Wagner Meier

Petrobras (NYSE:PBR) is a large Brazilian state oil company with a market capitalization of just over $60 billion. The company’s investment recommendation was recently bumped down by UBS; however, as we’ll see throughout this article, the company still has the potential to drive substantial shareholder returns at a variety of valuations.

Petrobras Financial Results

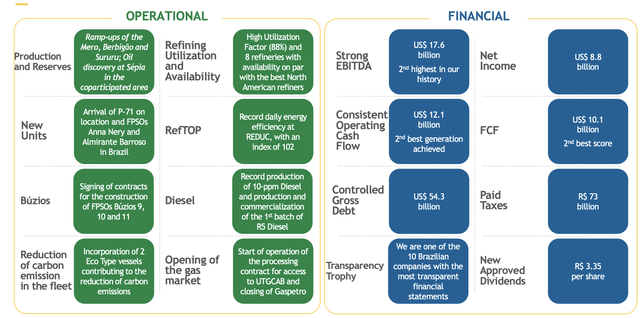

Petrobras generated strong financial results in the most recent quarter as its assets continue to outperform in an expensive quarter.

Petrobras Investor Presentation

The company had almost $9 billion in net income and $10.1 billion in FCF. It paid substantial taxes and approved a massive new dividend. The company has hit some trouble over those who feel that its dividend contributions are too large, but the state’s massive ownership does incentivize large dividends including over 10% in the most recent quarter alone.

The company is continuing to focus on high-efficiency and utilization of its existing assets while ramping up several new developments. The company’s more than 50% FCF yield highlights its financial strength and its ability to continue shareholder returns.

Petrobras Financial Picture

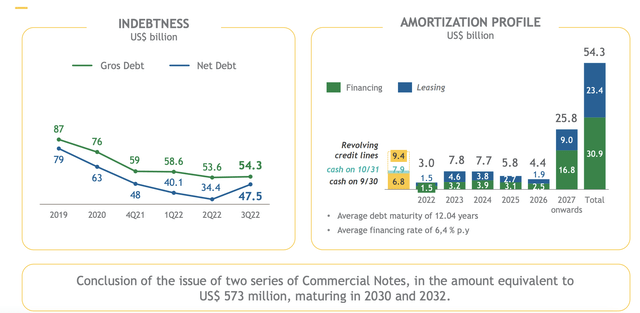

Petrobras continues to have an incredibly strong financial picture, although we’d like to see it not let dividend payments increase its debt.

Petrobras Investor Presentation

The company’s net debt hit a low of $34.4 billion before increasing to $47.5 billion on the back of some massive dividend payments. We’d like to see the company keep its debt more in the $20-30 billion level given the geopolitical risk that it has historically faced in its operations that could hurt its ability to raise debt.

Even given the company’s financial position and its current strength, it does face an average interest rate of 6.4% which is fairly steep for debt with an average 12-year maturity rate that’s largely denominated in stronger currencies. Given the company’s $10 billion in quarterly FCF, it could easily hit a $20-30 billion debt rate.

Regardless, it’s worth highlighting that the company has done an incredible job through COVID-19 of lowering its debt load.

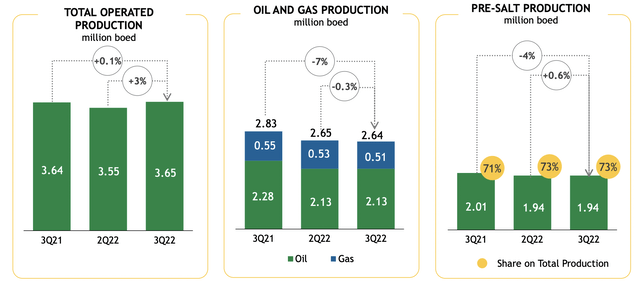

Petrobras Exploration & Production

Petrobras is continuing to focus well on exploration and production.

Petrobras Investor Presentation

The company does have some legacy assets that’re slowing down meaning it needs to work hard to maintain production. Oil and gas production has declined to 2.64 million barrels / day while operated production is roughly 3.65 million barrels / day. Pre-salt production, the company’s new share of asset development, make up 73% of its production.

The company has managed to reduce the total cost of oil produced to $40 / barrel, with $17 / barrel as government taxes, and $6 / barrel in lifting costs. Pre-salt lifting costs remain incredibly low at less than $4 / barrel. The company has 5 new projects scheduled to start in 2023, including multiple 150 thousand barrels / day FPSOs.

In this regard, Buzios continues to remain one of the company’s most important wells with installed capacity expected to increase from 600 thousand barrels / day today to more than 2 million barrels / day. An accelerated timeline here for the company with a 93% stake could help to accelerate the company’s production growth.

The company has recently signed contracts for the creation of 3 more FPSOs for Buzios with Petrobras’ high capacity design (225k barrels / day oil + 12 million cubic meters / day natural gas). A big part of the company’s ambitions are increasing natural gas supplies to the Brazilian markets. For the company, oil exports remain fairly low and Brazilian market sales are substantial.

Unfortunately for the company, it will continue for the foreseeable future to be partially susceptible to the demands and whims of the Brazilian government and the desire of the populace for lower oil prices more so than anything else.

Petrobras Opportunity

Petrobras has the ability to generate substantial shareholder returns going forward.

The company did reduce its cash position to generate substantial dividends; however, it is still generating substantial FCF to the tune of $10 billion quarterly. The company’s $40 billion in annualized cash flow highlights its financial strength and gives the company a more than 50% FCF yield and a more than 30% FCF yield based on enterprise value.

We’d like to see the company repurchase shares and focus on reducing its net debt position, especially in a market that can be expected to remain volatile. Given the Brazilian government’s large position and pressure for dividends, we’d especially like to see the company avoid giving out too much in dividends, hurting its overall financial position.

Regardless of how the company spends its money, however, it still has the potential to generate substantial shareholder returns.

Petrobras Risk

Petrobras has substantially more risk than simply Brent crude prices. The company does remain incredibly profitable though at a variety of oil prices, as we discussed above with the company’s costs. However, the company also has potential costs due to its focus on Brazil and Brazil government ownership.

That combination of factors makes it more susceptible to government whims and a desire for lower prices for the population, both of which can affect future returns.

Conclusion

Petrobras has an incredibly strong portfolio of assets. The company has a market capitalization of just over $60 billion, while it’s focused on using its substantial FCF to generate impressive dividends for shareholders. The company’s quarterly FCF of just $10 billion is an incredibly affordable number, one that the company can use for continued returns.

We’d like to see the company avoid falling into the trap of the Brazilian government. The company has already been caught up before, and now it’s hurting its financial position to pay out massive dividends. However, the company still has a unique portfolio of assets, and we expect it to generate valuable long-term returns going forward.

Be the first to comment