Jay Yuno/E+ via Getty Images

Article Thesis

Petroleo Brasileiro S.A. (NYSE:PBR)(NYSE:PBR.A), or Petrobras, is a leading oil company that is extremely profitable with oil prices trading where they are right now. The company is able to pay hefty dividends, and yet, shares are priced for disaster. Politics are a risk, but even if politicians forced Petrobras to cut its profits by selling at lower prices, Petrobras could still be a solid choice.

Petrobras – A Leading Oil Player With Massive Profits

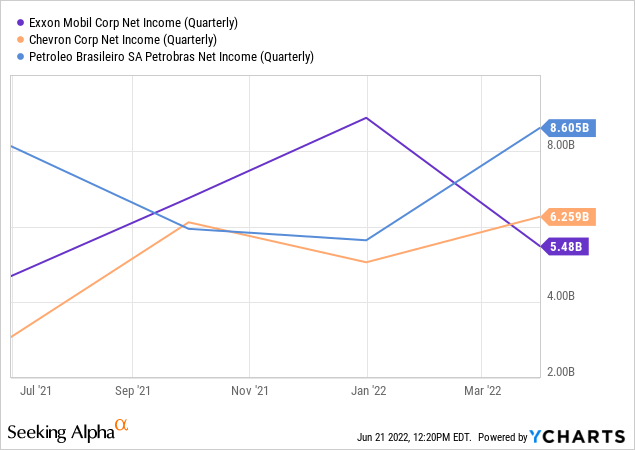

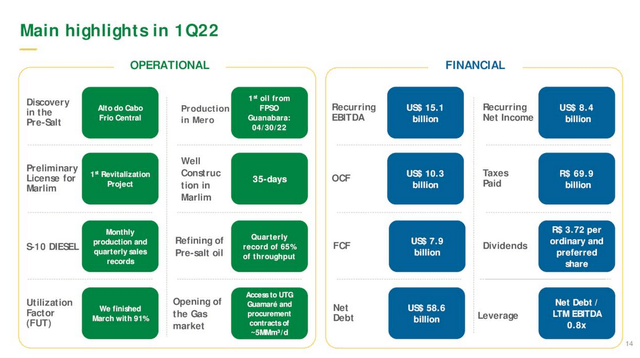

Petrobras has become one of the largest oil companies in the world, with both a vast upstream (production) business and a considerable downstream (refining and marketing) footprint. In the current environment of high oil prices and high refining margins, Petrobras naturally is very profitable. But even in Q1, when refining spreads and oil prices were still considerably lower, on average, Petrobras generated great results:

Apart from some important operational highlights, such as new discoveries in Brazil’s vast pre-salt layer, Petrobras reported some excellent financial results. Net profits totaled around $8.5 billion, which is, for reference, around 50% higher than the net profits of Exxon Mobil (XOM) and Chevron (CVX), as we can see in the following chart:

Free cash flow, at $8 billion, or $32 billion annualized, was very strong as well. Petrobras was able to generate these profits and cash flows despite paying a hefty 70 billion Brazilian Real in taxes, which equates to around $14 billion — for a single quarter. Thanks to strong commodity pricing and low production costs, Petrobras is thus generating hefty cash for both its shareholders as well as for the Brazilian government, thereby playing an important role in financing that country’s budget. Petrobras paid a dividend of 3.72 Brazilian Reals for the quarter, which is equal to around $0.72. Annualized, that comes out to around $2.90 per share. The PBR ticker represents two shares, thus dividends have to be doubled, which gets us to a payout of more than $5 at the Q1 run rate. This, in turn, translates into a yield of more than 40%, also reported here on Seeking Alpha.

Q2 Should Be Even Better

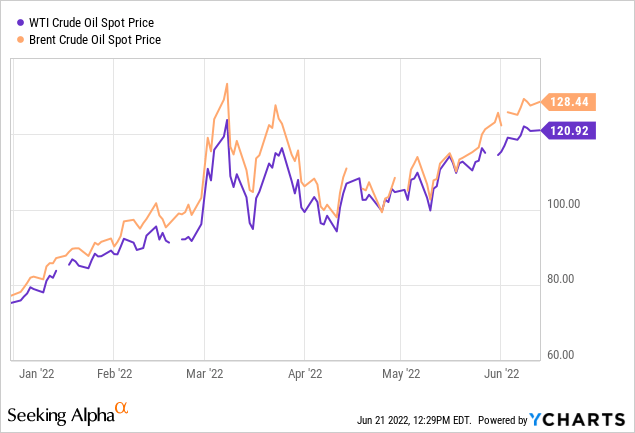

Entering Q1, oil prices were far from low, but still significantly lower than they are today. The average oil price for the second quarter is, with the quarter almost over, way higher than the average for the previous quarter, as we can see in the following chart:

With both Brent and WTI trading below $80 per barrel in early Q1, and them rising more or less steadily since, crossing above $120, we can expect to see even stronger profits in Q2, compared to the already hefty profits we have seen in Q1. Chevron is forecasted to see its profits rise by 50% between Q1 and Q2, while Exxon Mobil is forecasted to see an even larger profit gain. The same may not happen for Petrobras at a similar magnitude, but this example shows that investors can expect another major increase in profits from the already very attractive level seen during the first quarter.

Petrobras holds considerable net debt, at more than $50 billion, but its leverage ratio is pretty reasonable. On a trailing twelve months basis, its net debt to EBITDA ratio stands at 0.8, and that will decline further as Q2 (with even higher EBITDA than Q2 2021) comes around. Petrobras should thus “deleverage” even without paying down debt, as the EBITDA denominator rises in the current high-oil-price environment. The not-too-high leverage ratio should allow Petrobras to continue to pay hefty dividends if the company chooses to do so. Investors should note, however, that there is no guarantee for these high dividends, as the company may decide to do something else with the money.

Political Risks For Petrobras

Politicians interfering is another potential risk for Petrobras’ dividend and profits, although I believe that investors might worry about these risks too much. Petrobras is important when it comes to financing Brazil’s government, but as we have seen earlier, Petrobras is already doing that pretty well, with annualized dividends of more than $50 billion. Politicians can’t really argue that Petrobras isn’t paying its fair share — in fact, the company pays more taxes than Apple (AAPL) and Microsoft (MSFT) combined. When politicians attack Petrobras for its high profits, they are thus not arguing in good faith, I think, as Petrobras is already very heavily taxed and providing billions of dollars for the government. For an example of politicians criticizing Petrobras, Brazil’s president Bolsonaro has recently argued against gasoline price increases (but PBR still went through with them).

Brazil is a country where average income and wealth are considerably lower than in the US, for example. This means that consumers in the country feel an even larger pressure from high gasoline and diesel prices. Politicians that argue that Petrobras is too profitable could thus see their message resonate well with consumers that are hurt by high transportation and energy cost. But even in a scenario where Petrobras cuts its refining margins considerably, the company would most likely not suffer too much.

According to its Q1 report, Petrobras generated the majority of its profit in the upstream segment, at more than 80%. Only around 20% of adjusted EBITDA was generated in the Refining, Transportation, and Commercialization segment. If Petrobras was forced to cut its refining and marketing margins to zero, which is unlikely, I believe, EBITDA would thus fall by around 20%. That would not make earnings fall off a cliff, however. In fact, if Petrobras had not generated any profit in the downstream space at all in Q1, it would still have been pretty profitable — roughly as profitable as Chevron and Exxon Mobil. Q2 profits will most likely rise above what we have seen in Q1, but even if Petrobras was forced to cut its profits and dividend by 50% compared to the Q1 level, Petrobras would still generate profits of $17 billion a year or so, and its dividend yield would still be north of 20%.

I thus do believe that there are indeed political risks, but with Petrobras already paying hefty taxes and not earning that much money in the downstream segment, politicians’ arguments for higher taxes aren’t great. It’s thus not a sure thing that political factors will cut into Petrobras’ profits. But even if that were to happen, with earnings dropping massively, e.g. by 30%-50% relative to the Q1 level, Petrobras would still be a very profitable company offering very juicy dividends. It makes sense to keep an eye on these political risks, but I think it is unlikely that we will see measures against Petrobras that make its profits and dividend slump to a very low level. Even a hypothetical 80% dividend cut relative to Q1 would still result in an 8%+ dividend yield.

PBR Stock – An Extremely Low Valuation

At current prices, Petrobras is valued at around $80 billion. If Petrobras were to earn $8.5 billion per quarter during Q2-Q4, in line with Q1, the company would trade at an earnings multiple of 2.3, as it would generate net profits of around $34 billion this year. With profits likely higher in Q2, and possibly higher in Q3-Q4 (although that depends on future oil prices), the actual earnings multiple for the current year could be even lower.

Many oil companies trade at a pretty low valuation, but for a major oil company to trade at a low-single-digit earnings multiple is far from normal. Exxon Mobil, Chevron, etc. trade at high-single-digit earnings multiple. If Petrobras were to be valued like them, its shares would climb by several hundred percentage points. Due to higher political risks that is unlikely, but still, Petrobras is trading at an absolutely bombed-out valuation today — shares are priced for a disaster. If such a disaster does not materialize, investors could see their investments rise considerably while receiving hefty dividends on the way.

I do believe that PBR should only be held in a diversified portfolio and that position sizes should incorporate the risks, but for those with some appetite for risk, Petrobras could be an opportunity with a hefty payout if things go right. This is a high-return, higher-risk pick — not for everyone, but a potentially good choice for some investors.

Be the first to comment