Pinnacle West Capital (PNW) is a regulated utility company operating in Arizona, serving 1.3 million customers, including the metropolitan area of Phoenix. While Arizona has seen a slight uptick in employment, the state carries one of the highest population growth rates at 1.7% versus the national average of 0.6%. Additionally, utilities are one of the few industries where investors can hide from COVID-19, as they provide essential services and stand among those with the least exposure (along with technology, telecoms, pharmaceuticals, consumer staples, etc.).

For many utilities, shifting sources of energy from coal into renewables has become mandated by the EPA and other federal guidelines. Fortunately, PNW stands ahead of the curve relative to most other electric utilities, with only 22.7% of the composition coming from coal. Management anticipates that the company’s coal consumption will be zero by 2031, and to have completely carbon-free energy production by 2050. Creating such goals and already making significant progress insulates against harsh decisions from the Public Utilities Commission and allows for the prospect of stronger returns for equity holders.

Operating Performance

PNW has been performing as most utilities should with a steadily growing customer base in combination with typical rate hike schedules supporting clockwork earnings growth.

Healthy depreciation in combination with the lowered corporate tax code has placed PNW’s effective tax rate ranging from 0% to 30% in the last few years. While high capital expenditure budgets have neutralized any free cash flow generation, management has needed to tap debt markets to finance its shift away from coal into natural gas and renewables. Fortunately, PNW is ahead of the curve relative to competitors and will enjoy lower transitional capex spend in the future.

Staying Conservative

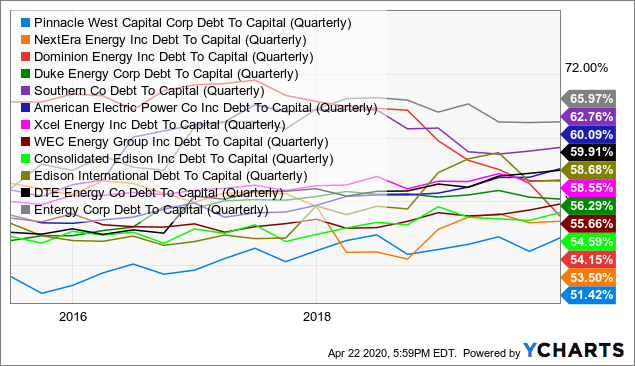

PNW management has still managed to maintain one the strongest balance sheets in the industry. For example, it carries one of the lowest debt-to-capital ratios relative to industry peers, including large caps:

Data by YCharts

Data by YCharts

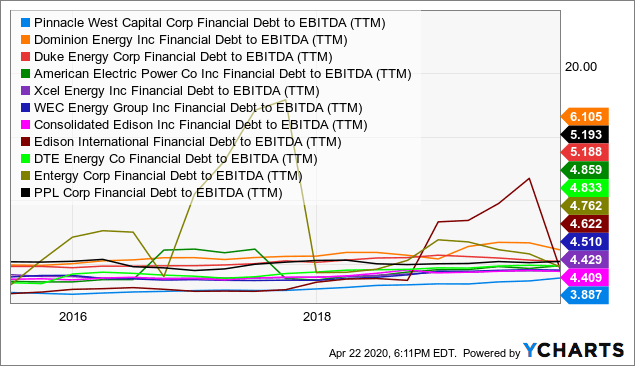

Alternatively, financial leverage remains low relative to operating performance as well, trending at only 3.9x, whereas most other utilities trend around 5x.

Data by YCharts

Data by YCharts

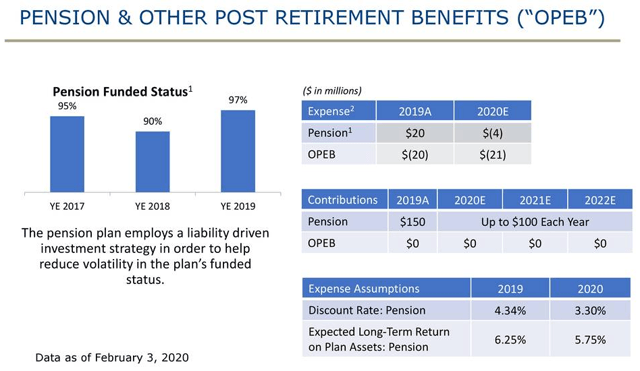

Balance sheet resilience has palpably weakened across the industry, especially in the last 5 years, for the sake of boosting EPS and adhering to continuous dividend hikes. Given PNW’s position, it carries a relative advantage. Another challenge that many public companies are working through are underfunded pension programs; these not only drag on long-term returns, but they have also been so devastating to even cascade companies into bankruptcy. Fortunately, PNW has made a concerted effort to have their employee pension almost entirely funded on an annual basis, while conservatively lowering their expected long-term returns:

Another interesting dynamic for utilities are the credit ratings. Nearly the entire utilities ratings universe is rated BBB, with only a small fraction A-rated or non-investment grade. The effective borrowing rate for A-rated operators is only 200bps, whereas BBB-rated peers have costs of 350bps or higher, plus or minus based on the industry factor. Given utilities that have most of their capital stack financed with debt, this cost basis has a significant impact for residual earnings. Fortunately, PNW maintains A credit ratings from all three bond rating agencies. Circling back to my comment from a previous article, PNW carries a leading cost position and has a solid maturity schedule:

The Dividend

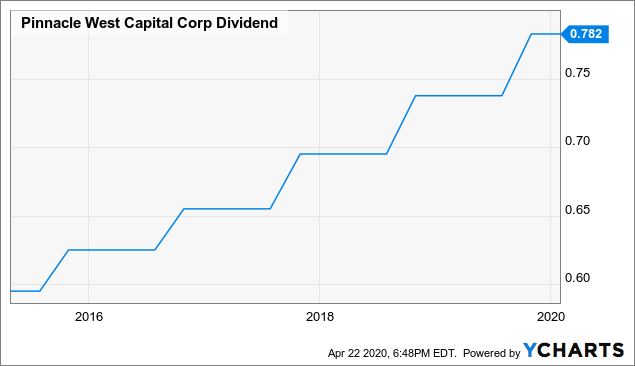

Perhaps the dividend yield of 4% isn’t the most impressive; however, it does exceed the Utilities Select Sector SPDR ETF (XLU) dividend of 3.6% and there is certainly room for distribution increases in the future. Based on their historical earnings growth and dividend rate hikes, the annual dividend should exceed $4 by 2025, which would translate to a ~5% dividend yield today.

Data by YCharts

Data by YCharts

Bottom Line

In the COVID-19 world, utilities are a relatively safe place to park your money and it’s one of the few categories that will actually realize dividend increases going forward. Perhaps underfollowed relative to large cap utilities, PNW has a good story with its solid customer profile, well-diversified energy sourcing mix, strong capitalization, and having one of the safest balance sheets in the industry. Thank you for reading and please comment below.

Disclosure: I am/we are long PNW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment