Huang Evan

The Dividend News

If you’re a Philip Morris (NYSE:NYSE:PM) investor, then it’s quite likely that you’ve already heard the news about the $1.27/share quarterly dividend. That’s an increase of 1.6% from the previous $1.25/share quarterly dividend. Of course, annualized, that’s $5.08 per share, per year.

On the surface, that’s fine news. There’s really nothing too crazy here, or at least that’s what I thought at first. But, this got me thinking about PM’s dividend track record and related trends. Plus, I started to see some very happy investors despite this slim increase. This article explores the dividend increase and the strange response I’ve seen. Most importantly, there’s something eating up PM and many other great stocks.

Dividend Grades

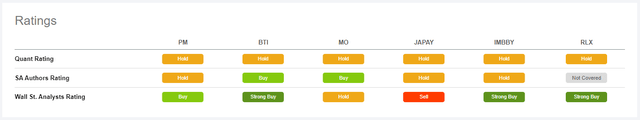

Seeking Alpha does a fine job providing an at-a-glance comparison of PM’s peers, including British American Tobacco (BTI), Altria Group (MO), Japan Tobacco (OTCPK:JAPAY) and Imperial Brands (OTCQX:IMBBY). Here’s a peek at the Quant Ratings, SA Authors Ratings, and Wall Street Ratings:

Tobacco Company Ratings (Seeking Alpha)

Interestingly, the Quant view says that PM is a hold. SA Authors feel the same way. Then again, the Quant view says Tobacco as a whole is a Hold. What’s more interesting to me is that BTI and MO are both a Buy according to SA Authors, versus PM. In a sense, this tells me that PM maybe isn’t the best value in Tobacco. That’s affirmed when PM’s Buy is compared to BTI and IMBBY, which both get a Strong Buy.

On a total return basis over five years, PM is up 5.6% which seems rather weak. However, that is far better than PM’s peers. See the five year total returns for yourself and then decide:

- BTI (13.4%)

- MO (4%)

- JAPAY (50%)

- IMBBY (22%)

That’s right. PM has outpaced all other major tobacco stocks. And remember, this is on a total return basis, so that’s capital gains (and losses) combined with all those juicy dividends. As a tobacco investor, this certainly doesn’t give me any warm and fuzzy feelings. What I can say here is that this data does partially explain why investors think PM is the best company. I’m just not sure it’s the best value. We’ll come back to that in a short while.

Here’s what else we know:

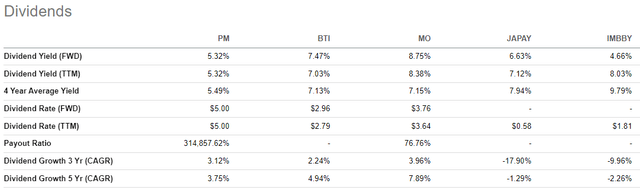

Tobacco Stock Dividends Compared (Seeking Alpha)

PM has the lowest dividend but it’s still in the same ballpark as its peers. It’s probably best here to be looking at the TTM yield, but we’re not going to get too hung up on the exact details. What matters more is looking at the three year and five year dividend growth rates.

PM’s been limping along with small increases. BTI is lumpy, but positive. JAPAY and IMBBY are ugly. The only stronger company in this comparison is MO. As a dividend champion, that’s not too surprising really.

How Things Get Weird

So, on the one hand, we have comments like this from H0ney_badger:

Somewhat surprised by the stingy raise here.

Along with comments like this from secorewb:

Disappointing but fair.

There are plenty of other comments like this, where investors and commenters are let down by PM’s 1.6% dividend raise.

But, at the same time, there are plenty of others who are satisfied. This comment from big8pointer is especially interesting:

I’ll take it, especially in this inflation environment.

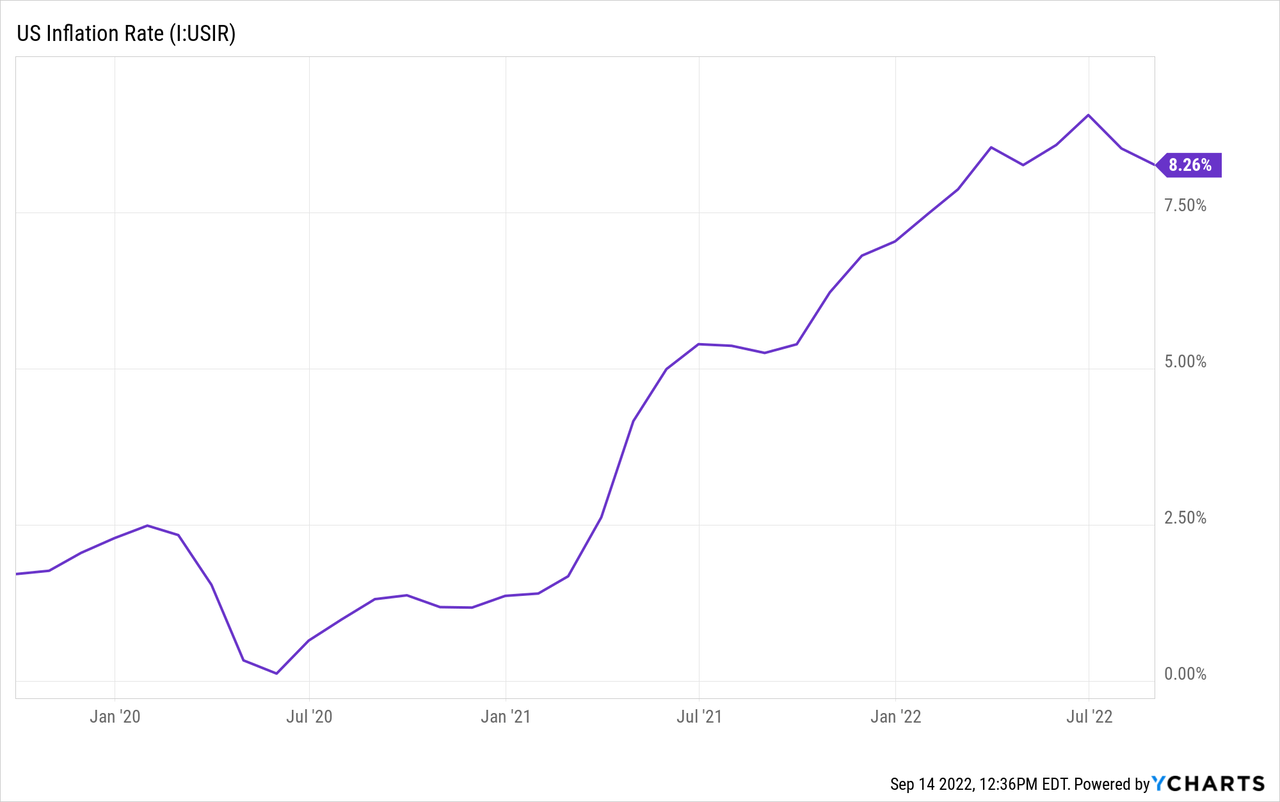

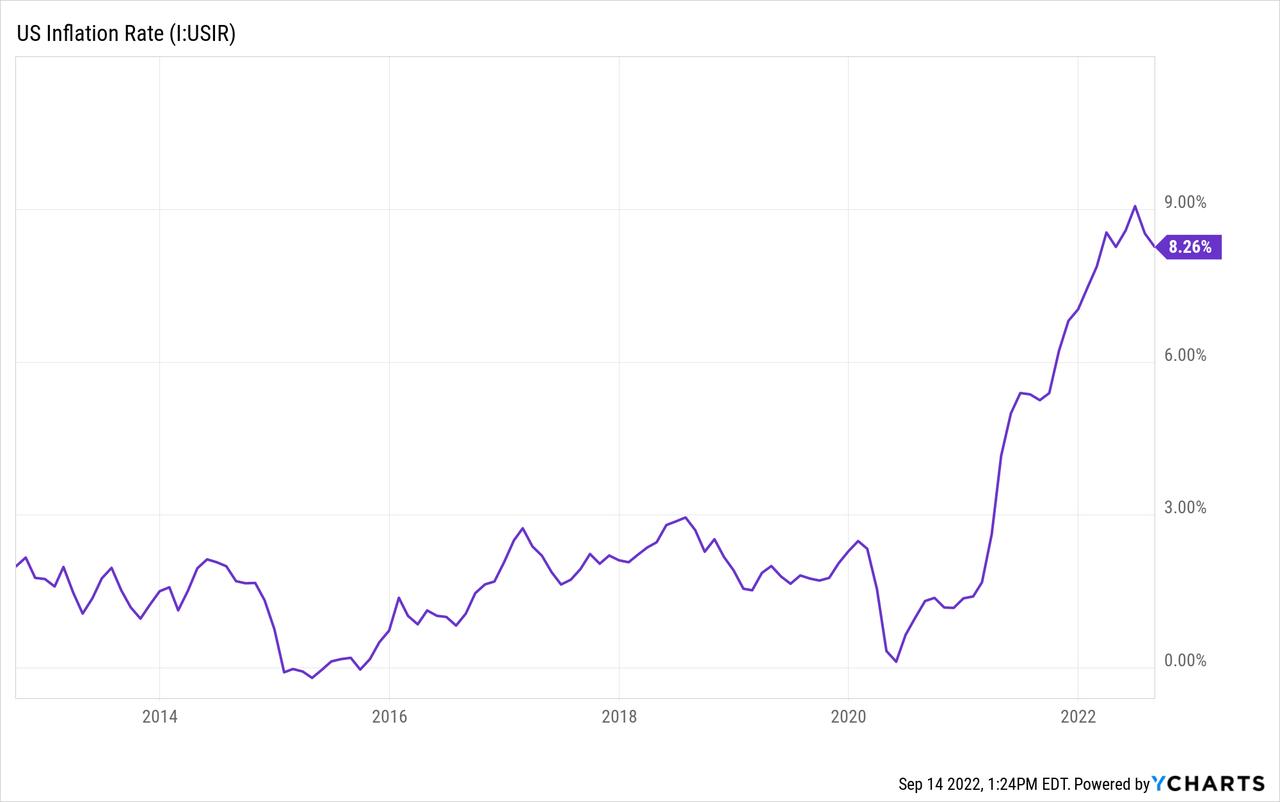

On the whole, it appears that investors are happy there was a raise but they are a bit disappointed in the size of the raise. The odd part is that the dividend raise is far, far below CPI, which itself is most likely far below real inflation. Take a look for yourself.

In other words, the 5.4% dividend yield plus the 1.6% increase are still below the inflation rate. Waving my thumb at this, I’m saying that holding PM means you’re losing money against inflation. Many investors depend on dividend increases to keep up their “cost of living increases” with their income producing stocks.

Before anyone throws any rotten tomatoes, I fully realize that most stocks aren’t keeping up with inflation right now. They aren’t growing fast enough, and the dividend increases aren’t keeping up well enough either. Put another way, very few growth stocks and very few high quality dividend stocks are beating inflation.

My key point right here is that a 1.6% increase isn’t meaningful in the face of inflation. Investors who believe they are winning with this kind of increase probably need to reassess their thinking. I’m also going to throw MO under the bus at bit. Last month, MO increased their dividend by 4.4%, which is nice, but again, it’s not enough to beat inflation. Folks, we’re losing and until inflation calms down, our capital is eroding and the value of our income is being chewed up.

Why The Paltry 1.6% Increase?

While I didn’t make a prediction like I did for MO, I did expect something a little bit higher for PM. Here’s some recent history:

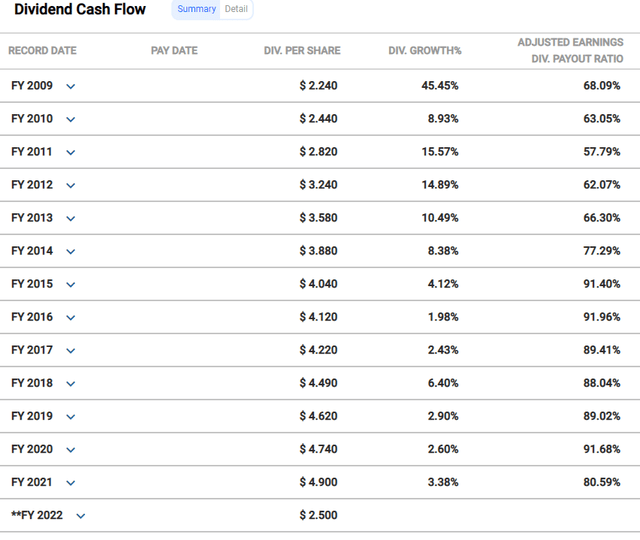

PM Dividend Increases (FAST Graphs)

Regarding increases, PM hasn’t done much since 2016. We’re talking about 2%, 2.4%, 6.4%, 2.9%, 2.6%, 3.4% and now 1.6% in 2022. That’s an average of about 3%, give or take. So, 2022 was even weaker than the limp increases over the last several years. The point is that the increases haven’t been huge and this recent increase is below average.

And, I suppose I’ll mention again that PM’s dividend increases are not keeping up with inflation. Well, they were roughly in line from 2016 to 2020, but 2021 and especially 2022 have been murder compared to PM’s increases.

So, what gives? Why has the mighty PM stagnated, especially in terms of dividend increases? I’ll keep it pretty simple here:

I’ll also be watching how this plays out:

On June 11, 2021, the Board of Directors authorized a new share repurchase program of up to $7 billion, with target spending of $5 to $7 billion over a three-year period expected to commence after the company’s second-quarter 2021 earnings call.

Adding it all up, PM is investing in growth, they are facing macro headwinds, and they are rewarding shareholders via other capital allocation actions. In short, PM is deemphasizing dividend growth to handle everything else going on. Some good, some bad.

Wrap Up

I’m sad that the dividend increase wasn’t bigger. Fortunately, the dividend yield is currently high and the small increase helps a bit. So, I’m not going to moan too much more. That’s mostly because I trust PM’s management and excellent track record over long periods of time.

Perhaps my greatest frustration isn’t with the small increase. Instead, it’s that even excellent companies with high (and growing) dividends aren’t able to slay the relentless tapeworm.

Warren Buffett said it best in 1981:

For inflation acts as a gigantic corporate tapeworm. That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism. Whatever the level of reported profits (even if nil), more dollars for receivables, inventory and fixed assets are continuously required by the business in order to merely match the unit volume of the previous year. The less prosperous the enterprise, the greater the proportion of available sustenance claimed by the tapeworm.

Under present conditions, a business earning 8% or 10% on equity often has no leftovers for expansion, debt reduction or “real” dividends. The tapeworm of inflation simply cleans the plate.

In light of this, PM is doing pretty well. Let’s call PM a Hold for now. I certainly won’t be selling even a single share at this point. Carry on, PM, carry on.

Be the first to comment