, but I’m definitely fine with a more moderate growth pace.

Pipestone Energy Investor Relations

Investment thesis

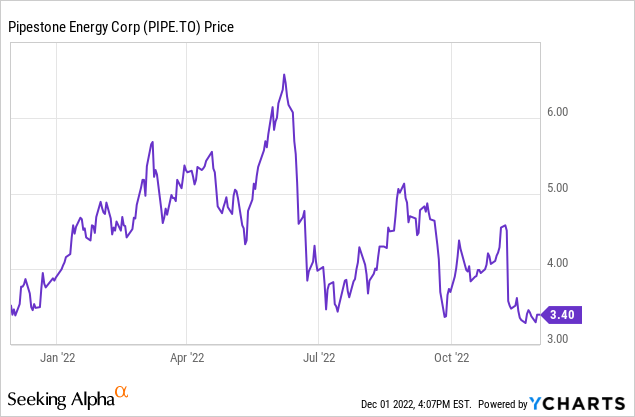

Pipestone’s share price came under pressure a few weeks ago, and I think some of the preferred shareholders which converted the preferred shares into common shares may have been taking some profits off the table. That being said, I like the company’s outlook and even though Pipestone will become a net taxpayer from 2024 on, there should still be plenty of after-tax cash flow to reward the shareholders.

I have a small long position in Pipestone Energy, but I am planning to add to this position on weakness. I’m in no rush, but I like the company’s approach and projections for the next few years where the focus will be on cash flow in combination with moderate growth.

Be the first to comment