Pioneer Natural Resources’ dividend has been a gusher for investors over the last year.

grandriver

Having traded investment grade fixed income, we were trained to always question rates/yields that are outliers to peer groups. Sometimes you can do some research and get comfortable with outlier yields, but the vast majority of the time there is a reason that things trade out of line versus peer investments. That is not to say that it is always a bad reason, sometimes there are good reasons – although in these situations sometimes you have to look at another measurement (such as yield to call, or YTC).

Investors have become infatuated with energy dividends over the last 18-24 months, so much so we have seen a number of companies stop paying the special dividends which had become a bit of a trend and instead make their quarterly dividends “blended”. Pioneer Natural Resources (NYSE:PXD) is one of those companies, and due to some decisions made by management the company is currently able to pay a forward dividend yield of just over 13% via a base dividend of $1.10/share per quarter and a variable dividend of $7.47/share per quarter for a total of $8.57/share per quarter. As impressive as this return of capital is for shareholders, it actually gets better because Pioneer is also utilizing share repurchases; with the current share repurchase plan authorized to buy back $4 billion of the company’s stock, of which $3 billion is still available.

So What To Make Of The Dividend?

Pioneer Natural Resources’ management team is one of the E&Ps who have been carrying little to no hedging exposure. When prices move in your favor it certainly looks like you hit it out of the park, and right now Pioneer has. Due to the variability of cash flows due to the company’s lack of hedges, investors need to do a deep dive into how they view the energy market moving forward in order to establish some comfort into the safety and sustainability of the company’s dividend moving forward.

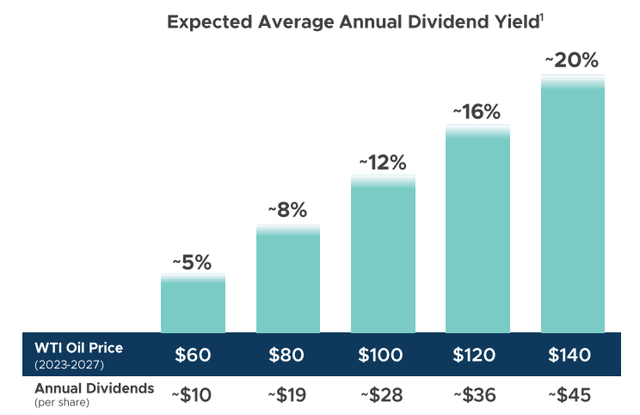

To start this exercise one needs to look at management’s estimates on where the dividend will be based upon energy prices. The following graph lays this out:

Pioneer Natural Resources’ management team’s estimated annual dividend at various WTI oil prices. (PXD Investor Presentation)

The above graph gives investors a good idea of where management believes the dividend will be based off of WTI oil prices, but that still does not tell the entire story. While Pioneer has a lot of oil production, it also produces a lot of NGLs and dry natural gas. Since the company does not have hedges, changes in prices for this other production can impact the dividend as well, which is why investors also need to look at the below information when modeling out their price assumptions.

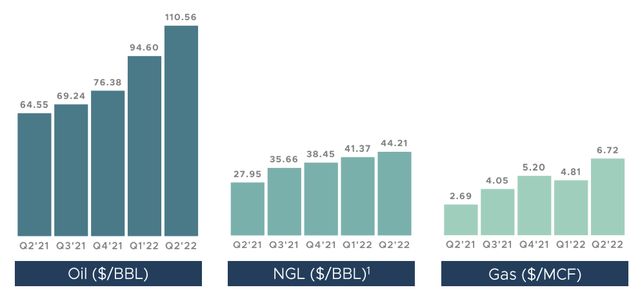

PXD has benefited from higher realized prices across the board for their production. (PXD Investor Presentation)

Oil makes up over 50% of Pioneer’s production, with NGLs and natural gas making up the rest. NGL pricing is more closely tied to oil prices than natural gas prices are, but we think investors might want to pay attention to the realized pricing in Q2 2022 for oil and natural gas. Oil prices have fallen a little over 10% (although that is not to say that Pioneer’s realized pricing has fallen that much) and natural gas prices have shot up lately due to U.S. natural gas prices now being bid up by European buyers.

Back of the envelope math tells us that the dividend (base and variable) could increase yet again next quarter off of higher natural gas prices, even with the pullback in oil prices. While that is good news, the question we see arising is how the company will approach hedging moving forward. Prices cannot go higher forever, and we have seen both oil and natural gas price spikes in the past met with sharp sell-offs that saw a lot of pain for producers (which in some cases lasted years). We think this question will have to be answered over the next year or so, but also telling is that Pioneer’s CEO Scott Sheffield believes that oil prices will average $100/bbl or more over the next five years.

Natural Gas prices have been on a run this year, having doubled with European buyers bidding up American LNG imports. (Seeking Alpha)

So then one has to wonder how sure Pioneer is about natural gas prices moving forward and where they see fair value. Over the last almost 30 years natural gas prices have only traded above current levels two times, and with the current fracking era in full force one has to wonder if prices will correct as quickly as they have in the past. Keep in mind, Russian gas is not flowing due to trade restrictions, but that gas is not truly lost/depleted production, it is just currently misplaced, or maybe it would be best to describe it as semi-displaced. With that in mind, any additional natural gas supply coming online today might very well hurt prices in the future when Europe finally figures out their natural gas problem (will they still buy U.S. natural gas and utilize LNG transport or will they look to Africa or Israel for natural gas to be pipelined into the continent).

Hedging Impact

The risk as we see it is that an aggressive U.S. Federal Reserve takes the wind out of the sails of energy prices, and lower energy prices would have an outsized negative impact on the company’s dividend (due to the large percentage of the variable portion of the dividend). Let’s not forget that investors pay up for repeatable, safe cash flows, so Pioneer shareholders might benefit from management taking some energy price volatility risk off of the table via hedges. Yes, hedges cost money, and could lower earnings and cash available for distribution, but by hedging the company could confidently adjust the ratio of fixed to variable components of their dividend. Remember, currently the company’s fixed, or as they describe it – base, dividend has a yield of roughly 1.67%, or only 12.78% of Pioneer’s total 13.06% yield.

Hedging could take away a good bit of future upside if oil and natural gas prices continue higher, but we look at it as an insurance policy. One does not have to hedge all of their production, just a portion of it, and even with hedges of 20% of production we think there would be a clear path for the company to adjust their fixed/base dividend to around 30% of the yield.

Moving Forward

This is one of the best run, well-managed energy companies out there, and it does not hurt that they have some very attractive acreage as well. While we would prefer for them to hedge some production and focus on more share repurchases, we cannot argue with the hot streak that management has been on. Sometimes you have to let your winnings ride, we just hope that management is prepared to pivot when we reach the top of the market and do not leave investors to watch yield destruction should we have energy prices pull back sharply causing the variable rate dividend to decrease.

Pioneer’s ex-date is September 2, 2022 and the dividend is payable on September 16, 2022. While we like almost everything about this company, we no longer see it as a ‘Buy’ and instead think it is a ‘Hold’ at current prices until management increases share buybacks or enters hedges. Both of those moves would enable Pioneer to increase the fixed/base dividend rate moving forward, and right now that is what we are most concerned about; the safety of future dividends at predictable rates. That might not be a popular take among readers, but it is certainly prudent for a well-constructed portfolio dependent upon yield.

Be the first to comment