Maksim Labkouski

Piper Sandler (NYSE:PIPR) when it was Piper Jaffray was not a particularly respected bank even in the mid-market space. However, it has proven itself among the more resilient franchises even in corporate finance. While 2021 comps don’t do the current results any favours, other parts of the business are doing well on a YoY basis, and on a sequential basis corporate finance is actually doing well thanks to some well positioned franchises. Fixed income businesses are suffering right now, but if things get better, they’ll recover, and if they get worse the addition to the restructuring MD headcount should show real resilience once dialogue in restructuring becomes actual deals. Overall, PIPR is pretty solid.

Q3 Results

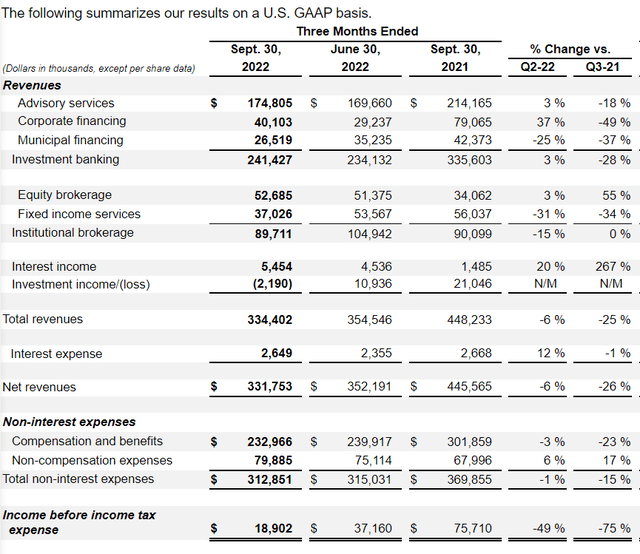

Let’s begin with a swift look at some of the Q3 results, focusing on the salient points:

We’re mostly focused on revenues are where momentum may be building or dwindling.

- YoY the corporate finance and overall investment banking businesses are getting destroyed by the phenomenal 2021 comp that cannot be beaten. Sequentially, there is a much more promising clip of growth. Corporate financing businesses are being held up by the healthcare franchise but the growth sequentially is being driven by energy and oil franchises. Advisory services sees modest sequential growth but the pressures here despite the larger tickets are the slowdown in closure rates. This is a complaint we are seeing across the industry. However, the declines here are much less serious compared to other recently reported competitors who rely much more on both sponsor business and LevFin conditions with exposure to a larger segment of the market. The mid-market exposure is proving to be relatively resilient.

- The weakness in investment banking is coming from the municipal financing business which is about 10% of overall revenue. While most of the business here is investment grade, some of it is higher yield. Those businesses are suffering due to already existing debt on the markets that is going for fire sale prices. The market for new high yield issues is terrible right now. Even in the investment grade exposures, the incentive to refinance is extremely low. The yield curve is flat and translated upwards. While rates could go a little higher from here, they are already high, and the best bet at this point is to hope for a total change in the yield curve, because there’s certainly no benefit from acting sooner rather than later when the yield curve is flat.

- In the institutional brokerage business, the equity brokerage segment is doing well thanks to volatility. On a sequential basis it is growing modestly, on a YoY basis it is growing substantially but this is also because of an acquisition of Cornerstone last year which is massively exaggerating the YoY growth. Tailwinds are certainly there but not to the shown extent. Fixed income is bad. Fixed income service solutions is doing poorly sequentially because activity in those markets has fallen so much. The lack of velocity in fixed income trading as things get so uncertain and the clientele being conservative credit unions, banks and other public entities, until things stabilise in the rate environment things are pretty uninteresting here.

Bottom Line

Management was quite underwhelmed by its own quarter.

I would say, to be honest, not much has changed. I mean we had a small sequential pickup. I mean that can be from just a couple of larger fees at close, I mean, we continue to see things a pretty difficult market. Deals are getting done, they’re taking longer, longer to get announced, longer to get closed. Financing market’s still tough. Maybe as with the passage of time, buyer and seller expectations start to line up. But I think we just — we sort of view it as more of the same, and that’s sort of the trend we’ve seen into Q4 here.

Chad Abraham, CEO of PIPR

Analysts were probing to see if the sequential strength in the investment banking businesses may have been interpreted by management as a signal of momentum among corporates, where we know for sure that financial sponsors are more passive right now, but the reality of closing transactions remains very difficult as everyone remains wary of the uncertainty. Also converting conversations with clients into any business is more difficult than before.

While not overly dependent, the sponsor side also remains difficult as sellers have still not fallen into line on pricing.

However, PIPR has been adding to the restructuring line up these last quarters. We have yet to see how that business would come online if things got even tougher. If there’s a pivot and a soft landing all the other businesses would see recovery, and it wouldn’t matter. Overall, PIPR isn’t flailing in most of the possible economic scenarios. They demonstrate good topline resilience across their businesses. While we’re not buyers because they could easily be affected by sentiment still to the downside, and their multiple is high on forward earnings, the increment shouldn’t be too poor for PIPR.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment