Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 19.

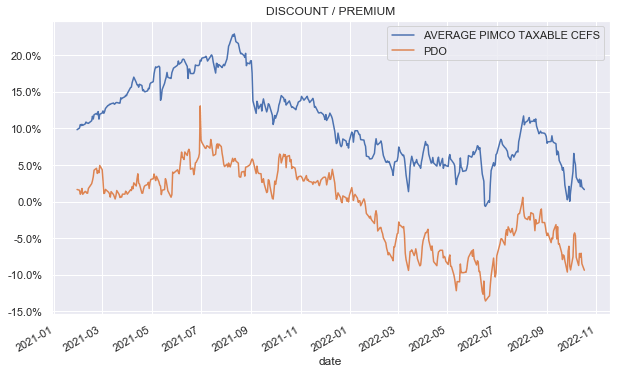

In this article, we provide an update on the PIMCO CEF suite. Specifically, we discuss the changes in leverage and distribution coverage for the month of September. We also discuss how the income profile of interest rate swaps held by the taxable funds has changed over this period of rising short-term rates. Overall, we continue to favor the Dynamic Income Opportunities Fund (PDO) which trades at a 8.2% discount and a 11.6% current yield.

Leverage Update

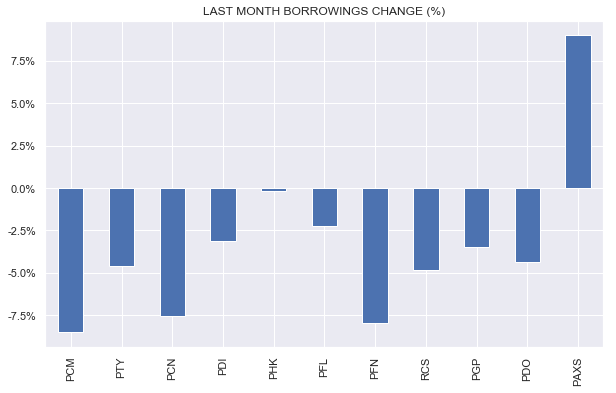

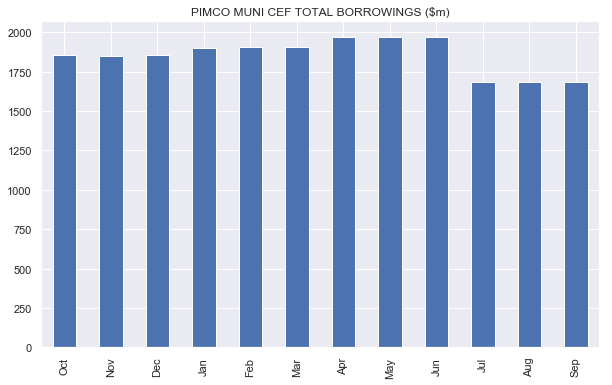

Taxable fund borrowings fell for the sixth consecutive month with all funds seeing a drop except for (PAXS) which has been building up its leverage after its inception this year.

Systematic Income

Over the past 6 months the overall reduction in taxable fund borrowings is on the order of 15-40%. On a total asset basis this makes for a smaller drop – closer to 10-15% – which has a direct bearing on the income profile of the fund. These days a deleveraging is less impactful in terms of lost income because the cost of leverage is very high but the loss in income is still there.

Systematic Income

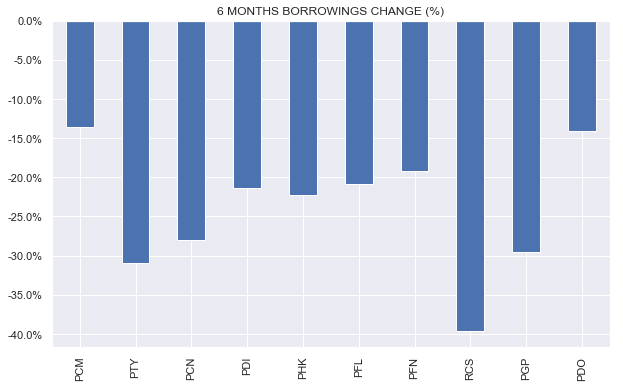

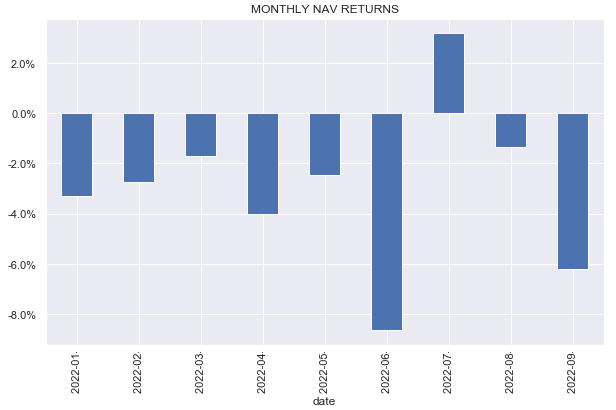

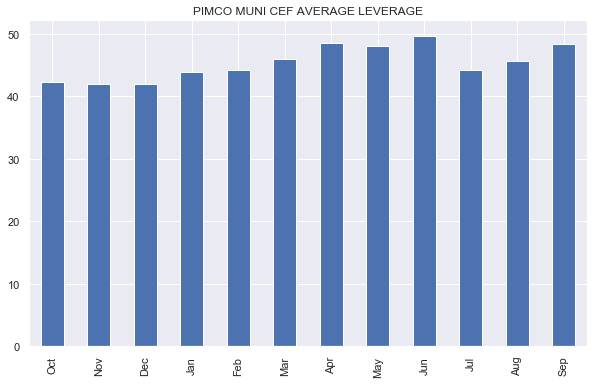

The reason for this continued deleveraging has to do with the simple fact that a drop in the fund’s equity level or the NAV (which has happened every month this year outside of July) mechanically increases its leverage. PIMCO funds try to keep their funds below a 50% leverage level (funds holding ARPS such as PFL, PFN and others have a lower cap) which necessitates a cut in borrowings to restore leverage to lower levels. The chart below shows the average monthly change in the PIMCO taxable CEF NAVs.

Systematic Income

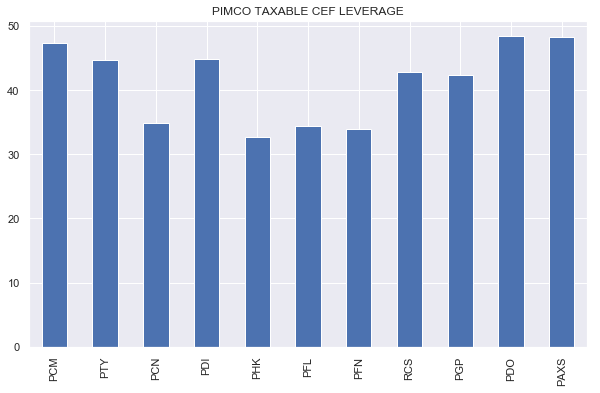

PAXS looks to have completed its leverage increase and is now on par with PDO as the second highest-leveraged fund in the suite.

Systematic Income

After a sharp deleveraging in July the Municipal funds have not done a whole lot.

Systematic Income

However, because Muni NAVs continued to fall after July the leverage of the Muni funds has risen and, once again, stands not far from their 50% leverage cap. This increases the likelihood of another deleveraging if Muni yields keep moving higher.

Systematic Income

Coverage Update

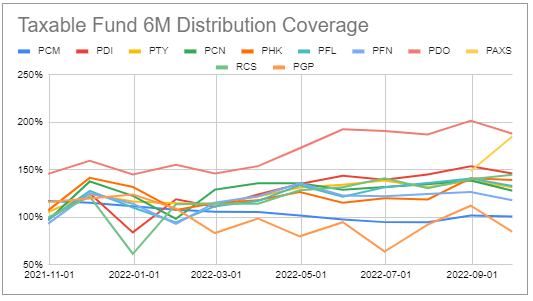

Taxable coverage fell for all but two funds: RCS and PAXS. The reason for the continued rise in coverage is clear for PAXS – the fund has been increasing its leverage over time. All taxable funds except for one have coverage north of 100%.

Systematic Income CEF Tool

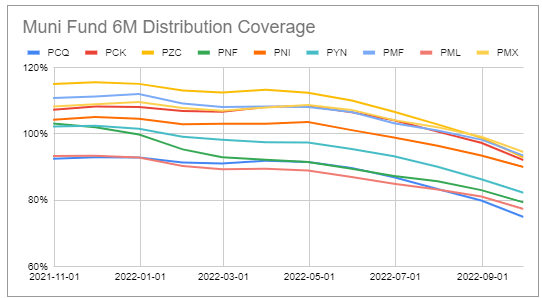

Muni fund coverage levels have continued to slide with all funds having coverage levels well below 100%.

Systematic Income CEF Tool

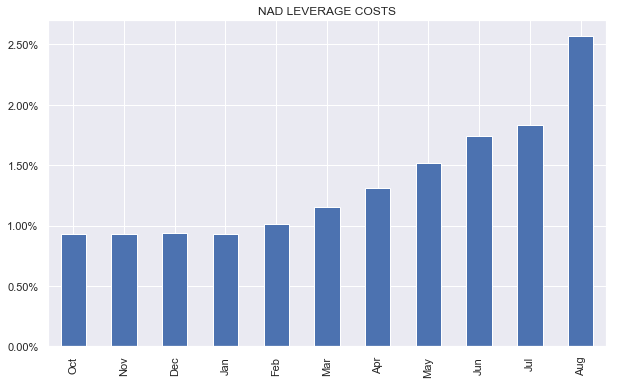

The rise in leverage costs as well as the recent sizable deleveraging in the Muni suite have continued to eat away at net income.

Systematic Income

A Tangent On PIMCO Data

In this article we take a quick look at whether swaps income is impacting overall income levels of the PIMCO taxable funds. This is because these funds are heavy users of swaps as we discuss below and changes in short-term rates have an impact in the level of income thrown off by swaps. However, first we need to make a complaint about PIMCO reporting – readers who aren’t interested in our whining are welcome to skip right to the next session.

Overall, the reporting by PIMCO CEFs is very good. There are detailed statistics on its website and monthly updates with regard to leverage, coverage, UNII and other key factors. However, one area where it seems to fall down is in aligning its holdings reports (provided on its website as excel spreadsheets) to its semi-annual shareholder reports.

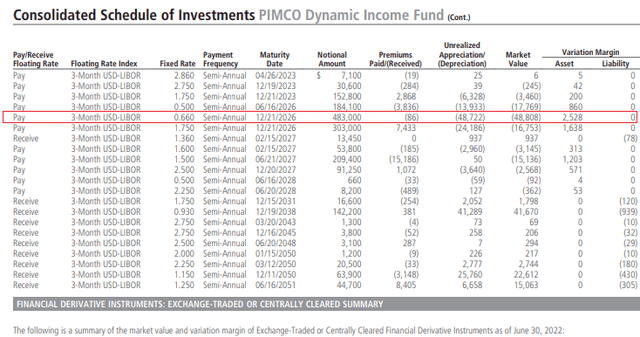

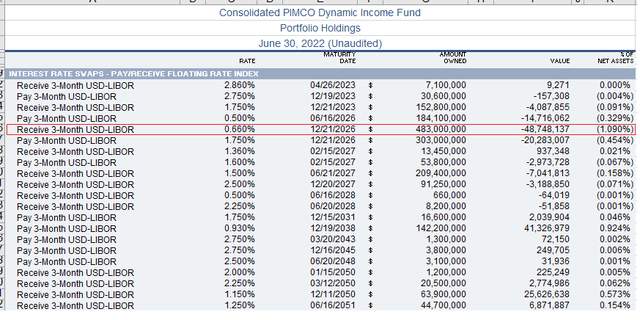

For instance, consider the following two screenshots – the top one is from its shareholder report and the second is from its holdings spreadsheet. Both are as of Jun-2022 and both document its interest rate swap portfolio.

We highlight the same interest rate swap in both – the largest swap as it happens – or the $483m 2026 swap. Notice that in the shareholder report it is shown as a “Pay Floating Rate” but in the spreadsheet it is shown as “Receive Floating Rate”. The order of the swaps is the same in the two reports however the “Side” i.e. Pay or Receive is all over the place.

We use the numbers from the shareholder report for three reasons. First, they are audited whereas the holdings spreadsheets are not. Two, they make a lot more sense from a mark-to-market perspective (a swap with a large negative mark-to-market would have the fixed coupon below the current swap par rate for the same maturity). And three, they are in line with the fund’s yield curve DV01 profile which we find in the NPORT-P SEC filings.

In short, this is not the end of the world but it’s pretty sloppy. We have asked PIMCO to correct this but have not heard back unfortunately. Complaint over.

Have Swaps Become an Income Tailwind?

A while back we discussed the unusual role of interest rate swaps in PIMCO CEFs. Specifically, PIMCO taxable CEFs use interest rate swaps in several ways. The first is to manage the duration exposure of the fund. This use of swaps is not unusual in the CEF space. For instance, most preferred CEFs use swaps to shorten up the duration exposure of their portfolios.

The second use of swaps by PIMCO is to take a view on the level of interest rates as well as the shape of the interest rate curve. Historically, PIMCO have had a strong view on the shape of the yield curve which has made it into their public commentary. This more tactical use of swaps is not unheard of in the CEF space but it’s fairly uncommon.

The third use of swaps by the PIMCO taxable funds is to manage its income profile. This can be managed by entering an off-market swap by setting the fixed-rate of the swap to some arbitrary (within reason) level. It is also done by entering into a forward-starting swap where cashflows are, in effect, switched off. PIMCO typically does this for swaps that would contribute negative income.

The key question we are trying to gauge in this section is how do the funds’ current swap portfolios affect their income profile. The answer to this question depends on 3 things. First, it depends on the fund’s actual swaps position. Two, it depends on whether the swaps are spot or forward-starting (i.e. whether their cashflows are turned on or off). And three, it depends on what has happened to Libor.

If we look at the largest taxable fund – the Dynamic Income Fund (PDI) – what we see is that there are no forward-starting swaps and that the yield curve DV01 position is broadly the same steepener profile the fund has maintained for a long time. This leaves Libor as the deciding factor in the fund’s swaps income profile.

The key technical point here is that typically a yield curve steepener will have less positive / more negative carry (i.e. income) when Libor rises, all else equal, and vice-versa. This is because the shorter-term part of the steepener where the fund receives fixed / pays Libor will carry a larger notional amount than the longer-term part of the steepener. In other words, on a net basis the fund will be a payer of Libor. So when Libor rises it detracts from the fund’s overall income.

Based on the PDI swap portfolio we estimate that its swap income went from +$15m to -$30m i.e. a drop of $45m from the rise in Libor from zero to 4%. A $45m swing in income is not particularly terrible for PDI which has $4.4bn of net assets – it is about 1% on the NAV – but it’s not insignificant as it’s about 7% of the fund’s total distribution rate. There is a lot of carryover to the other taxable funds given they, apart from PCM, tend to all have very similar swap profiles. The main takeaway here is that rising interest rates are a small headwind for the PIMCO taxable funds with respect to their swaps portfolios. However, because the funds hold a significant amount of floating-rate assets they are likely to be relatively immunized from rising short-term rates overall.

Takeaways

Within the taxable suite we continue to favor PDO. The fund’s widest discount in the taxable suite becomes increasingly attractive as bond fixed-income yields and short-term rates continue to rise.

Systematic Income

This is because higher fixed-income yields allow the fund to deliver a higher level of yield to investors and to offset its highest management fee in the suite – a dynamic we discussed here. And rising short-term rates hurt the income profile of those funds holding ARPS due to their coupon multiplier which we discussed here. The fund remains vulnerable to a further backup in Treasury yields and credit spreads, however, the valuation of the broader fixed-income space has reached historically attractive levels and PDO is an attractive way to participate in this.

Be the first to comment