DNY59

Introduction

The PIMCO Dynamic Income Fund (NYSE:PDI) is a fund that invests worldwide into fixed income investments. The fund’s securities consists of a diverse basket of emerging market corporate and sovereign bonds, mortgaged backed securities, and various other domestic investment/high-yield corporate bonds. This fund is a solid choice for income seeking investors who want an income stream during a tumultuous market. The management has combined investment experience of over 80 years. Furthermore, volatility is low enough to provide risk-averse investors with adequate utility and superb risk-adjusted performance.

Fund Statistics

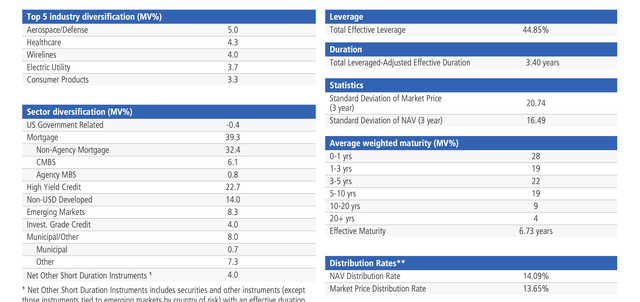

The following is the fund’s characteristics including the fund’s diversification, volatility, duration, and leverage.

Pimco

At first glance, you see that the fund is diversified amongst numerous types of fixed income producing vehicles in different regions and industries. The fund also has an average weighted maturity of only 6.73 years and a leveraged adjusted duration of 3.4. Through the funds diversification among so many types of investment vehicles, combined with its fairly low maturity and duration, this fund has solid interest rate risk, given its high yield. In addition, this fund has a proven track record providing high distributions for investors as they’ve never missed on a distribution in 10 years.

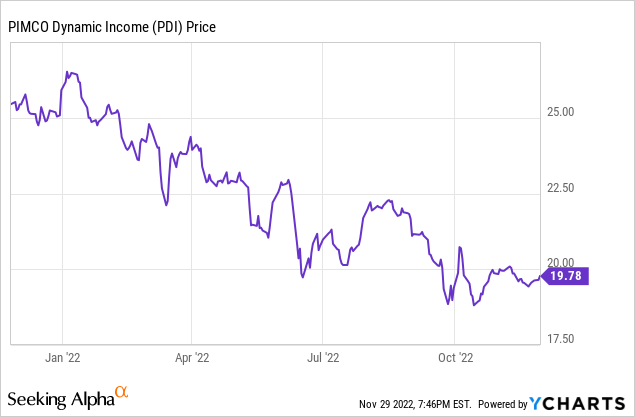

Seeking Alpha

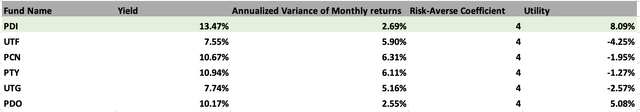

Applying Utility Theory Towards PDI

Due to income investors generally being more conservative, I did a basic utility analysis comparing PDI to other funds with similar objectives and mandates. Utility is how much investor satisfaction an investor derives from an entire portfolio. A higher utility indicates higher satisfaction while a lower utility indicates lower investor satisfaction. For the sake of this analysis, we will only incorporate income generated on the fund, not expected capital appreciation. Looking among the peer group generated by Seeking Alpha, and using a risk-aversion coefficient of 4, we have our utility coefficients among different funds with similar strategies and mandates.

Author’s calculation

As seen in the visual above, PDI exhibits the highest utility out of the comparable funds, assuming we only look at distribution. This means that risk-averse investors would be getting the most utility out of PDI, assuming we only look at the fund’s current yield and not capital appreciation.

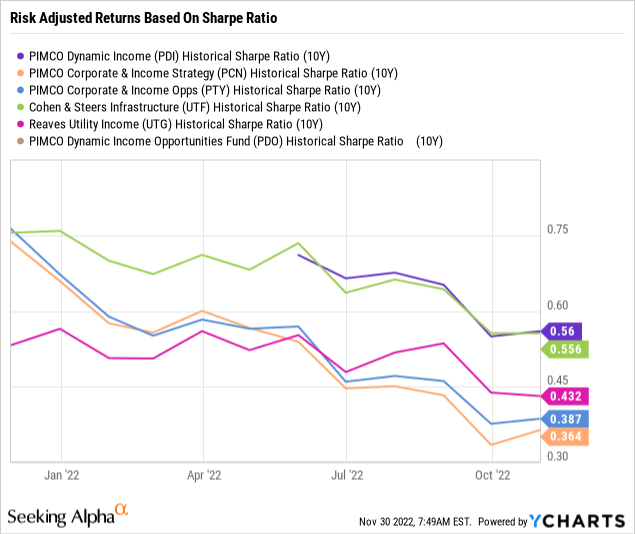

Risk-Adjusted Comp Analysis

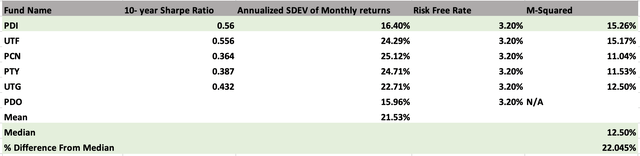

Next, we will look at risk-adjusted performance as income seeking investors generally prefer lower volatility and tend to be more risk-averse. The following is a comp analysis on PDI and other similar funds to relatively measure PDI’s risk-adjusted returns. First, we’ll look at the Sharpe ratio which measures how much per unit of standard deviation the fund returned above the risk-free rate. The following is the 10-year Sharpe ratio of all similar funds to PDI.

As you can see, in the long term, based on the Sharpe Ratio, investors have received the highest risk-adjusted return from PDI when compared to similar funds. Next, we will also look at the M-Square statistic which also measures risk-adjusted performance and expands on the Sharpe ratio. Using the mean standard deviation as the benchmark standard deviation for these funds, the current 5-year U.S government bond yield as the risk free rate, and the standard deviation of each fund, we computed the M-Squared statistic to relatively measure PDI’s risk-adjusted performance.

Excel

Once again, notice that PDI outperformed its peers based on the M-Squared statistic. This concludes that the portfolio managers at PDI have utilized their combined investment experience to model a portfolio that has superior long-term risk-adjusted performance that also can maximize risk-averse investors utility.

Risk Factors: Heavy Reverse Repo Usage

The risk factor that should be discussed is the fund’s heavy reliance on reverse repo for interim financing. Currently, PDI uses a heavy amount of reverse repos to magnify their current returns.

Pimco

With 43.27% of their total assets being tied up in reverse repos, the fund runs the increased risk of liquidity events and more severe drawbacks. Comparably, PIMCO Corporate & Income Strategy Fund (PCN) only has 28% of their total assets used in reverse repos. Leverage tends to be a double-edged sword; it works until it doesn’t. With that being said, the fund has still outperformed their peer group on a risk-adjusted basis. Additionally, where their risk exposure is higher with leverage, the fund makes up for it by owning fixed income vehicles with reduced interest rate risk.

Conclusion: Suitable For Relatively Conservative Investors Who Just Want Income

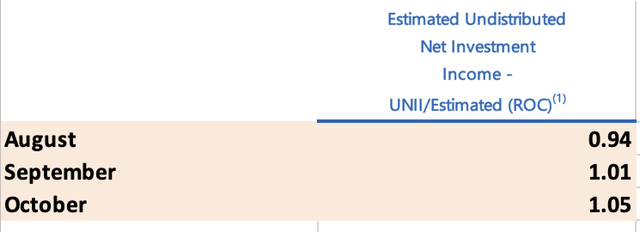

To conclude my analysis on PIMCO Dynamic Income Fund, the fund invests in a diverse basket of fixed income instruments while providing a stellar track record of risk-adjusted performance. Secondly, the fund based on its distribution yields a higher utility for risk-averse investors than comparable funds. Thirdly, the funds positions have relatively mid-to-low interest rate risk when looking at the portfolio’s weighted average maturity and effective duration. Finally, a possible additional distribution could be provided at year-end as undistributed net investment income per share has been rising month-to-month from 0.94 to 1.01 during August and September and then again from 1.01 to 1.05 from September to October.

Pimco

Overall, this fund is a solid addition for relatively conservative investors who seek income, especially if you think interest rate hikes will subside or possibly even come down.

Be the first to comment