tupungato/iStock via Getty Images

Today there is a multitude of factors influencing markets. Some of these factors dominate headlines more than others, distracting many from the most significant trends. In my view, one of the most important and undercovered, financial issues today is the ongoing crash in the fixed income market. After years of ultra-low yields, interest rates are skyrocketing at a very fast pace. In just eight months, average U.S mortgage rates have gone from record lows to multi-year highs. Thus far, the bond market has lost $2.6T in value, more than the $2T in total financial losses during the 2008 crash, making the ongoing crash the largest on record.

The stunning decline in bonds has implications for all investors. Companies, governments, and people will soon see interest expenses rise as debt becomes more expensive. Many pensions funds and many “60/40” retirement portfolios will see notable declines in net worth. Additionally, as interest rates rise, the discounted fair value of many assets will decline (as the time value of money increases), potentially spurring a more widespread sell-off in other asset classes. The yield curve, one of the most accurate recession predictors, has also nearly inverted.

I say this not to be an alarmist but to encourage investors to take a cool-headed, objective, and rational look at their portfolio risk exposures. By any historical measures, such as the yield curve inversion, the rate hike cycle, valuations, debt leverage levels, and rising commodity prices, the risk of loss in financial markets is abnormally high today. Denial of these facts may serve from a psychological standpoint, but objectively speaking, investors would be wise to limit exposure to assets with poor risk-reward profiles.

In my view, one notable example of an asset class with an abysmal risk-reward profile is preferred equities. This is not necessarily due to their downside risk but also the misconception that preferred equities are “safe” assets. Indeed, preferred equities such as those in iShares Preferred Equity ETF (NASDAQ:PFF) usually have lower volatility than common stocks; however, when interest rates rise, they carry excess risk due to their duration and credit exposure.

I have been bearish on this asset class for some time, as detailed in December in “PFF: Preferred Equities Are Riskier Than Common Stocks Today.” Many readers naturally questioned my take at the time, but since then, PFF is down ~8% while the S&P 500 is only down 4.5%, implicating preferred equities as a precarious asset class today. Given the significant decline in both preferred equities and bonds, it seems like a good time to look at the situation to reassess preferred equities’ risk-reward potential today.

PFF Still Carries Notable Duration Risk

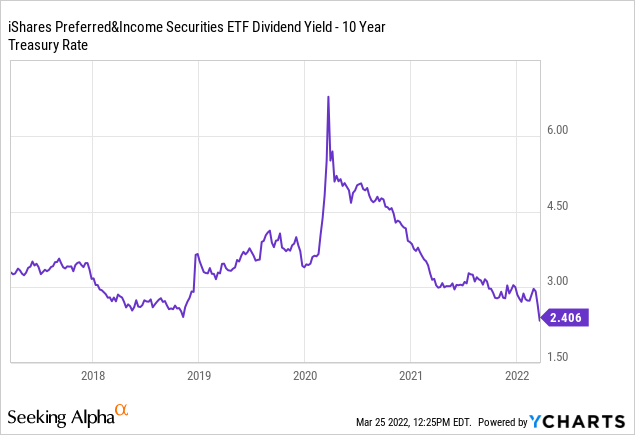

U.S Treasury bonds carry limited credit risk while having relatively large “duration risk.” This risk factor relates to a bond’s price decline given a rise in interest rates and is more extensive for bonds with longer maturities. Since most preferred equities are technically fixed-income assets with no expiration, they carry very high duration risk. For example, preferred equity with a fixed 4% yield should decline by roughly 20% if interest rates rise by 1% (measured as 4% ÷ 5% – 1). Duration risk declines as rates rise as an equal jump in yield from 5% to 6% would cause a preferred equity’s price to decline by 16.6% (5% ÷ 6% -1). That said, Preferred equity yields do not always rise with Treasury rates due to fluctuations in other factors. Importantly, PFF’s yield spread to the 10-year Treasury is very low today, implying potential overvaluation of PFF compared to the benchmark. See below:

The low spread between PFF and the 10-year Treasury bond may soon create further declines for PFF. The preferred equity fund’s “yield spread” to the Treasury bond is roughly 0.60% below its typical level (~3%). At a yield of 4.7%, PFF’s price must decline by approximately 11% for its yield to rise by 60 bps as is necessary to keep its yield spread to the Treasury market within its normal range.

Bond yields have risen at a substantial pace since 2022 began and are seeing further acceleration as the inflationary commodity shortage issue worsens. Additionally, inflation-indexed “real” interest rates have remained low but are starting to rise from record lows. Eventually, this may add negative duration risk factors for preferred equities as bond yields spike even higher. Fortunately, preferred equity investors can limit their exposure to this factor by opting for variable-rate preferred equity ETFs such as (PFFV). In my view, PFFV is vastly superior to PFF today since its dividend rises with interest rates, drastically limiting its duration risk.

Move Over Duration Risk, Here Comes Credit

The duration risk issue aside, there are more important risk factors facing preferred equities today that can not be avoided with alternative variable-rate options like PFFV. Most notably, a rise in credit risk comes as the economy slows and corporations (and households & governments) struggle to meet obligations given the impact of rising interest rates and accelerating prices. Credit risk is the ultimate negative factor for stocks since they have the lowest protection in the event of bankruptcy. That said, it is also exceptionally high for preferred equities since they are still in the “equity” tier of a company’s shareholder priorities. As credit risk perception increases, preferred equity prices can decline rapidly as investors account for the potential of companies allowing preferred equity payments to fall into arrears.

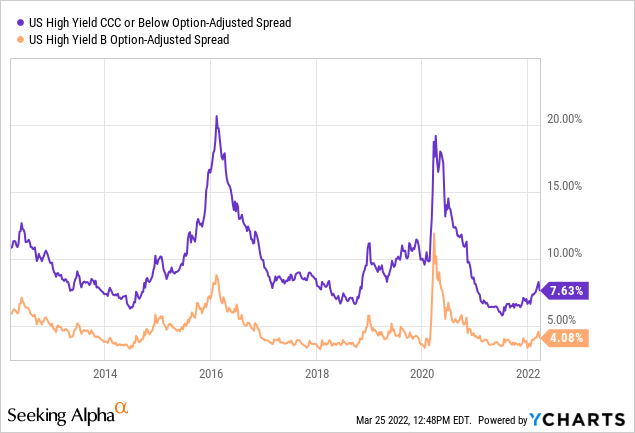

We can measure credit risk trends through junk bond yield spreads to Treasuries. Most of the preferred equities in PFF carry credit risk in the “BBB to B” range, though around a quarter of its holdings are not rated and therefore may carry worse credit quality. Over recent weeks, we’ve seen some notable increase in credit risk perception, particularly in the lowest-rated segments of the corporate fixed-income market, such as the B to CCC range. Thus far, 2022 has only seen a slight increase in market credit risk perception, but recent data implies this trend is accelerating. See below:

As you can see, 2022 has brought a roughly 0.5% to 1% increase in spreads in fixed-income assets with higher credit risk exposure. Historically speaking, this is not a significant increase as credit spreads often rise by 10% or more during recessionary environments as in 2020 and 2016 (the little-known 2016 “recession” being limited to commodity-centric segments of the economy and emerging markets.)

At this point, the economic trend remains uncertain as there is only a slight increase in credit risk perception; however, as transportation costs spike, significant demand destruction for virtually all goods seems inevitable. In an inflationary environment such as this, there is very little the government can do to stimulate the economy without risking even worse hyperinflation.

For example, gas prices are rising because there is more demand for gas than supply. If one is needed, the solution is to reduce demand to clear the shortage. However, some states and the U.S government are considering a “gas rebate” stimulus check. Though it may temporarily lower recession credit risks, boosting demand in an environment where demand is above supply will likely cause prices to rise faster, worsening the issue. There is a direct trade-off between credit risk/employment levels and inflation; it is nearly impossible to keep both healthy if the global economic output declines (such as it is today).

The Bottom Line

Going forward, I expect PFF and other preferred equity assets will continue to see their value deteriorate. Bond yields have risen at a breakneck pace, and the bond market ETF (BND) is now back at a historically strong support level. While it is possible that accelerating inflation will push yields even higher, it seems Treasury rate volatility may slow for some months as other asset classes adjust to the negative economic impact of higher rates. In other words, over the coming weeks and months, I expect the bond market’s rate of decline to slow while stocks and other credit risk assets (such as preferred equities) decline as more investors and analysts realize the high probability of an imminent recession.

PFF is a good benchmark for the preferred equity market. Roughly 60% of the fund is allocated to financial institutions, which usually carry the highest exposure to a rise in credit risks. From April 2007 to March 2009, PFF’s price plummeted by a staggering 70% during the last significant credit risk event for financial institutions. Today, financial credit risk may be lower than it was then (though it is actually higher by many measures), but given high inflation, duration risk is much greater than in 2008. Banks already see their net interest margins squeezed dramatically as the yield curve flattens and the Federal Reserve hikes at an even faster pace.

High inflation also dramatically restricts the government’s ability to pursue rate cuts, Q.E, tax cuts, and stimulus measures (as improving economic demand would worsen inflation). Unlike 2008 and 2020, there is nothing practical the government can do to help the economy if it does enter a recession. So, if PFF crashes, there is no guarantee that it will recover with government stimulus as it has before. With this in mind, I remain very bearish on PFF and other preferred equity ETFs and believe investors’ portfolios would be more secure in a mixture of cash and gold (or other pro-inflation assets).

Be the first to comment