FrozenShutter/E+ via Getty Images

If you are not already a shareholder, I would gather that you are likely completely unfamiliar with the company Perimeter Solutions (NYSE:PRM). However, if you have watched any coverage of the wildfires that have been ravaging the west coast of the USA over the last two decades, you have absolutely seen its products in action.

The company operates in two niche markets. The first is the highly attractive aerial fire retardant market. The second is the phosphorus pentasulfide market, which is primarily used in the manufacturing of engine oil.

While the phosphorus pentasulfide oil additive market has been performing well and generates significant earnings for the company, the focus of this article will be on the highly profitable, deep moated and growing aerial fire retardant market.

Overview

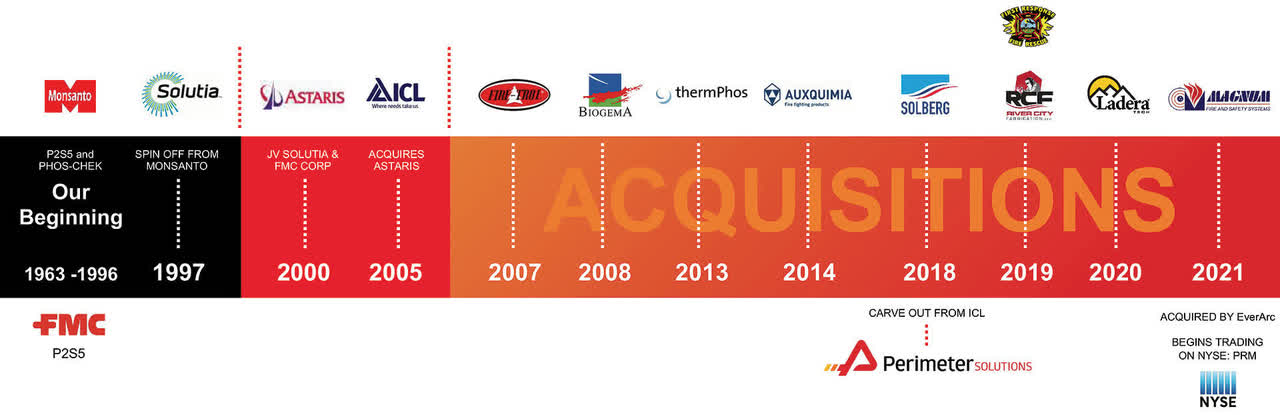

Perimeter Solutions has been around in various forms for nearly 60 years now, with the fire retardant solution tracing its roots back to Monsanto in 1963 and the oil additive products from FMC Corp. (FMC) in 2000. The current company, Perimeter Solutions, was formed in 2018 when SK Capital Partners purchased the business from Israel Chemicals, leading to the successful IPO in 2021 as a stand alone company.

Perimeter Solutions

This rather muddied origin story does not really do justice to the ridiculous extent that Perimeter Solutions dominates the North American aerial fire retardant market. To put it bluntly, they currently own 100% of it.

Perimeter Solutions’ “Phos-Chek” brand is the only fully approved, long-term fire retardant by both the US Forest Service and the Canadian Interagency Forest Fire Centre, giving it a complete monopoly in this lucrative market, worth an estimated $300 million.

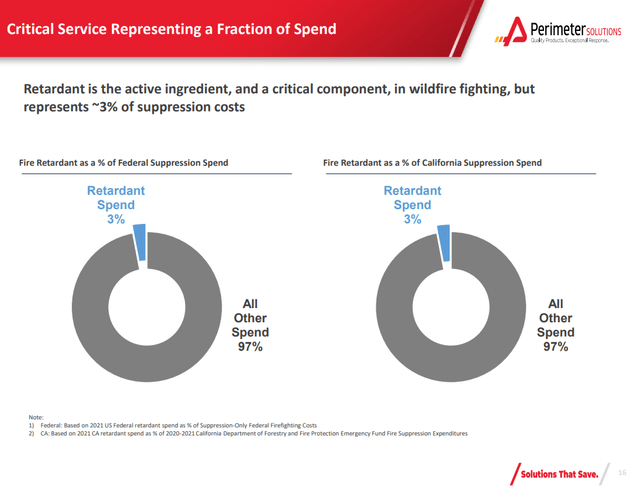

I am sure that your first question is why on earth is there no competition? Well, my inquisitive friend, it is largely because Perimeter Solutions product works extremely well, is non-toxic, only represents a tiny amount of total fire control spending and the company has frankly been doing a really good job servicing its customers.

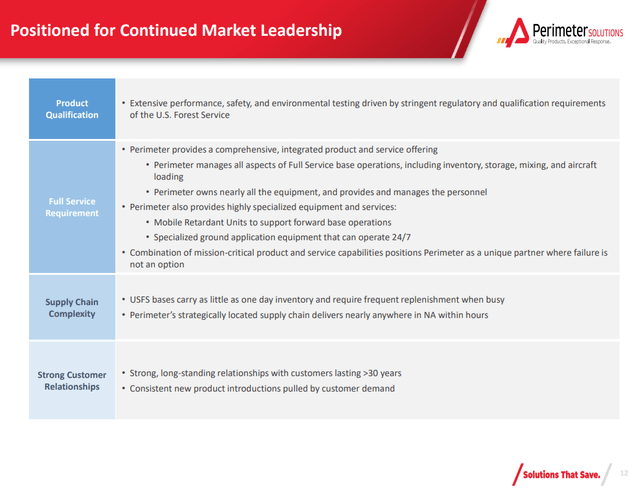

The company’s strategy here is absolutely brilliant. They have made themselves a truly indispensable partner in the government’s fire control program by integrating itself directly into the Forest Service by way of owning, employing and operating nearly all equipment and personnel at the bases that the service uses. The way I am seeing this is that the names US Forest Service and Perimeter Solutions are basically interchangeable in the realm of wildfire suppression.

This level of integration with the US Forest Service has taken decades to achieve and has only been possible through the company providing a reliable service at a fair price, thus giving the service zero incentive to actively seek additional providers.

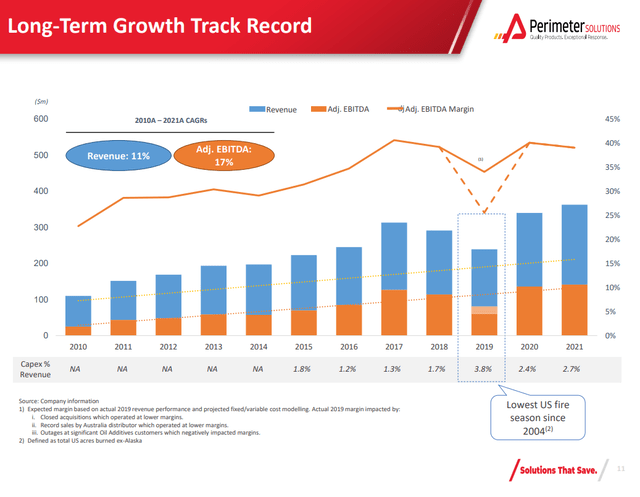

Over the last few decades, Perimeter, in my opinion, has been extremely docile with the monopoly that it currently enjoys, relying primarily on the growth of the wildfire market, along with efficiencies to post its impressive results over this time period.

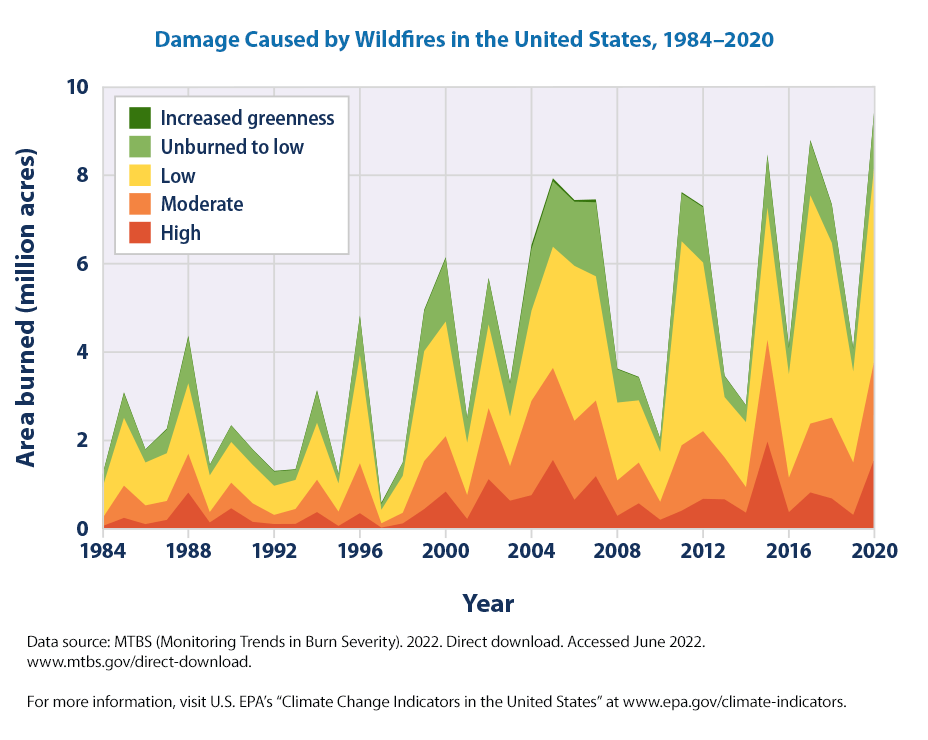

It is an unfortunate reality that wildfires are an increasing threat around the globe given the changing climate, increased drought frequency and population migration trends. According to the EPA, the acreage burned by wildfires has risen from 1.5 million acres in 1984, to over 9 million acres in 2020.

EPA

The urgency to effectively combat wildfires is an issue that countries around the world are finally actively addressing, and you guessed it, Perimeter Solutions has stepped up with the hope to become a trusted partner with other governments around the globe.

So far in 2022, the company has made important progress in onboarding both Greece and Italy as customers, using the model that it employs in the USA. The company has established a mobile fire retardant base in Greece and Italy has adopted the model used in the United States where Perimeter owns and operates nearly all infrastructure and personnel of the national retard operation.

It is important to note that most international fire control operations currently use the much less effective foam products to fight wildfires and pre-treating acreage is not common practice, making the international arena a ripe area of growth for the company going forward to supplement the natural growth of the market in the USA.

Risks

Over the years, many potential competing products have been proposed, however none of them, so far, has dented the incredible moat that Perimeter has built. The next product in line to challenge the company’s position is the Fortress line of aerial fire retardants based on magnesium chloride.

The Fortress products, to this point, seem to be progressing much further that other potential rivals to Perimeter’s dominance have in the past, as the company has reached conditional qualification status and is currently in active testing with the Forest Service.

Fortress’s main selling point is the claim that the product causes less environmental damage than Perimeter’s phosphate based product with the main hypothesis appearing to be that phosphate based products can cause more invasive vegetation growth as it is in essence a fertilizer, along with potential negative effects to native fish populations.

Fortress is backed by its lead investor Compass Minerals (CMP), which has pledged to help Fortress by way of its extensive logistics network and infrastructure. Unfortunately for Perimeter, this does look like a legitimate potential threat looming on the horizon.

While Fortress’s product does appear to have some initial traction to potentially reach the market, the integration with the Forest Service that Perimeter has built is absolutely immense and will require many, many years for any competitor to realistically match.

I believe that this is an area to keep an eye on, however the investment and build out that will be required to even come close to the offering that Perimeter currently provides to its customers will be extremely difficult and the most likely result may be a token offering in select markets.

Valuation

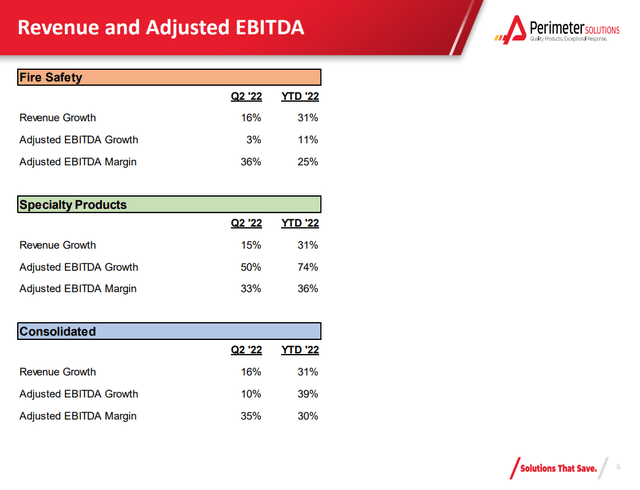

Perimeter Solutions is not cheap, although it has certainly become more reasonable given its 17% drop since the 2021 IPO. The company currently trades for a 2022 forward P/E ratio of 36.91 making it appear downright expensive, however, given the growth that the company is currently experiencing, along with an expected 17-26% growth over the next few years, settling into a high teens growth rate long term, its metrics certainly begin to look more reasonable.

The company currently carries $126 million in cash to go along with $767 million in long-term debt, giving the company a less than pristine balance sheet, although not overly levered.

In addition, the company appears to have a rather generous payout agreement with the SPAC sponsor EverArc, which grants them 1.5% of the outstanding shares annually until 2027, along with a “variable annual advisory amount” payable based on the market price of the shares until 2031, which in my opinion, is completely absurd.

Bottom Line

Perimeter Solutions is a high quality company, operating with one of the greatest moats I have ever seen, in a business that is unfortunately primed for long-term growth, wildfire suppression.

I see multiple levers for future growth and the company appears to be a responsible steward of the monopoly granted to it by the Forest Service, leaving little reason for either party to upset the status quo.

Fortress products do present a potential threat to this monopoly, however Perimeter has built such a unique operation that the threat, if real, may be a decade or more from doing any real damage.

The main detractor for me here is not the competing Fortress product, but the ridiculous SPAC “advisory” agreement. This agreement, as I see it, unnecessarily dilutes and penalizes shareholders for nearly a decade going forward. This agreement and its cost, must be built into the valuation metrics of the shares going forward.

As of today, I am personally still on the sidelines in this name, however I am bullish overall on the company’s prospects, hence my buy rating. I do believe that longer term, shareholders will be rewarded for owning such a deep moated company with impressive growth potential and I will look to purchase a position as capital allows.

Let me know your thoughts in the comments section. Thank you for reading and good luck to all!

Be the first to comment