Feverpitched

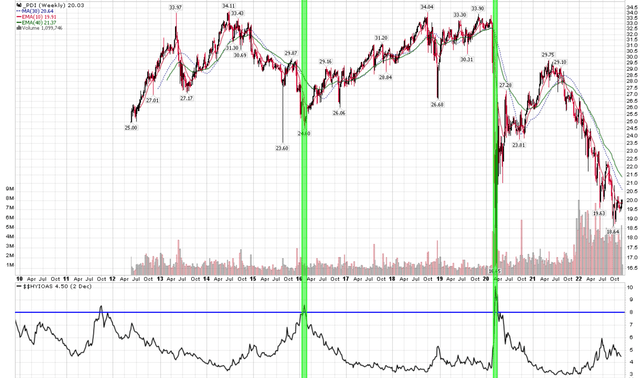

A few months ago, I initiated coverage on the PIMCO Dynamic Income Fund (NYSE:PDI) with a few cautious articles, highlighting the risk of its portfolio holdings heading into an interest rate hiking and credit tightening cycle.

Since the summer, PDI has lost approximately 5% on a total return basis on the back of the Federal Reserve’s consecutive 75 bps rate hikes in September and November, validating my cautious view.

As we head into year-end, a reader recently asked if I had any updated thoughts on PDI, given ‘we are close to a bottom in bonds’ (Figure 1).

Figure 1 – Question from a reader (Seeking Alpha)

So here are my updated thoughts on the Fed’s monetary policies, the economy, and their combined impacts on PDI.

Fed Set To Slow Down, But Signal ‘Higher For Longer’…

Those who follow the financial news will know that in the past few months, the Federal Reserve have sent out numerous smoke signals on their intention to slow down the pace of rate hikes (as an aside, readers interested in U.S. monetary policy should definitely follow WSJ’s Chief Economics Correspondent Nick Timiraos, as he has been nicknamed ‘The Fed Whisperer’ for his timely articles on the Fed’s policies and thought processes; some even speculate he is used by the Fed to guide market expectations).

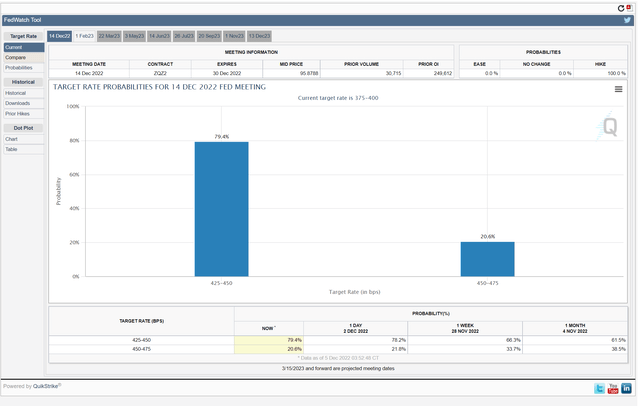

As of December 5th, the market implied probability of a 50 bps rate hike sits at 79% (Figure 2). In fact, Chair Powell all but confirmed a step down to a 50 bps hike at the upcoming December 14 FOMC meeting, during his Brookings Institute speech.

Figure 2 – Market Implied Fed Funds rate (CME)

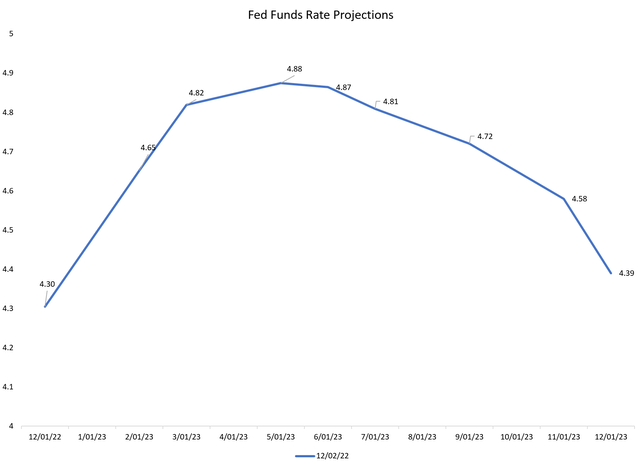

However, while the markets have ‘listened’ to the Fed on their desire to step down to a 50 bps hike in December, they seem to have ignored the second and third part of the Fed’s message that the Fed wants to raise interest rates to a higher than expected level in 2023 and keep it there for an extended period of time to defeat inflation. As of December 2nd, 2022, Fed Funds futures were pricing in a peak terminal Fed Funds rate of 4.88% by May and a quick decline (i.e. Fed rate cuts) to 4.39% by December 2023 (Figure 3).

Figure 3 – Market implied Fed Funds rate projections (Author created with data from CME)

…But Markets Pricing In A Recession For 2023

Why have the markets ignored the Fed’s ‘higher for longer’ message? The answer may be because of rapidly deteriorating economic data and the fears of a global recession in 2023.

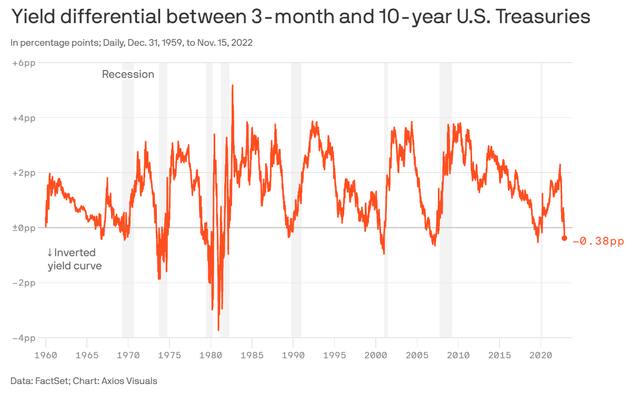

For example, the recent S&P Global Flash U.S. Composite PMI reading of 46.3 was a big miss versus consensus and is “consistent with the economy contracting at an annualised rate of 1%”, according to S&P Global Market Intelligence’s Chief Business Economist. The ISM Manufacturing index also recently recorded its first contraction since May 2020. Finally, the 3M-10Yr yield curve is the most inverted in years, suggesting a recession is imminent (Figure 4).

Figure 4 – 3M-10Yr Yield Curve Inversion (Axios)

These, and many other indicators and projections, strongly suggest a recession is in the cards for 2023. Therefore, the market is betting that the Fed will have no choice but to start cutting interest rates as soon as the middle of 2023 in order to boost growth.

Is The Bear Market Over For PDI?

Having laid out the monetary policy and economic backdrop, the next question is how will PDI react and perform? I see two likely scenarios developing for PDI.

No Recession – PDI To ‘Muddle Through’

First, the optimistic scenario is that all the indicators I have highlighted above are wrong, and the economy will not suffer a recession. This scenario is supported by the recent November ISM Services PMI reading of 56.5, which shows the U.S. services sector still expanding rapidly in November. Readers should note that the U.S. economy is ~70% services, so it is possible the U.S. economy avoids a recession on the back of strong service businesses.

However, if the economy does not enter a recession, then investors need to worry about the ‘higher for longer’ threat from the Fed. This is because last week’s jobs report showed the labour market remained extremely tight, with average hourly earnings (“AHE”) rising 5.1% YoY, far above the consensus 4.6%. The Labour Force Participation rate also declined 0.1% to 62.1%. Recall from Powell’s Brookings Institute speech, he split inflation into 3 parts: goods inflation, housing, inflation, and services inflation. Goods inflation has likely peaked, housing inflation is set to decline due to higher interest rates, but the key to the inflation outlook is services inflation. (author highlighted important passages)

Finally, we come to core services other than housing. This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.

Later on in the speech, Powell said:

Wage growth, too, shows only tentative signs of returning to balance. Some measures of wage growth have ticked down recently. But the declines are very modest so far relative to earlier increases and still leave wage growth well above levels consistent with 2 percent inflation over time. To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation.

Finally, in his conclusion, he said:

Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

Clearly, 5.1% YoY AHE growth is not consistent with 2% inflation, so if the services sector continues to run hot and pressure wages, then investors should expect the Fed to maintain a ‘higher for longer’ level of interest rates. Investors will have to adjust their Fed Funds expectations higher in H2/2023, which should pressure risk assets.

With respect to PDI, with no recession (so no deterioration in credit) but ‘higher for longer’ interest rates, I expect PDI to ‘muddle through’, earning income while suffering from modest duration induced price declines as interest rates ratchet higher.

Significant Downside In Recession Scenario

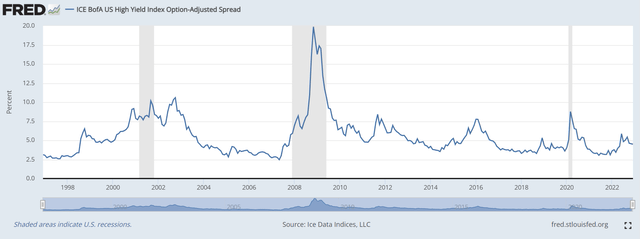

On the other hand, if the economy does enter a recession, then I expect credit spreads and bond defaults to spike, as companies will struggle to service their debts. A recession has never occurred without a rise in high yield credit spreads (as measured by the ICE BofA High Yield OAS) to 8-10% (Figure 5). We are currently at 4.5%, so there is significant price downside to junk bonds in a recession scenario.

Figure 5 – High yield credit spreads spike during recessions (St. Louis Fed)

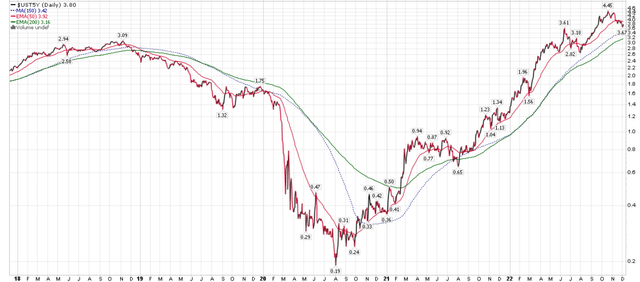

A 1% increase in credit spreads has as much impact to a bond as a 1% increase in interest rates. YTD to October 31, the 5 year treasury yield (for PDI, I compare it to 5 Yr treasuries as PDI’s leverage adjusted effective duration is 4.5 years) went from 1.3% to 4.3% (Figure 6) and high yield spreads modestly widened from 3.1% to 4.6%.

Figure 6 – 5Yr treasury yields (stockcharts.com)

Based on 1st order approximation (price change = duration x change in yield), PDI’s portfolio should have lost 20.3% in price YTD to October. In fact, PDI’s NAV declined 24.7% YTD to October 31, 2022, so the 1st order approximation was fairly accurate.

Looking forward, if high yield spreads were to spike to 8-10% in a recession, I expect PDI’s 2023 returns could be as bad as 2022, if not worse, even if the Fed were to cut interest rates. This is because the spike in credit spreads will outweigh any decrease in treasury yields from expected Fed rate cuts.

Continue To Wait For A Good Entry

Personally, based on the weight of the evidence, I believe a recession is more likely, so I am waiting for a good entry in PDI when high yield spreads do spike into the 8-10% range (Figure 7). As I wrote in my most recent article,

While I’m not predicting a COVID pandemic level crash in the markets, we see that every few years, credit markets do give investors good entry points (2009, 2011, 2016, 2020). Hence I would recommend patience for investors on the sidelines.

Figure 7 – HY spread > 8% have been good LT entries (Author created with price chart from stockcharts.com)

Distribution Coverage Still Solid

Finally, it is worth mentioning that the PDI fund is still covering its distribution from income. My analysis above revolves around the movements in interest rates and credit, which affects the portfolio’s NAV.

From PDI’s latest Undistributed Net Investment Income (“UNII”) report, we can see that PDI has 3 and 6 month rolling coverage ratio of 136% and 157% respectively.

However, I should note that PDI has no operating history within a recession (the fund was launched in 2012 and the only recession it has seen was the short COVID-pandemic recession). It is unclear whether the portfolio’s income will be maintained in a recessionary environment.

Risk To My Cautious View

The biggest risk to my cautious view is a ‘soft landing’ scenario where the Fed achieves lower inflation without having to raise interest rates ‘higher for longer’. Based on the data we’ve seen to date (ISM Services, labour report), I think that is a low probability outcome, but I will keep my mind open to the possibility and adjust my thinking based on incoming data.

Conclusion

Personally, I am in the recession camp, as the data I look at suggest a significant economic slowdown is imminent. However, if one were optimistic, a ‘higher for longer’ interest rate scenario would probably mean subpar investment returns for PDI as duration offsets income. I believe more patience will be required.

Be the first to comment