JamesBrey

Thesis

Based on our analysis, we believe Pinduoduo Inc. (NASDAQ:PDD) is a contrarian, margin-expansion investment proposition that is perfect for investors seeking to regionally diversify their portfolios ahead of earnings. Unlike most Chinese technology stocks, Pinduoduo is a profitable business, with extremely strong moats and operating in an industry that is not in the crosshairs of the Chinese regulators. In addition, the People’s Bank of China (PBoC) has started to implement an easy monetary policy, which should provide support to high-growth tech stocks like Pinduoduo. Despite the recent drawdown in Chinese ADRs, we believe Pinduoduo is a good long-term investment for those who are willing to bear short-term headline risks and hold investments in China.

Strong Business Moat

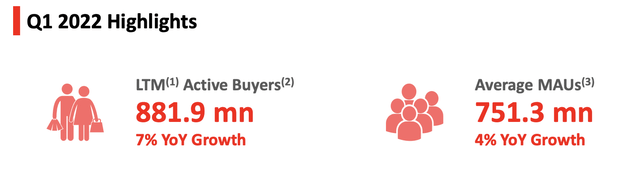

Pinduoduo’s feed-based shopping platform and a business strategy centered around user experience are key factors that contribute to the company’s business moat. In short, Pinduoduo takes a more “social approach” to e-commerce by integrating a social feed into the shopping experience, in addition to adding games and AI-driven algorithms to recommend products and services. We believe that these competitive advantages have contributed to consistent MAUs (Monthly Active Users) to the tune of 750 million users and Active Buyers of around 900 million people. The sheer number of users on its platform provides Pinduoduo an unparalleled business moat in China, and we believe the lack of threat of new entrants will allow the company to increase profitability and margins over the long term.

Pinduoduo Q1 2022 Earnings Presentation

Financials and Valuation

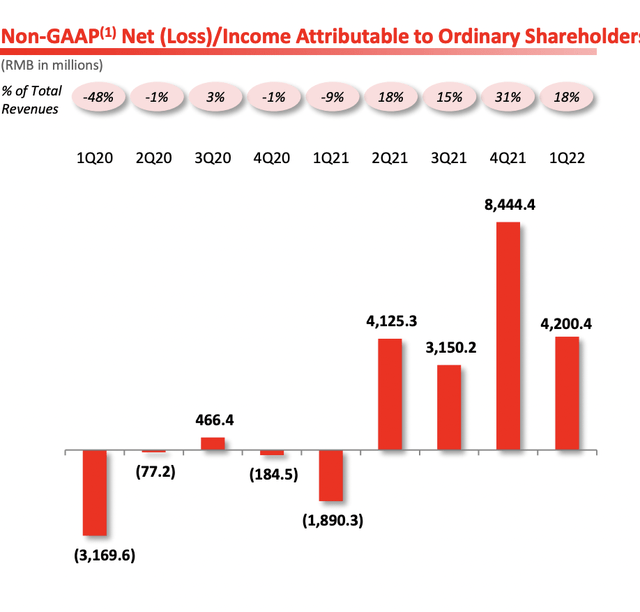

We believe that Pinduoduo’s stock price is likely to appreciate with the increase in its top-line number and an expansion of its profit margin, as the company focuses on increasing profits. The company has only recently become profitable and is still in the early stages of profitability. In the last 8 reported quarters, the company averaged ~9% net profit margin as seen below. For the past 4 quarters, the company has seen a quarterly net profit margin range between 15% and 31%. We believe that in 5 years, the company should comfortably be able to reach a 20% net profit margin as the baseline. This profit margin of 20% is similar to a social media/tech company like Meta (META) which has reported a net profit margin of ~22% in the last quarter.

Pinduoduo Q2 2022 Earnings Presentation

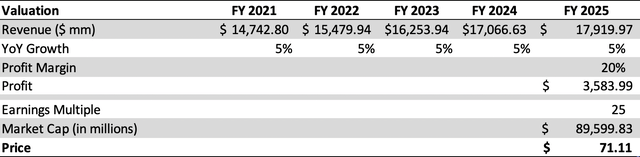

If revenue continues to grow at around an average of 5% in the next 5 years (slightly above GDP growth and below the recently reported 7% YoY quarterly revenue growth), we could see Pinduoduo’s price rise to $71.11 per share at a valuation of ~25x P/E. That presents a ~44% upside in 3 years (FY 2025) in this conservative scenario (in 2020, the stock price reached as high as ~$200 as recently as last year). Any expansion of its earnings multiple, or higher than expected profit margin would propel the stock to a price higher than the one estimated below.

Sweet Minute Capital Valuation Model

Economic and Geopolitical Risks

It is no secret that the Chinese economy is under pressure from various macroeconomic and geopolitical circumstances. Retail sales are sluggish and property values are on the decline. In addition to economic pressures, there are a lot of political uncertainties in China with the upcoming National Congress of the Chinese Communist Party and the continued worsening of U.S. and China relations after Nancy Pelosi’s visit to Taiwan. We are cognizant of these macroeconomic and geopolitical forces and how these forces may weigh down on the long-term profitability of Pinduoduo. However, we believe that Pinduoduo’s platform-based business model will fare much better than most traditional Chinese businesses due to its scale and high margins. Recent PBOC’s rate cuts and infusion of cash through repo operations should signal an easy monetary environment that should support prices of high P/E stocks like Pinduoduo. In addition, through initiatives that help Chinese farmers in rural regions and with no previous history of aggravating Chinese regulators, we see minimal risk of political circumstances materially affecting Pinduoduo’s business prospects.

Summary

We believe Pinduoduo is a great investment for investors who are looking for regional diversification and shareholder value growth for the long term. Pinduoduo has strong business moats and financial performance that will weather most macroeconomic and geopolitical challenges, and we believe that recent PBOC rate cuts and easy monetary policy will provide a floor for the stock price. In addition, based on our fairly conservative valuation model, we see that the stock can have considerable stock price growth over the next 3 years.

Be the first to comment