bymuratdeniz

Permian Resources (NYSE:PR) still looks capable of generating approximately $1 billion in positive cash flow in 2023 despite WTI oil strip prices declining to the mid-to-high $70s.

I now estimate Permian’s value at approximately $11.50 per share in a long-term (after 2023) $70 WTI oil environment. This is slightly lower than my October estimated value for Permian due to the decreases in projected near-term cash flow. For example, Permian’s projected cash flow for 2023 was about $200 million higher than now with mid-$80s WTI oil. Permian is partially protected by hedges, which cover around 30% of its oil production. However, this means it is still significantly affected by changes in oil prices.

Updated 2023 Outlook

Permian Resources expects to produce around 157,500 BOEPD (52% oil) in 2023, which is approximately a 9% increase from the 145,000 BOEPD it expects to average (at guidance midpoint) in Q4 2022.

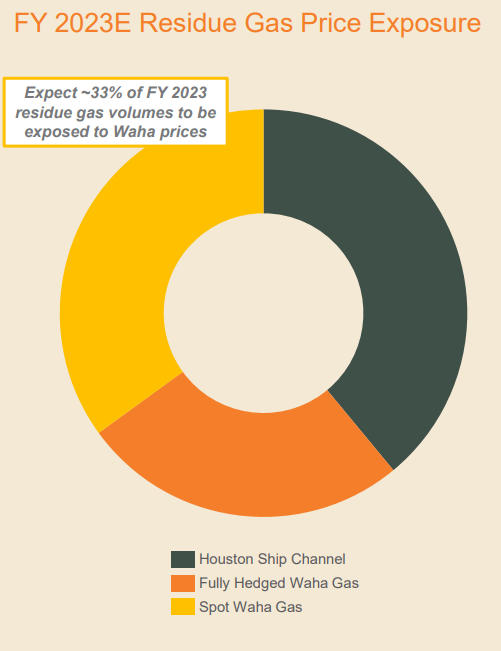

At current 2023 strip of $77 WTI oil and $5.00 Henry Hub natural gas, Permian is projected to generate $2.943 billion in revenues before hedges. Permian’s hedges are projected to have $93 million in positive value in 2023 at strip. This includes its Waha basis hedges, which cover around 25% of its 2023 natural gas production at a negative $1.25 differential to Henry Hub. Permian expects 33% of its natural gas to be exposed to Waha prices, which often trade at a large discount to Henry Hub. That leaves around 42% of its natural gas production receiving Houston Ship Channel pricing, which typically averages close to Henry Hub prices over the full year.

Natural Gas Pricing Exposure (permianres.com)

Thus, including hedges, Permian is projected to generate $3.036 billion in revenues.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Oil | 29,893,500 | $74.50 | $2,227 |

| NGLs | 10,922,625 | $33.50 | $366 |

| Gas | 100,028,250 | $3.50 | $350 |

| Hedge Value | $93 | ||

| Total | $3,036 |

This leads to a projection that Permian will generate $990 million in positive cash flow in 2023 at current strip before dividends.

| $ Million | |

| Lease Operating, Cash G&A and GP&T | $460 |

| Production Taxes | $221 |

| Cash Interest | $115 |

| Capex | $1,250 |

| Total | $2,046 |

Dividends And Share Repurchases

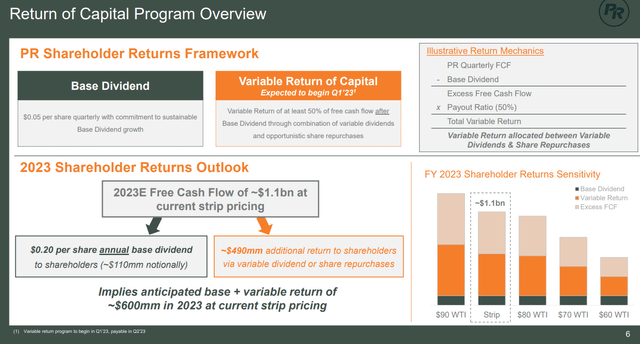

Permian’s quarterly dividend of $0.05 per share adds up to around $112 million per year currently, leaving $878 million for other purposes. Based on its variable return of capital program, it would put around $439 million towards variable dividends and/or share repurchases.

Permian’s Return Of Capital Framework (permianres.com)

Permian currently has around 558 million shares outstanding, while its 3.25% convertible notes due 2028 can be converted into another 27 million shares.

Thus, Permian’s total dividend for 2023 could approach $1 per share if it put all its return of capital towards variable dividends. On the other hand, it could repurchase close to 48 million shares if it put all that $439 million towards share repurchases (based on its current share price). This would reduce its outstanding share count by around 9% from its current level.

Estimated Valuation

I am tweaking Permian’s estimated value down slightly to around $11.50 per share in a long-term (after 2023) $70 WTI oil and $4 Henry Hub gas scenario. This is due to the reduction in Permian’s projected 2023 free cash flow. With the 2023 oil strip moving down by around $6 to $7 since mid-October, as well as some declines in the natural gas strip too, Permian’s projected cash flow for 2023 has been reduced by approximately $200 million.

Waha basis differentials are also something to keep an eye on, with Permian’s production being around 29% natural gas. As noted above though, Permian has reduced its exposure to Waha prices to under 60% of its natural gas volumes, with Waha basis hedges further mitigating potentially wide differentials to a significant extent as well (at least for 2023).

Conclusion

Permian Resources is now projected to generate nearly $1 billion in positive cash flow in 2023 at current strip of mid-to-high $70s WTI oil. This is a couple of hundred million lower than what I projected for Permian in mid-October at roughly mid-$80s WTI oil. Permian also expects a decent amount of production growth (9% from Q4 2022 levels to 2023 average production) while generating that positive cash flow.

As a result of the trimmed estimates for 2023 free cash flow, I’ve lowered my estimated value for Permian slightly to $11.50 per share in a long-term (after 2023) $70 WTI oil scenario. Permian still looks in good shape overall, with net debt at the end of 2023 potentially at approximately 0.7x EBITDAX, despite putting over $400 million during 2023 towards variable dividends and share repurchases.

Be the first to comment