Aguus/E+ via Getty Images

Investment Thesis

Photronics (NASDAQ:PLAB) is a very high-margin photomask technology business.

Photronics is well-positioned and is benefitting from a very strong pricing environment driven in part by chip shortages. If chip shortages start to improve, there’s likely to be a fast compression to its very alluring operating margins.

If that’s the case, paying 9x its 2024 won’t seem all that cheap.

However, for now, the story and the figures are very attractive. What’s more, Photronics has upgraded its financial model not once, but twice in the past few quarters. In fact, Photronics is now reporting revenues way ahead of schedule.

I rate this stock a buy.

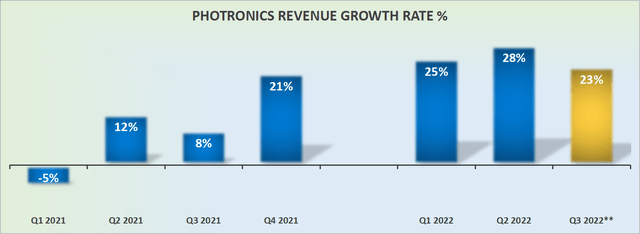

Photronics’ Revenue Growth Rates Are Fair

PLAB revenue growth rates

Photronics had a very easy comparison period in Q1 2022. Consequently, for Photronics to report 25% y/y growth rates was not an impressive deal.

However, when Photronics came against Q2 of last year and still reported attractive growth rates, that’s obviously a reason to take notice.

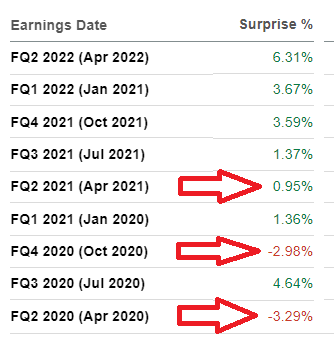

PLAB revenue surprises

During the bulk of fiscal Q2 2020 up until fiscal Q2 2021, Photronics was just as likely to beat its revenue estimates, as it was to just marginally meet estimates or even miss consensus revenue estimates.

However, more recently, Photronics appears to have righted its ship and is now handily beating estimates.

Hence, I’m inclined to suspect that when Photronics provides its 2-year guidance, it’s attempting to err on the side of caution.

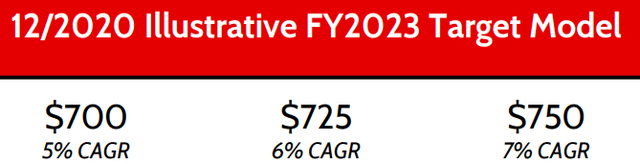

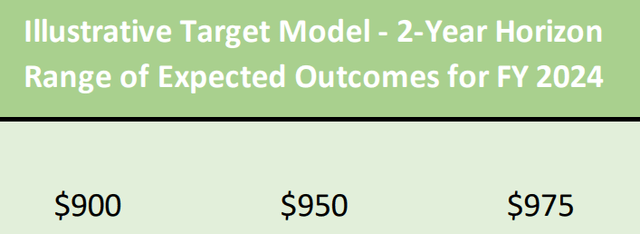

With that in mind, consider the following long-term targets:

PLAB Q4 2021 presentation

This target was provided as a 2-year outlook, together with its Q4 2021 results.

As you can see above, Photronics declared that at the midpoint of its range, by 2023 its revenues would have reached $725 million, while growing at a 6% CAGR.

Then, fast-forward to Q1 2022, when the following update was provided:

PLAB Q1 2022 presentation

What you see from Q1 2022, is a 2-year target, where the business is no longer growing at 6% CAGR, but instead, it’s now expected to grow at 10% CAGR, a 400 basis improvement in its revenue growth rates.

Next, more recently, together with its Q2 2022 results, this is its now updated target:

PLAB Q1 2022 presentation

Photronics removed CAGR guidance and instead increases its total revenue assumptions to $950 million at the midpoint.

Now note this, by the time Q3 2022 is completed, over its trailing twelve months Photronics revenue would have reached $790 million.

This will mean that Photronics will have surpassed its previous 2023 targets more than 1 year ahead of schedule. See the first long-term target, above.

This now begs the obvious question. What sort of CAGR could Photronics sustainably generate over the next couple of years?

Because if we take Photronics’ latest guidance, it implies that Photronics will go from $790 million in Q3 2022 to $950 million. That means that over the next 9 quarters, the business is at least expected to have an 8% CAGR.

Clearly, 8% CAGR is not aligned with the mid-20s% CAGR that Photronics is now growing at.

Either the business is going to substantially slow down and do so imminently, or Photronics will substantially increase its 2024 target when it reports its Q3 2022 results.

Is Photronics likely to slow down?

Photronics’ Near-Term Prospects

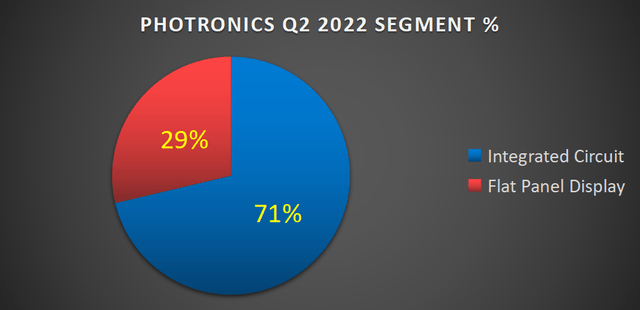

Photronics is a leader in photomask products. Its products are semiconductor masks and flat-panel displays. Photronics has two main segments, Integrated Circuit (”IC”) and Flat Panel Display (”FPD”).

PLAB segment percentage, Q2 2022

As you can see above, approximately 70% of the business is coming from its IC segment. And this segment just reported 30% y/y growth when compared with Q2 2021.

Consequently, one could argue that Photronics’ IC segment is able to make or break the investment thesis here.

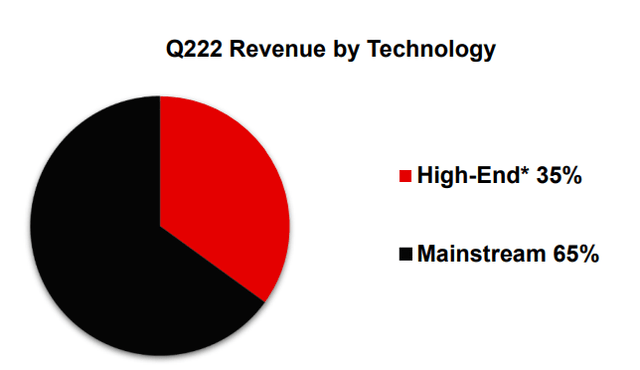

PLAB Q2 2022 presentation

And as you can see above, circa two-thirds of the revenue within its IC segment is coming from mainstream revenues. Think of it as being driven by consumer products, IoT, 5G, and Crypto.

This now makes the investor think, if we go into a recession, are these areas going to be immune? Or will a slowing economy be meaningfully detrimental to Photronics prospects?

Indeed, everyone knows the problem with the semi-industry. These companies get a tremendous amount of operating leverage. That’s why these stocks are often cheaply priced and carry a low multiple to free cash flows. When things are going well, these companies sizzle. But just as quickly, things can implode.

To that end, this is what an analyst put forward on the earnings call,

[…]What gives you confidence, because you were looking at some new target model metrics of over 40% gross margins, 30% operating margins, numbers we’ve never seen from the photo mask industry as a whole.

To which Photronics’ management replied,

[…] we have long term purchase agreements with many customers, some of which we’ve kind of renegotiated, and there were others coming up for renewal, some are one year, some are longer than one year, and as they come up for renewal, the prices–you know, the opportunity is still there to continue the price increases.

A lot of our locations are at capacity, so where the operating leverage is outstanding from those locations and then the opportunities created by the business environment to improve pricing, we expect to continue well into the future. I think you’ve read the same things that we’ve read, and most of what you read supports that assumption.

Essentially, Photronics makes the case that having long-term contracts in place while operating at capacity, provides Photronics with medium-term pricing power and sustainably high operating margins.

With all that in mind, let’s discuss its profitability profile.

Photronics’ Robust Operating Margins

Before getting stuck into its free cash flow potential, let’s spend a moment discussing its balance sheet. Photronics’ balance sheet has a net cash position of approximately $250 million and no debt on its credit facility. In short, it holds a very clean balance sheet, with plenty of flexibility.

Meanwhile, looking further ahead to Photronics’ 2024 target, Photronics expects to see around $2.55 of free cash flow per share at the midpoint of its guidance.

PLAB Stock Valuation – Priced At 9x Free Cash Flow

As touched on already, if we take Photronics’ 2024 midpoint target at face value, the business is priced at approximately 9x two years forward free cash flow.

As touched on throughout, semi-companies are notoriously cyclical. And when things are going well, they sizzle. But when things are not going very well, they rapidly implode for long periods of time.

For instance, consider Micron (MU). Obviously, Micron’s memory business is very different from Photronics’ integrated circuit business. But for context, keep in mind that Micron is priced at 6x this year’s EPS. Not 2023. Not 2024. This year, 2022.

Hopefully, this provides a framework to consider Photronics’ valuation.

The Bottom Line

There’s a lot to like about Photronics. Moreover, there are long-term contracts being put in place that provide Photronics with visibility. Having visibility and a history of meeting and beating estimates typically translate into a higher multiple to earnings over time.

Hence, I believe that paying a high single-digit to future free cash flow, for a business that is clearly growing at double digits, makes a lot of sense. I rate this stock a buy.

Be the first to comment