Moyo Studio/E+ via Getty Images

Investment Summary

We are constructive on PetIQ, Inc. (NASDAQ:PETQ) following a robust performance from the company last quarter. We’d note that demand in PETQ’s end-markets continues exhibit strong underlying growth, and this pulled through to its P&L during the period. This is a name that sits on the cusp of our coverage universe, so we needed solid evidence the company had the torque in its growth engine to re-rate to the upside. Thankfully, we saw it deliver on this front, and it looks set to do so looking ahead.

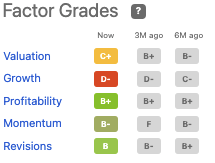

Hence, we’re here today to discuss our key findings on the PETQ investment debate. Net-net, we rate the stock a buy, and view a highly undervalued proposition with asymmetrical risk/reward symmetry. Hence, we are seeking price objectives up to $36 at the upper end in this name. The stock is rated highly in terms of profitability, momentum and revisions on Seeking Alpha’s factor grades, adding bullish weight to the risk/reward symmetry.

Seeking Alpha factor grades, PETQ:

Data: Seeking Alpha, PETQ quote page

Key downside risks to the investment thesis that investors should be clearly aware of before proceeding include:

- Competition Risk: PetIQ operates in a highly competitive market, which could lead to decreased sales, market share, and profits.

- Reimbursement Risk: PetIQ‘s products are not always covered by pet insurance providers, which could lead to decreased sales.

- Regulatory Risk: PetIQ is subject to laws and regulations governing the distribution and sale of its products, which could lead to increased costs or decreased revenue.

- Product Recall Risk: PetIQ may be forced to recall its products due to safety issues, which could lead to reputational and financial damage.

- Supply Chain Risk: PetIQ is dependent on the availability of raw materials, which could lead to decreased production and sales

PETQ Q3 financials illustrate robust demand for its product segments

Turning to the company’s latest numbers, we should note it was a period of robust growth for PETQ. Several consumer trends continue to support the long-term growth of the pet industry, and we believe PETQ is uniquely positioned in its position to capitalize on this. Therefore, despite a decline in the total flea and tick category year-to-date, it has gained additional market share and is outperforming the overall category.

Net sales of ~$210mm were at the apex of managements guidance of $200mm–$210mm. We saw that gross margin increased by 420bps YoY on adjusted EBITDA of $19.2mm, again ahead of the forecasted range of $16.5mm to $17.5mm.

It’s also worth noting the company realized record quarterly CFFO $64.5mm generated during the quarter. Growth was attributed to the consumption of its higher-margin PetIQ-manufactured brands alongside strategic investments in new products.

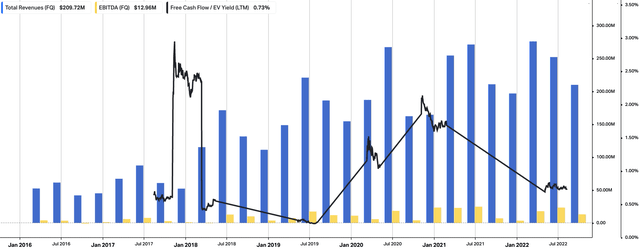

A more comprehensive look at PETQ’s operating results from FY16–date is seen in Exhibit 1. You can note the cyclical sales and core EBITDA prints at each quarter, yet, the overall uptrend remains in situ. Equally as important in our estimation is the cyclical uptrend of PETQ’s free cash inflows, that’s tied to a ~200bps trailing return on capital employed.

Exhibit 1. PETQ quarterly operating walk-through from FY16–date. Revenue, core EBITDA remains in cyclical uptrend, with trailing FCF yield of ~2%.

Data: HBI, Refinitiv Eikon, Koyfin

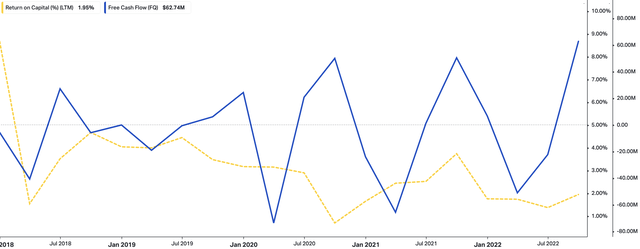

Exhibit 2. PETQ cyclical upswing in free cash flows, return on capital

Data: HBI, Refinitiv Eikon, Koyfin

PetIQ’s manufactured products saw exceptional performance in Q3, outpacing the broader market and generating sales growth across 5 out of 7 product divisions.

Notable achievements from the quarter, in our estimation, include:

- We saw double-digit growth for 4 product categories including a 41% increase in pet supplement sales, and strong growth in dental treats, cat treats and dewormers

- Furthermore, PETQ continues to lead in the rapidly growing health and wellness and flea-and-tick solution categories, with its over-the-counter flea and tick products outperforming the sluggish market conditions. This superior market performance led to a 77bps increase in market share, driven by the company’s 18.8% YoY growth in e-commerce.

- We also should note the Nexstar brand continued to drive market share growth, accounting for 1.2% of the market category for the same 12-week period. This success represents “the largest brand launch in the over-the-counter flea and tick category in the past 5 years” per management on the call.

- PETQ’s flea and tick products saw strong performance across all sales channels, with e-commerce again playing a significant role. In Q3, over 42% of over-the-counter flea and tick category sales were generated online. The company has grown to generate a similar amount of its product segment sales through e-commerce. The company expects this trend to continue, potentially representing an even larger percentage by FY22 year-end.

These factors combined fold into our buy thesis on PETQ.

Reiterated guidance points to strength in end-markets looking ahead

Management reiterated FY22 guidance on the earnings call. It continues to forecast net sales to between $920mm–$940mm, representing an increase of approximately 400bps compared to 2021 [note, this excludes the $36.1mm of sales related to the lost distribution in the prior year].

In addition, the company has increased its adjusted EBITDA guidance by $1mm and now expects adjusted EBITDA to reach between $93mm–$95mm. This represents a significant increase of approximately 320bps compared to 2021.

These growth assumptions are based on the strengths of the company’s manufactured brands and the resulting flow-through in the P&L from higher gross profit and margin expansion.

Valuation and conclusion

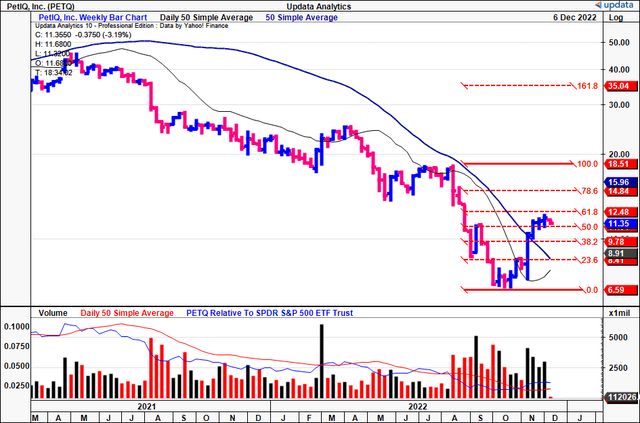

We’ve turned to the charts to help guide price visibility downstream. You can see below PETQ has retraced a good portion of the downside move that begun in August.

It is now flirting with the 50% market on the channel, having thrust off the 50DMA and 250DMA over the past 5 weeks.

At the same time, the weekly volume trend has been pushing north, suggesting strong accumulation into the move.

From here, the next target is $14.85, then $18.50 and $35.04.

Exhibit 3. PETQ 18-month price evolution [weekly bars, log scale] – shares now pushing to $14.85

Data: Updata

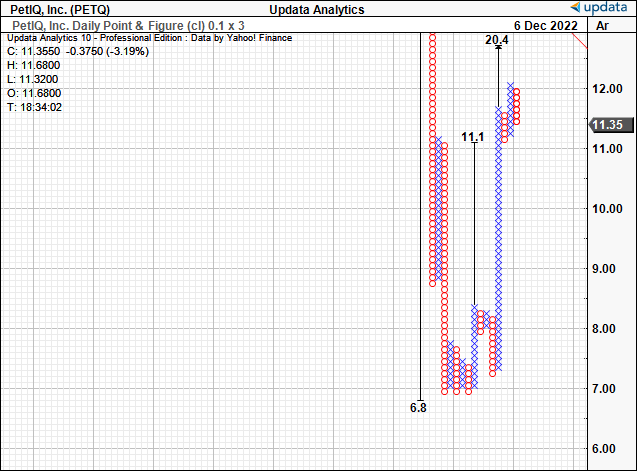

We therefore have upside targets to $20.04, as seen in the point and figure analysis below.

Exhibit 4. Upside targets to $20.40

Data: Updata

We’d also note that consensus has PETQ valued at ~8x forward EBITDA, a roughly 40% discount to the sector. This could suggest that investors are expecting PETQ to outpace the sector at this level, but we’d also note the company’s growth percentages this period are worth considering. Even at the 8x forward EBITDA, this derives a price target of $26.20 on the company’s $95mm FY22 adjusted EBITDA projections. Assigning the sector’s 11.2x multiple this derives a price target of $36. These numbers corroborate with technically derived targets above, and confirm our buy thesis.

Be the first to comment